[ad_1]

In a technical evaluation shared by famous crypto analyst Josh Olszewicz on the social platform X, there seems to be a major bullish sentiment constructing round Bitcoin, notably if it surpasses the essential $72,000 mark. Olszewicz, leveraging each the Ichimoku Cloud and Fibonacci extensions, illustrates a state of affairs the place breaking this key resistance stage may catapult Bitcoin in the direction of a goal of $91,500.

Right here’s How Bitcoin May Skyrocket To $91,500

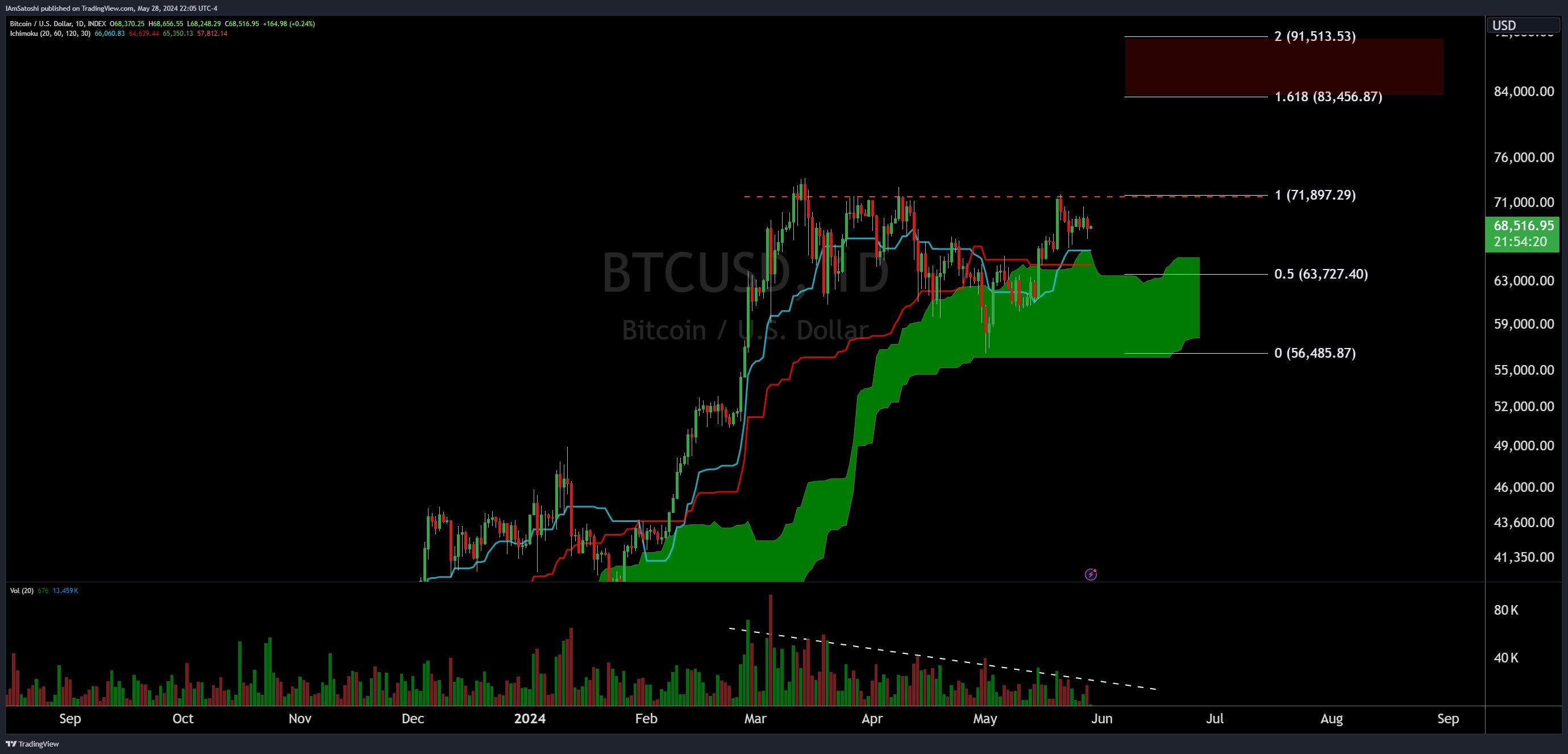

The evaluation makes use of the Ichimoku Cloud, a fancy technical indicator that gives insights into the market’s momentum, development course, and potential areas of assist and resistance over totally different time frames. At the moment, Bitcoin’s worth motion is depicted as being in a bullish section, located above the cloud. This positioning above the cloud is historically considered as a bullish sign, suggesting a robust uptrend with sturdy assist ranges fashioned by the cloud’s decrease boundaries.

Within the Ichimoku setup, the conversion line (Tenkan-sen) and the baseline (Kijun-sen) cross sometimes, offering purchase or promote alerts based mostly on their intersection relative to the cloud. As of the newest chart, the conversion line not too long ago crossed above the baseline, reinforcing the bullish outlook depicted by the cloud’s positioning.

Associated Studying

Including one other layer to the technical narrative, Fibonacci extension ranges have been plotted from a major low at $56,485.87 as much as a excessive, offering potential targets and resistance ranges. The 0.5 Fibonacci extension stage is marked at $63,727.40, already surpassed by the present worth trajectory.

The 1.0 extension finds itself at $71,897.29, intently aligning with the analyst’s famous pivotal stage of $72,000. Past this, the 1.618 extension at $83,456.87 represents a profitable first worth goal, whereas the final word 2.0 extension looms at $91,513.53.

A key commentary is the quantity profile, which exhibits a declining development in buying and selling quantity. This reducing quantity can usually point out a interval of accumulation, as much less promoting stress permits costs to stabilize and probably construct a base for an upward breakout. The declining quantity development line underpins the consolidation section seen in latest months, suggesting {that a} sharp motion may very well be imminent as soon as accumulation concludes.

Associated Studying

Olszewicz’s emphatic comment, “BTC: when this child hits $72k you’re going to see some severe shit,” underscores the excessive stakes related to this resistance stage. This isn’t merely a technical commentary however a sign to the market that after $72,000 is decisively damaged, the trail to a lot greater ranges turns into more and more possible.

Such a breakout would probably activate a flurry of buying and selling exercise, as each retail and institutional traders may see it as a affirmation of a sustained upward development, probably pushing the worth in the direction of the $91,500 mark indicated by the two.0 Fibonacci extension.

At press time, BTC traded at $67,783.

Featured picture created with DALL·E, chart from TradingView.com

[ad_2]

Supply hyperlink

.png?w=280&resize=280,210&ssl=1)

Leave a Reply