[ad_1]

Indices Evaluation Abstract

Persevering with from the earlier article, the evaluation of the assorted rankings for the indices reveals that the information within the desk is strong and correct. In abstract, there are two sorts of total trendiness measures; Trendiness One makes use of all the knowledge to find out trendiness, and Trendless makes use of solely the trending knowledge decided by the filtered wave worth and the pattern size. After all, Trendiness One is the complement of Trendless evaluation. They’re nonetheless measuring trendiness, simply in two totally different arenas. There are additionally two measures of Up Trendiness utilizing the identical idea.

This might have simply as simply been a rating of down trendiness, however I believe up trendiness is extra prevalent in most markets.

Appendix B incorporates quite a few tables that present the tables ordered by their ranks, which makes it simpler to seek out the rating you’re in search of. The next tables present numerous subsets of the All desk simply analyzed.

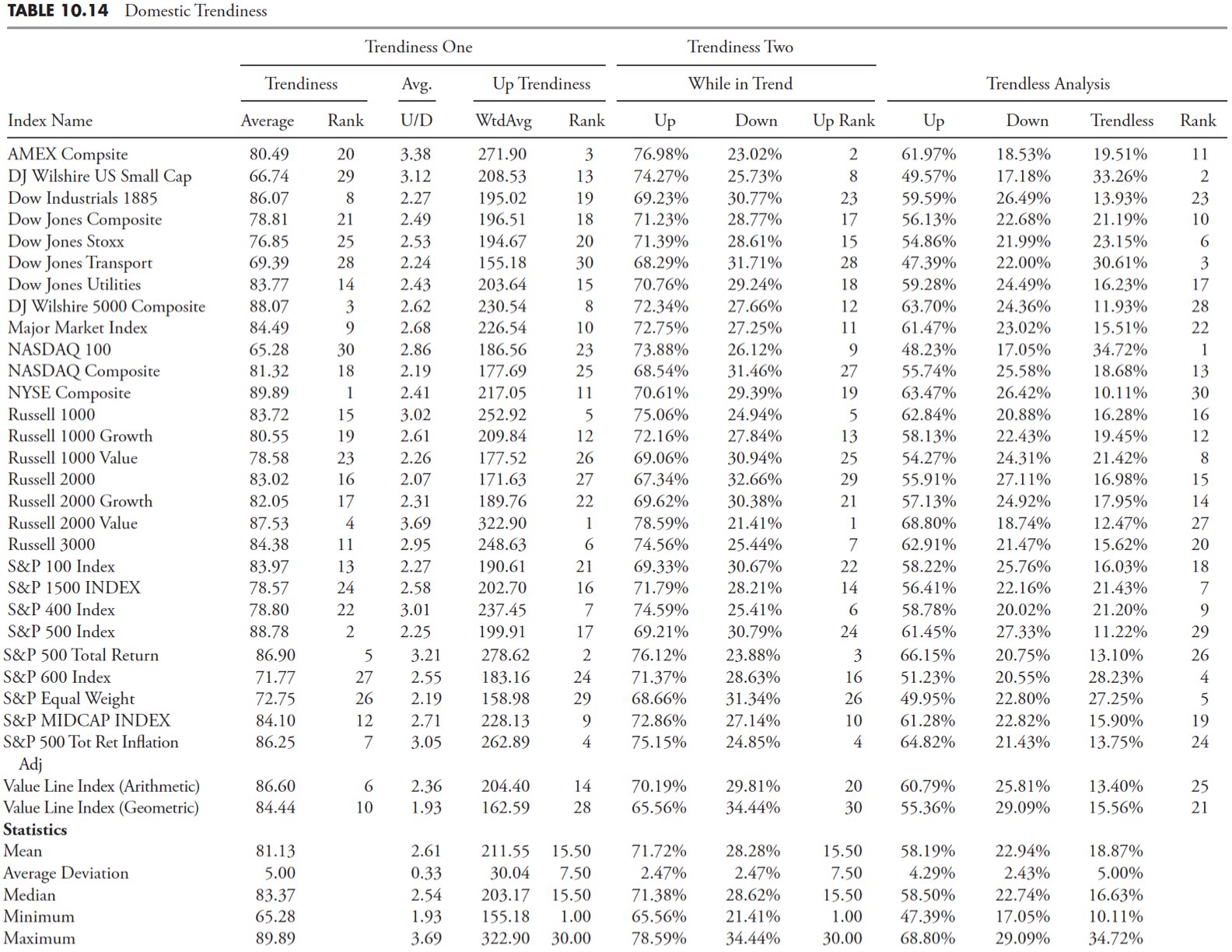

Home Trendiness

Desk 10.14 incorporates solely the home points.

