[ad_1]

The largest Bitcoin (BTC) merchants have just lately change into extra risk-averse, based on the CEO of blockchain analytics agency CryptoQuant.

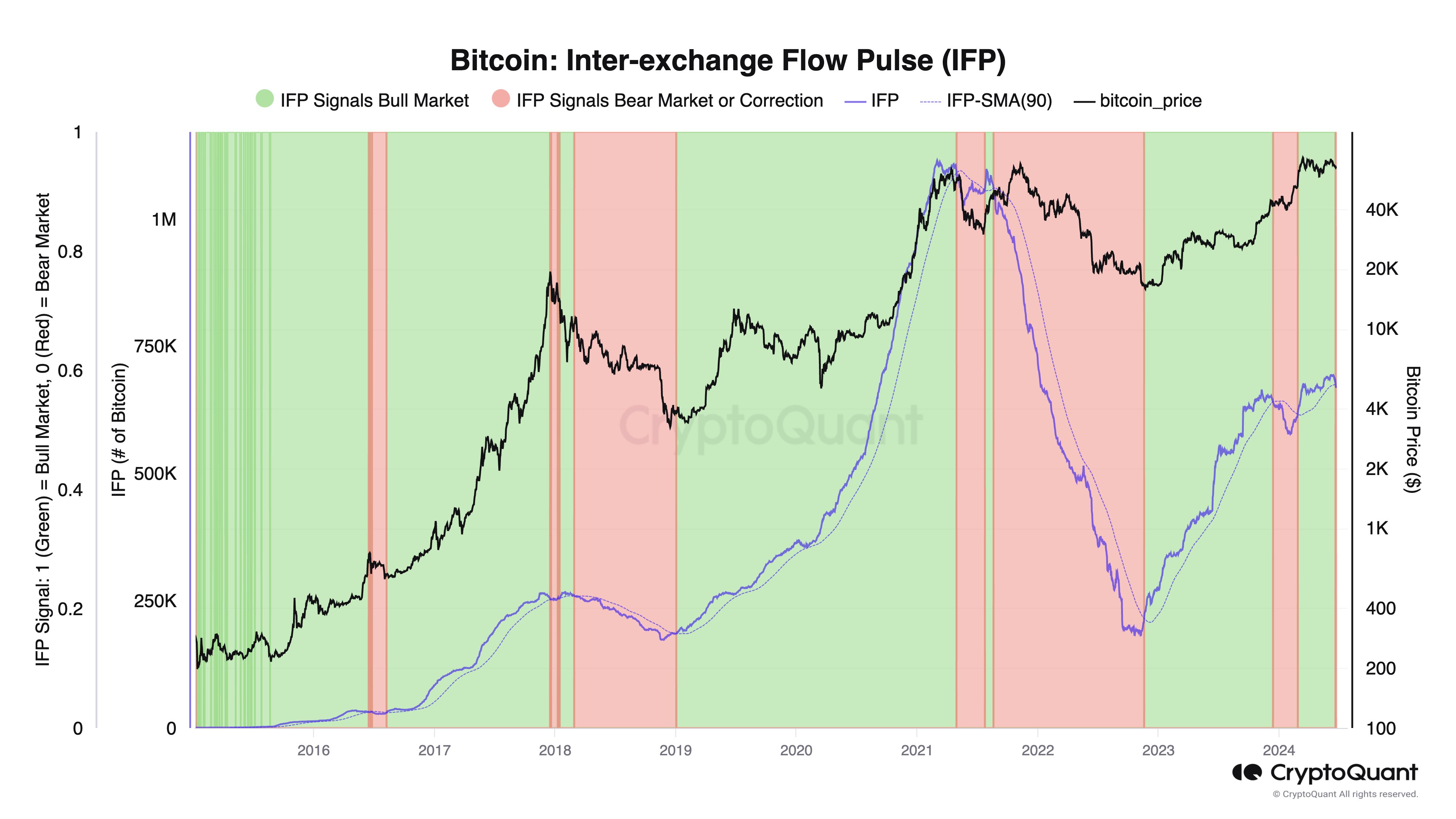

Ki Younger Ju tells his 349,000 followers on the social media platform X that the interexchange-flow-pulse (IFP) indicator, which tracks the circulate of BTC between spot and derivatives exchanges, is signaling that whales at the moment are in “risk-off mode.”

Merchants deposit belongings to derivatives exchanges and use them as collateral to tackle extra dangers by way of leveraged positions.

Ju notes that the IFP is at present beneath its 90-day shifting common.

“[The] Bitcoin IFP indicator turned crimson. Whale merchants on derivatives exchanges are in risk-off mode…

IFP (Interexchange-Circulation-Pulse)… tracks Bitcoin actions between spot and spinoff exchanges, reflecting market sentiment.

Elevated flows from spot to spinoff exchanges might point out sending BTC as collateral for brand new/present positions. Whales shifting BTC to derivatives usually sign lengthy positions, particularly at cyclical market bottoms.

The technique targets Bitcoin publicity throughout IFP uptrends, with IFP’s 90-day shifting common crossovers marking market shifts (inexperienced and crimson areas on the chart).”

At time of writing, Bitcoin is buying and selling at $62,290, down greater than 3% prior to now day.

Taking a look at Ethereum, CryptoQuant just lately mentioned ETH‘s Market Worth to Realized Worth (MVRV) indicator is rising quicker than Bitcoin’s MVRV.

MVRV is the ratio of a digital asset’s market capitalization relative to its realized capitalization (the worth of all of the belongings on the worth they have been purchased). It’s used to evaluate whether or not the token is undervalued or overvalued.

Says the agency,

“This means that ETH’s market is heating up. Traditionally, when Ethereum surges, different alts are inclined to comply with.”

At time of writing, Ethereum is price $3,366, down over 4% on the day.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney

[ad_2]

Supply hyperlink

Leave a Reply