[ad_1]

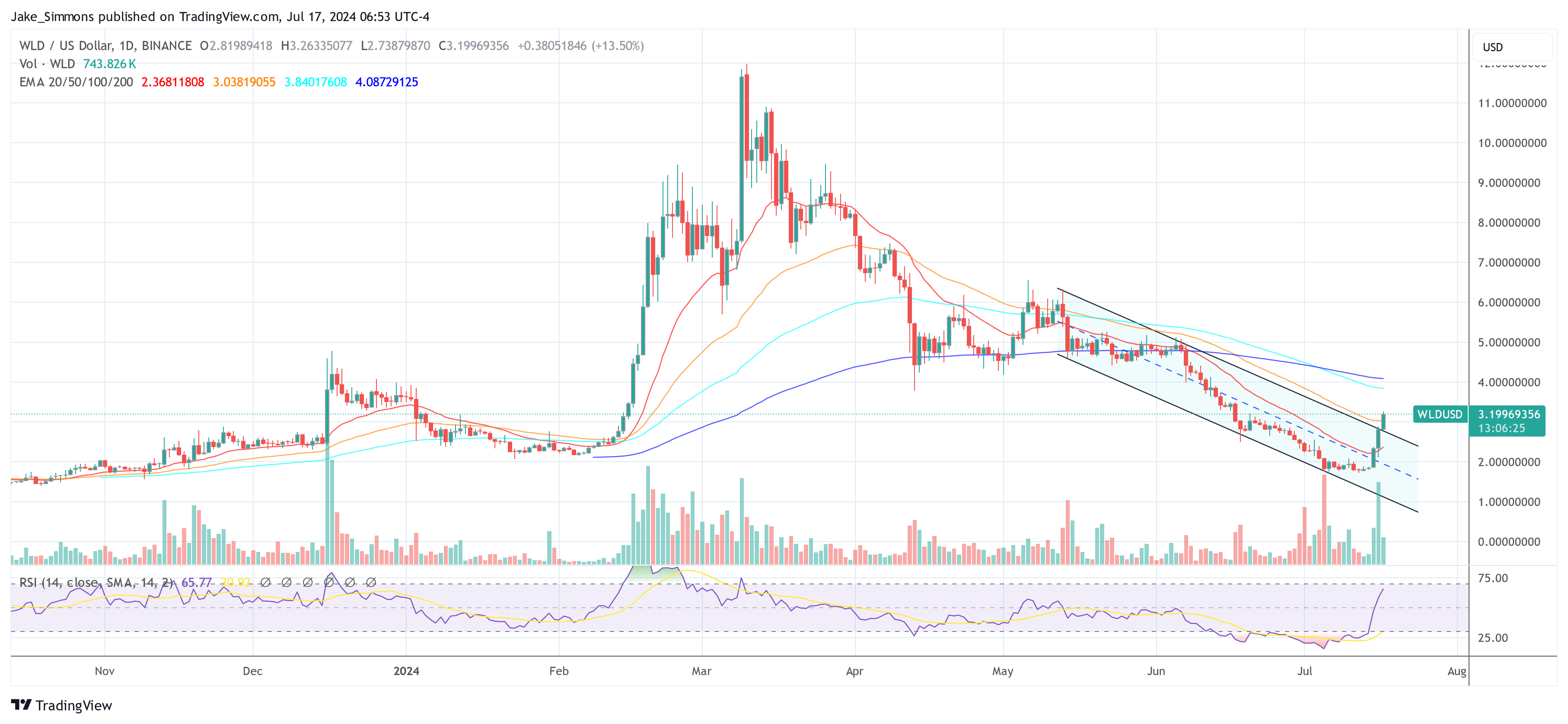

The cryptocurrency Worldcoin (WLD) has seen a dramatic value enhance, surging 75% over the previous 5 days, with a big 38% enhance within the final 24 hours. Based on DeFi^2 (@DefiSquared), the primary ranked dealer on Bybit and a high 10 pockets on DeBank, this value motion isn’t merely speculative however indicative of potential market manipulation, timed with upcoming insider unlocks.

