Tops and bottoms are a lot enjoyable to foretell, however key indicators should not at all times correct. That is the place a wholesome dose of skepticism is available in. At EarningsBeats.com, we attempt to put as many indicators collectively as attainable, searching for corroboration. That helps to construct confidence within the indicators. For instance, I turned short-term cautious final week for a number of causes.

First, I am a pupil of historical past and I do know that the interval from the July seventeenth shut via the July twenty fourth shut is the third worst week of the yr traditionally. That covers all buying and selling days since 1950 on the S&P 500 and since 1971 on the NASDAQ. The annualized returns for this July 17-24 interval on the S&P 500 and NASDAQ are -16.37% and -32.12%, respectively. Additionally remember that the worst interval of the yr is NOT Could 1st via October thirty first because the “go away in Could” of us, who clearly do little analysis, would have you ever consider. As a substitute, it is July seventeenth via September twenty sixth. Throughout this era, the S&P 500 and NASDAQ have produced annualized returns of -2.36% and -5.40%, respectively. That will not appear to be a lot, however take into account that the -2.36% annualized return on the S&P 500 covers 3,643 buying and selling days since 1950. That is the equal of 14+ years. How excited would you be about investing if I informed you that the S&P 500 would go down a mean of two.36% per yr via 2038? Most likely not too excited. Effectively, that is the equal of what has occurred throughout this bearish interval since 1950. The NASDAQ’s -5.40% annualized return for a similar interval covers 2622 buying and selling days, or roughly 10 years. That is only a small pattern of the standard analysis that we offer our members day by day.

Second, final week was max ache week. That is the week when month-to-month choices expire. That is usually a really troublesome interval for U.S. equities and final week was no exception. Each month, we offer our members a listing of roughly 135-140 shares, exhibiting their closing value as of the Friday earlier than month-to-month choices expiration Friday. We then present every inventory’s max ache value, which primarily is the value level at which market makers would pay out the least quantity of choices premium. Let me provide you with a number of examples of how this labored so fantastically final week. Under I am offering inventory symbols, their closing value (CP), their max ache value (MP), and their low value (LP) final week:

- NVDA: 129.24 CP, 100.89 MP, 116.56 LP

- AMZN: 194.49 CP, 172.48 MP, 180.11 LP

- AMD: 181.61 CP, 160.07 MP, 150.62 LP

- MSFT: 453.55 CP, 426.13 MP, 432.00 LP

- AMAT: 243.40 CP, 217.99 MP, 210.26 LP

Do you see the worth in figuring out about max ache? It actually saved a lot of our members 1000’s of {dollars}. I do not use this data to ensure me {that a} inventory goes to drop to its max ache value. As a substitute, I take advantage of this data as a directional clue, no completely different than a optimistic or damaging divergence, key value help or resistance, overbought and oversold territory, and so forth. It is merely another clue that max ache offers. And I would say the clue was fairly useful for July.

Subsequent, how in regards to the reversal simply because the 5-day SMA of the fairness solely put name ratio ($CPCE) hit a key complacency degree that tends to mark tops?

The purple circles spotlight the 2 occasions that this sign did not work out effectively, however loads of others labored simply fantastic, particularly final week’s, tipping us off to a reversal to the draw back.

Lastly, any time I see the correlation between the S&P 500 and the Volatility Index ($VIX) flip optimistic, the chances enhance that we’ll see a reversal within the S&P 500 – both decrease off an uptrend or larger off a downtrend. Test this newest optimistic correlation that when once more sparked a reversal:

You’ll be able to see that the VIX and SPX transfer reverse each other more often than not, leading to a correlation that’s nearly at all times within the -0.50 to -1.00 vary. Journeys above zero, nevertheless, do supply a touch as to a attainable market reversal and this newest sign additionally labored once more. Bear in mind, these are ALL short-term cautious indicators, not long-term.

What To Look For Longer-Time period

There is a TON to observe, however let me provide you with 3 short-term technical clues I will be watching, so as of significance:

- Expertise (XLK)

- Semiconductors ($DJUSSC)

- NVIDIA Corp (NVDA)