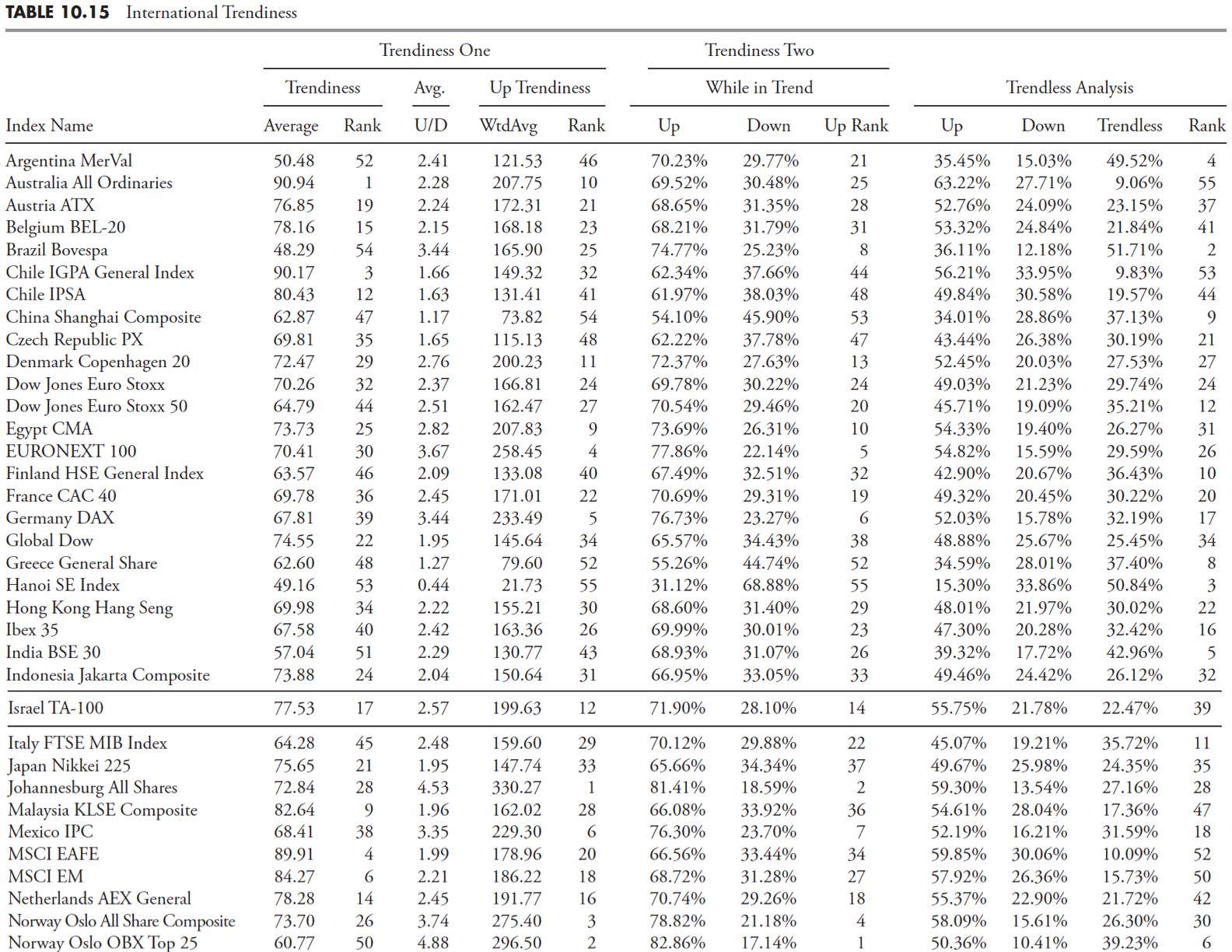

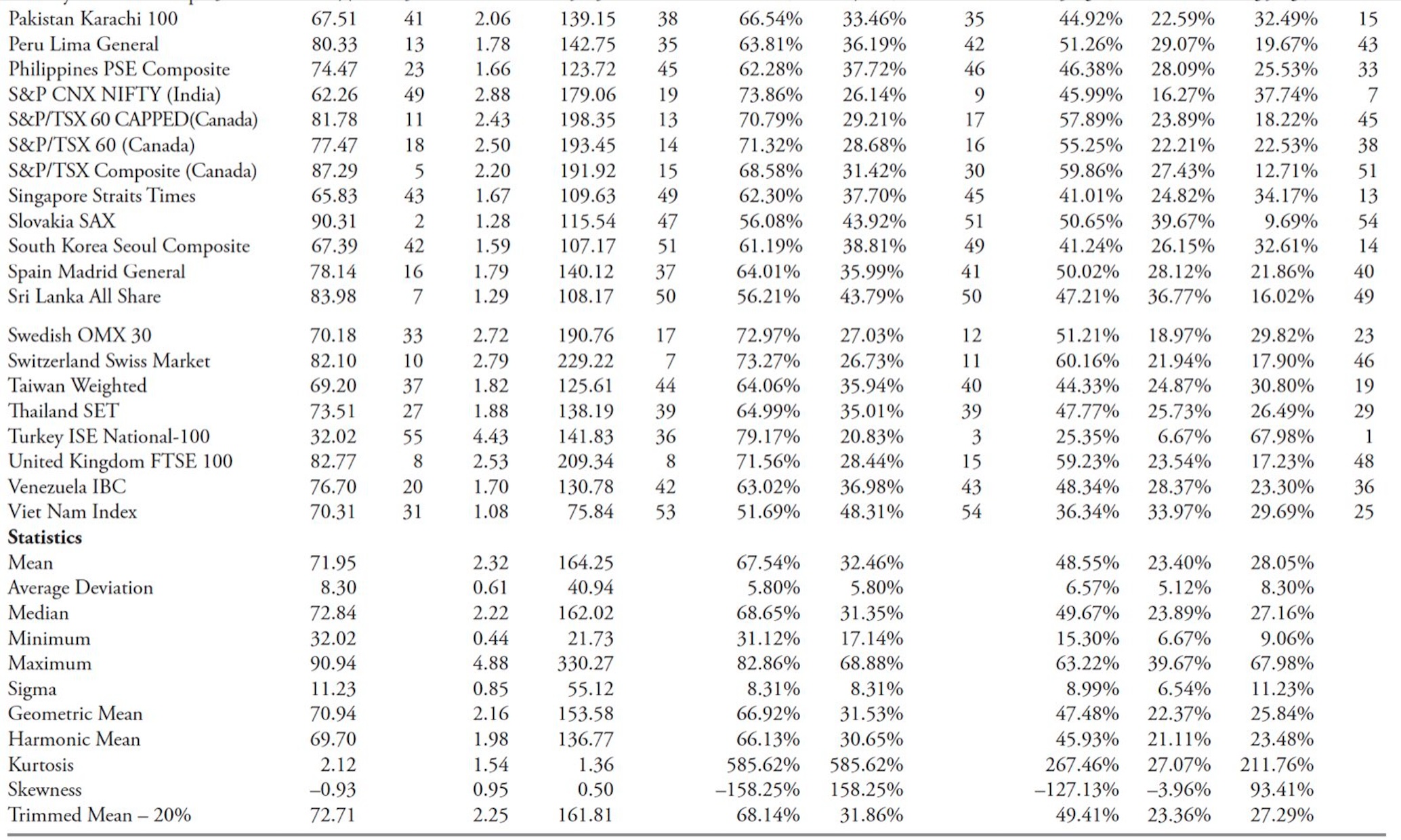

Worldwide Trendiness

Desk 10.15 incorporates solely the worldwide points.

