[ad_1]

In a video replace, Miles Deutscher, a broadly adopted crypto skilled, offered his 502,800 followers on X with an in-depth evaluation of the present market situations. This replace got here in response to what Deutscher described as “huge ramifications” for sure altcoins following a notable Bitcoin value surge.

Deutscher started his dialogue by mentioning a important rally in Bitcoin’s value, which soared from $68,500 to over $71,000. This motion aligns together with his remark of considerable inflows into Bitcoin spot ETFs, which he highlighted as almost reaching $900 million in a single day. This determine is distributed throughout varied funds, with Constancy, BlackRock and ARK contributing the biggest shares.

“That is the best influx that Bitcoin has gotten because the main breakout in March,” Deutscher said. He related these inflows to a broader bullish sentiment out there, suggesting that they point out a strong institutional curiosity that had not been seen since Bitcoin’s earlier highs round $74,000.

Strategic Altcoin Play #1: BNB Ecosystem

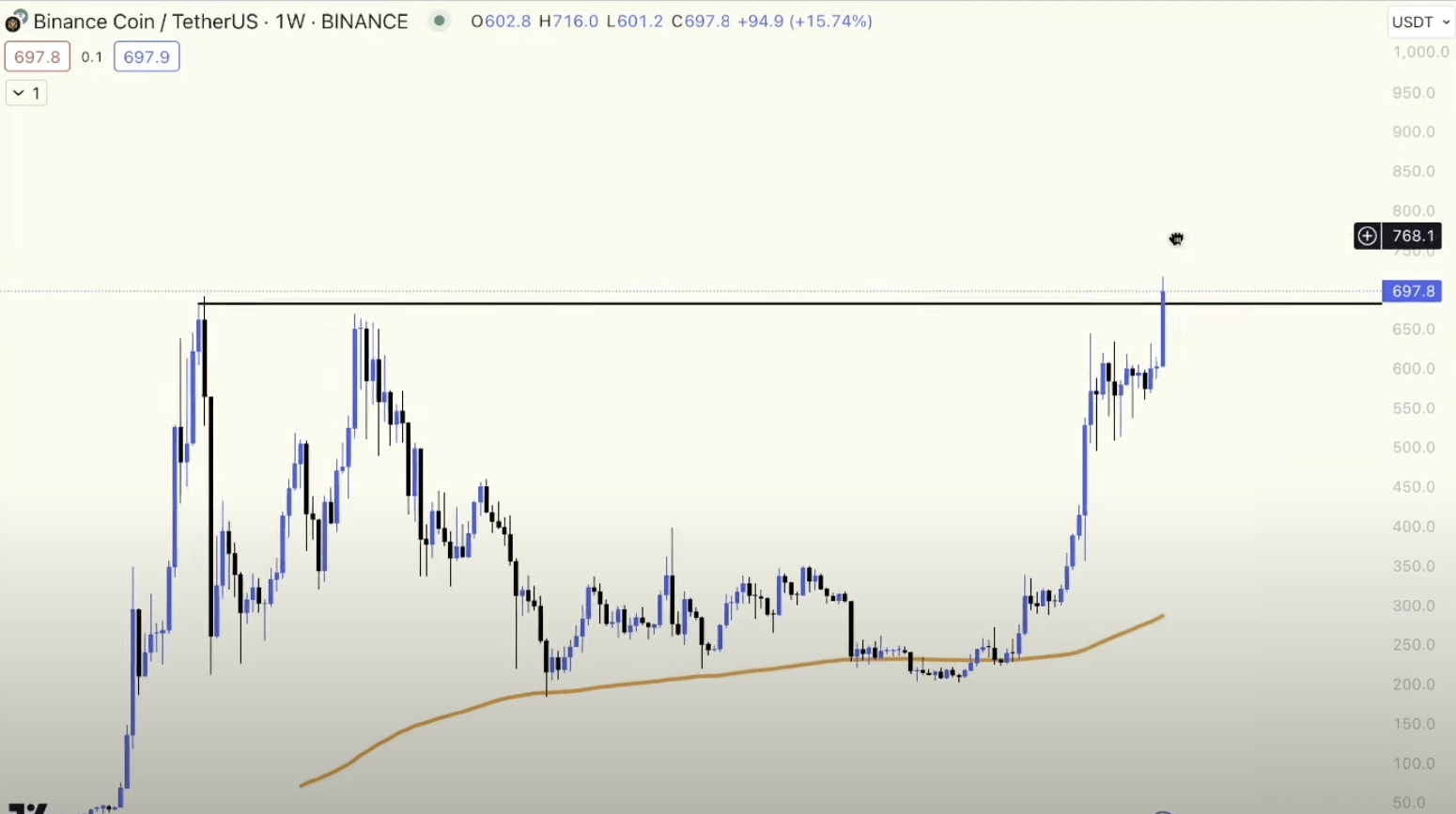

Shifting the main target to the altcoin market, Deutscher honed in on Binance Coin (BNB) and its related tokens. He elaborated on BNB’s efficiency, noting its breakout to new all-time highs and its defiance of typical market gravity. He suggested potential traders to contemplate coming into positions after a definitive weekly shut.

Associated Studying

“When a coin is in value discovery, it’s typically very onerous to fade that coin. In the event you’re considering an extended right here, await an in depth above on the weekly when you’re the next timeframe dealer, after which you will have very clear invalidation for this subsequent leg to the upside,” Deutscher mentioned.

Within the BNB ecosystem, Deutscher identified particular tokens poised for progress, particularly FLOKI and Cake. FLOKI, which gained the analyst’s nod as “one of many main meme cash on the Binance Sensible Chain,” has proven comparable value actions to a different meme coin, Pepe. Observing these patterns, Deutscher predicted a attainable 20% upside potential for Floki following its breakout.

