[ad_1]

KEY

TAKEAWAYS

- Nasdaq 100 shares account for over 30% of the S&P 500.

- Nasdaq 100 shares signify the danger urge for food within the inventory market.

- Chartists can quantify the danger urge for food utilizing Nasdaq 100 particular breadth indicators.

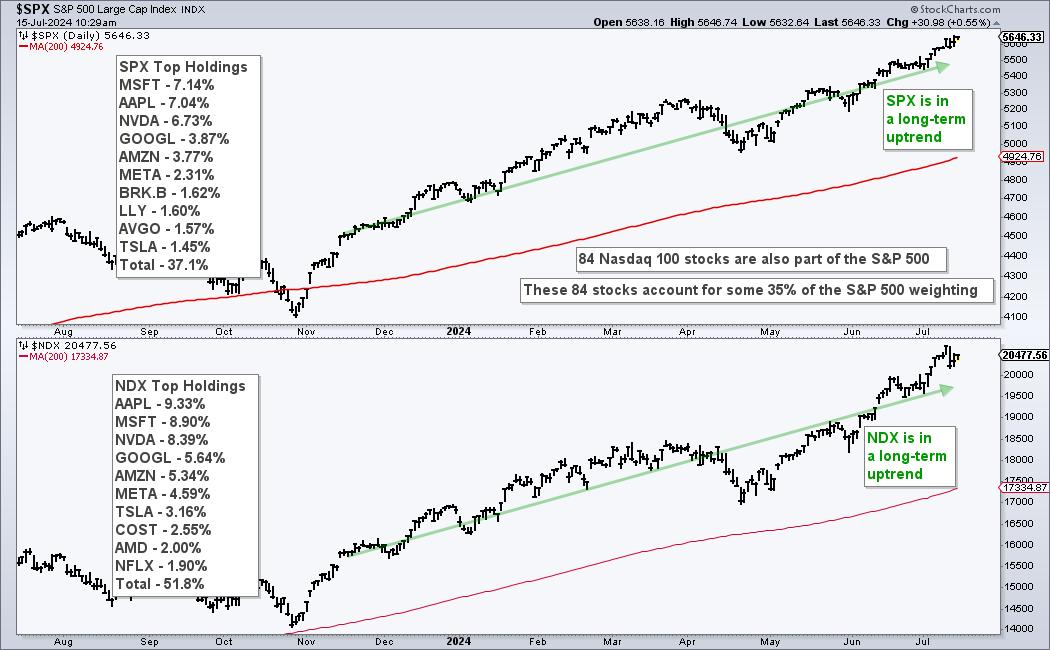

The Nasdaq 100 is a significant driver within the inventory market and Nasdaq 100 breadth indicators must be a part of our broad market evaluation routine. 84 Nasdaq 100 shares (16.8%) are additionally within the S&P 500 and their weighting accounts for over 30% of the S&P 500. The truth is, the six largest shares within the S&P 500 come from Nasdaq 100 and account for 31.26%. The chart under exhibits the holdings for every index. Additionally word that each are in long-term uptrends.

Nasdaq 100 shares additionally signify the danger urge for food inside the inventory market. These shares usually have increased development charges and better Betas. Chartists can observe efficiency for Nasdaq 100 shares utilizing Nasdaq 100 particular breadth indicators. I wish to commerce Nasdaq 100 shares and be absolutely invested when these indicators are bullish. I wish to shun Nasdaq 100 shares and lift money when these indicators are bearish. We use an analogous mannequin for our Twin-Momentum Rotation Methods at TrendInvestorPro. To this finish, I’m utilizing three long-term breadth indicators to quantify Nasdaq 100 circumstances. The chart under exhibits the proportion of Nasdaq 100 shares above their 150 and 200 day SMAs in addition to 52-week Excessive-Low P.c. The latter is the proportion of 52-week highs much less the proportion of 52-week lows.

All three indicators are long-term oriented and I’m utilizing bullish/bearish thresholds for indicators. Divergences don’t determine into my evaluation as a result of these are, most of the time, simply distractions. Discover how QQQ superior at the same time as bearish divergences fashioned all through 2024 (purple arrow-lines). I’ll persist with the indicators and ignore the nuance. NDX %Above 200-day SMA turns bullish with a transfer above 60% and stays bullish till a bearish sign triggers with is a cross under 40%. Including sign thresholds above/under the midpoint (50%) reduces whipsaws. NDX %Above 150-day turns bullish with a transfer above 70% and bearish with a transfer under 30%. These thresholds are wider as a result of the shifting common is shorter. And eventually, NDX Excessive-Low P.c turns bullish with a transfer above +10% and bearish with a transfer under -10%.

Utilizing all three indicators, chartists can take a weight of the proof strategy for assessing the Nasdaq 100. The bulls rule when two of the three indicators are on bull indicators and the bears rule when two of the three are on bearish indicators. A bearish sign triggered in January 2022 and a bullish sign triggered in early February 2023.

TrendInvestorPro not too long ago launched a market timing mannequin primarily based on long-term breadth indicators for the S&P 500 and Nasdaq 100. We printed an intensive report and video describing this mannequin and the way it compares to fashions that use small-cap breadth. This mannequin will probably be used for our Twin Momentum Rotation Technique that commerce Nasdaq 100 and S&P 500 shares. Click on right here to subscribe and achieve rapid entry.

////////////////////////////////////////

Select a Technique, Develop a Plan and Observe a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Creator, Outline the Pattern and Commerce the Pattern

Wish to keep updated with Arthur’s newest market insights?

– Observe @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic strategy of figuring out development, discovering indicators inside the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.

[ad_2]

Supply hyperlink

Leave a Reply