[ad_1]

1. Introduction

Emerald EA Builder, because the title states, is an EA Builder (Skilled Advisor Builder) that gives a large set of indicator and value motion indicators so you may shortly develop your individual methods for Foreign exchange, Shares, Futures, and some other market you would like.

Uninterested in shopping for rip-off EAs available in the market? Simply simply create your individual technique with a single Skilled Advisor.

By combining the extra of 20 accessible indicators and 10 value motion indicators, together with the chance so as to add your individual customized indicators, Emerald EA Builder permits the consumer to create an inifinity of methods. That’s, the EA is useful for individuals who do not code, in a way that you just needn’t know MQL5 to create methods across the built-in or customized indicators. On the similar level, the EA is useful for coders, as a result of it simplifies the method, so that you needn’t code a thousand of EAs everytime you construct a brand new technique.

The principle aim is to offer a fast, protected and straightforward to make use of Skilled Advisor. That is why a 4-year optimization interval ought to usually take round a couple of minutes to finish (1 minute OHLC or Open Costs modelling) in a 8-core CPU.

That is the weekly replace notes that come into the EA.

2. Week updates

This week, we jumped from the model 1.0 to 1.3!

Amongst efficiency updates (the EA is even quicker…) and bug fixes (… and safer!), some new indicators had been added this week. Let’s know a bit extra about them:

- Exterior bar: an Exterior Bar happens when a brand new bar is fashioned and its excessive is larger than the earlier excessive, but in addition its low is larger than the earlier low;

- 123 purchase/promote: an 123 is 3-candles value motion sample that happens for a lengthy sign when the center bar has its low beneath the primary and the third bars lows and in addition its excessive is decrease than the primary and third bar highs; a quick sign occurs when the center bar has its excessive above the primary and the third bar highs and in addition its low is larger than the primary and the third bar lows;

- Ignored bar: an Ignored Bar is a 3-candle sample that happens for a protracted sign when the center bar is a bearish candle, however its low is larger than the third bar low. Additionally, the primary bar should shut above the center bar excessive; a brief sign occurs when the center bar is a bullish candle, however its excessive is decrease than the third bar excessive. Additionally, the primary bar should shut beneath the center bar low.

We additionally added the Fee of Change (ROC) indicator. ROC represents how a lot change the worth had in a time window. As an instance the present value is 1. If it closes at 1.10 within the subsequent day, the RoC can be 10% for 1-period. If the day after it will shut at 1.20, the RoC can be 20% for 2-periods, and so forth. This indicator is sweet to keep away from coming into in positions when the worth has already moved an excessive amount of.

Extra patterns parameters had been additionally added. For instance, you may customise how a doji is outlined (by default, it’s a doji bar if the open and the shut costs of a candle are in between 33% and 66% of the candle amplitude) or a hammer candle (by default, a purchase hammer happens when the bottom of the shut and the open costs are above 75% of the candle amplitude, while the very best of the shut and the open costs have to be above 90% of the candle amplitude; an inverted hammer, or promote hammer, happens the opposite method round).

Have a look on a few of the latest added patterns:

