[ad_1]

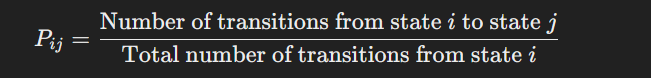

Every aspect P i j P_ij Pij is calculated as:

Step 4: Use the Markov Chain for Predictions

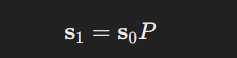

Use the transition likelihood matrix to foretell future states. Given the present state, the long run state possibilities could be calculated by multiplying the present state vector with the transition matrix.

If the present state vector is s0

Step 5: Develop a Buying and selling Technique

Primarily based on the expected future states, develop a buying and selling technique. For instance, if the mannequin predicts a excessive likelihood of worth enhance (transitioning to an growing state), you would possibly determine to purchase. Conversely, if a worth lower is predicted, you would possibly determine to promote or quick the asset.

Instance in MQL5

Beneath is an instance of the way you would possibly implement a easy Markov chain-based technique in MQL5:

enum PriceState DECREASE_SIGNIFICANTLY, DECREASE_SLIGHTLY, STABLE, INCREASE_SLIGHTLY, INCREASE_SIGNIFICANTLY ; PriceState GetState(double priceChange) if (priceChange < -0.5) return DECREASE_SIGNIFICANTLY; if (priceChange < -0.1) return DECREASE_SLIGHTLY; if (priceChange < 0.1) return STABLE; if (priceChange < 0.5) return INCREASE_SLIGHTLY; return INCREASE_SIGNIFICANTLY; double transitionMatrix[5][5] = 0.2, 0.3, 0.2, 0.2, 0.1, 0.1, 0.3, 0.4, 0.1, 0.1, 0.1, 0.2, 0.4, 0.2, 0.1, 0.1, 0.1, 0.3, 0.4, 0.1, 0.1, 0.1, 0.2, 0.3, 0.3 ; PriceState PredictNextState(PriceState currentState) double rnd = MathRand() / (double)RAND_MAX; double cumulativeProbability = 0.0; for (int i = 0; i < 5; i++) cumulativeProbability += transitionMatrix[currentState][i]; if (rnd <= cumulativeProbability) return (PriceState)i; return currentState; void OnTick() static PriceState currentState = STABLE; static double previousClose = 0.0; double currentClose = iClose(Image(), PERIOD_M1, 0); if (previousClose != 0.0) double priceChange = (currentClose - previousClose) / previousClose * 100; currentState = GetState(priceChange); PriceState nextState = PredictNextState(currentState); if (nextState == INCREASE_SIGNIFICANTLY previousClose = currentClose;

Key Factors:

- Outline states: Primarily based on worth adjustments.

- Calculate transition possibilities: From historic information.

- Predict future states: Utilizing the transition matrix.

- Develop technique: Purchase or promote primarily based on predicted states.

Utilizing Markov chains helps in capturing the probabilistic nature of worth actions and is usually a great tool in growing buying and selling methods.

[ad_2]

Supply hyperlink

Leave a Reply