[ad_1]

The slow-moving dumpster hearth that’s the Synapse-Evolve meltdown has changed into a nightmare for a lot of fintech prospects.

Synapse acted as a intermediary between banks and fintechs, however there have been a number of disagreements between Synapse and these banks and fintechs. Shoppers who assumed their cash was secure are caught within the center.

Synapse had contracts with 20 banks and round 100 fintechs with a complete of 10 million finish customers. Many of those finish customers have been locked out from accessing their funds.

There are a number of tales of customers with tens of hundreds of {dollars} that they’re unable to entry. The cash doesn’t look like gone, solely frozen in place, whereas Synapse works out its variations with one in all its largest financial institution companions, Evolve Financial institution & Belief.

Hearings in Synapse’s chapter case have been ongoing this week in California because the choose tries to grasp a fancy and messy state of affairs.

It’s not a superb search for banking-as-a-service and for fintech typically. This must be resolved shortly, or we are able to count on policymakers to step in.

Featured

> Fintech nightmare: ‘I’ve almost $38,000 tied up’ after Synapse chapter

Synapse is a center man between customer-facing fintech manufacturers and FDIC-backed banks, but it surely has had disagreements about how a lot in buyer balances it owed.

From Fintech Nexus

>Fintech’s future predicted in Team8 report

By Tony Zerucha

A Team8 report charts the business’s path by predicting what stays and modifications whereas taking a couple of massive swings at potential mega-trends.

> Aplazo baggage $45B from QED buyers to broaden BNPL in Mexico

By David Feliba

Mexican fintech Aplazo concluded its Collection B funding spherical, securing $70 million, with an extra $45 million in new fairness financing.

Podcast

Brendan Carroll, Co-Founder & Senior Companion of Victory Park Capital, on the expansion of personal credit score

The Co-Founding father of Victory Park takes us by the historical past of asset backed lending, how the business has grown, and what…

Editorial Cartoon

Webinar

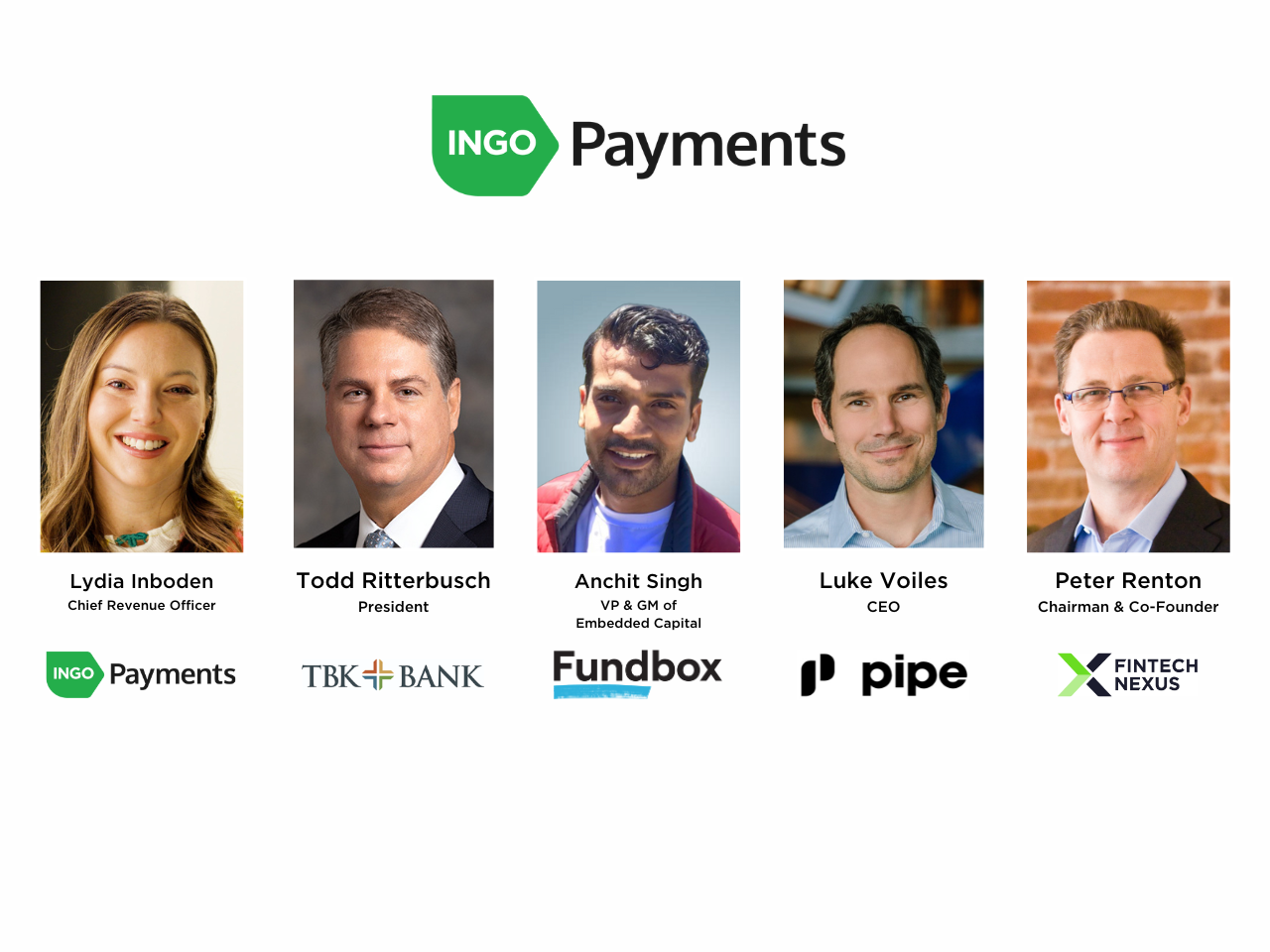

Prompt funds orchestration: an important instrument now for lending and factoring

Jun 5, 2pm EDT

In as we speak’s on-demand economic system, instantaneous funds are transferring from a nice-to-have to vital. Within the small enterprise area,…

Additionally Making Information

- USA: Varo Financial institution faces lawsuit over March information breach

The lawsuit accuses the net financial institution of failing to guard private info saved inside its community, together with buyer telephone numbers and the final 4 digits of Social Safety numbers.

- USA: Freelancers See Prompt Funds as Monetary Lifeline

Being a freelancer requires continuously drumming up work whereas hoping for immediate cost. Furthermore, customers who work freelance, contract or consulting depend on disbursement funds for half, if not all, of their revenue. Failure to obtain well timed cost can result in monetary pressure. Prompt funds can relieve this for freelancers.

- USA: Profitable When Prospects Win: Reworking Client Finance

LendingClub CEO Scott Sanborn discusses the corporate’s transformation since buying Radius Financial institution in 2021, the methods they’re using to navigate a difficult financial atmosphere and their imaginative and prescient for leveraging expertise and information to redefine client banking.

- UK: Zopa enters renewable power market

Zopa Financial institution has entered the UK’s £23 billion renewable power market, making its suite of purchase now, pay later and retail finance merchandise obtainable to Octopus Power prospects throughout the nation.

To sponsor our newsletters and attain 180,000 fintech fanatics together with your message, contact us right here.

[ad_2]

Supply hyperlink

Leave a Reply