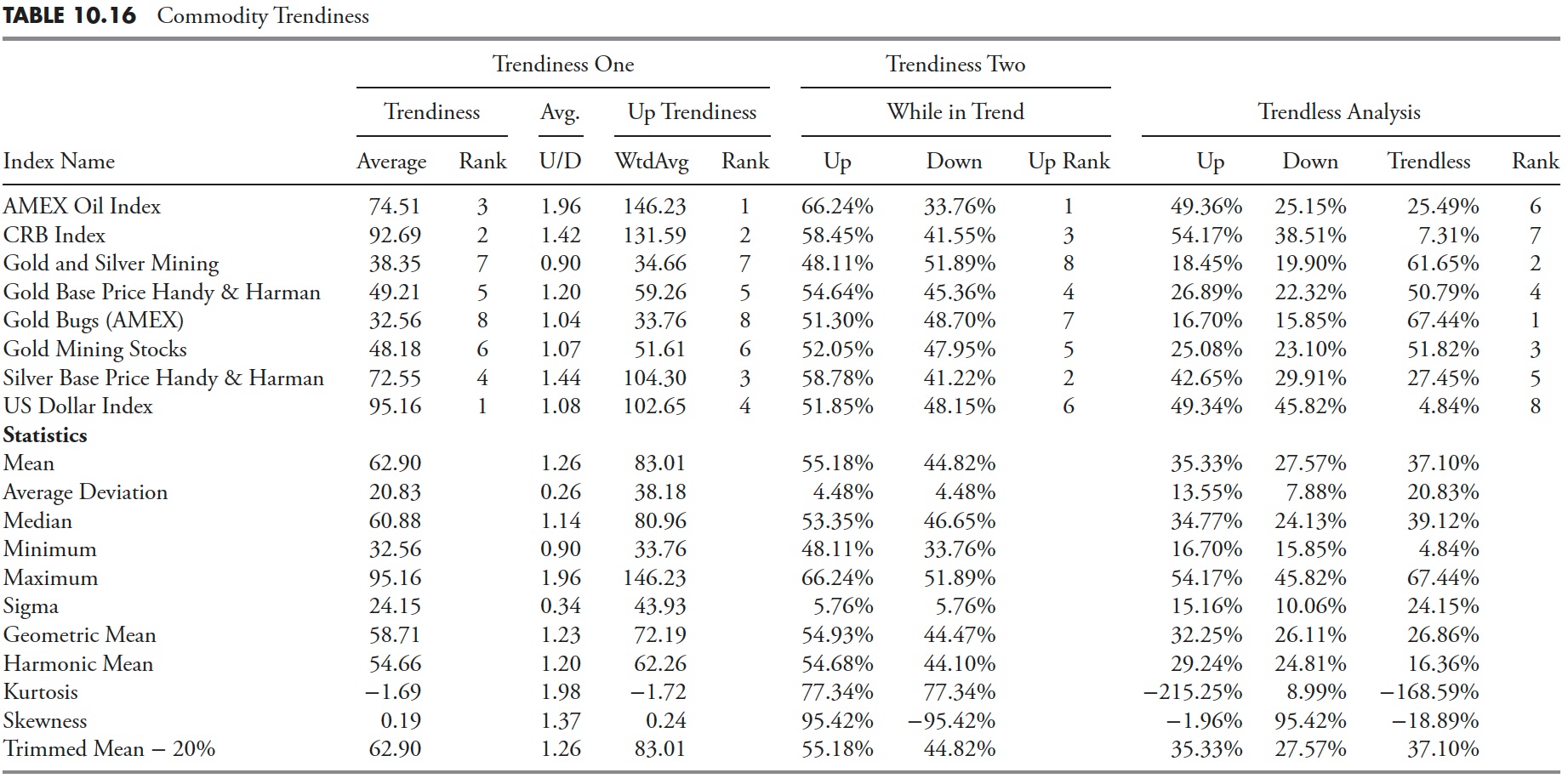

Commodity Trendiness

Desk 10.16 incorporates solely the commodity-based points.

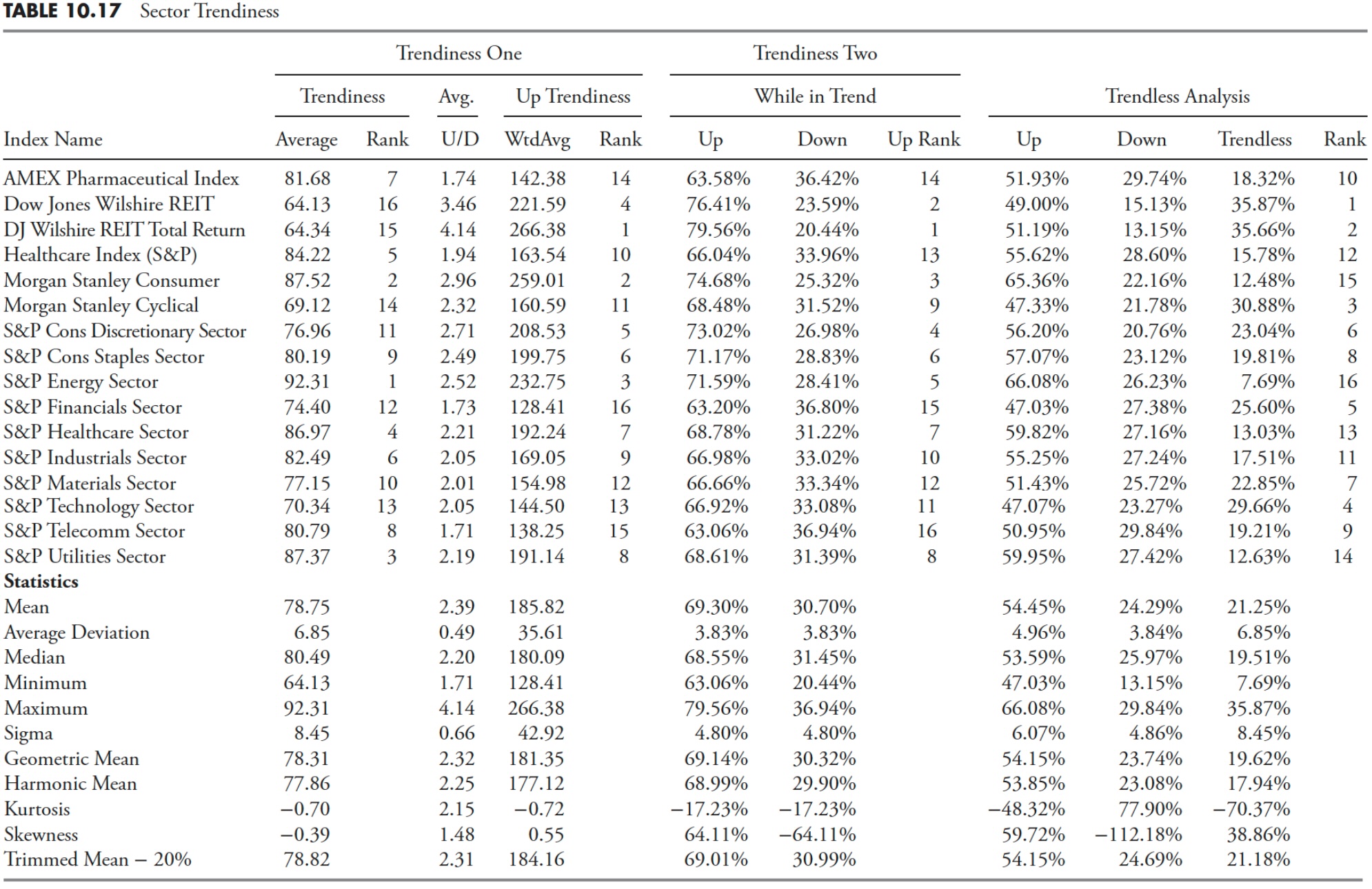

Sector Trendiness

Desk 10.17 incorporates solely the sector-related points.