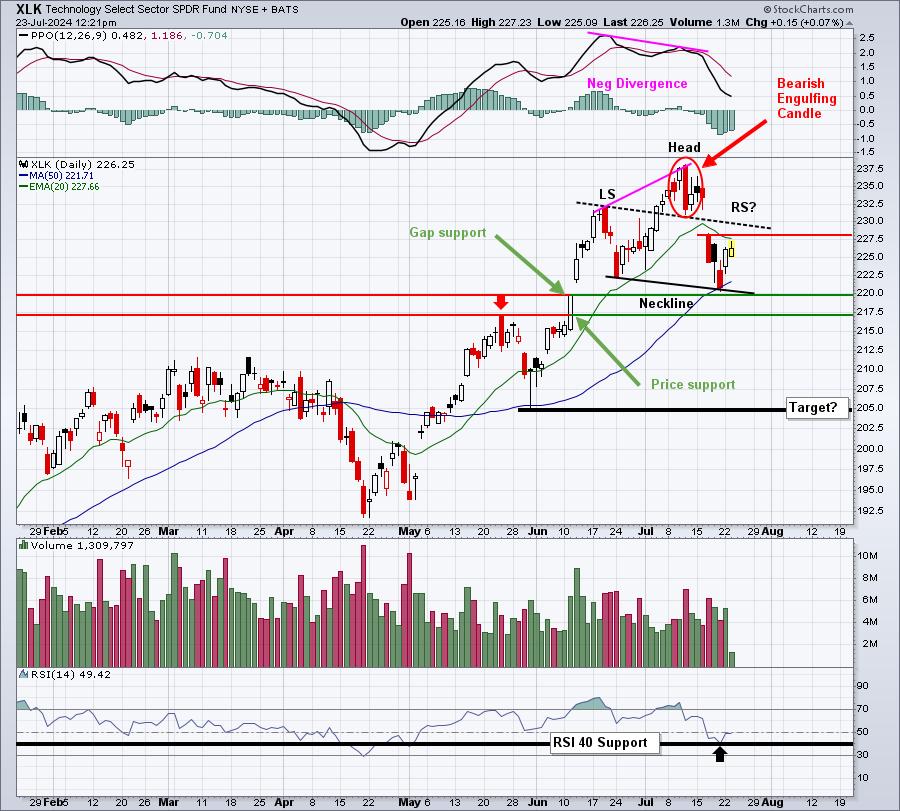

It is no secret that expertise represents 32% of the S&P 500 and 50% of the NASDAQ 100. If this group breaks down, the chances of an extra drop would enhance considerably. Let us take a look at the XLK:

Let me say that bearish patterns forming throughout secular bull markets MUST affirm. I give the good thing about the doubt to the bulls each single time throughout a secular bull market advance, which is strictly what we have had on our arms for the reason that April low. However we now have exterior components just like the Fed that would rapidly change the technical image, which is why I am watching these different indicators so carefully.

That is a completely CLASSIC head & shoulders topping sample. All the markers are current. First, a damaging divergence printed with a bearish engulfing candle on the high. The ensuing low modified the character of the chart, no less than briefly, by printing a decrease low. Be aware that the promoting did cease on the 50-day SMA and in addition above each hole help and value help. Sadly, we’re left with a down-sloping neckline, which if violated, could be way more bearish. The bounce that we’re seeing could possibly be the formation of an essential proper shoulder on the now-declining 20-day EMA and/or the underside of hole resistance, or presumably barely larger to rein within the final consumers earlier than a way more important decline. The measurement of this head & shoulders sample, if executed, could be roughly 205, a far cry from the present 226 degree.

We must also control the RSI. The bounce off 40 was stunning, however regular bull market pullbacks contact that degree after which take off. A return journey to RSI 40, or beneath, would begin to paint a extra bearish image.

Subsequent, semiconductors:

Semiconductors would be the major key for expertise. This chart would not look an entire lot higher than the XLK chart itself. I circled 4 very bearish days up to now month that recommend important distribution. Previous to mid-June, I do not know if we had 4 comparable days earlier in all of 2024. RSI help is teetering with one check already at 40. We’ve a double backside on the AD line and a rapidly-deteriorating PPO, although, for now, it stays above centerline help. We do not have a serious breakdown simply but, however key warning indicators are there. And the semis signify an enormous chunk of the XLK. I am not exhibiting it right here, however the DJUSSC has a damaging divergence on its weekly chart, so short-term breakdowns might turn into way more extreme.

Working our method down the totem pole, subsequent up is NVIDIA Corp (NVDA), which has issues of its personal. As a result of it is the poster little one of semiconductors, a breakdown on this important inventory could be very detrimental to each the semiconductor group and expertise, as an entire. Try NVDA and nil in on its key areas of help:

Hear, here is your chief in semis. Everybody shall be watching to verify NVDA holds help. Make no mistake, I’m BULLISH NVDA, the semis, and expertise over the long-term, however might Q3 be an issue? Sure, it very effectively might.

To conclude, I am fearful in regards to the market right here. I see points constructing not simply on the charts above, however inside our financial construction. The Fed might have quite a bit to say about how deep the present promoting/downtrend goes. I am not a fan of Fed Chief Powell and I have been fairly vocal in regards to the Fed’s delay in reducing the fed funds price. This lack of price cuts is simply now starting to point out up in deteriorating financial circumstances. That is essential sufficient that I needed to carry an occasion this Saturday for our EB.com members. I will be discussing the various warning indicators that are actually popping up, together with what it will take for me to show way more bearish. Should you’ve adopted me, you understand that I do not get bearish each different week. I’ve not been bearish since I stated to go lengthy U.S. shares on June seventeenth, 2022, in the course of the depths of the 2022 cyclical bear market.

If you need to hitch this occasion, “Why The S&P 500 Could Tumble”, on Saturday, July twenty seventh at 10:00am ET, merely CLICK HERE to study extra and to register. We’re very more likely to attain capability, so please register TODAY. We’ll get your FREE 30-day trial began and you’ll expertise all the advantages of an EarningsBeats.com membership.

Watch out on the market!

And, as at all times, completely satisfied buying and selling!

Tom

Leave a Reply