[ad_1]

Introduction

The Monte Carlo methodology is without doubt one of the playing system betting strategies, and it’s a “on line casino technique” that has a legend that it destroyed a land-based on line casino in Monte Carlo, Monaco.

The Monte Carlo methodology means that you can increase or decrease the guess quantity in accordance with the set guidelines and situations, so to cowl your losses whenever you lose and make a revenue.

Click on right here for an in depth clarification.

However, for the reason that improve within the quantity of bets is gradual, the potential of chapter is small.

Due to this fact, I’ve been considering for a very long time that I can commerce with a bonus by making use of this to Foreign exchange lot sizing, and I’ve succeeded in systematizing it this time.

We’ve got already been conducting an actual ahead for about 8 months, and it has proven excellent efficiency.

On this article, I want to introduce the Skilled Advisor (EA) that I developed by making use of the Monte Carlo methodology.

Benefits and downsides of the Monte Carlo methodology

To start with, I’ll clarify the benefits and downsides of making use of the Monte Carlo methodology to Foreign exchange.

Benefits: The revenue and loss curve rises fantastically

Disadvantages: The drawdown turns into deeper

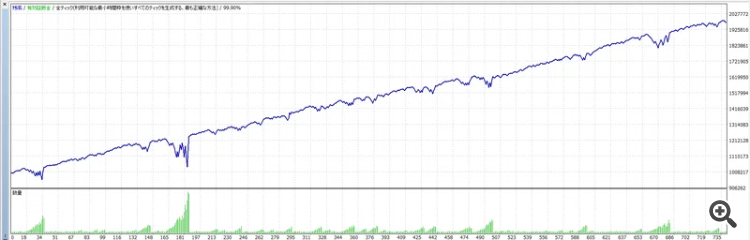

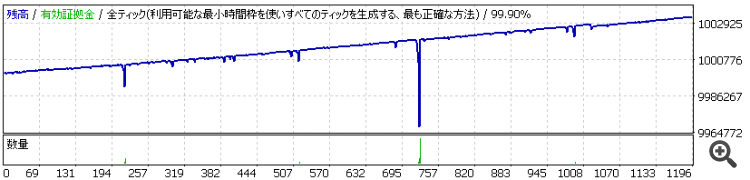

The determine under is an instance of a revenue and loss curve for lots sizing system utilizing the Monte Carlo methodology.

You’ll be able to perceive the benefits and downsides of the above.

As proven on this graph, if it goes effectively, the revenue and loss curve will rise virtually in a straight line.

Nonetheless, for those who lose cash, the lot will swell, so after all cash administration is vital.

It is usually vital to plan methods to stop losses from being concentrated.

Clarification of Montecarlo EA

Now, I’ll clarify the “Montecarlo EA”, which applies the Monte Carlo methodology to lot sizing.

Technique Overview

Along with the usage of the Monte Carlo methodology for lot sizing, Montecarlo EA additionally has the next options:

1. So as to benefit from the lot sizing in accordance with the Monte Carlo methodology, all positions are executed at 50 pips for take revenue and cease loss (designed with a risk-reward ratio of 1:1).

2. So as to stop the lot from rising resulting from consecutive losses, it consists of a complete of 19 charts of 6 EAs with completely different logic and a number of forex pairs, and in addition implements a singular algorithm for additional decentralization.

3. All six logics are advantageous logics that may make a revenue with out lot fluctuations.

As you possibly can see, there are a lot of methods to utilize the Monte Carlo methodology.

Subsequent, let’s check out efficiency (back-test, reside buying and selling).

Again-test

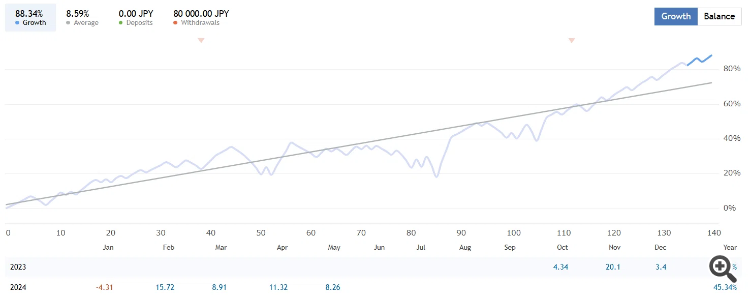

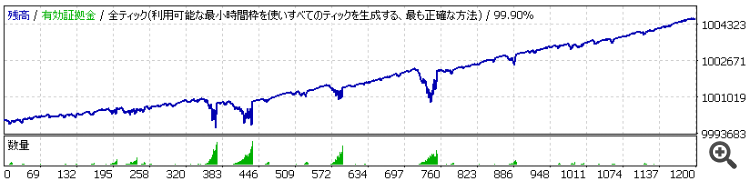

The next is a abstract of the back-test for 19 charts utilizing Quant Analyzer.

We’ve got been ready to attract a steadily rising asset curve.

Nonetheless, this back-test has not been capable of replicate the impact of the decentralization algorithm described above.

Due to this fact, it’s doubtless that DD tends to be smaller than back-test.

Now, let’s examine the efficiency of actual buying and selling that may display the effectiveness of the decentralized algorithm.

Dwell Buying and selling

Beneath is the efficiency of actual commerce.

Dwell Buying and selling Hyperlink

It has been eight months since we began operation, and we have now been ready to attract a revenue and loss curve that’s steadily rising in accordance with the idea.

The income can also be impeccable at 88%.

Nonetheless, since this EA makes use of the Monte Carlo methodology, it’s pure that the asset curve will rise steadily.

Now, let’s check out what sort of efficiency it might be if we did not use the Monte Carlo methodology.

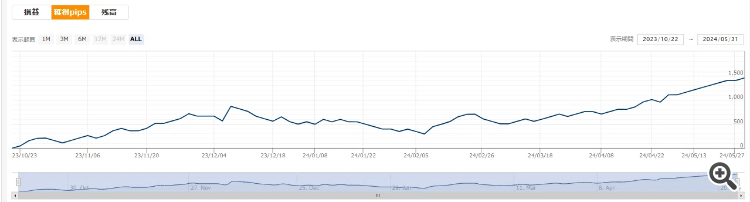

Beneath is the asset curve on a pips foundation.

The drawdown interval is longer than that of the curve utilizing the Monte Carlo methodology, however it’s nonetheless rising steadily.

From this, we will see that it’s not an EA that wins solely by lot sizing.

Conclusion

On this article, we have now described an EA that applies the Monte Carlo methodology to lot sizing.

If you’re excited about “Montecarlo EA” after studying this text, please take a look at the next gross sales web page.

We hope that this text and EA will assist you’ve gotten a snug buying and selling life.

EA web page is right here

[Reference]

Monte Carlo methodology has a slower lot change than the Martingale methodology which additionally used as a profitable technique in casinos, and DD is suppressed.

The next is a comparability of the back-test when the Monte Carlo methodology and the Martingale methodology are carried out with the identical logic, so please confer with it.

Within the Monte Carlo methodology, the utmost lot is suppressed to 37 occasions the preliminary lot, however the Martingale methodology is swollen to 1024 occasions, and the utmost DD can also be overwhelmingly bigger within the Martingale methodology.

Monte Carlo methodology

Preliminary lot: 0.03

Most lot: 1.1 (37x)

Martingale methodology

Preliminary lot: 0.01

Most lot: 10.24 (1024 occasions)

[ad_2]

Supply hyperlink

Leave a Reply