Cake, recognized for its position as the biggest DEX on the Binance Sensible Chain, has began to indicate promise by reclaiming key assist ranges. “Cake is an attention-grabbing play. As a result of Cake, on the weekly chart, has been fairly unimpressive, but it surely’s now lastly beginning to present indicators of desirous to reclaim that main assist degree, […], a reclamation of that degree might ship it to $5.”

#2 Ethereum Is Prepared To Shock

A good portion of Deutscher’s evaluation was devoted to Ethereum and the speculative impacts of the upcoming spot Ether ETFs in the USA. He mentioned how Ethereum’s potential underperformance relative to Bitcoin might arrange a profitable shopping for alternative forward of the ETH ETF’s launch.

Associated Studying

Deutscher quoted market sentiment from varied tweets, indicating a basic consensus that Ethereum may underperform in ETF inflows, which he believes is an undervalued viewpoint.

“Given the truth that Bitcoin is considerably upticking, the ETH inflows might shock. And the ETH chart actually hasn’t completed as a lot as you assume it will, contemplating they’re on the verge of a significant, main catalyst ” he defined, suggesting that the market could be underestimating Ethereum’s attraction to institutional traders.

#3 Crypto Development: Actual-World Property

Third, Deutscher explored the idea of real-world asset (RWA) staking as an rising funding alternative throughout the Ethereum ecosystem. He cited Ondo Finance as a pacesetter on this space, already displaying sturdy efficiency and potential for additional beneficial properties.

“It’s really consolidating into one other bull flag right here on the 1-hourly and the 4-hourly after breaking above that $1.33 degree. The worth motion right here is totally completely wonderful. It’s a factor of magnificence,” Deutscher famous.

He additionally highlighted tasks like Mantra and Pendle as different key gamers benefiting from the shift towards RWA staking. “Mantra just lately introduced their staking as properly. Pendle is clearly a platform to allow you to earn yield. It is a clear beneficiary. These tokens, for my part have been the RWA leaders, […]. All of those can carry out properly.”

At press time, ETH traded at $3,799.

Featured picture created with DALL·E, chart from TradingView.com

[ad_2]

Supply hyperlink

Leave a Reply