[ad_1]

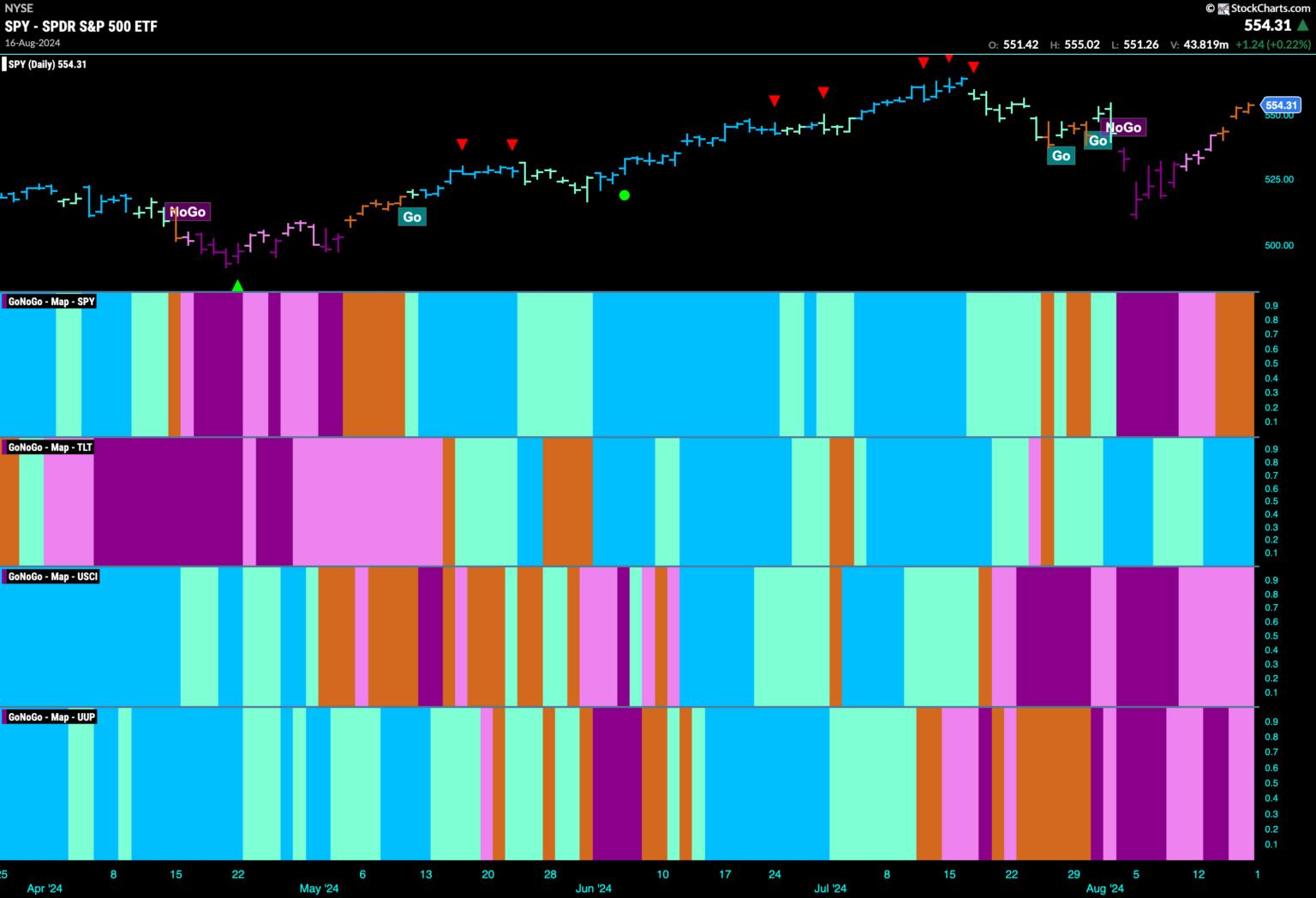

Good morning and welcome to this week’s Flight Path. Equities proceed their path out of the “NoGo” correction. This week we noticed amber “Go Fish” bars over the second half of the week. GoNoGo Pattern exhibits that the pattern in treasury bond costs noticed power with robust blue bars. U.S. Commodities index remained within the “NoGo” pattern however proceed to point out weak spot. The greenback as effectively, noticed weak pink “NoGo” bars on the finish of the week.

$SPY Rallies and Indicator Paints “Go Fish” Bars

On Thursday, worth gapped increased and GoNoGo Pattern painted extra “Go Fish” bars because the week got here to a detailed. There was a lot enthusiasm this week and we’re quick approaching an interim excessive. GoNoGo Oscillator has damaged away from the zero line and out of a small GoNoGo Squeeze into optimistic territory. With optimistic momentum, we’ll watch to see if this provides worth the push it must enter a brand new “Go” pattern.

