[ad_1]

Monitoring adjustments in liquidity is equally essential as monitoring adjustments in Bitcoin‘s on-chain knowledge. Every worth motion, be it up or down, exerts important stress on liquidity. One option to analyze adjustments worth swings carry to the market is to take a look at market depth.

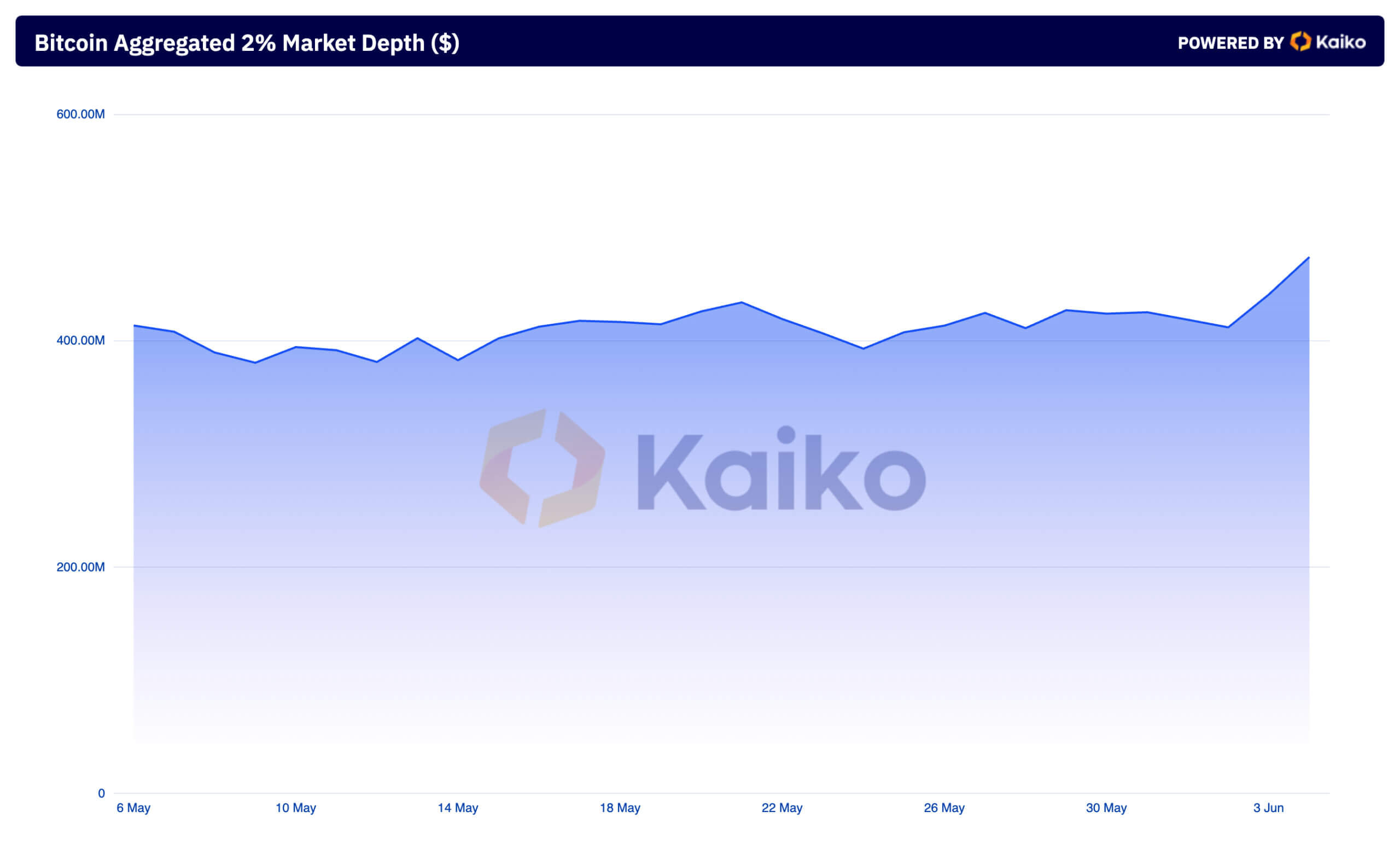

The aggregated 2% market depth and the two% bid vs. ask depth are wonderful indicators of market liquidity and sentiment for Bitcoin. The aggregated market depth represents the mixed worth of purchase and promote orders inside a 2% vary of the present worth. It gives perception into how a lot BTC could be traded with out inflicting important worth actions. On June 2, the aggregated market depth was $411.83 million throughout centralized exchanges tracked by Kaiko. The depth spiked to $473.97 million on June 4, the best previously two months.

