[ad_1]

Coinbase’s market management within the US is beneath risk, in keeping with crypto market knowledge analytics agency Kaiko Analysis.

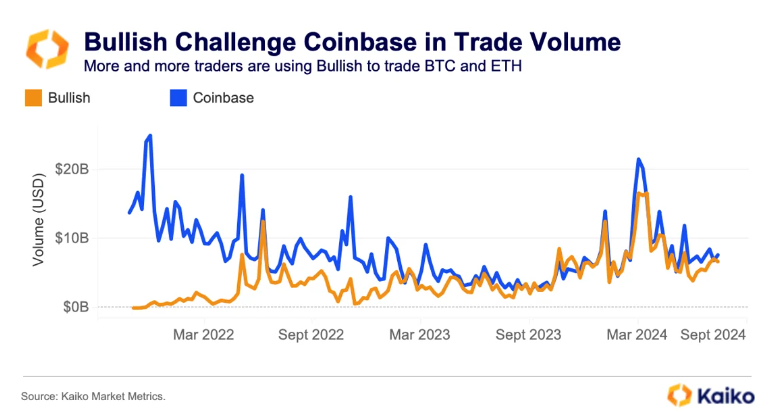

In a brand new report, Kaiko Analysis says that the US crypto trade panorama has undergone a “shift” with a comparatively new entrant Bullish managing to garner elevated market share to the purpose of gaining a bonus over Coinbase on some digital property.

“In terms of Bitcoin (BTC) and Ethereum (ETH) buying and selling Bullish now has comparable commerce volumes to Coinbase. The comparatively newer trade has even eclipsed Coinbase BTC and ETH volumes at instances this 12 months.

Bullish, which was launched on the peak of the final bull market in 2021, has seen persistently excessive buying and selling volumes for BTC and ETH over the previous 12 months.”

Based on Kaiko Analysis, Bullish “gained market share after market makers fled Binance.US in June of final 12 months amid regulatory scrutiny.”

Among the many key figures at Bullish embody Brendan Blumer, the co-founder of the EOS (EOS) blockchain, who serves because the trade’s present chairman. Tom Farley, a former president of the New York Inventory Change (NYSE) proprietor, Intercontinental Change (ICE), is the CEO of Bullish.

Kaiko Analysis additionally says {that a} metric related to the Coinbase crypto trade is signaling a rise in institutional demand for Bitcoin (BTC).

“The Coinbase premium, outlined because the distinction between hourly Bitcoin costs on Coinbase’s BTC-USD pair and Binance’s BTC-USDT pair, turned optimistic in early July after hitting its lowest stage for the reason that collapse of Terra in 2022 on the finish of June.

This metric is typically seen as a gauge of institutional sentiment as a result of institutional buying and selling quantity accounts for over 80% of buying and selling exercise on Coinbase, whereas Binance has a powerful retail repute.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE3

[ad_2]

Supply hyperlink

Leave a Reply