[ad_1]

As Bitcoin faces robust headwinds, breaching two vital help ranges at $60,000 and $56,500 in fast succession, it could, on the floor, seem that concern is gripping the market. There are causes to be afraid, particularly for coin holders leveraging BTC in decentralized finance (DeFi) protocols, trying to take out loans utilizing the asset as their collateral.

Concern Is But To Grip The Bitcoin Market

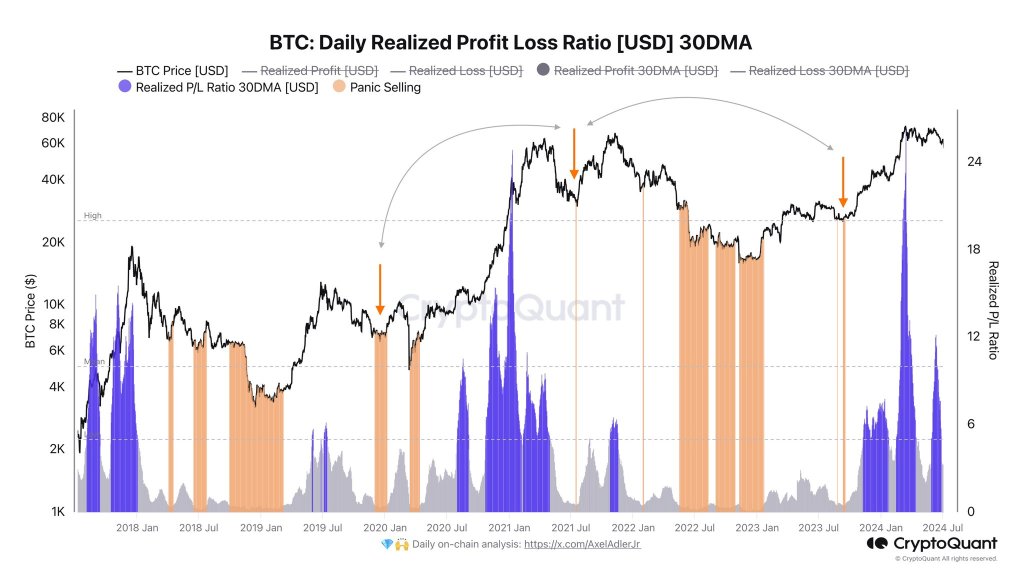

Whilst costs plunge, one on-chain analyst, taking to X, argues that the market is comparatively composed and concern and panic haven’t totally gripped it but. Pointing to the Bitcoin Every day Realized Revenue Loss ratio, the analyst mentioned that until there may be an uptick within the variety of addresses in pink, pointing to panic promoting, the market can face up to extra losses.

Per the analyst’s evaluation, the absence of “panic promoting” bars means that traders are nonetheless processing the present occasions. Whilst costs crater beneath $56,500, the market, the analyst added, can fall to as little as $47,000, a degree that “doesn’t look as horrible because it did three weeks in the past once we have been at 70,000.”

Associated Studying

Nonetheless, amid this obligatory correction, the analyst added that the shakeout must be slower. On this approach, there shall be a extra orderly market correction.

As of July 5, Bitcoin fell almost 30% from all-time highs and is beneath immense promoting stress. Following the drop beneath $56,500 earlier right this moment, it’s evident that the coin is now inside a bear breakout formation. The sell-off pressured costs from the March to Could 2024 vary. This indicators a brand new section after expansions in Q1 2024 when the coin roared to $73,800.

Analysts anticipate extra losses with sellers within the driving seat and Bitcoin inside a bear breakout formation. So far, the speedy help is at $50,000 and $45,000, marking January 2024 highs.

Greatest Time To Purchase Bitcoin? Wait For This Sign

Whereas the drop is forcing traders to hunt refuge in stablecoins, one other analyst thinks this could possibly be one of the best time to scoop extra BTC at a reduction. Taking to X, the analyst identified a number of elementary components that paint a long-term bullish image.

Associated Studying: This Dormant Bitcoin Pockets Holding $6.8 Million BTC Simply Reactivated, Are They Promoting?

A few of these tailwinds embody the supply of spot Bitcoin exchange-traded funds (ETFs). There’s additionally regulatory readability within the United States forward of the extremely contested presidential election. On the identical time, the analyst is satisfied the upcoming $16 billion payout by FTX trustees could be a internet constructive for optimistic BTC bulls.

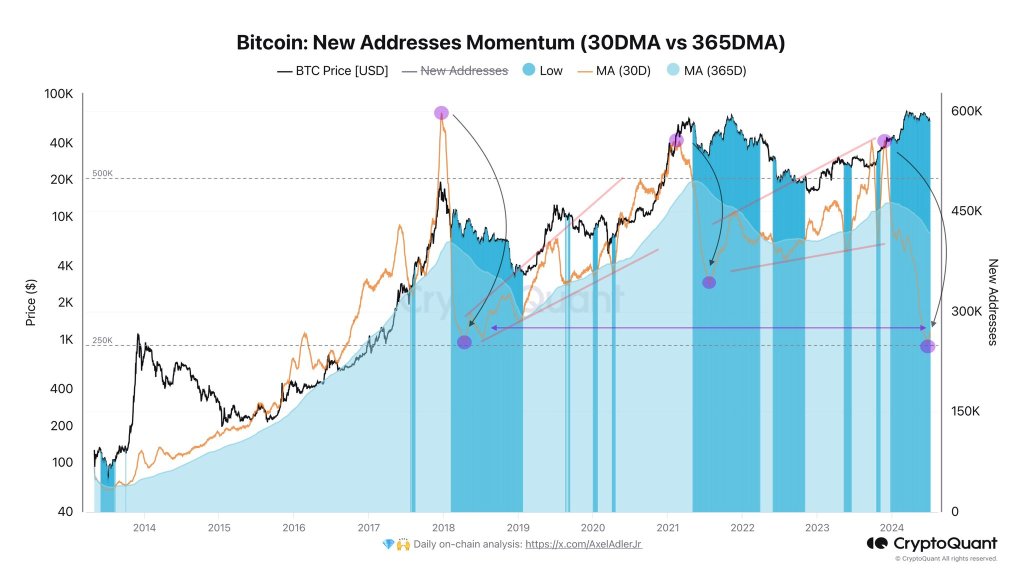

Even so, earlier than there may be stability and this week’s sell-off countered, there have to be an uptick in new addresses. As soon as that is noticed, it might imply that new traders are pouring in, creating demand for the coin. For now, costs are plunging, and fewer addresses are being created.

Function picture from DALLE, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply