[ad_1]

KEY

TAKEAWAYS

- Tech shares took a dive on Wednesday however appear like they’re making up a few of these losses previous to hitting the following assist stage.

- Count on volatility within the inventory market within the coming weeks because it’s earnings season and there is a Fed assembly subsequent week.

- Regulate small-cap shares since they might outperform large-cap shares within the coming weeks.

Wednesday’s value motion within the inventory market indicated that worry is again. The Cboe Volatility Index ($VIX) closed up by over 22%, the most important share transfer for the yr. There’s an opportunity volatility may stay elevated for the close to time period—it is the center of earnings season, the November election panorama has modified, and it is a seasonally weak interval for equities.

On Wednesday, the S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) skilled the worst buying and selling day of the yr. The Nasdaq Composite was hit laborious, closing decrease by 3.64%. From a big-picture viewpoint, how a lot harm did the drop do? Let’s look carefully on the value motion within the Nasdaq Composite, beginning with the weekly chart.

The Macro View of the Nasdaq

Taking a look at a five-year weekly chart under, the uptrend that commenced in October 2023 remains to be in play. The transferring averages overlaid on the chart are adjusted to replicate assist ranges for the uptrend since October 2023. The short-term uptrend adopted the eight-week exponential transferring common (EMA). In April 2024, the Nasdaq Composite bounced off the 25-week easy transferring common (SMA), and in October, the index bounced off its 48-week SMA.

CHART 1. WEEKLY CHART OF NASDAQ COMPOSITE. Will the Nasdaq discover assist at its 25-week transferring common? Chart supply: StockCharts.com. For instructional functions.

On Wednesday, the Nasdaq Composite broke under its eight-week EMA, the primary alarm bell indicating that issues will not be nice in AI land. The next day, the selloff continued within the early a part of the buying and selling day however recovered some losses.

If the selloff continues, the following level to observe could be the 25-week SMA which corresponds carefully with the assist of the final earlier weekly excessive. Will the Nasdaq bounce off this stage just like what it did in April or will it proceed decrease and bounce off its 48-week SMA prefer it did in October? Or will the Nasdaq honor the assist stage of earlier highs and lows (blue dashed traces)?

Any of the eventualities may play out, or, as is attribute of the inventory market, it may do one thing distinctive.