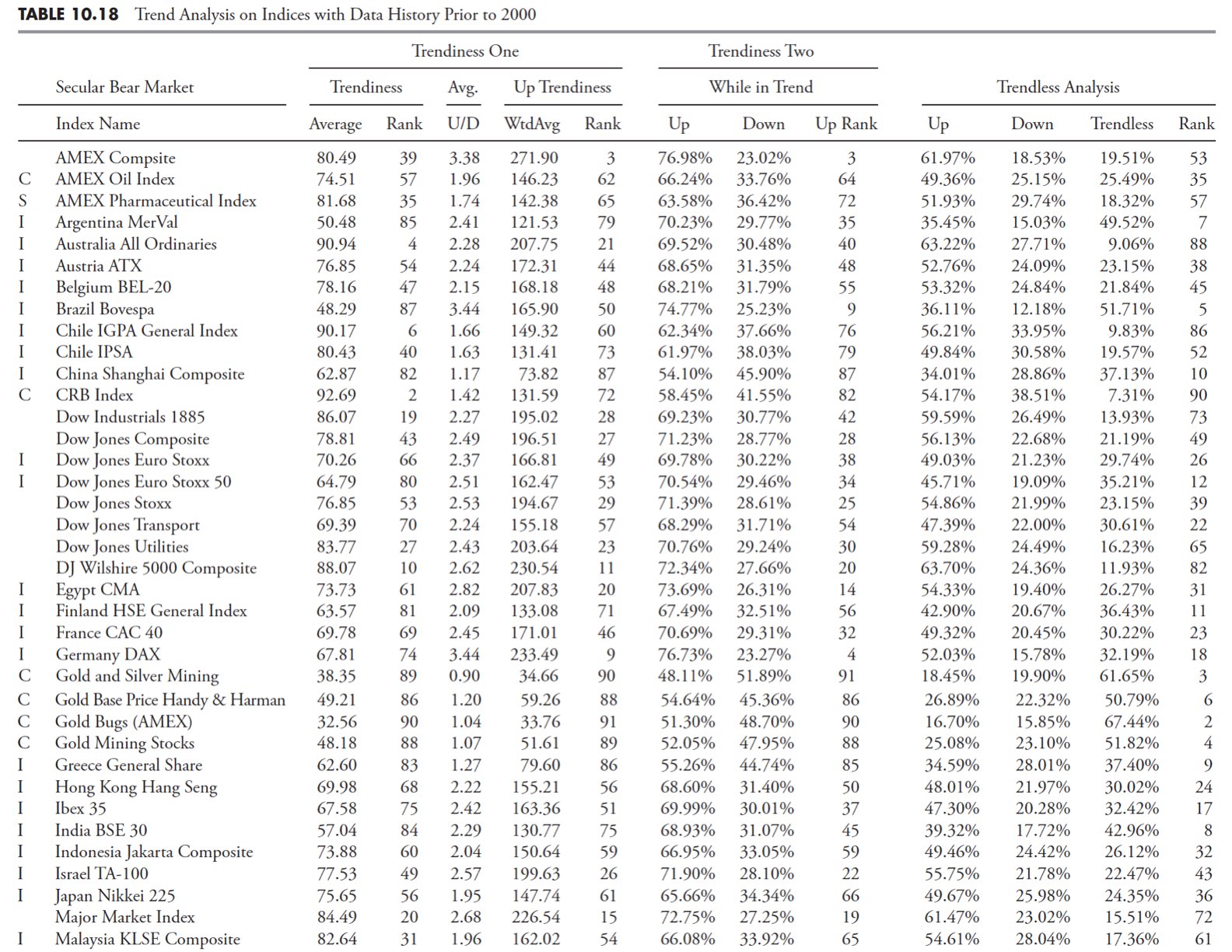

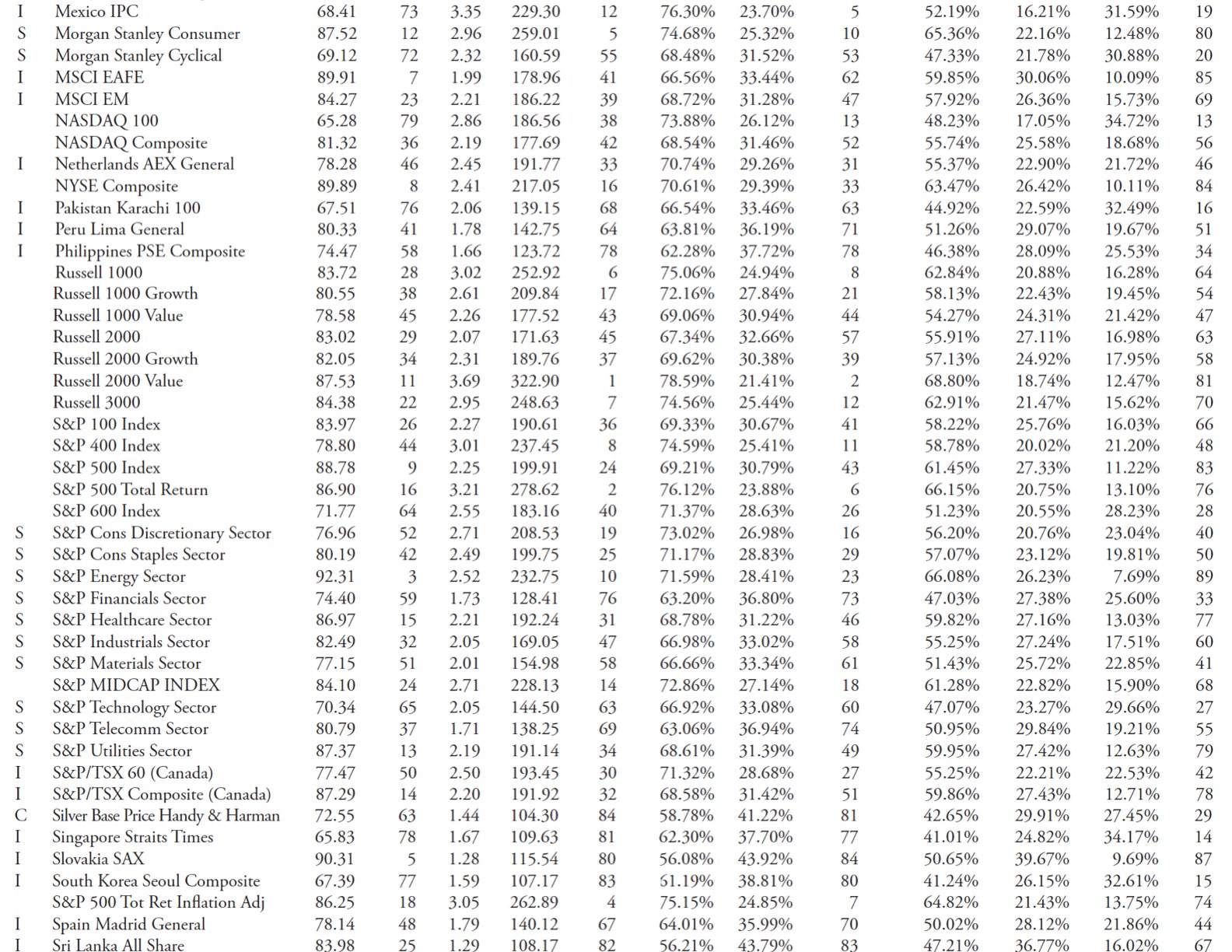

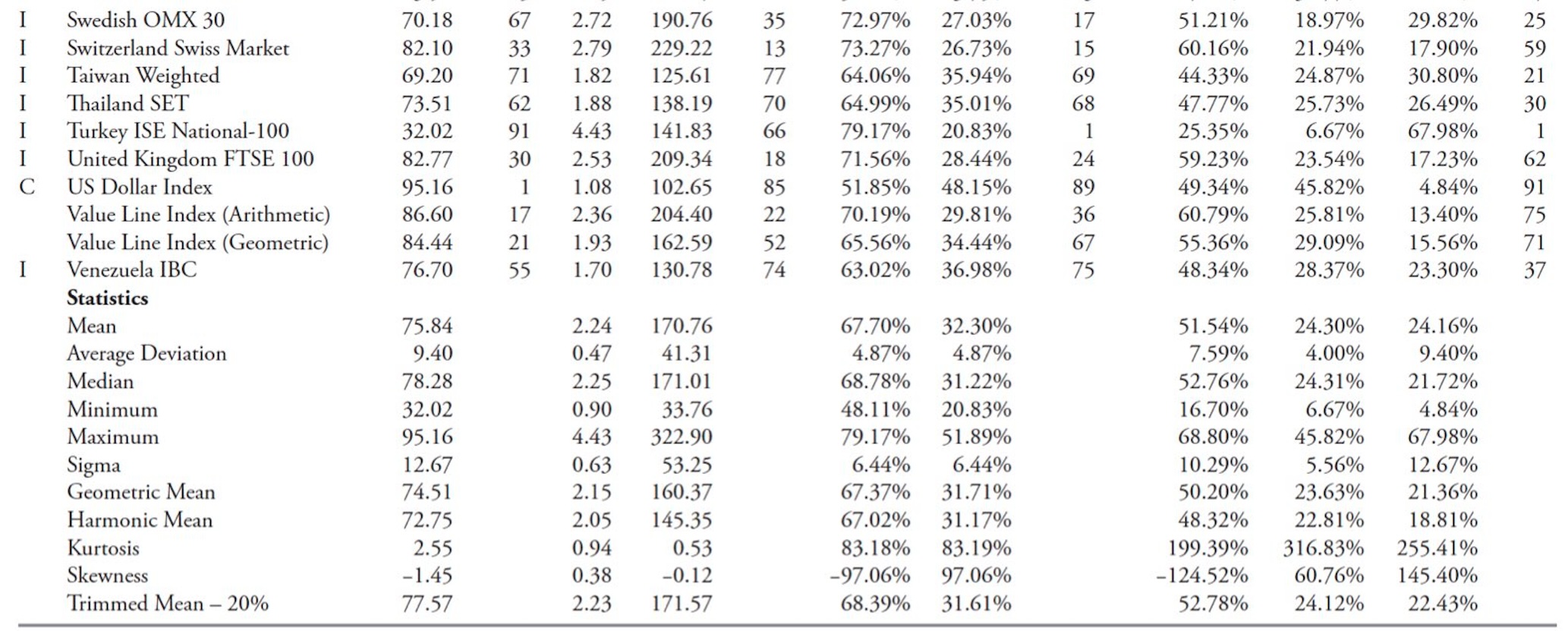

Knowledge with Historical past Previous to 2000

Desk 10.18 incorporates all the problems which have knowledge that started previous to 2000. This desk incorporates extra points than the next