The longer time-frame chart tells us that the “Go” pattern remains to be protected for now. The week’s robust rally pushed worth increased and away from final week’s lows. We take a look at the oscillator panel and see that GoNoGo Oscillator examined the zero degree for under a bar or two, and was shortly capable of finding assist and bounce again into optimistic territory. Now we will say that momentum is resurgent within the course of the underlying “Go” pattern and we’ll look to see if worth can climb farther from right here.

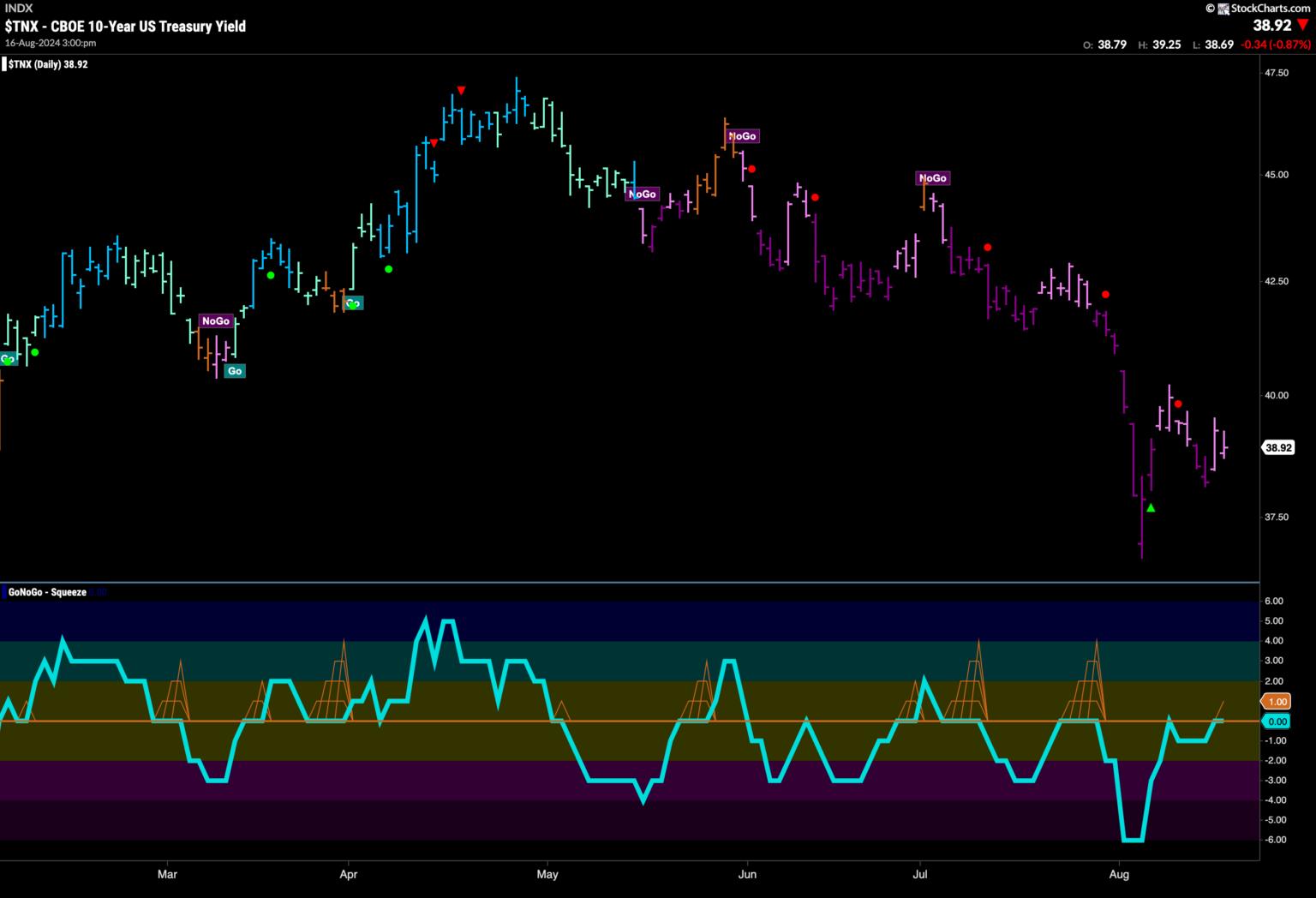

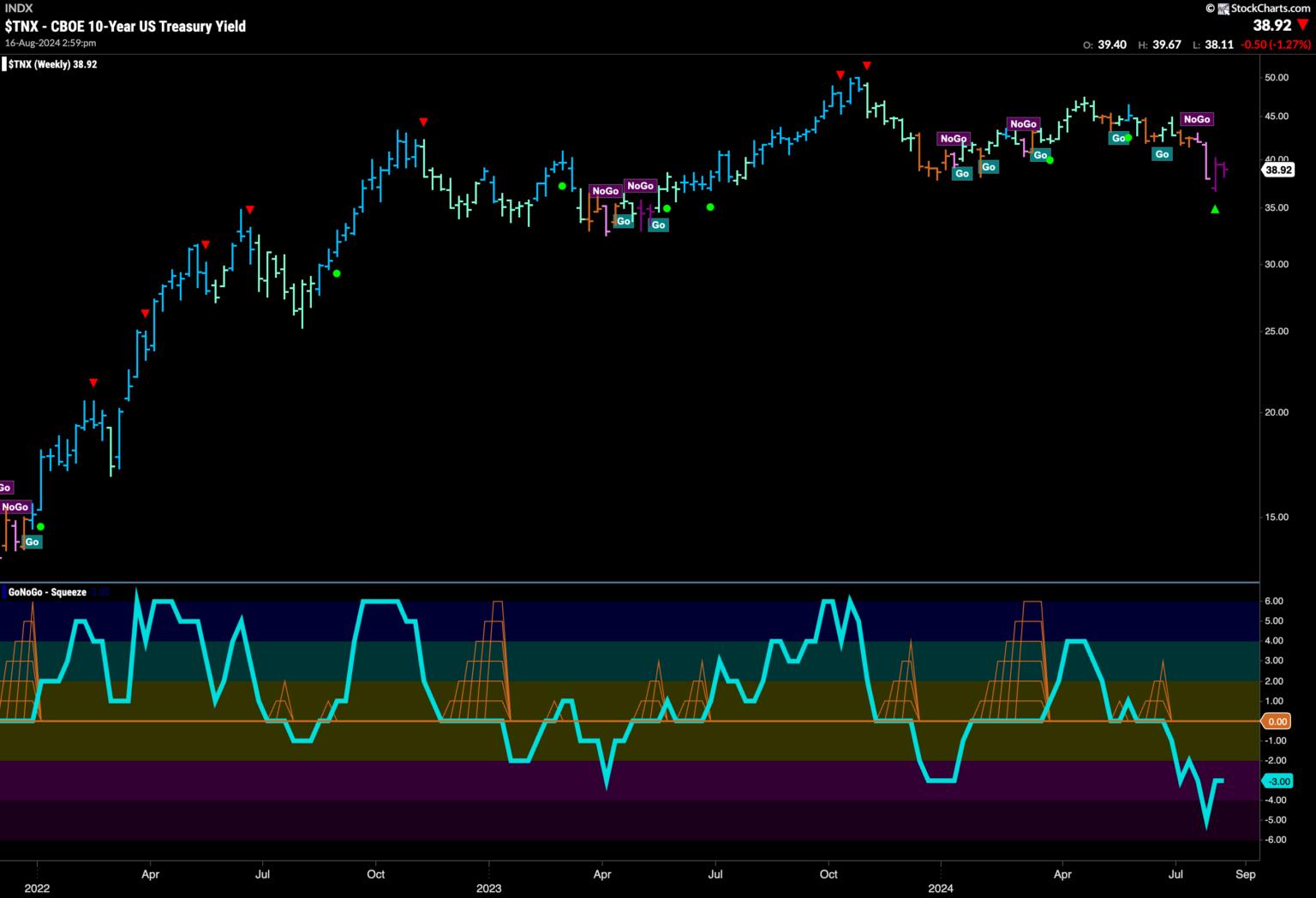

Treasury Stay Suppressed

Whereas there was no new decrease low this week, the “NoGo” pattern remained in place. We will see that worth is portray pink “NoGo” bars, increased than the latest low and decrease than the latest excessive. If we take a look at the oscillator panel, we will see that GoNoGo Oscillator is testing the zero line from beneath once more. We are going to watch to see if it finds resistance at this degree because it has now for a number of weeks.

he weekly chart beneath exhibits us that the pattern stays strongly “NoGo”. That is the second robust purple bar in a row and we will say that there’s draw back strain on costs with the load of the proof method. GoNoGo Oscillator is in damaging territory however now not oversold at a worth of -3.

The Greenback’s “NoGo” Weakens however Stays

It was an up and down week for the greenback. It fell early within the week then gapped increased earlier than falling once more on Friday. We noticed GoNoGo Pattern transfer between pink and purple “NoGo” bars. When worth gapped increased it was not capable of set a brand new excessive and as costs fell once more on Friday we noticed a NoGo Pattern Continuation Icon (crimson circle). GoNoGo Oscillator has been rejected once more by the zero line and so we all know that momentum is within the course of the “NoGo” pattern.

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing the usage of information visualization instruments that simplify market evaluation to take away emotional bias from funding selections.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise buyers’ mastery and ability in mitigating market danger and maximizing return in capital markets. He’s a seasoned enterprise govt targeted on instructional know-how for the monetary providers trade. Since 2011, Tyler has introduced the instruments of technical evaluation all over the world to funding corporations, regulators, exchanges, and broker-dealers.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product improvement of analytics instruments for funding professionals.

Alex has created and carried out coaching packages for giant firms and personal shoppers. His educating covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Study Extra

[ad_2]

Supply hyperlink

Leave a Reply