[ad_1]

Bitcoin is dumping when writing, cooling off from Could highs of practically $72,000. Down roughly 10% from all-time highs, there might be extra losses on the way in which, no less than wanting on the candlestick association within the every day chart.

Now, Willy Woo, a Bitcoin on-chain analyst, thinks the drop is primarily due to the continuing “miner capitulation.” Woo notes that the community is now actively “culling” out weak miners, forcing them to close down their operations.

Associated Studying

As they exit, they promote their BTC holdings, working into hundreds, if not tens of hundreds, of the coin.

Bitcoin Community “Culling” Weak Miners

Due to market dynamics, the upper the provision, the decrease the costs; Bitcoin is flushing decrease, squeezing out much more miners. It stays to be seen for the way lengthy this may proceed, however the impression of Halving is now more and more evident.

In Woo’s evaluation, miner capitulation is critical. Furthermore, weak miners’ pressured liquidation of BTC will solely make the community extra resilient. It is because the “cull” will remove much less environment friendly gamers from the community, in the end resulting in a extra strong system.

On April 20, the Bitcoin community Halved miner rewards from 6.25 BTC to three.125 BTC. Since miners rely on rewards as their main earnings supply, their income was slashed by 50%.

In the event that they select to proceed working, they need to not solely compete with bigger mining companies, most of that are public, like Riot Blockchain and Mara Digital, however they need to even be very environment friendly, utilizing trendy gear for the next hash price.

Staying environment friendly is a main problem, and slightly than competing with public miners, some, because it seems, are folding and selecting to exit the enterprise.

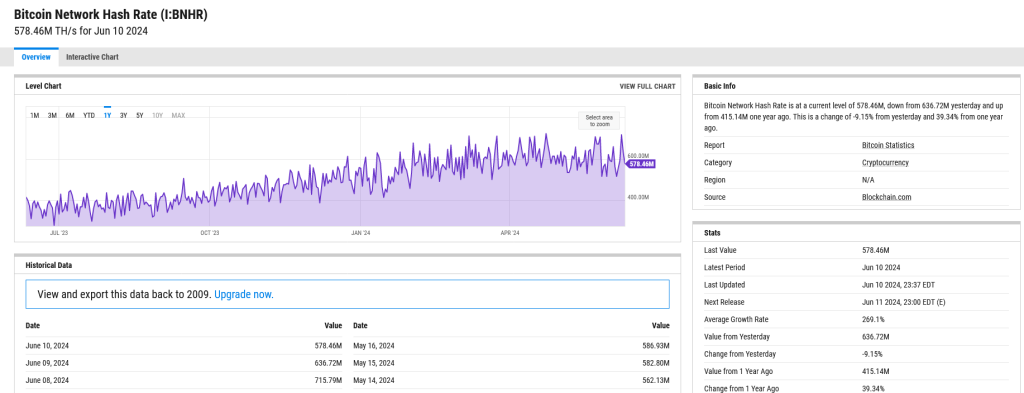

Curiously, at the same time as “weak” miners shut down operations, the community hash price–a measure of the entire computing energy–continues to be at close to file highs. In response to YCharts, the hash price is 578 EH/s, down from 721 EH/s registered on April 23.

Will BTC Costs Get better If Speculative Bets Are Purged?

Woo additionally thinks there’s a must “purge the degen open curiosity in futures bets.” The analyst says extreme leverage buying and selling on perpetual platforms like Binance, OKX, and Bybit should drop. The spike in degen buying and selling has pushed up the “paper Bitcoin,” or speculative bets.

Woo explains that following the collapse of FTX in November 2022, speculative bets had been wiped, permitting for a swift restoration in BTC costs within the following months.

Associated Studying

If the coin is to get well and reject the present makes an attempt for decrease lows, the clearance of the present “paper Bitcoin” overhang might be required for a sustained leg up.

Whether or not the “cleaning” of weak miners and speculative bets will assist drive up costs stays to be seen for now. Bitcoin is trickling decrease, confirming the losses of June 6.

The fast help lies at $66,000. If this degree is misplaced, BTC might flash crash to $60,000 and even Could 2024 lows of $56,500.

Function picture from DALLE, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply