[ad_1]

Fast Take

On the finish of 2023, VanEck made 15 bold predictions for the digital property market in 2024. Right here’s a have a look at how a few of these predictions have fared up to now.

1. The US Recession and the First Spot Bitcoin ETPs

Prediction: The US would enter a recession within the first half of 2024, and the primary spot Bitcoin ETPs would launch with vital inflows, holding Bitcoin above $30,000.

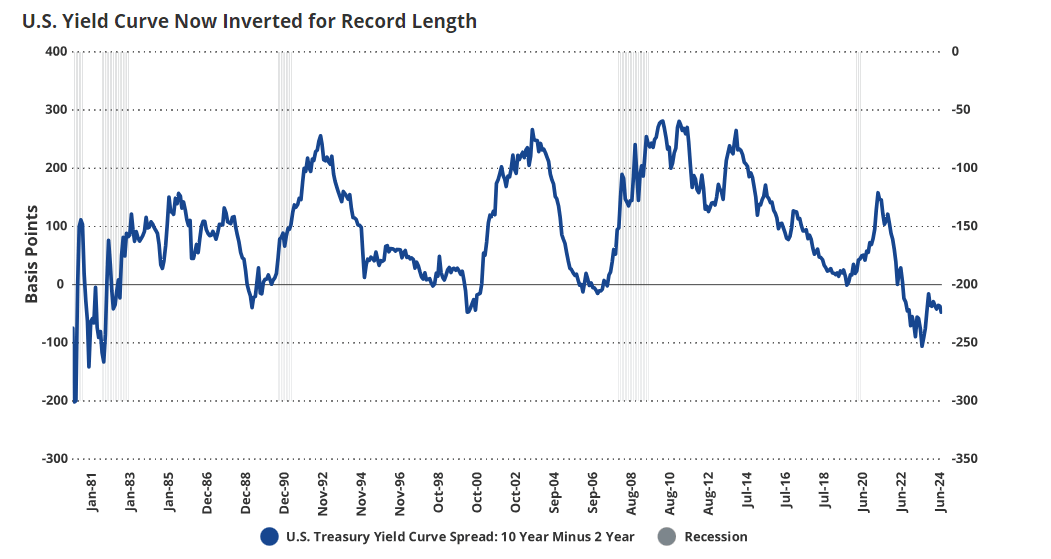

Whereas the US recession has but to materialize, the inverted yield curve, the longest bond market inversion in historical past, stays a powerful recessionary sign, in accordance with VanEck.

In the meantime, Bitcoin ETFs have shattered information, with $14.5 billion in inflows holding Bitcoin’s value above $30,000. Bitcoin has largely traded above $60,000 since March, with few exceptions.

2. Bitcoin Halving

Prediction: The Bitcoin halving in April 2024 would proceed with out main points, with Bitcoin buying and selling above $48,000 after the occasion.

One other correct prediction was the sleek Bitcoin halving in April 2024. Publish-halving, Bitcoin has not fallen beneath $55,000. The occasion additionally marked the launch of Runes, which set new information for BTC charges and initiated the present miner capitulation section.

3. Bitcoin’s All-Time Excessive in This autumn

Prediction: Bitcoin will attain an all-time excessive in This autumn 2024, pushed by political adjustments and regulatory optimism.

VanEck additionally foresaw Bitcoin reaching an all-time excessive in This autumn 2024, pushed by political adjustments and regulatory optimism. Though BTC hit its peak earlier, in March, the forecast was directionally correct.

4. Ethereum Gained’t Flip Bitcoin in 2024

Prediction: Ethereum wouldn’t surpass Bitcoin in market cap however outperform mega-cap tech shares.

Moreover, VanEck appropriately predicted that Ethereum wouldn’t surpass Bitcoin in market cap however would outperform main tech shares, which has been the case. One of many tech firms not included was NVIDIA, which is up 155% year-to-date (YTD) and 190% over the previous 12 months. At one level, NVIDIA even grew to become the largest firm on the planet.

Total, VanEck’s predictions scored a formidable 95 out of 150 doable factors, demonstrating the agency’s deep perception into the quickly altering crypto market.

[ad_2]

Supply hyperlink

Leave a Reply