[ad_1]

Ethereum (ETH) value is hovering forward of the Securities and Change Fee (SEC) resolution relating to the Spot ETH ETF (exchange-traded fund). Buyers’ and market watchers’ optimism has elevated because the ‘King of altcoins’ surpasses the $3,900 mark.

Some analysts imagine this bullish momentum may quickly propel ETH’s value above all established value targets.

Associated Studying

Ethereum Soars Amid ETF Approval Expectation

Ethereum, the second-largest cryptocurrency by market capitalization, has seen a major uptick this week. As rumors of ETH spot ETFs being authorised this Wednesday surged, the neighborhood’s sentiment in the direction of the asset turned extraordinarily bullish.

Beforehand, Bloomberg specialists had asserted that possibilities of an ETF approval have been slim as a result of US authorities’s crackdown on the business. Nonetheless, this week’s U-turn from the Biden administration sparked a optimistic sentiment that elevated the possibilities to 65-75%.

Because of this, Ethereum surged a powerful 30.4% from its value seven days in the past. The King of altcoins went from buying and selling slightly below the $3,000 mark to surpassing the $3,900 resistance degree on the time of writing.

The neighborhood’s optimistic expectations proceed as a number of US lawmakers urge SEC chair Gary Gensler to approve Ethereum ETFs.

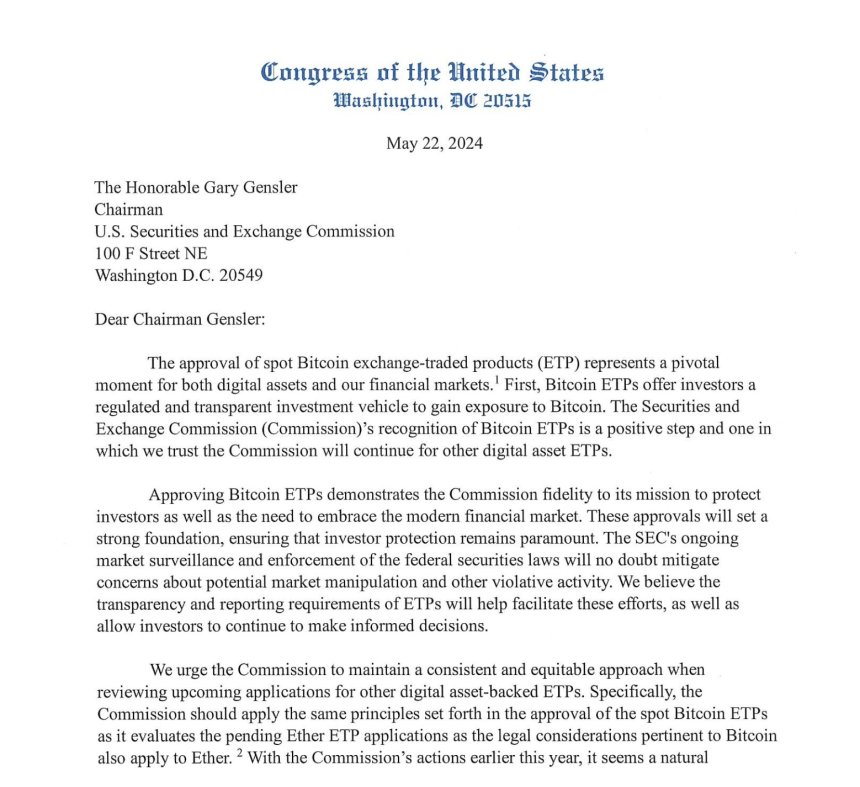

As reported by Eric Balchunas, a bipartisan group of Home lawmakers despatched a letter on Tuesday to the SEC’s Chair asking for the approval of ETH ETFs “and different digital belongings.”

Based on the letter, the Congress members imagine digital asset-backed ETFs supply “buyers a regulated and clear funding automobile to realize publicity.” The US lawmakers urged the Fee to “keep a constant and equitable method when reviewing upcoming purposes” for different crypto ETFs.

Are Worth Targets Too Low?

Ethereum has carried out remarkablely over the previous few days. ETH has surged 5.6% because the neighborhood awaits the SEC’s resolution.

As identified by a number of market watchers, ETH’s weekly candle is resting ranges not seen for the reason that first half of March. Crypto Yoddha highlighted Ethereum’s historic habits for the earlier all-time excessive (ATH) runs.

Per the chart, the second-largest crypto asset went via a 700-day accumulation section earlier than breaking out and beginning the bullish run. Equally, ETH seemingly ended a 700-day accumulation interval this cycle, which may result in a rally in the direction of a brand new ATH, if historical past repeats. The analyst set a goal of $15,300 for this cycle.

Likewise, Crypto Jelle identified that ETH broke out of a multi-month falling wedge sample. Its latest efficiency efficiently reclaimed the important thing resistance above the $3,600 mark and is at the moment testing the $3,900 value vary.

The dealer considers that, if that is the present efficiency earlier than the approval of ETH ETFs, his $10,000 goal for this cycle could be “too low.” Nonetheless, he urged buyers to “strive to not get sucked into overtrading.”

He considers the preliminary response to the choice “arduous to know” regardless of the bullish sentiment. Finally, Jelle suggests the neighborhood to “give attention to what you understand” because the long-term outlook is far clearer.

Associated Studying

On an identical word, Crypto analyst Mikybull factors out that ETH is repeating the 2020 path that “sparked off Alts season in 2021.” Because of this, the dealer considers that the bull targets for this cycle are $9,000-$11,000.

The SEC’s resolution relating to ETH ETFs can be introduced round 8:30 pm UTC on Might 23.

Featured Picture from Unsplash.com, Chart from TradingView.com

[ad_2]

Supply hyperlink

Leave a Reply