two tables, as every of them reduces the variety of points by growing the quantity of knowledge by utilizing an earlier beginning date.

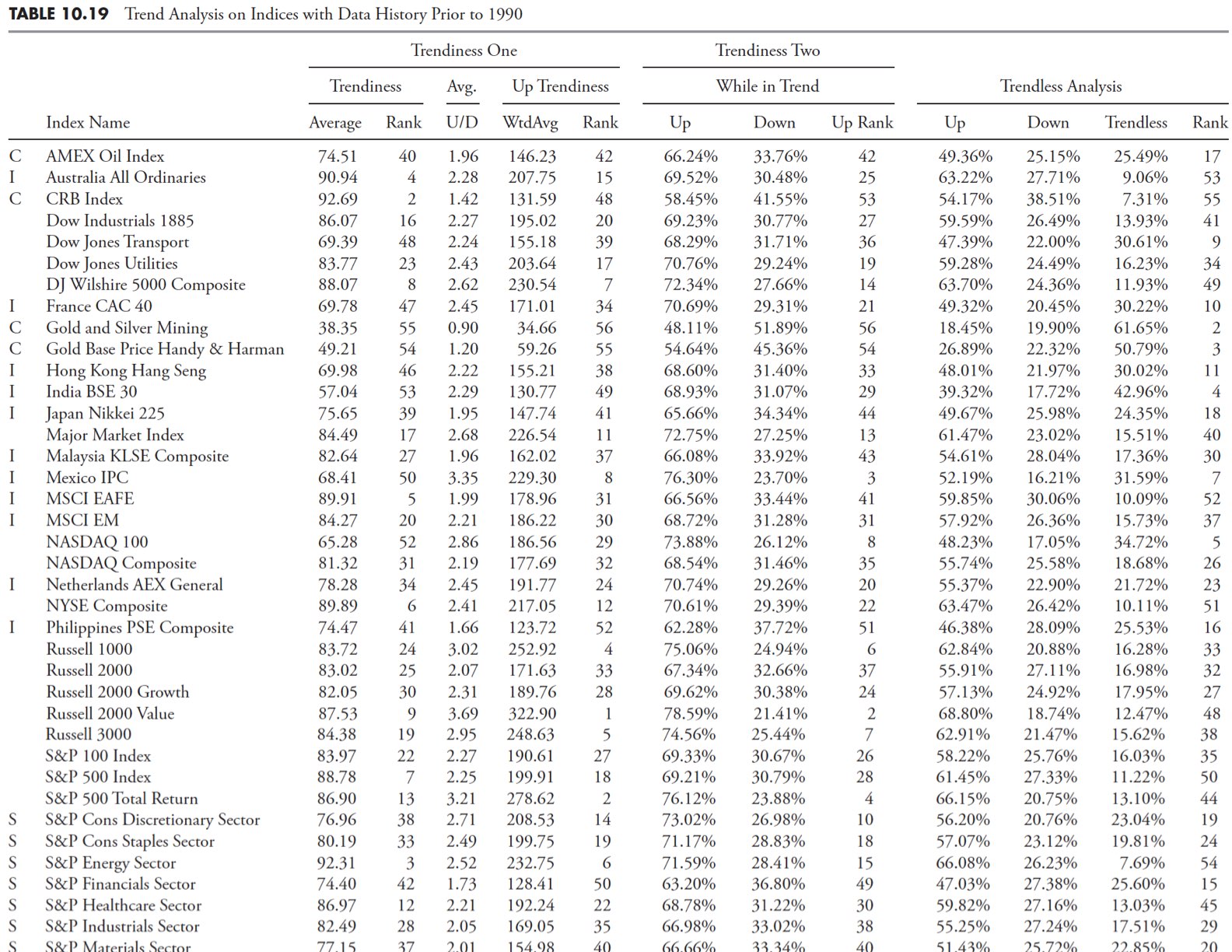

Knowledge with Historical past Previous to 1990

Desk 10.19 incorporates all the problems which have knowledge that started previous to 1990.