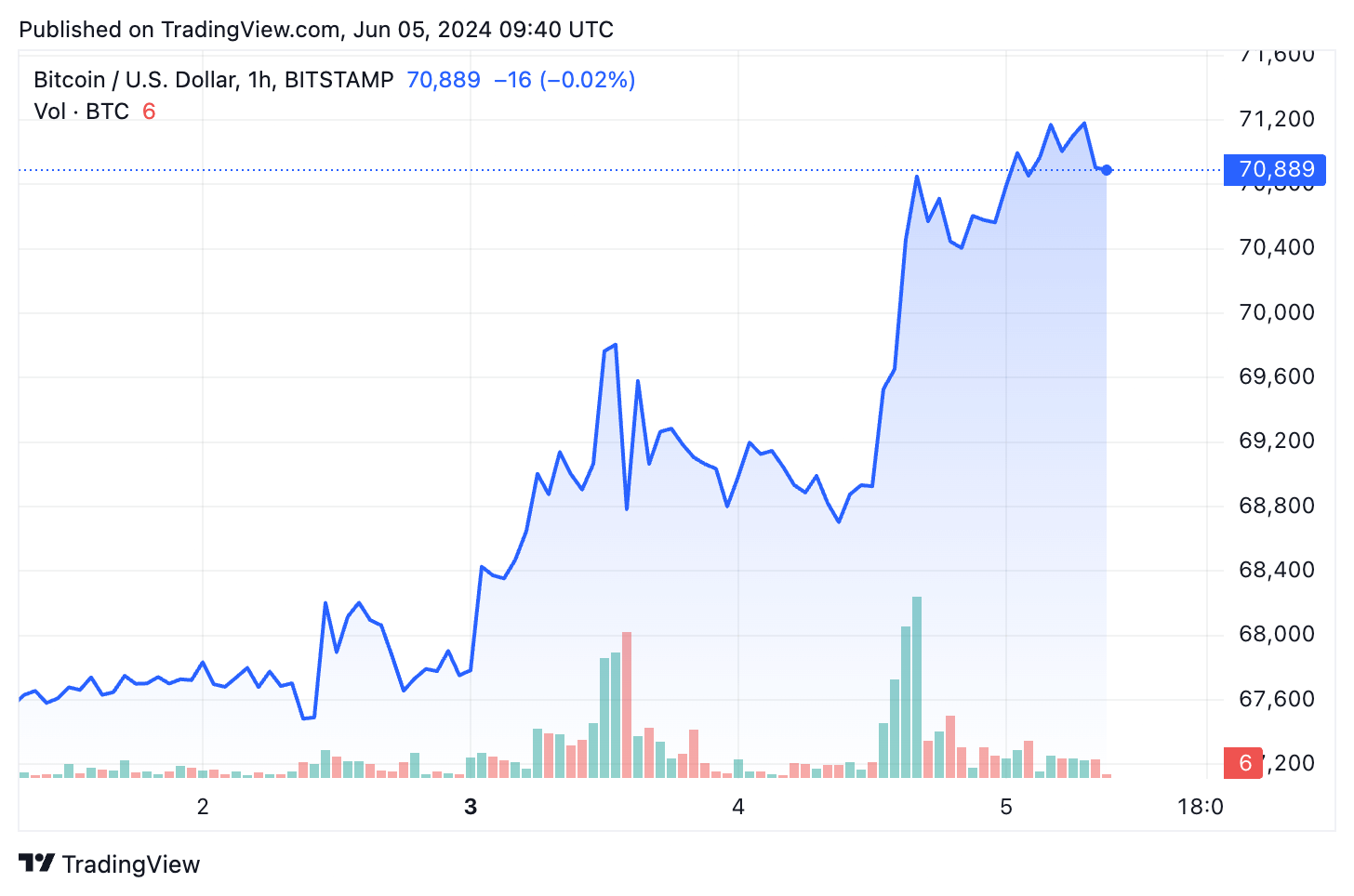

The spike in market depth adopted Bitcoin’s worth improve from $67,750 to $70,600. Whereas this may not be a big proportion improve, $70,000 is an particularly essential psychological milestone. This spike turns into much more important when accounting for the truth that BTC spent weeks within the mid $60,000 vary.

