[ad_1]

Each the S&P 500 and the NASDAQ are sitting at new highs as we wind down a really optimistic incomes season. To this point, nearly 80% of S&P 500 corporations have reported a optimistic earnings shock, with the year-over-year earnings progress charge on the highest stage since Q2 of 2022.

Amid this company progress, we’re now seeing rates of interest pull again following Wednesday’s core CPI knowledge, which got here in decrease than anticipated. In response, the yield on the important thing 10-year treasury bond fell to as little as 4.3% earlier than ticking increased into right this moment’s shut.

That is nice information for progress shares corresponding to Know-how, which have been struggling because the markets march to new highs. A rising charge atmosphere is a damaging for progress shares corresponding to Know-how.

Each day Chart of Know-how Sector (XLK)

Each day Chart of Know-how Sector (XLK)

Whereas Apple’s (AAPL) 12% advance following the discharge of their earnings 3 weeks in the past is actually a think about Know-how’s new uptrend, a reversal in each Semiconductor and Software program shares this previous week is poised to be the newest driver.

As subscribers to my MEM Edge Report are conscious, I have been looking out for renewed curiosity in these excessive progress areas, as our watchlist had prime Semi and Software program names which have now been added to the prompt holdings listing.

Each day Chart of Semiconductor Group (SOXX)

Each day Chart of Semiconductor Group (SOXX)

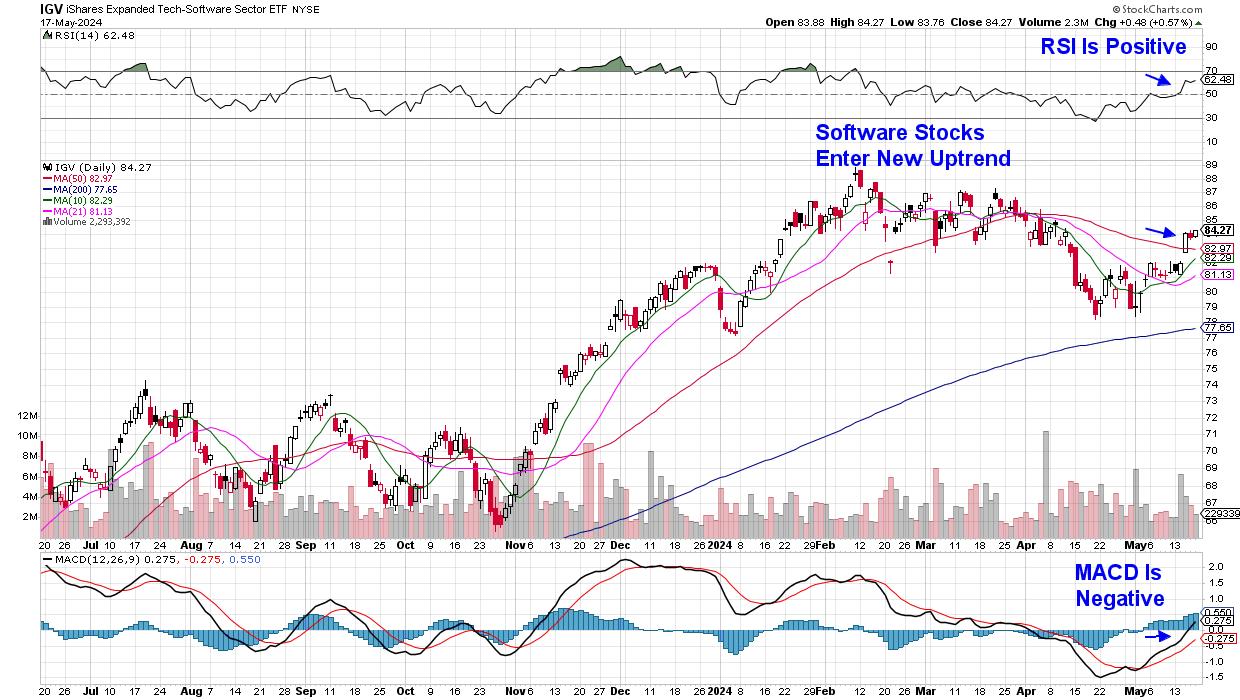

Each day Chart of Software program ETF (IGV)

Each day Chart of Software program ETF (IGV)

Subsequent week might show to be pivotal for these teams amid earnings studies from key gamers. Most impactful will probably be Nvidia (NVDA), which is because of report earnings subsequent Wednesday after the markets shut. Going into the report, analysts are anticipating vital income progress, pushed primarily by their knowledge heart phase because of AI demand.

Amongst Software program shares, Palo Alto (PANW) is because of launch their quarterly outcomes after the market closes on Monday. The Software program Safety inventory is recovering from a niche down in worth after their final quarterly report, the place administration introduced a product launch shift. PANW has entered a brand new uptrend because it strikes nearer to closing its hole decrease.

Different non-growth sectors have additionally been shifting into favor amid elevated AI progress prospects and a decrease rate of interest chance. If you would like to be tuned into these newer areas, in addition to the shares finest positioned to take benefit, use this hyperlink right here to trial my twice-weekly MEM Edge Report for a nominal payment.

Warmly,

Mary Ellen McGonagle

MEM Funding Analysis

Mary Ellen McGonagle is an expert investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to turn out to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra

[ad_2]

Supply hyperlink

Leave a Reply