[ad_1]

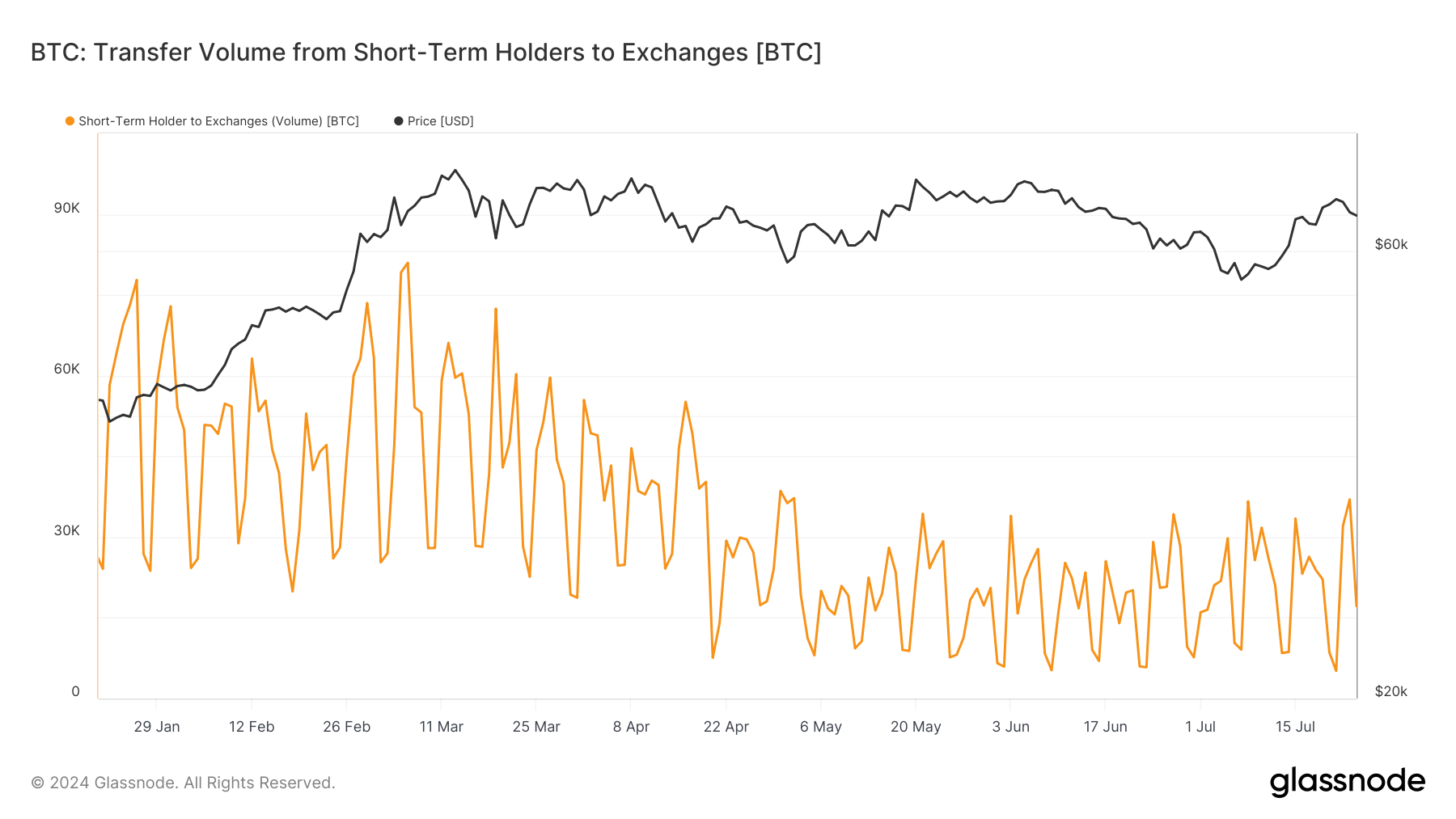

The general quantity of short-term Bitcoin holders transferring funds to exchanges peaked on Ethereum ETF launch day, July 23, on the highest degree since Might.