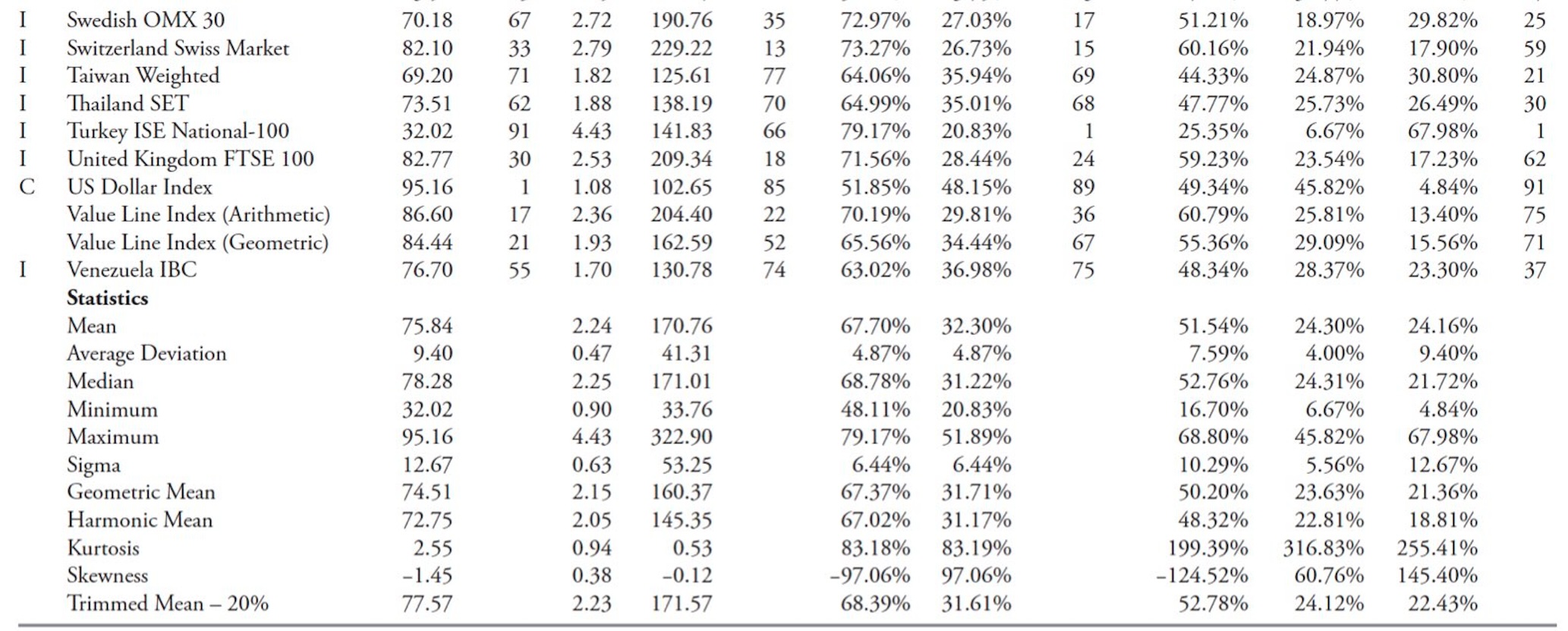

Knowledge with Historical past Previous to 1980

Desk 10.20 incorporates all the problems which have knowledge that started previous to 1980. That is the desk with the longest set of knowledge and therefore, the fewest variety of points.

Development Evaluation on the S&P GICS Knowledge

Subsequent, I will conduct an analogous research on the 95 S&P GICS Sectors, Trade Teams, and Industries. This can be a totally different research in that the parameters for dedication of trending markets have been significantly expanded. The variety of days for pattern dedication was tabulated for days from 15 to 65. The filtered wave share was additionally expanded from 5% to 11%. The entire evaluation that was included within the earlier part was carried out on these 95 sectors and trade teams.

The International Trade Classification Customary (GICS) is an trade taxonomy developed by MSCI and Customary & Poor’s (S&P) to be used by the worldwide monetary neighborhood. The GICS construction consists of 10 sectors, 24 trade teams, 68 industries, and 154 subindustries into which S&P has categorized all main public firms. The system is much like ICB (Trade Classification Benchmark), a classification construction maintained by Dow Jones Indexes and FTSE Group.

