[ad_1]

KEY

TAKEAWAYS

- Sturdy Sector Rotation Out Of Expertise

- Financials and Actual Property Lead

- Inventory/Bond Ratio Triggers Promote Sign

Flying Financials

Within the latest sector rotation, principally OUT of know-how and INTO the rest, Financials and Actual-Property led the relative transfer.

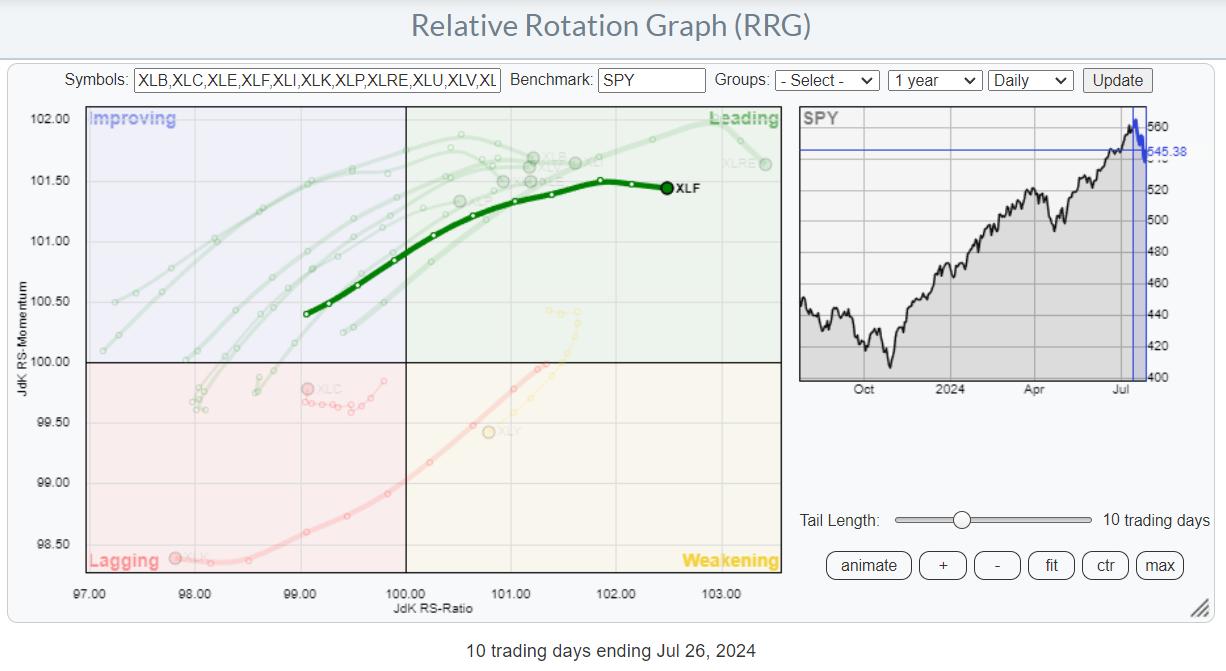

On the RRG above, I’ve highlighted the (every day) tail for XLF to point out the way it stands out from the opposite sectors.

On the weekly RRG, XLF continues to be positioned contained in the lagging quadrant however has began to twist again up on the again of the latest power.

The beginning of the rotation out of Expertise interprets right into a tail for XLK, which has began to roll over contained in the main quadrant. With elevated weak point for Expertise, Communication Providers, and Shopper Discretionary exhibiting on the every day RRG, it now turns into a balancing act to match this rotation with the one seen on the weekly RRG.

Expertise Nonetheless Carries a Lot of Weight

Let’s begin on the prime, the weekly timeframe. Expertise continues to be contained in the main quadrant and has simply began to roll over. There’s nothing uncommon or alarming from this rotation by itself. What’s uncommon, and no less than a bit worrisome, is the excessive focus of tails on the other facet contained in the lagging quadrant. This picture tells the story of slender breadth, which I’ve talked about in articles and blogs.

Info Expertise, on this weekly RRG, nonetheless carries the burden of all the market.

On the every day RRG, the scenario is the precise reverse. XLK has quickly rotated into the lagging quadrant. XLY is inside weakening and heading for lagging, whereas XLC is on a really brief tail inside, lagging with this week’s node choosing up relative momentum. ALL different sectors have rotated into the main quadrant at lengthy tails led by Financials and Actual Property.

This raises the query: Is the robust rotation on the every day RRG the beginning of an even bigger rotation, which is able to drag XLK out of the main quadrant on the weekly RRG, and can this profit the opposite sectors? Or is that this rotation on the every day RRG simply an intermezzo, and can the rotations which have began on the weekly RRG be accomplished on their respective sides of the chart and preserve their long-term relative developments?

Rotation To Different Sectors or Out of the Market?

From the RRGs alone, I really feel that Expertise has develop into top-heavy and desires a break. Cash has began to rotate out of the sector, which is probably going not over but. With the market capitalization remaining so break up between tech and the rest, it is rather effectively potential that the opposite sectors will now take over and assist $SPX keep afloat. In that case, we are going to see broader participation, with all sectors minus tech, however nonetheless a market beneath strain.

However this solely works when the cash stays within the inventory market, i.e., true sector rotation. It is a totally different story when cash begins to maneuver out of the market ($SPX).

Shares vs. Bonds Inform a Story

Once I examine shares and bonds, we see a transparent rotation out of shares (SPY) into bonds (GOVT) within the every day timeframe.

Right here, the weekly image can be not as pronounced, however the first cracks are seen.

On the straight 1-1 comparability between SPY and IEF, we get a bit extra readability.

This week (another hour of buying and selling to go), the SPY:IEF ratio is breaking down from its rising channel, which has been in place since October 2023. It’s breaking the rising assist line and the earlier low (double assist), whereas the destructive divergence between value and RSI is now executing/triggering with a break under the earlier low within the RSI.

So, all in all, it leads me to consider that we face, no less than, a number of weeks of sideways to decrease motion for the S&P 500.

To take care of the long-term uptrend, the market should catch the outflow from large-cap progress/Expertise shares and regroup throughout this era. Ideally, it ought to construct a stronger base by way of the variety of sectors and shares that contribute to a renewed or continued rally within the S&P 500.

For now, warning and cautious cash administration are key.

#StayAlert and have an incredible weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll definitely learn them and, the place fairly potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Drive in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra

[ad_2]

Supply hyperlink

Leave a Reply