[ad_1]

Final month, it was Chase, this month, it’s PayPal launching a brand new advert enterprise.

PayPal has employed Uber’s former head of promoting to run PayPal Advertisements, the brand new division that might be promoting focused advertisements based mostly on its buyer knowledge.

Let’s take into account PayPal’s scale for a second. Within the first quarter alone, PayPal processed 6.5 billion funds from 400 million customers. Every a type of funds is a novel knowledge level that can be utilized for advert concentrating on.

PayPal customers could be opted in by default however may have the flexibility to opt-out.

It will likely be attention-grabbing to see how these advertisements are acquired from PayPal’s clients as soon as they’re rolled out.

However I believe we’re seeing a wholly new product class emerge for these fintech corporations and banks with sufficient scale.

Featured

> PayPal Is Planning an Advert Enterprise Utilizing Information on Its Thousands and thousands of Consumers

The funds firm hires Uber’s former head of promoting to run a brand new advert division.

From Fintech Nexus

>Kueski, fintechs trip the BNPL wave in Mexico, the place money remains to be king

By David Feliba

Unique interview with Andrew Seiz, head of finance at Kueski, on the 2024 outlook for shopper lending and Purchase Now Pay Later in Mexico.

Podcast

Joel Sequeira, Director of Product at IDology, on utilizing AI in id verification

There isn’t any space of fintech shifting sooner than id verification at present. With new assault vectors coming on-line on daily basis…

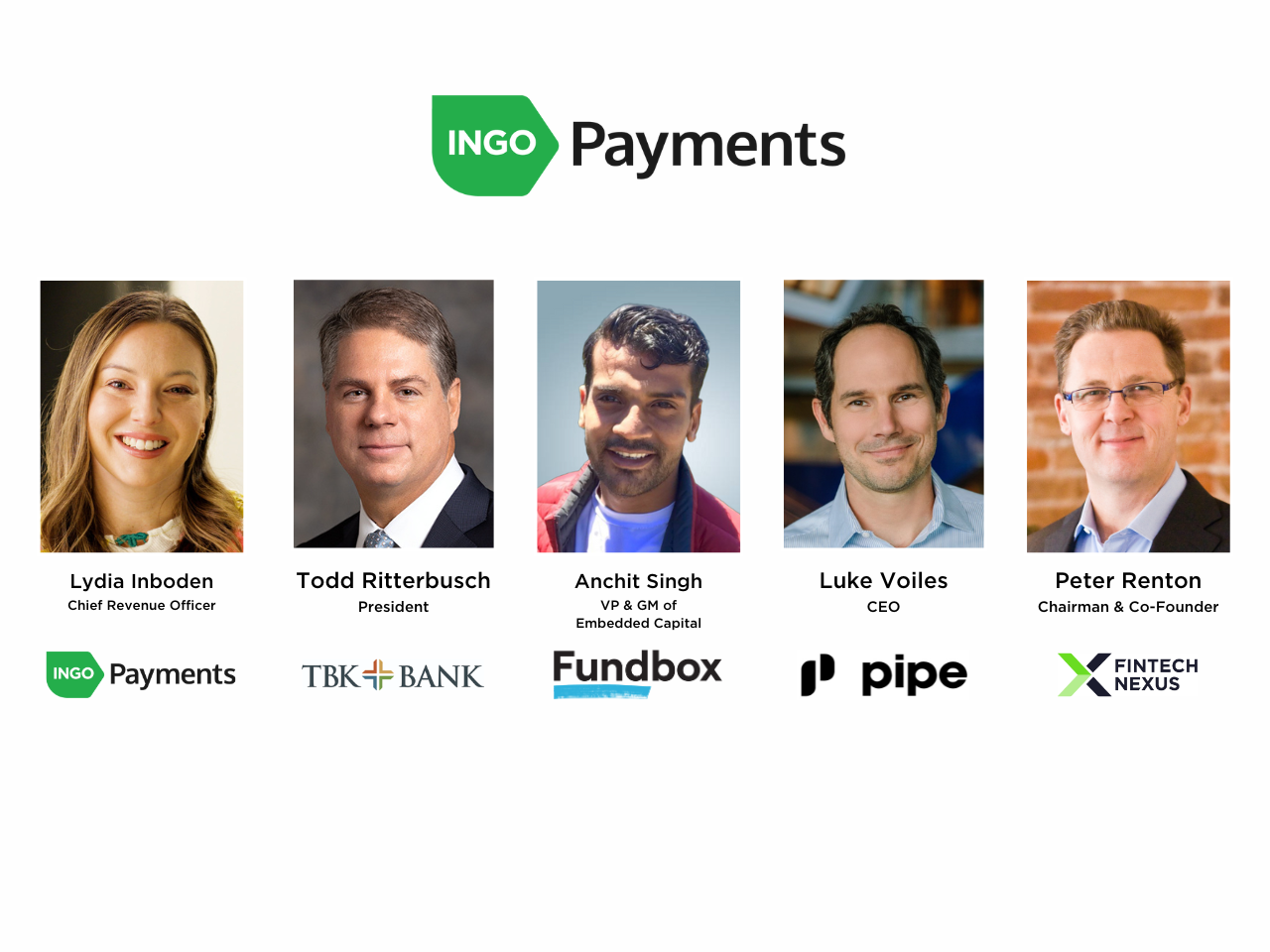

Webinar

On the spot funds orchestration: a vital instrument now for lending and factoring

Jun 5, 2pm EDT

In at present’s on-demand financial system, instantaneous funds are shifting from a nice-to-have to vital. Within the small enterprise area,…

Additionally Making Information

- International: The New Working System for B2B: Funds, Software program and Information

There’s no scarcity of complexities in terms of the enterprise relationship between patrons and sellers. There are cost strategies, phrases, timelines and compliance points, to call just some. Add financial uncertainty and excessive rates of interest that make cash scarce, and also you place extra stress on a enterprise to run effectively.

- USA: Is fintech the important thing to raised debt collections?

Digital-first assortment businesses resembling TrueAccord, January and InDebted are analyzing shopper engagement indicators and extra to find out the best approach for its purchasers to gather on debt.

- Europe: BaFin lifts N26 buyer onboarding cap

After greater than two years, Germany’s monetary regulator BaFin has lifted a cap on the variety of new clients that digital financial institution N26 can onboard.

To sponsor our newsletters and attain 180,000 fintech lovers together with your message, contact us right here.

[ad_2]

Supply hyperlink

Leave a Reply