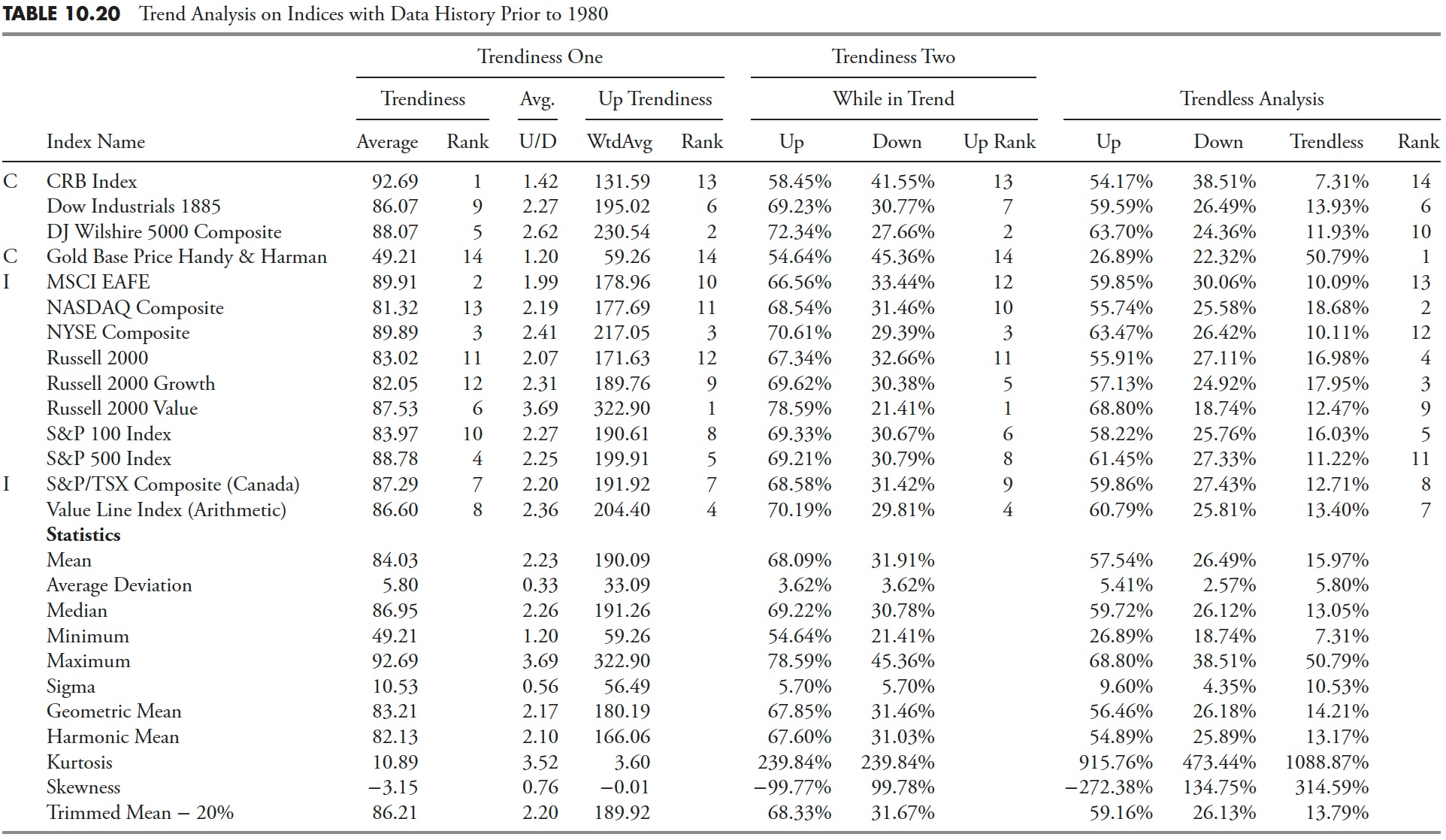

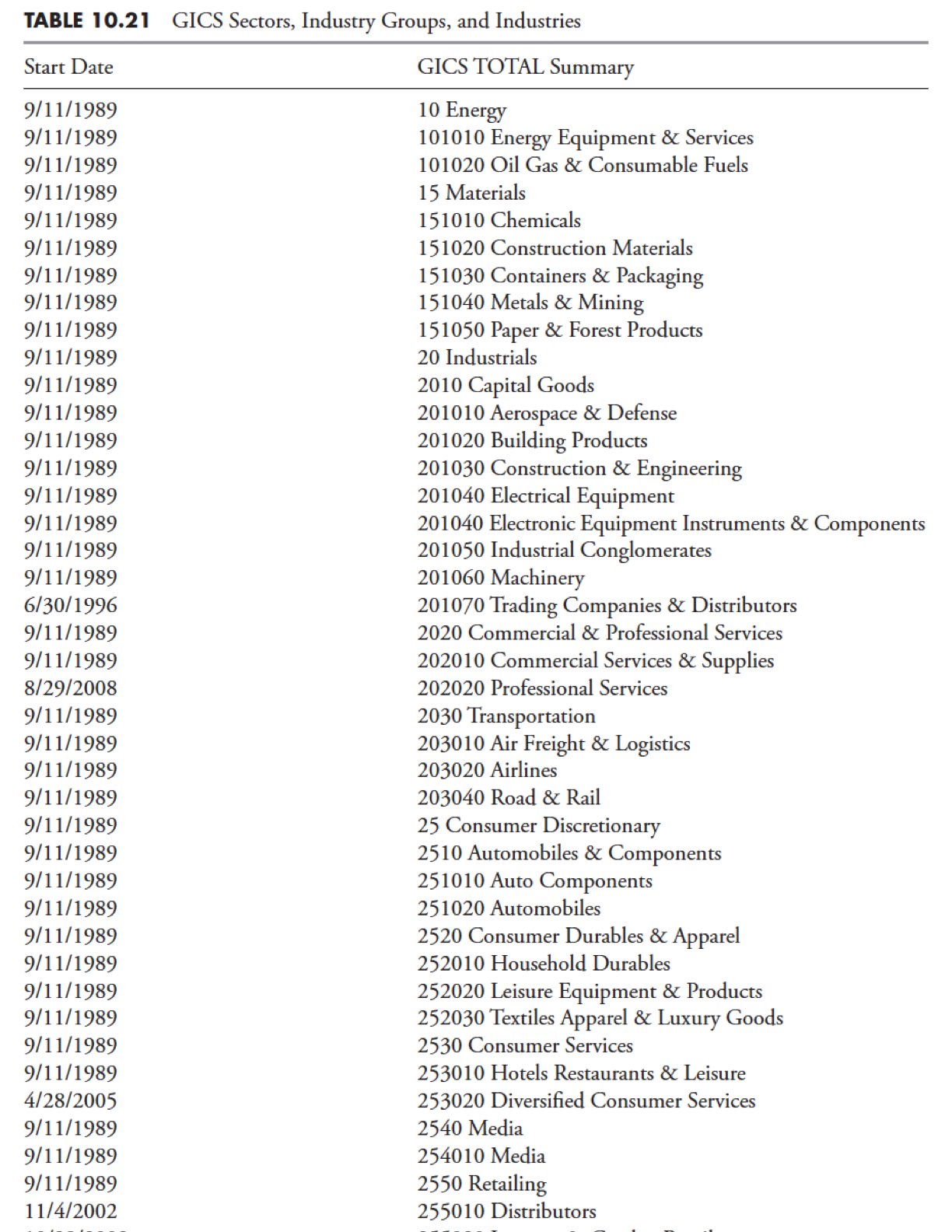

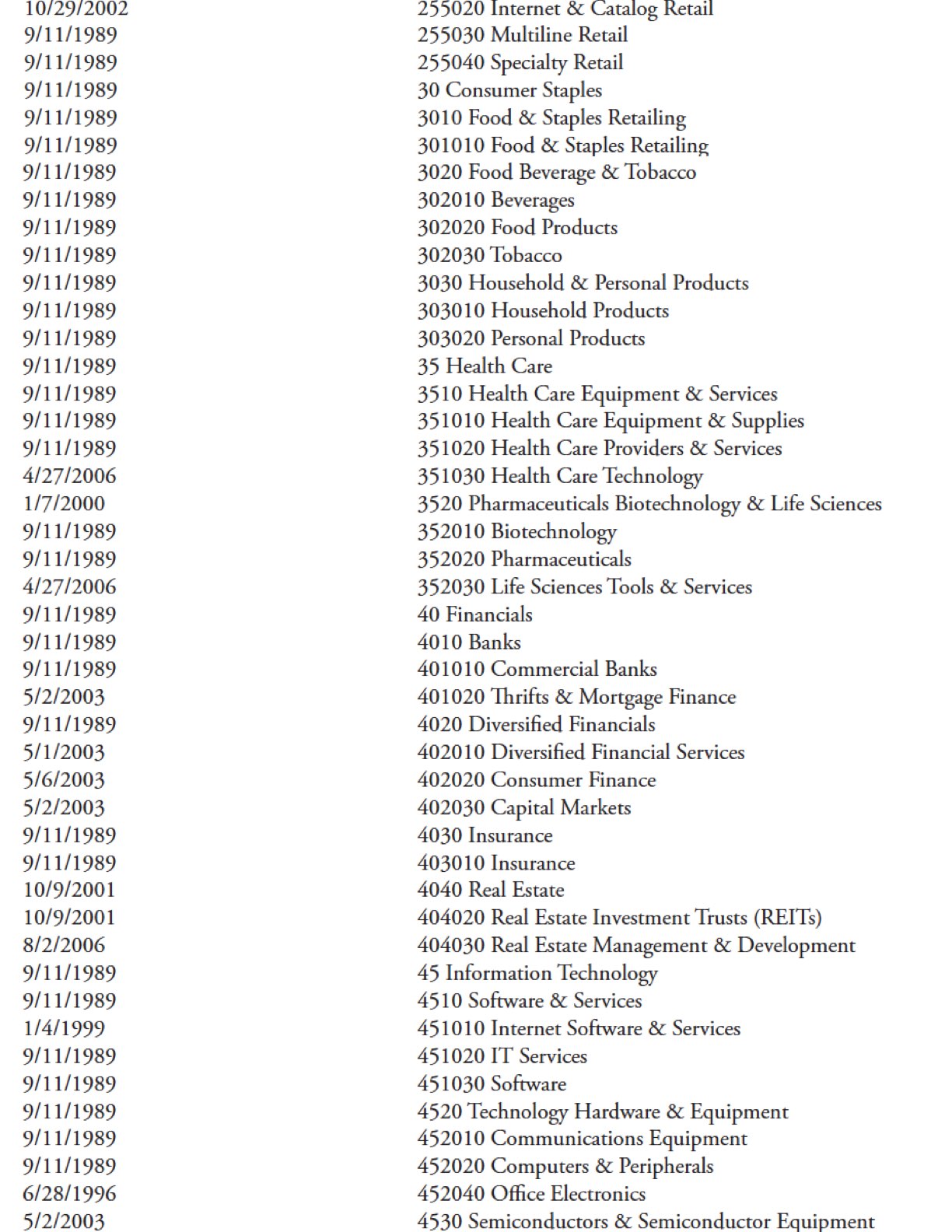

S&P Sectors, Trade Teams, and Industries

The numerical identification is precisely the identical utilized by Customary & Poor’s of their GICS classification methodology. Most, however not all, of the GICS database started in 1989; in actual fact, there have been solely 21 collection that didn’t start in 1989. When viewing the evaluation that follows, you possibly can cross-reference this desk if one specific sector or trade appears to pattern exterior the common, then verify the beginning date because it won’t have sufficient knowledge for good evaluation. Desk 10.21 reveals all of the GICS knowledge and every beginning date.

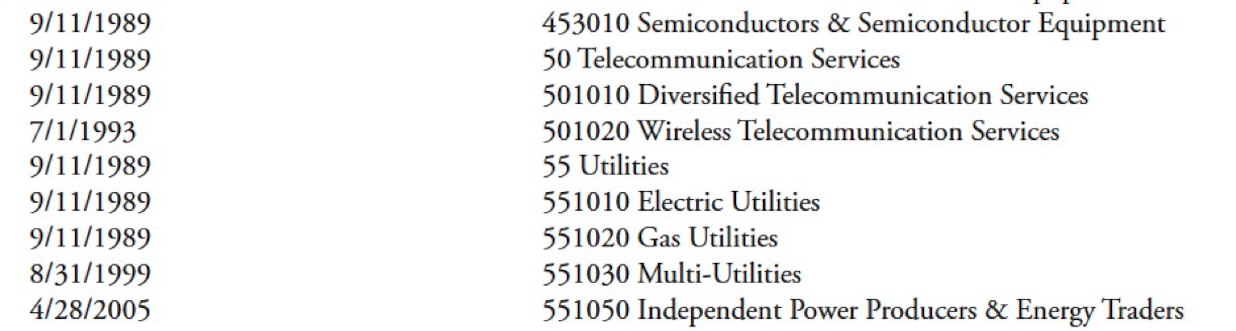

GICS Whole Abstract

Desk 10.22 reveals the robustness of the evaluation. It’s totally an excessive amount of knowledge to place right into a desk in a guide, however is