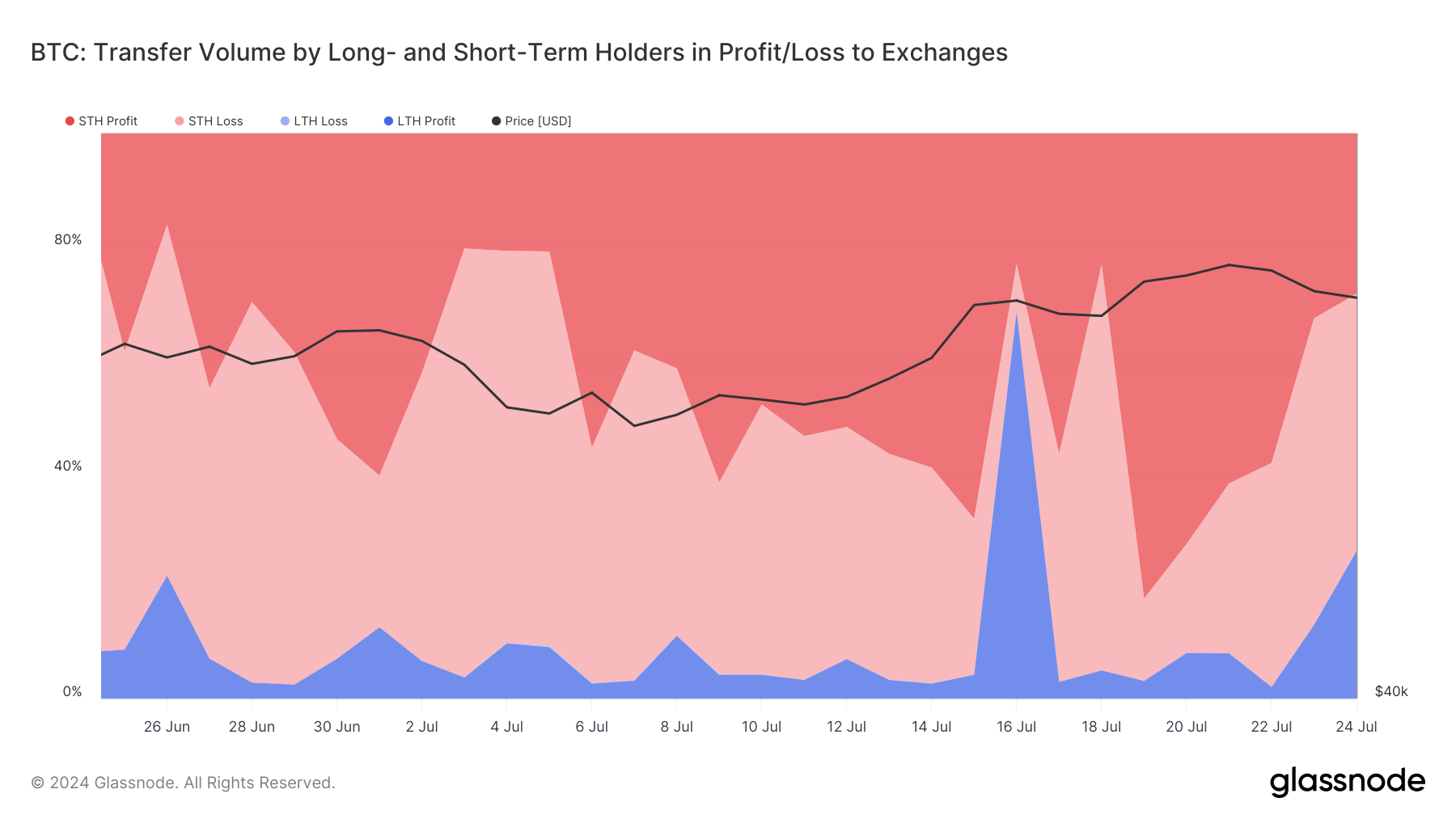

General, Bitcoin switch volumes for each long-term and short-term holders to exchanges confirmed short-term holders in loss represented a good portion of switch exercise at 54%, and short-term holders in revenue constituted 32%.

