[ad_1]

Associated Studying

USDT Flexes Muscular tissues

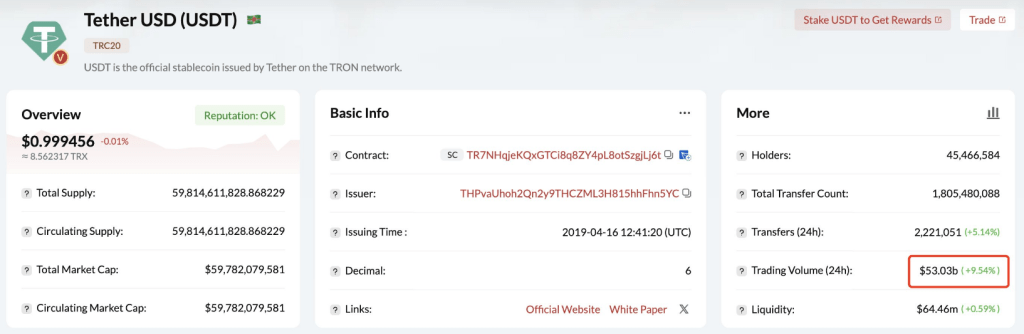

USDT’s dominance is clear. Out there on a number of blockchains, it has seen its market cap explode since its inception in 2014. However the latest milestone on Tron, a blockchain recognized for its decrease transaction charges, is especially noteworthy. Lookonchain information reveals USDT transactions on Tron hitting a staggering $53 billion in a single day, exceeding Visa’s each day common of $42 billion. This 20% lead underscores the growing adoption of stablecoins for on a regular basis transactions.

The 24-hour buying and selling quantity of $USDT on #TronNetwork is $53B, exceeding Visa’s common each day buying and selling quantity.

Visa’s buying and selling quantity in Q1 2024 was $3.78T and the typical each day buying and selling quantity was $42B. pic.twitter.com/jolGKIUcxE

— Lookonchain (@lookonchain) June 21, 2024

Why The Rise Of Stablecoins?

So, what’s driving this surge? Not like conventional cryptocurrencies recognized for his or her wild worth swings, stablecoins supply a haven of stability. They’re usually pegged to fiat currencies just like the US greenback, that means their worth stays comparatively fixed. This stability makes them preferrred for on a regular basis transactions, eliminating the worry of sudden worth drops that plague conventional cryptocurrencies. Moreover, stablecoins leverage the facility of blockchain expertise, enabling quicker, cheaper, and extra clear transactions in comparison with standard techniques.

Regulation On The Horizon

As stablecoins acquire traction, governments are scrambling to ascertain regulatory frameworks. The Lummis-Gillibrand Cost Stablecoin Act within the US and comparable initiatives within the UK spotlight a world concern for guaranteeing consumer safety and monetary stability within the face of this innovation. Whereas these rules are essential for accountable progress, navigating the ever-changing political local weather provides one other layer of complexity. As an illustration, the UK’s crypto coverage stays unsure with a looming normal election.

Associated Studying

The Future Of Finance

Regardless of the challenges, the momentum behind stablecoins appears unstoppable. Their means to bridge the hole between conventional finance and the crypto world provides plain benefits. Whereas each day transaction quantity could be risky, and considerations like rising transaction charges on Tron must be addressed, the general pattern is evident.

Stablecoins are right here to remain, and their affect on the worldwide monetary system is prone to be profound. As rules take form and the expertise matures, stablecoins have the potential to revolutionize the best way we conduct on a regular basis transactions, ushering in a brand new period of economic inclusion and effectivity.

Featured picture from Pexels, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply