KEY

TAKEAWAYS

- After two days of large selloffs, Friday’s restoration affords some hope.

- Buyers await earnings from mega-cap tech firms, financial information, and Fed assembly.

- Small caps proceed to development larger.

Main fairness indexes rose on Friday after a selloff that hit the Know-how sector particularly arduous. However this does not essentially imply that every little thing is OK going into subsequent week. Wall Avenue appears to be in whiplash land, veering from one market space to a different.

The Dow Jones Industrial Common ($INDU) closed larger by 1.64%, offering a lift to Industrials. The Nasdaq Composite ($COMPQ) and S&P 500 ($SPX) closed mid-range. That each one indexes closed above their Thursday lows is encouraging and a great way to finish every week that regarded prefer it may finish in doom.

Softer Inflation Information Sheds Optimism

It is attainable the June Private Consumption Expenditure (PCE) value index was the catalyst behind the restoration rally. The PCE rose 0.1% month over month and a pair of.5% 12 months over 12 months. The core CPI rose 0.2% month over month and a pair of.6% 12 months over 12 months. The info means that inflation is slowly converging towards the Fed’s 2.0% goal. So, maybe the delicate touchdown situation will grow to be a actuality. Let’s wait to listen to what Fed Chair Powell says subsequent week.

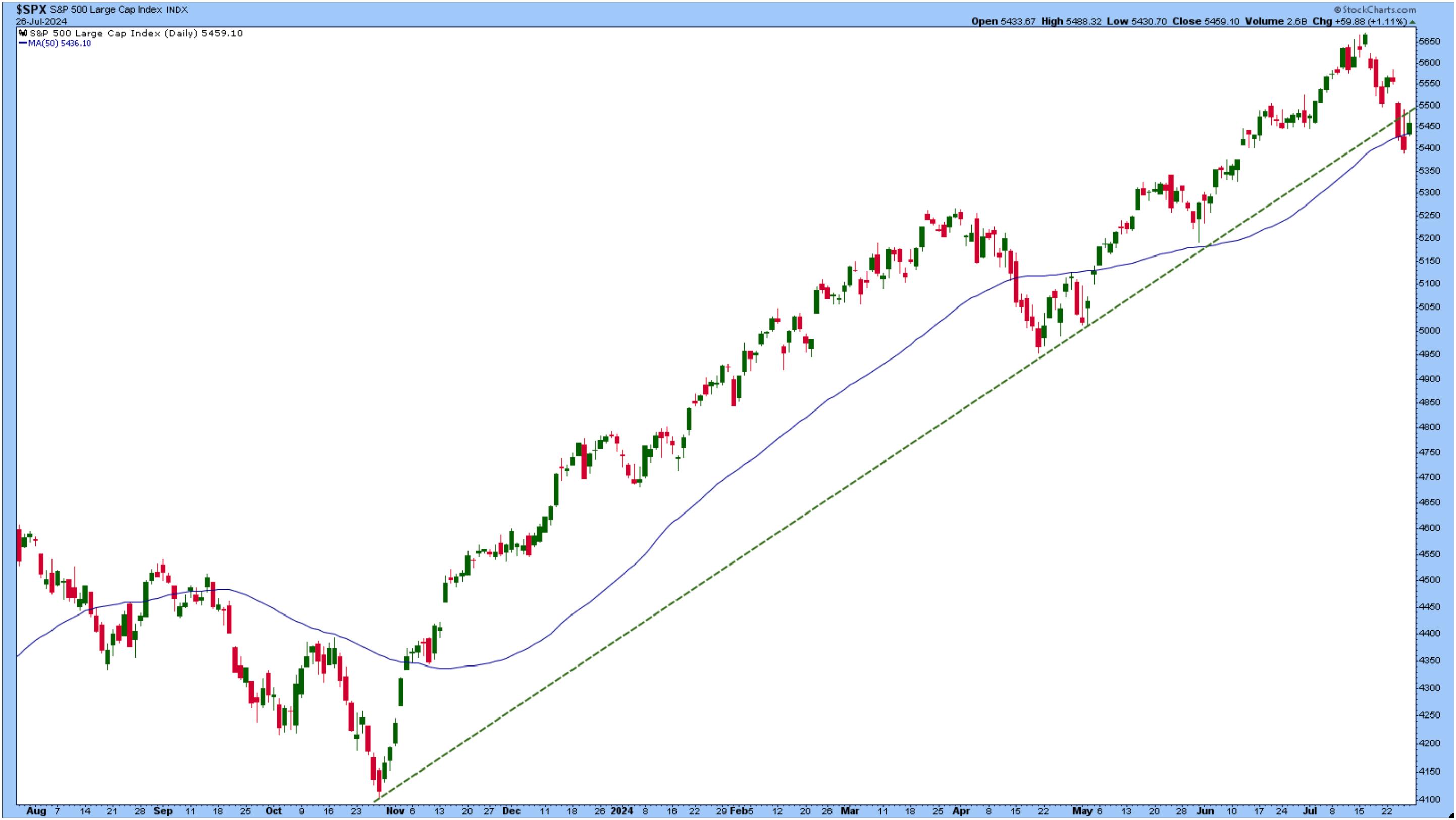

The S&P 500 bounced off the 50-day easy transferring common (SMA) and touched the October–April trendline at its excessive however closed decrease (see chart beneath). Will the trendline act as a robust help stage for the index to beat?

CHART 1. UPTREND IN THE S&P 500 SINCE OCTOBER 2023. The S&P 500 is in an vital space, and traders ought to watch to see if it breaks above or beneath the trendline or transferring common. Chart supply: StockCharts.com. For academic functions.

The long-term development remains to be trying sturdy, however on condition that the following few months is a seasonally weak interval, count on the market to appropriate. So long as it stays above its 25-week SMA and the SMA is trending larger, the long-term development will likely be bullish.

The Nasdaq was arduous hit on Wednesday and Thursday, and Friday’s restoration did not take the index above its 50-day SMA. It is nonetheless trying indecisive because it straddles beneath the 38.2% Fibonacci retracement stage (see chart beneath).

CHART 2. DAILY CHART OF NASDAQ COMPOSITE WITH FIBONACCI RETRACEMENT LEVELS. The Nasdaq failed to interrupt above its 38.2% Fibonacci retracement stage. Let’s examine what subsequent week brings. Chart supply: StockCharts.com. For academic functions.

The place Are Buyers Flocking?

The Dow Jones Industrial Common, which bought hit arduous after hitting a brand new excessive on July 17, was the massive winner on Friday. And for the reason that S&P 400 midcap index has a excessive focus of Industrials, the S&P 500 Mid Cap Index ($MID) bought a lift.

Small-cap shares additionally rose, with the S&P 600 Small Cap Index ($SML) hitting a brand new 52-week excessive. Does this imply that undervalued small caps are a great place to park your money whereas the mega-cap indexes undergo their correction? It could be value contemplating, on condition that a lot of the massive tech firms reporting subsequent week are trying weak technically.

So, what is going on properly? The cooling inflation information elevated expectations of rate of interest cuts which helped financial institution shares. Whereas the broader fairness indexes have been struggling, the KBW Financial institution Index ($BKX) noticed a light correction adopted by a rally. The index closed at a brand new 52-week excessive.

CHART 3. KBW BANK INDEX HITS NEW 52-WEEK HIGH. Expectations of cuts in rates of interest this 12 months despatched financial institution shares larger. Chart supply: StockCharts.com. For academic functions.

The inventory market is forward-looking, so it is vital to concentrate to what comes subsequent. We’re getting into every week of heavy earnings from some massive mega-cap tech shares. There’s additionally the Fed assembly. Whereas no charge cuts are anticipated in subsequent week’s assembly (the CME FedWatch Instrument reveals a 95.3% chance of no charge cuts in July), traders will hear intently to Chairman Powell’s feedback throughout his presser. Subsequent week can be an financial data-heavy week with July Manufacturing PMI and Non-Farm Payrolls. Each will give some indication of the US financial panorama.

Count on some market volatility subsequent week. Though the Cboe Volatility Index ($VIX) eased on Friday, it is nonetheless excessive, comparatively talking. Every day available in the market is completely different. Take every day because it comes.

- S&P 500 closed down 0.83% for the week, at 5459.10, Dow Jones Industrial Common up 0.75% for the week at 40,589.34; Nasdaq Composite closed down 2.08% for the week at 17357.88.

- $VIX down 0.79% for the week closing at 16.39

- Greatest performing sector for the week: Utilities

- Worst performing sector for the week: Client Discretionary

- Prime 5 Giant Cap SCTR shares: MicroStrategy, Inc. (MSTR); Carvana Co. (CVNA); Insmed Inc. (INSM); Tenet Healthcare Corp. (THC); Arm Holdings (ARM).

On the Radar Subsequent Week

- FOMC assembly

- Could S&P/Case-Shiller House Value MoM

- June JOLTs Report

- July Manufacturing PMI

- July Non-Farm Payrolls

- Earnings from Superior Micro Gadgets (AMD), Apple, Inc. (AAPL), Amazon.com, Inc. (AMZN), Coinbase International Inc. (COIN), Intel Corp. (INTC), Meta Platforms (META), Microsoft Corp. (MSFT), On Semiconductor Group (ON), Snap Inc. (SNAP), and lots of extra.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra

Leave a Reply