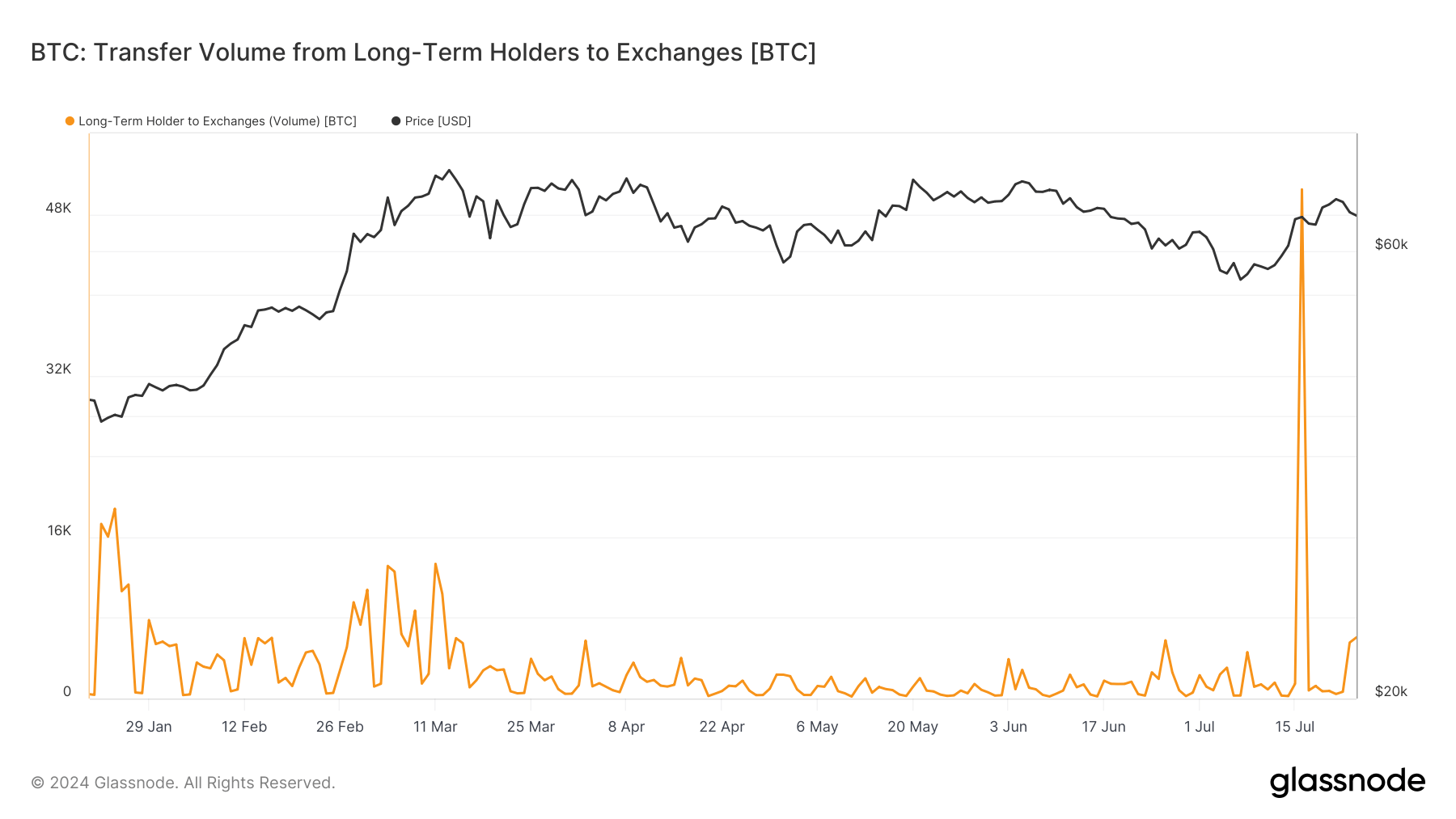

Conversely, long-term holders exhibited a extra cautious stance at simply 13%. Their switch quantity remained low and secure, suggesting a reluctance to promote regardless of unknown market circumstances.

All through Bitcoin’s historical past, short-term holders constantly present extra lively buying and selling conduct and better switch exercise than long-term holders. July 24 noticed a small 6,000 BTC spike in contrast to the remainder of 2024

This knowledge factors to exhibiting short-term profit-taking methods and cautious long-term funding conduct.

The submit Quick-term Bitcoin holder transfers to exchanges peak on Ethereum ETF launch day appeared first on CryptoSlate.

[ad_2]

Supply hyperlink

Leave a Reply