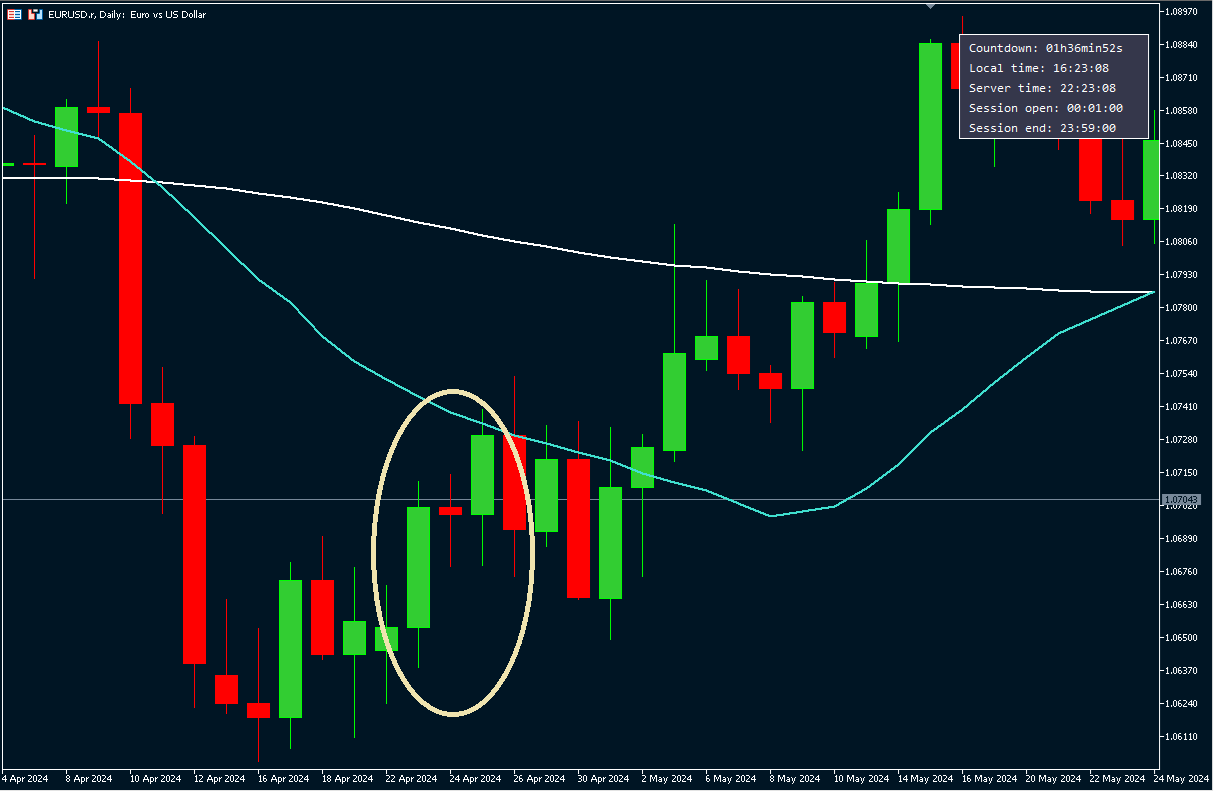

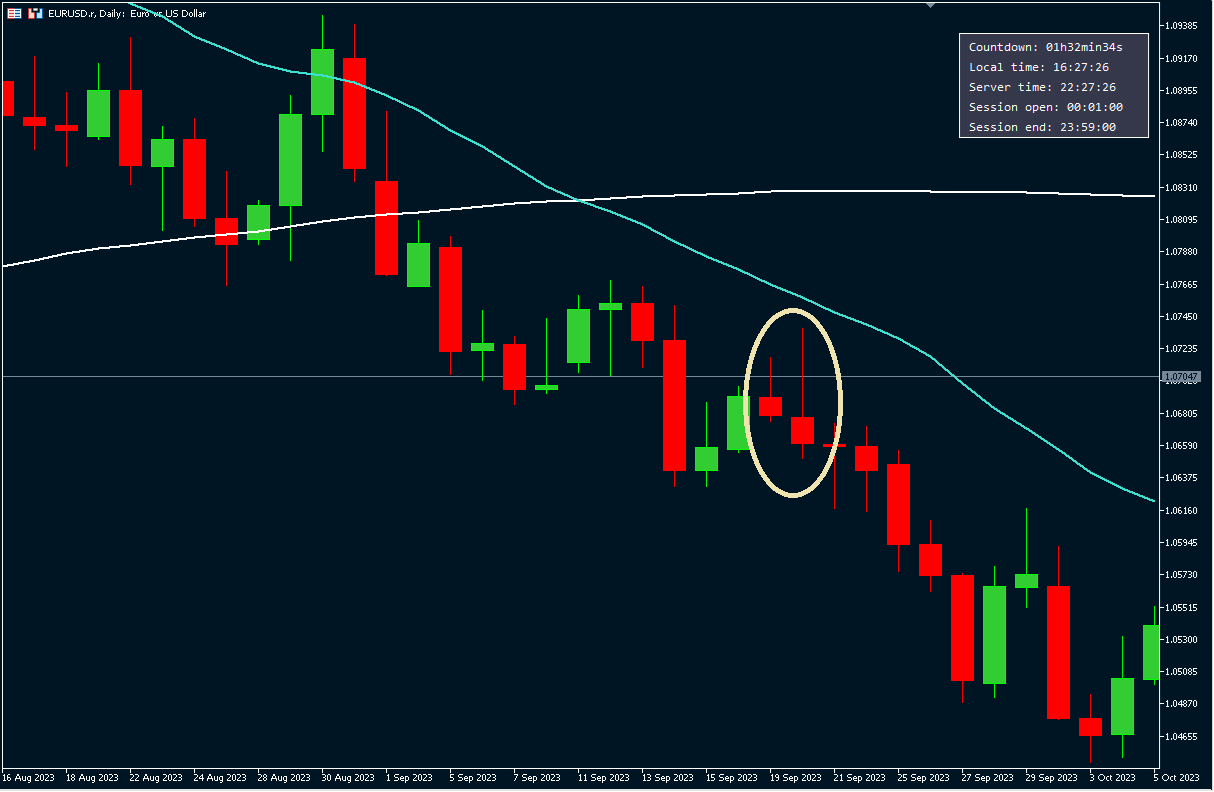

Instance of an Ignored Bar for a protracted place:

Exterior bar instance:

123-sell instance:

[ad_2]

Supply hyperlink

Leave a Reply