The Worldcoin Money Seize

In a submit shared through X, the highest dealer DeFi^2 has dropped at mild regarding particulars about Worldcoin’s market actions forward of its deliberate insider token unlocks. With solely 2.7% of WLD’s complete provide presently in circulation, the smallest share within the trade at unlock time, the issues focus on how the Worldcoin group has managed to take care of a staggering $30 billion totally diluted valuation (FDV).

“Worldcoin is projected to start insider unlocks in 7 days at one of many lowest floats ever recorded within the trade,” DeFi^2 wrote. “This analysis piece brings to mild precisely how the group is controlling the value to nonetheless carry a $30 billion totally diluted valuation as insider unlocks start, whereas falsely claiming to haven’t any involvement.”

Associated Studying

Worldcoin was initially launched with a 1.4% circulating provide, or 140 million WLD. Out of this, 100 million tokens had been assigned to market makers with name choices that allowed them to purchase again a big variety of tokens at a preset value of barely over $2. This was strategically geared toward dampening any sudden value spikes.

On “The Scoop Podcast,” Alex Blania, CEO of Worldcoin, brazenly mentioned these techniques, stating they had been essential in stopping the value from hovering, which may doubtlessly disrupt the market. “The intent to keep away from the value spiking to $10,” Blania defined, “is paramount, as such an occasion could be horrific for our strategic market positioning.”

Nonetheless, by December sixteenth, the state of affairs dramatically shifted when Worldcoin opted to not renew its market maker contract. This led to the removing of the decision possibility and a concurrent discount in WLD’s circulation by a further 25 million tokens. The rapid aftermath noticed the value double inside hours, a situation Blania had beforehand indicated the corporate supposed to keep away from.

Through the Token2049 convention in Dubai, Blania reiterated that Worldcoin doesn’t manipulate market costs, attributing fluctuations to pure market forces. This assertion starkly contradicts the evident results of the group’s strategic choices concerning tokenomics and market maker contracts.

Associated Studying

DeFi^2 emphasizes, “An 11-figure valuation is simply potential as a result of group’s deliberate design of tokenomics, and the each day value actions have typically been influenced by well-timed bulletins and coverage changes made by the group.”

Market Manipulation

The Worldcoin framework, which was ostensibly designed to facilitate common primary revenue (UBI), appears to be primarily benefiting insiders moderately than the supposed recipients. Present projections present that almost a billion tokens are slated for emission to group members and enterprise capitalists throughout the subsequent yr, whereas solely about 600 million tokens are anticipated to be distributed to UBI recipients in the identical timeframe.

“Which means that inside a yr, insider emitted WLD is anticipated to make up over 60% of your complete circulating provide of Worldcoin. 60% is a wild proportion- it mainly means the vast majority of the ecosystem purely exists for VCs to dump. This appears to straight counter the justification that the float is being left low proper now to learn UBI recipients,” the dealer writes.

Orb Operators, tasked with amassing biometric information, have additionally been a big supply of circulating provide, with some reportedly sending upwards of 20,000 WLD per week to exchanges like Binance. This example turned significantly pronounced when WLD’s value spiked to $12 in March, with substantial portions of WLD being moved to exchanges each few days.

Retail buyers, significantly in Korea, the place 25% of the circulating provide is held, are more and more weak. Many of those buyers are possible unaware of the intricate dynamics at play, holding tokens at almost $30 billion FDV, a valuation propped up by the optimistic information launched strategically per week earlier than the unlocks.

“It’s possible no coincidence that Worldcoin waited till 1 week earlier than unlocks to launch optimistic information. Regardless of being solely a small change to unlock promoting strain, the information has confirmed extremely efficient to this point in coercing retail to unwittingly present increased costs and extra liquidity for insiders to exit in per week’s time. Worse nonetheless, it seems possible (however not confirmed) that somebody from the group or VCs used insider data to frontrun shopping for the information earlier than it was even publicly introduced,” @DefiSquared claims.

He concludes with a stern warning: “This piece is meant to make clear a challenge that seems to be deliberately propping up a token value that ought to be decrease, and lots of the causes outlined are why I intend to be brief WLD over the months following the beginning of unlocks.”

At press time, WLD traded at $3.22.

Featured picture from Kucoin, chart from TradingView.com

[ad_2]

Supply hyperlink

Leave a Reply