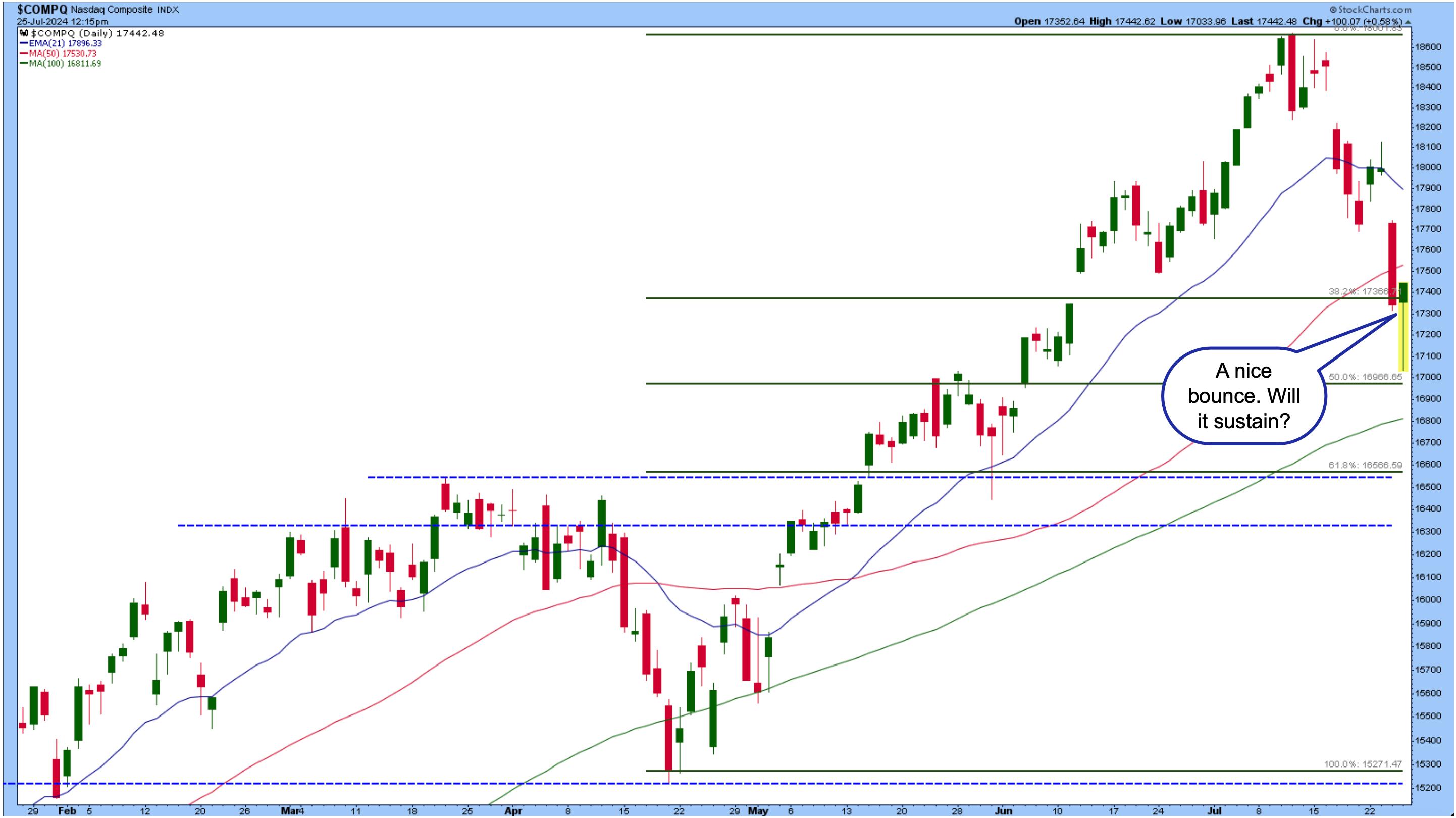

A Shorter-Time period View of the Nasdaq

Let’s flip to the every day chart (see chart under) to zero in on that first assist stage on the weekly chart, 16,670. To hit that stage, the Nasdaq Composite must fall between the 100-day SMA and the 61.8% Fibonacci retracement stage. You possibly can see from the chart that the Nasdaq approached its 50% Fib retracement stage however reversed and moved again as much as the 38.2% retracement stage.

CHART 2. DAILY CHART OF NASDAQ COMPOSITE. The index recovered. The query is, will it maintain? Chart supply: StockCharts.com. For instructional functions.

If VIX stays elevated, anticipate extra sizable actions within the Nasdaq and different fairness indexes. The Private Consumption Expenditure (PCE) for June drops on Friday.

Earnings Volatility

Earnings had so much to do with this week’s value motion. Alphabet (GOOGL) and Tesla (TSLA) reported on Tuesday after the shut. Though GOOGL beat earnings expectations, the decline in YouTube revenues led traders to promote the inventory. TSLA earnings missed estimates, with the inventory closing decrease by 12.33%.

Subsequent week, we’ll hear from extra Magazine 7 corporations. Provided that traders are getting jittery about tech shares, the businesses have to provide extremely robust earnings studies. Even one damaging report can ship the inventory value and your complete inventory market decrease.

Assuming that equities fall additional—it is a honest assumption given {that a} correction is predicted—what sort of funding technique do you have to apply? Your first thought could also be bonds, however they don’t seem to be exhibiting indicators of power. Bond costs fell on Wednesday together with shares. Commodities and cryptocurrencies aren’t exhibiting indicators of enthusiasm both.