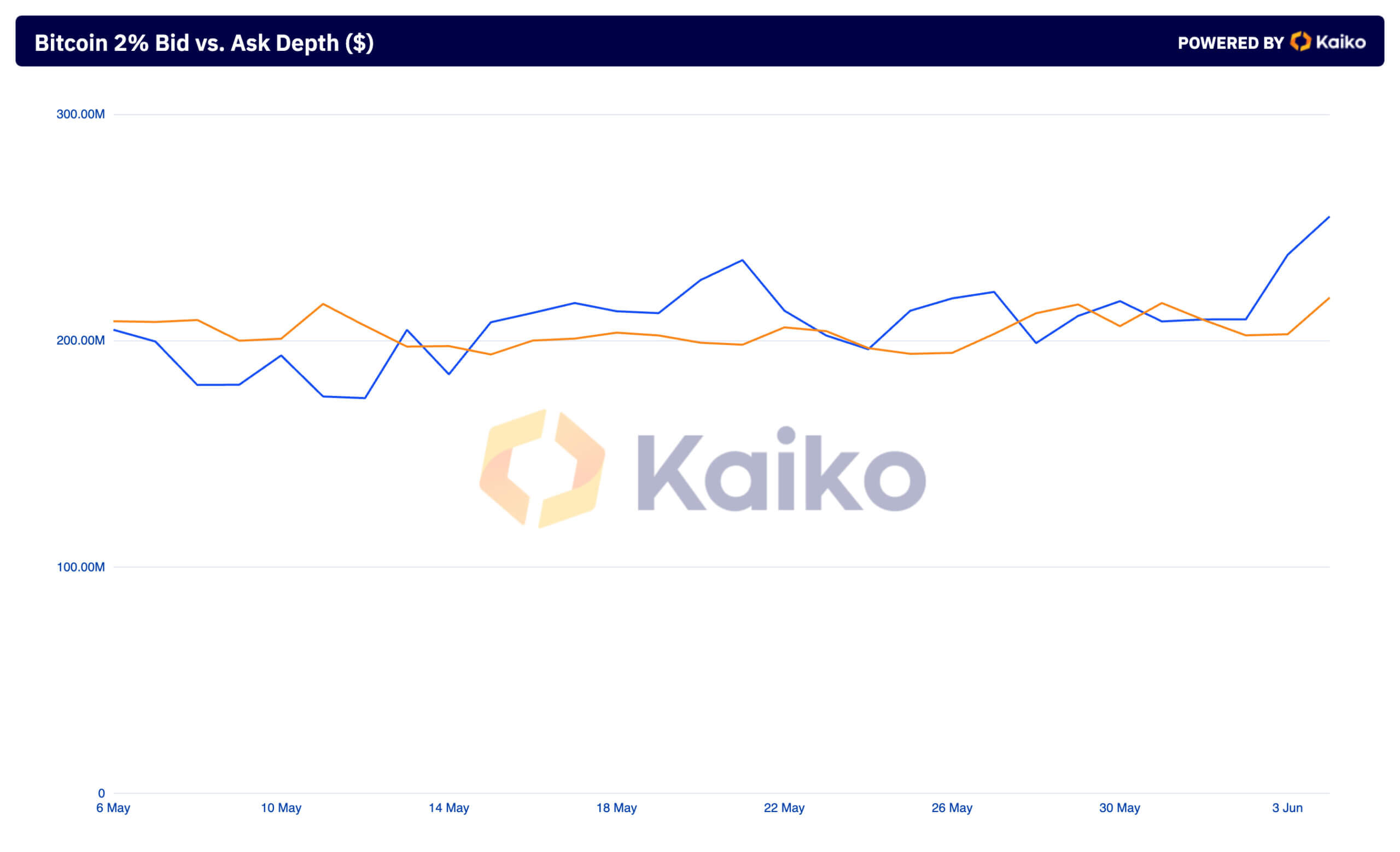

The bid vs. ask depth reveals the worth of purchase and promote orders throughout the similar 2%. This unfold additionally noticed a notable improve over the previous couple of days. On June 2, there have been $202.40 million in bids and $209.44 million in asks. This aligns with earlier CryptoSlate evaluation, which discovered the market nearly equally break up between shopping for and promoting.

By June 4, the bids had elevated to $219.06 million, and the asks had risen sharply to $254.91 million, ensuing within the largest unfold between asks and bids since early April. This improve in each market depth and bid vs. ask depth reveals heightened market exercise.

The rise in aggregated market depth means that the market can deal with bigger trades with much less affect on worth. It is a clear signal of better liquidity available in the market. This increased liquidity means merchants can execute substantial transactions with out inflicting important worth fluctuations, contributing to general market stability. The simultaneous improve in bid and ask depth displays the elevated exercise and confidence amongst merchants. Extra purchase and promote orders throughout the 2% vary present that merchants are extra actively taking part available in the market.

The bigger improve in ask depth in comparison with bid depth implies that sellers are setting increased costs, anticipating continued worth features. This sentiment is supported by the substantial rise in bid depth, indicating sturdy demand for Bitcoin at increased worth ranges. As extra consumers enter the market, prepared to buy at these elevated costs, the market’s upward momentum is strengthened. The elevated liquidity, coupled with increased bid and ask values, paints an image of a sturdy buying and selling atmosphere the place giant trades could be executed with minimal affect on the value.

A good portion of this exercise resulted from spot Bitcoin ETFs. Farside knowledge confirmed that spot Bitcoin ETFs noticed $886.6 million in inflows on June 4, making it the second-largest day of inflows since launch. CryptoSlate reported that this was the biggest influx ever for a day when no US ETF recorded an outflow, together with GBTC. The bigger unfold between asks and bids means that sellers anticipate continued worth will increase, setting increased costs accordingly. The elevated liquidity helps worth stability, making the market extra engaging to institutional traders and enormous merchants. The rising institutional curiosity, evidenced by the rise in ETF inflows, cements the demand for Bitcoin, contributing to the potential for sustained worth features within the coming months.

The publish Market depth reveals Bitcoin’s underlying power at $70k appeared first on CryptoSlate.

[ad_2]

Supply hyperlink

Leave a Reply