[ad_1]

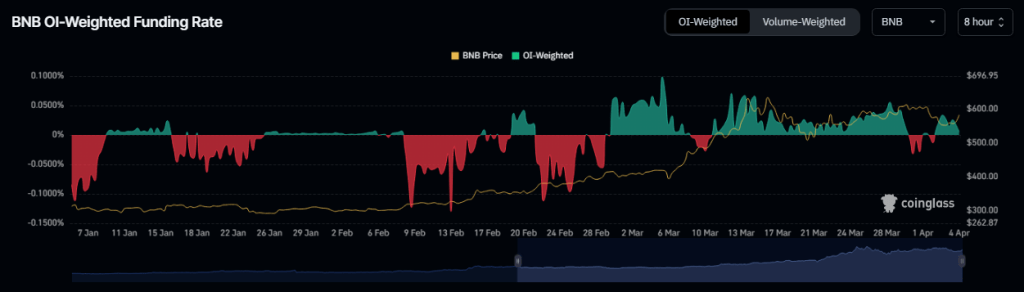

The outlook for Binance Coin (BNB) has turned cloudy, with each futures market information and technical indicators flashing bearish indicators. Based mostly on our evaluation of Coinglass information, unfavorable funding charges and declining open curiosity in BNB futures contracts paint an image of rising pessimism amongst merchants.

A unfavorable funding charge means that extra merchants are holding quick positions, anticipating a decline within the worth of the asset. This sentiment was confirmed on April 1st, when BNB’s funding charge dipped into unfavorable territory at -0.012%.

Binance Coin Funding Charge And Open Curiosity Down

Additional fueling the bearish narrative, BNB’s futures open curiosity has additionally witnessed a slight decline of 0.15%. Open curiosity displays the full quantity of excellent futures contracts that haven’t been settled but.

A lower in open curiosity suggests merchants are exiting their positions with out opening new ones, probably signaling waning confidence available in the market.

Supply: Coinglass

Funding charges are a vital mechanism in perpetual futures contracts that maintain the contract worth aligned with the spot worth. When the contract worth trades larger than the spot worth, lengthy place holders pay a price to shorts, leading to constructive funding charges.

Conversely, unfavorable funding charges materialize when the contract worth dips beneath the spot worth, indicating that quick sellers are presently paying charges to longs.

Supply: Coinglass

Extra Merchants Shut Their Positions

As unfavorable sentiments mount, this open curiosity is predicted to plummet additional. This might suggest that extra merchants are closing their positions and never opening new ones, suggesting a possible worth drop for BNB.

The bearish sentiment isn’t confined to the futures market. The Transferring Common Convergence Divergence (MACD), one other technical indicator, is suggesting a potential resurgence in promoting stress.

There’s a sign that the MACD line may cross beneath the sign line, usually interpreted as a bearish signal signaling the return of sellers to the market. It’s noteworthy that since March 18th, the MACD strains for BNB have been positioned for a downtrend.

BNB market cap presently at $87.9 billion. Chart: TradingView.com

BNB Value Retreat In The Offing?

Contemplating each the futures market and technical evaluation, there’s a possible for a short-term decline in BNB’s worth. Nevertheless, it’s necessary to acknowledge that market sentiment can shift quickly, and technical indicators aren’t infallible predictors of future worth actions.

On the time of writing, BNB was buying and selling at $587, up 6% within the final 24 hours, information from CoinMarketCap exhibits.

In the meantime, a more in-depth take a look at BNB’s technical indicators on the 24-hour chart reveals one other pattern.

The Directional Motion Index (DMI), used to gauge pattern power, displayed a bearish crossover the place the unfavorable directional index sits above the constructive directional index. This positioning means that bearish momentum is presently dominating the market.

Analysts generally interpret this explicit crossover as an crucial sign prompting merchants to think about exiting lengthy positions and initiating quick positions.

This strategic transfer aligns with the prevailing pattern indicated by the DMI, reinforcing the notion of a prevailing bearish sentiment throughout the market ecosystem.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site completely at your individual danger.

[ad_2]

Supply hyperlink

.png?w=280&resize=280,210&ssl=1)

Leave a Reply