[ad_1]

In per week marked by consolidation throughout the cryptocurrency market, the native token of Uniswap, UNI, has defied the development, surging over 15%, and surpassing the $10 mark. This bullish run comes amid constructive developments inside the Ethereum ecosystem and Uniswap’s ongoing authorized battle with the US Securities and Alternate Fee (SEC).

Associated Studying

Driving The Ethereum Wave

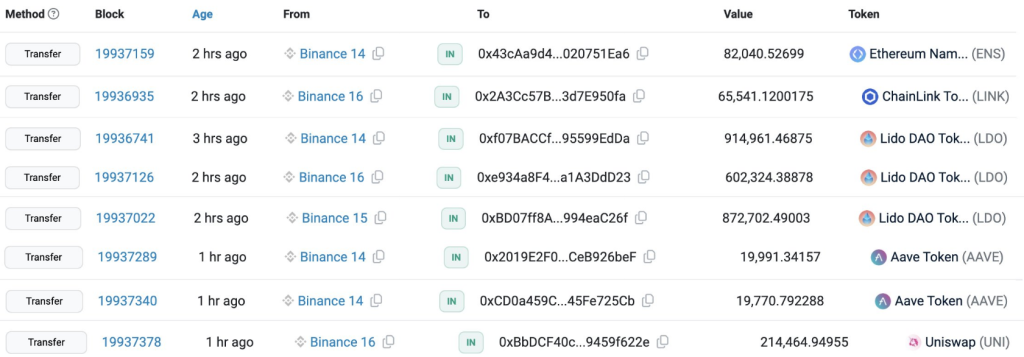

Past the authorized battle, the present momentum inside the Ethereum ecosystem can be propelling UNI’s value upwards. On-chain knowledge reveals important whale withdrawals from crypto exchanges following information of a possible spot Ethereum ETF.

One other contemporary pockets withdrew 213,166 UNI($1.96M) from #Binance simply now.https://t.co/u15CE864hm pic.twitter.com/kyOBv0TB5G

— Lookonchain (@lookonchain) Might 24, 2024

This flight to security, coupled with the general bullish sentiment surrounding Ethereum, is making a ripple impact that advantages UNI, a key participant inside the Ethereum DeFi panorama.

From a technical standpoint, UNI’s breakout from a month-to-month consolidation part paints a promising image. Each technical indicators and on-chain knowledge counsel a possible 25% value enhance for UNI.

The token’s current surge signifies a possible bull run, with analysts eyeing a value goal of $12.80 if the present momentum continues.

Including gas to the hearth is Santiment’s Age Consumed index, which measures the motion of dormant tokens. Spikes on this index usually precede value rallies, and the newest uptick by the latter a part of April appears to have foreshadowed UNI’s present uptrend.

This on-chain metric reinforces the bullish outlook for UNI, suggesting that buyers are awakening to its potential.

Brief Sellers Get Burned As Bulls Take Cost

The current value rally has additionally been accompanied by a major rise in buying and selling exercise. Information from Coinalyze reveals over $1 million in Uniswap liquidations within the final day.

Nearly all of these liquidations (over $750,000) have been brief positions, indicating that merchants betting towards UNI are feeling the warmth. This surge in open curiosity, with extra merchants going lengthy on UNI, additional strengthens the bullish management over the token’s value.

Uniswap Takes A Stand In opposition to The SEC

This show of defiance has instilled confidence amongst buyers, who view it as a constructive signal for Uniswap’s future. The favored decentralized trade (DEX) lately obtained a Wells discover from the regulatory physique, alleging that UNI is a safety. Nonetheless, Uniswap has vowed to problem this declare, asserting that the SEC’s case is weak.

Associated Studying

The SEC case towards Uniswap stays unresolved, and a unfavourable end result might dampen investor sentiment. A broader market correction might nonetheless affect UNI’s value.

Featured picture from Wallpapers, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply