[ad_1]

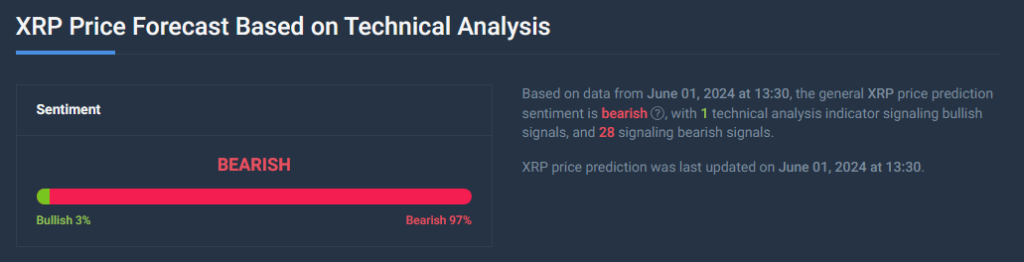

Crypto traders are conserving a detailed eye on Ripple (XRP) as technical indicators paint a regarding image for the altcoin’s worth. After closing beneath its 20-day exponential shifting common (EMA) for 4 consecutive days, XRP has entered what many analysts interpret as a bearish zone.

Associated Studying

This technical indicator suggests a possible shift in market sentiment, with the common worth of XRP over the previous 20 days appearing as a resistance degree. With the present worth buying and selling beneath this key benchmark, analysts concern a decline in demand might be imminent.

On the time of writing, XRP was buying and selling at $0.52, down 0.3% and three.1% within the final 24 hours and 7 days, respectively, knowledge from Coingecko exhibits.

Demand For XRP Loses Steam

Including gas to the bearish fireplace are XRP’s momentum indicators, which offer insights into the power and course of worth actions. Each the Relative Power Index (RSI) and Cash Circulation Index (MFI) are at the moment positioned beneath their impartial factors. This implies that purchasing strain behind XRP is waning, with traders probably trying to offload their holdings reasonably than accumulate extra.

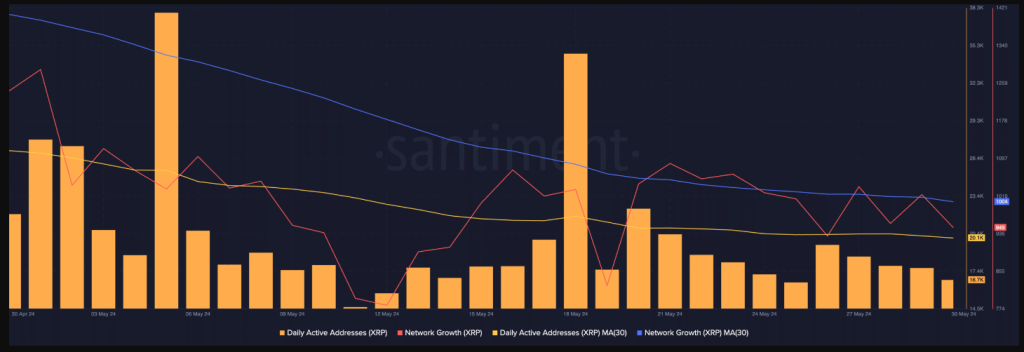

Additional dampening the temper is a big drop in XRP’s lively on-chain addresses. In line with knowledge from Santiment, the variety of each day lively addresses on the XRP community has cratered by 30% over the previous month. This decline is commonly seen as a precursor to a worth hunch, because it signifies a lower in general community exercise and consumer engagement.

Revenue Amidst The Gloom?

Nonetheless, there are some glimmers of hope for XRP bulls. An attention-grabbing knowledge level reveals that each day merchants are nonetheless managing to show a revenue. An evaluation of XRP’s each day transaction quantity in revenue in comparison with loss exhibits that for each transaction ending in a loss, 1.16 transactions yield income. This implies that regardless of the general bearish sentiment, short-term buying and selling alternatives would possibly exist for expert traders who can capitalize on market volatility.

MVRV Ratio Provides A Completely different Perspective

One other issue that might entice some traders is the unfavorable Market Worth to Realised Worth (MVRV) ratio for XRP. This metric primarily compares the present market worth of XRP with the common worth at which all XRP tokens have been acquired.

A unfavorable MVRV ratio means that XRP is at the moment undervalued, probably presenting a shopping for alternative for traders searching for belongings buying and selling beneath their historic worth factors.

Associated Studying

XRP Worth Forecast

In the meantime, the present XRP worth prediction signifies a 20% rise to $0.626627 by July 1, 2024, regardless of a bearish market sentiment mirrored by technical indicators. The Worry & Greed Index at 72 exhibits excessive investor greed, suggesting robust shopping for habits but in addition a threat of overbought situations and potential worth corrections if sentiment shifts.

[ad_2]

Supply hyperlink

Leave a Reply