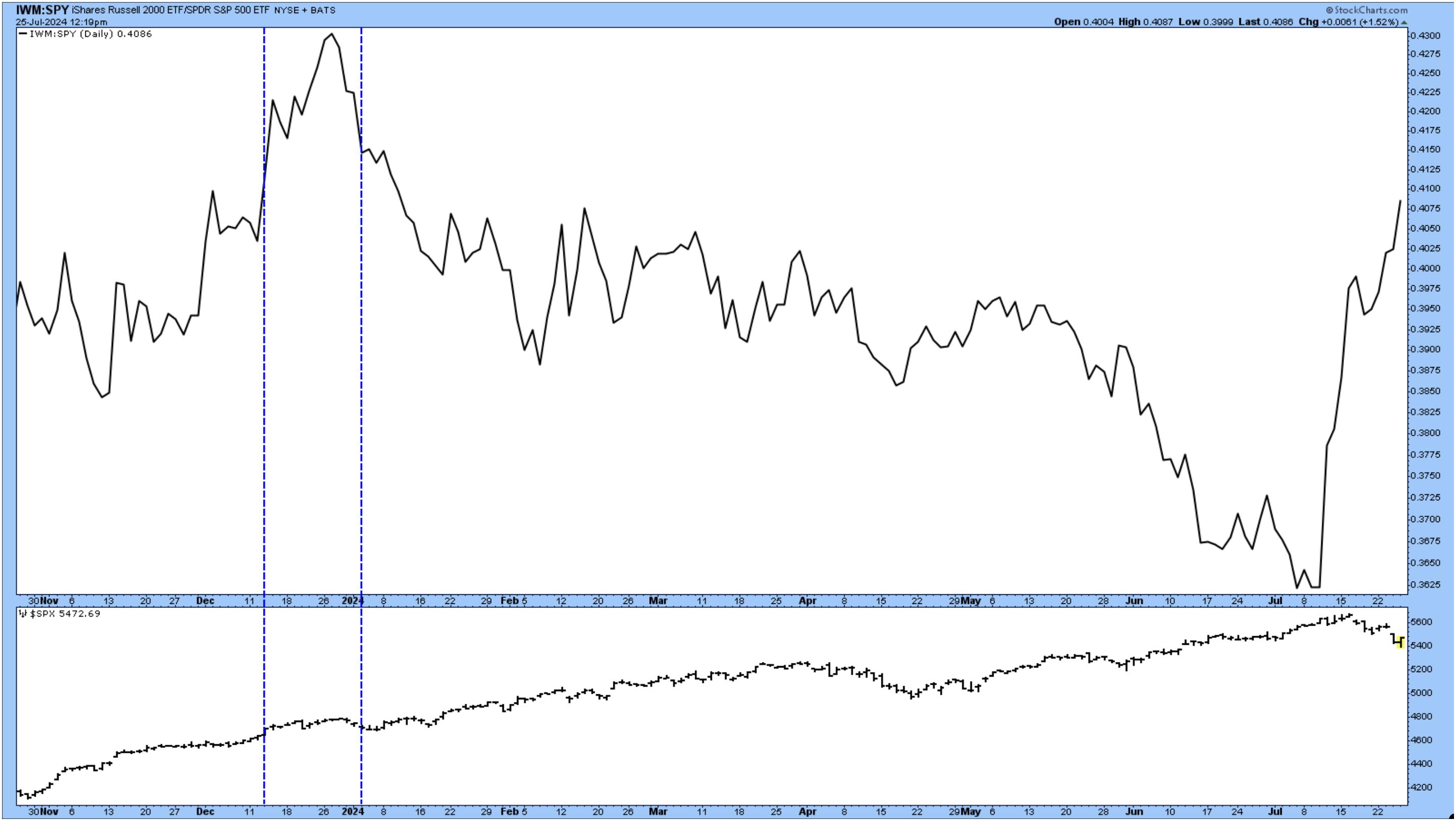

Small-Cap Shares

Small-cap shares are outperforming large-cap shares, as displayed within the chart of the ratio between iShares Russell 2000 ETF (IWM) and the SPDR S&P 500 ETF (SPY) under. Evaluate the worth motion to what occurred between December 2023 and January 2024. The S&P chart within the decrease panel would not present a large correction throughout that interval. However no two durations are alike so it is best to maintain a detailed watch on the completely different transferring elements of the inventory market.

CHART 3. SMALL CAPS VS. LARGE CAPS. Small caps are outperforming large-cap shares, though it would not essentially imply that enormous caps will pull again considerably. It is nonetheless price watching this chart. Chart supply: StockCharts.com. For instructional functions.

IWM is made up of small-cap US shares. Curiously, one of many high holdings in IWM is Insmed Inc. (INSM), a inventory with a excessive StockCharts Technical Rank (SCTR) rating. It additionally has an attention-grabbing chart sample (see chart under).

CHART 4. DAILY CHART OF INSMED INC. (INSM). The chart gapped about its earlier all-time excessive in 2021 and is now consolidating. With a robust SCTR rating, will the inventory preserve its robust place? Chart supply: StockCharts.com. For instructional functions.

The inventory value gapped up above its February 2021 all-time excessive and has continued transferring greater. It is now consolidating. Look ahead to the inventory to interrupt out above the descending triangle sample (blue dashed traces) or to succeed in the assist of its 25-day SMA. An upside follow-through from both of those patterns may make this a robust buying and selling candidate. So, set your alerts on StockCharts so you do not miss this one.

You possibly can do the same evaluation on different high IWM holdings, corresponding to FTAI Aviation Ltd. (FTAI), Vaxcyte Inc. (PCVX), and Sprouts Farmers Market Inc. (SFM).

Different Market Segments To Contemplate

Different areas of the market price contemplating are worth shares. Convey up a ratio chart of the iShares Russell 1000 Worth ETF (IWD) to the iShares Russell 1000 Development ETF (IWF).

Regional banks are additionally performing properly. Convey up a chart of the SPDR S&P Regional Banking ETF (KRE). If this catches your consideration, head to the StockCharts Image Abstract web page, kind in KRE, and begin your analysis. The Profile part has a hyperlink to the ETF web page from the place you’ll find the highest holdings.

Closing Place

If risky situations persist available in the market for the following month or so, you will have to develop a method to handle your portfolio to cushion your drawdowns. Subsequent week there are extra earnings and a Fed assembly. So, be ready together with your recreation plan.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

[ad_2]

Supply hyperlink

Leave a Reply