[ad_1]

A well-liked crypto analyst says Bitcoin (BTC) could also be gearing up for a large breakout based mostly on a number of aligning indicators.

Pseudonymous analyst TechDev tells his 443,100 followers on the social media platform X that the Wyckoff accumulation schematic is bullish for digital property.

He additionally says that the Gaussian channel is indicating digital property are about to take off on a large uptrend. Gaussian channels are momentum indicators that can be utilized to establish worth tops and bottoms.

“That is normally the place the place issues go vertical.”

Trying on the charts, the analyst means that the Wyckoff accumulation schematic is getting into Part E of the sample, which signifies the markup section or a interval of worth rises.

The analyst’s Gaussian channel is utilized to the market cap of digital property excluding the highest 10 and means that the present crypto market is repeating an identical sample in 2016 and 2020 that preceded a large uptrend.

The analyst additionally says that Bitcoin is positioned on the weekly chart in relation to key indicators because it was in 2020 earlier than it went on to print new all-time highs (ATHs).

“As soon as once more on the intersection of the prior ATH and 2x 350-day transferring common (DMA), with two-month MACD (transferring common convergence divergence) within the inexperienced.”

The MACD is historically used to identify development reversals and make sure developments.

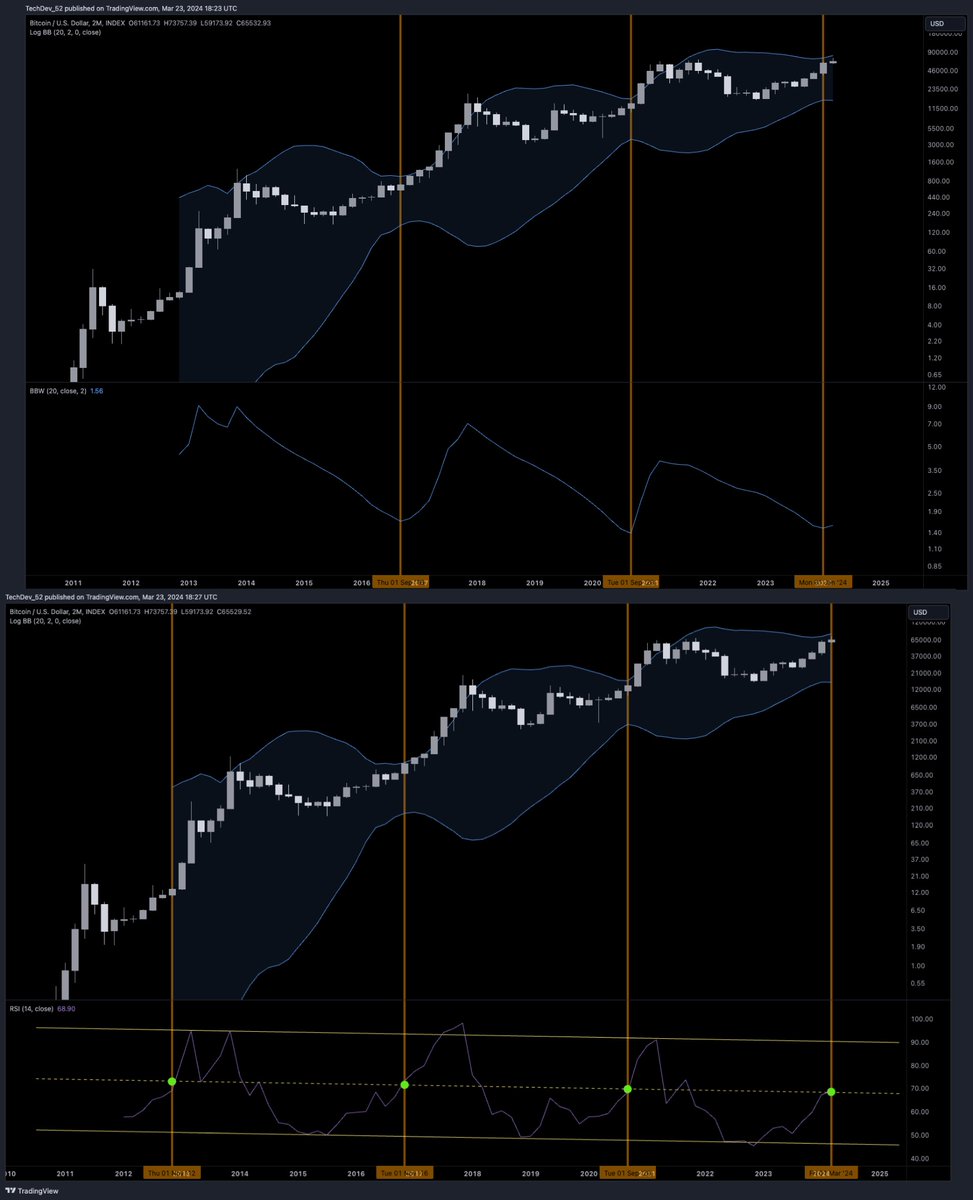

Lastly, the analyst shares Bitcoin’s two-month chart with the Bollinger bands bandwidth (BBW) indicating the crypto king is on the verge of hovering.

The BBW is a worth volatility gauge that sees its higher and decrease bands widen when volatility declines whereas the bands contract when volatility is about to blow up.

“Two-month growth has solely simply begun.

As RSI (Relative Energy Index) has solely simply crossed the channel EQ (equilibrium).”

The analyst’s chart additionally reveals the RSI, a broadly used momentum indicator that goals to find out if an asset is overbought or oversold.

Bitcoin is buying and selling for 66,117 at time of writing, up barely within the final 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate marketing online.

Generated Picture: DALLE3

[ad_2]

Supply hyperlink

Leave a Reply