[ad_1]

An analyst has identified how Bitcoin is again above the price foundation of the short-term holders, an indication that may be bullish for the asset.

Bitcoin Is Again Above The Realized Value Of Quick-Time period Holders

As defined by CryptoQuant group supervisor Maartunn in a brand new publish on X, BTC has reclaimed the Realized Value of the short-term holders. The “Realized Value” right here refers to an indicator that, briefly, retains observe of the typical price foundation of the traders within the Bitcoin market.

When the worth of this metric is larger than the cryptocurrency’s spot value, the typical holder within the sector could be assumed to be carrying some unrealized revenue. However, the indicator being beneath the BTC value implies the dominance of losses available in the market.

Associated Studying

Within the context of the present dialogue, the Realized Value of the complete userbase isn’t of curiosity, however that of solely part of it: the short-term holders (STHs). The STHs check with the Bitcoin traders who bought their tokens throughout the previous 155 days.

This cohort makes up one of many two foremost divisions of the BTC sector based mostly on holding time, with the opposite a part of the market being often called the long-term holders (LTHs).

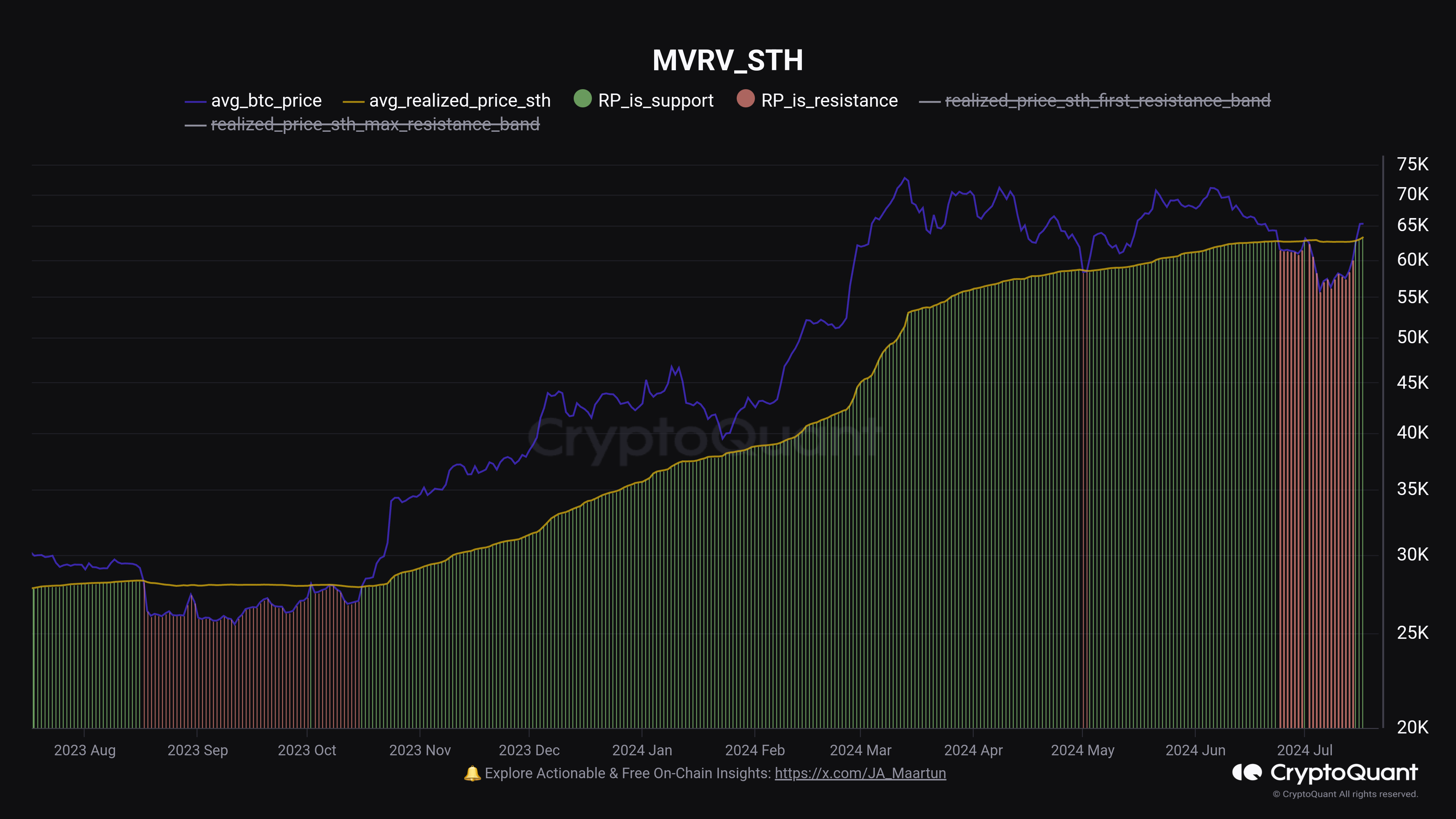

Now, here’s a chart that reveals the pattern within the Bitcoin Realized Value particularly for this cohort over the previous yr:

As is seen within the above graph, the Bitcoin spot value had plunged beneath the Realized Value of the STHs final month, which means that this group had gone right into a state of web loss.

After spending a while under the road, although, the cryptocurrency has risen above the metric with the most recent rally, thus bringing this cohort again into revenue.

“That is often a really bullish signal,” notes Maartunn. The chart reveals that the final time the asset broke again above this stage after an prolonged keep under it was final October. This surge again above the road kicked off a run that might ultimately end result within the coin setting a brand new all-time excessive (ATH).

As for why BTC breaking above the STH Realized Value has traditionally been one thing bullish, the reply lies in investor psychology. The STHs, who’re comparatively inexperienced arms, could be delicate to cost actions. Extra particularly, they’re prone to present a response when their common price foundation undergoes a retest.

When these traders are bearish, they might resolve to promote when the value rises to their price foundation, as they might fear that the surge gained’t final. Equally, they react by accumulating additional as a substitute throughout bullish intervals, as they might see their price foundation as a worthwhile level for getting extra.

Associated Studying

As BTC has been capable of surge previous this line lately, it wouldn’t seem that the STHs are providing resistance proper now, and thus, a bullish sentiment remains to be dominant amongst them.

BTC Value

Bitcoin had recovered above $66,000 yesterday, however the coin has since seen some pullback as its value is now right down to $64,800.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

[ad_2]

Supply hyperlink

Leave a Reply