[ad_1]

Bitcoin has been having a nasty time lately, however this analyst isn’t too apprehensive about it, primarily based on the current pattern in an on-chain indicator.

Bitcoin Unrealized Loss Has Been At Low Ranges Not too long ago

In a brand new submit on X, on-chain analyst Checkmate talked about how the newest worth motion of the cryptocurrency isn’t too scary when contemplating the pattern within the Unrealized Loss.

The “Unrealized Loss” right here refers to an on-chain indicator that retains monitor of the entire loss that addresses throughout the Bitcoin community are holding proper now.

This metric works by going by the transaction historical past of every coin in circulation to see what worth it was final moved at. Assuming that this newest transaction was the final level at which the coin modified fingers, the value at its time would mirror its present price foundation.

If this price foundation is greater than the present spot worth of the cryptocurrency for any coin, then that individual coin could be thought of to carry a web unrealized loss at the moment.

The Unrealized Loss subtracts the 2 values to calculate the magnitude of loss for each coin after which sums them up. Naturally, cash of the alternative kind contribute in the direction of the “Unrealized Revenue” metric as a substitute.

Within the context of the present dialogue, the Unrealized Loss itself isn’t of curiosity, however slightly a normalized type referred to as the Relative Unrealized Loss. This metric divides the Unrealized Loss by the asset’s market cap.

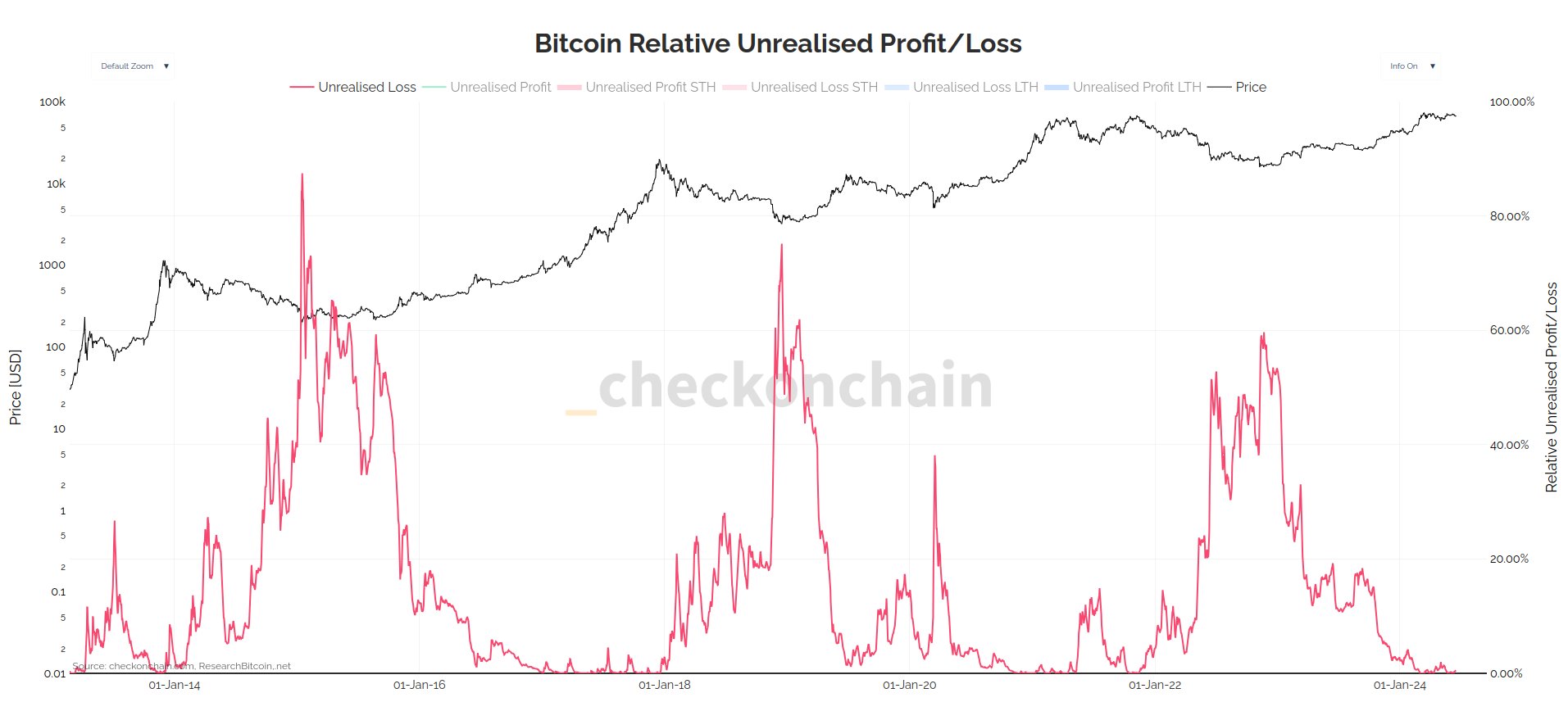

Beneath is a chart exhibiting this Bitcoin indicator’s pattern over the previous decade or so.

As is seen within the graph, the Bitcoin Relative Unrealized Loss peaked throughout the November 2022 bear market lows and has since been heading down. Not too long ago, the metric’s worth has been near zero, implying the losses out there have solely been equal to a negligible proportion of the market cap.

The explanation behind these lows is the current worth surge in the direction of the new all-time excessive (ATH). Your complete provide turns into worthwhile throughout ATH breaks, so the Unrealized Loss shrinks to zero.

The indicator naturally additionally fell to zero earlier within the yr when the ATH came about, however the bearish worth motion since then has meant that a few of the traders have gone again into losses.

Curiously, although, the indicator’s worth has nonetheless been extraordinarily low, implying that whereas some shopping for has occurred on the greater costs, it hasn’t been extreme.

From the chart, it’s seen that spikes adopted bull market tops previously within the indicator, as solely a small drop was sufficient to place all of the latecomers chasing hype right into a loss. That hasn’t been the case within the present cycle thus far.

“It’s onerous for me to be too petrified of Bitcoin worth motion when unrealized losses appear like this,” notes Checkmate. The analyst additionally cautions that it might deteriorate from right here, but it surely hasn’t occurred but.

BTC Value

Bitcoin has continued its current bearish momentum throughout the previous day as its worth has now slipped to $64,500.

[ad_2]

Supply hyperlink

.png?w=280&resize=280,210&ssl=1)

Leave a Reply