displayed right here merely as proof (solely partial knowledge is proven). The uncooked knowledge will likely be eliminated for the rest of this evaluation, solely displaying the common rankings and relative rankings. This can be a desk that reveals the full pattern (up and down) for all of the uncooked knowledge used within the evaluation, with filtered waves from 5% to 11% and pattern lengths from 15 to 65 days. The desk is offered right here simply to provide you an concept as to how a lot evaluation went into this. A abstract desk follows that’s a lot simpler to view.

The GICS Abstract tables are proven under, however with out the huge quantity of uncooked knowledge — solely the identify of the classification, the common of all of the uncooked calculations, and the relative rank of every. Following these tables are tables utilizing the identical evaluation that was carried out beforehand on the 109 indices.

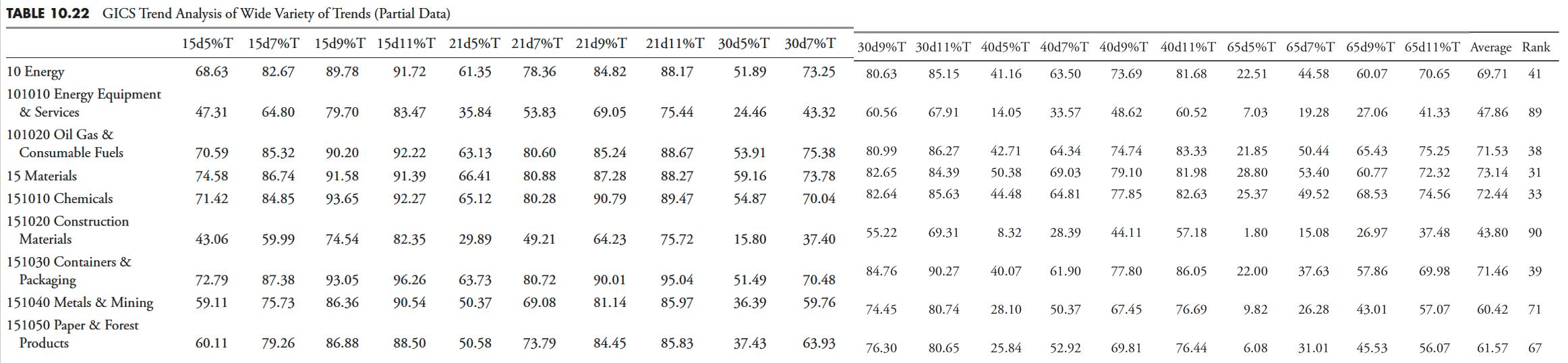

GICS Abstract

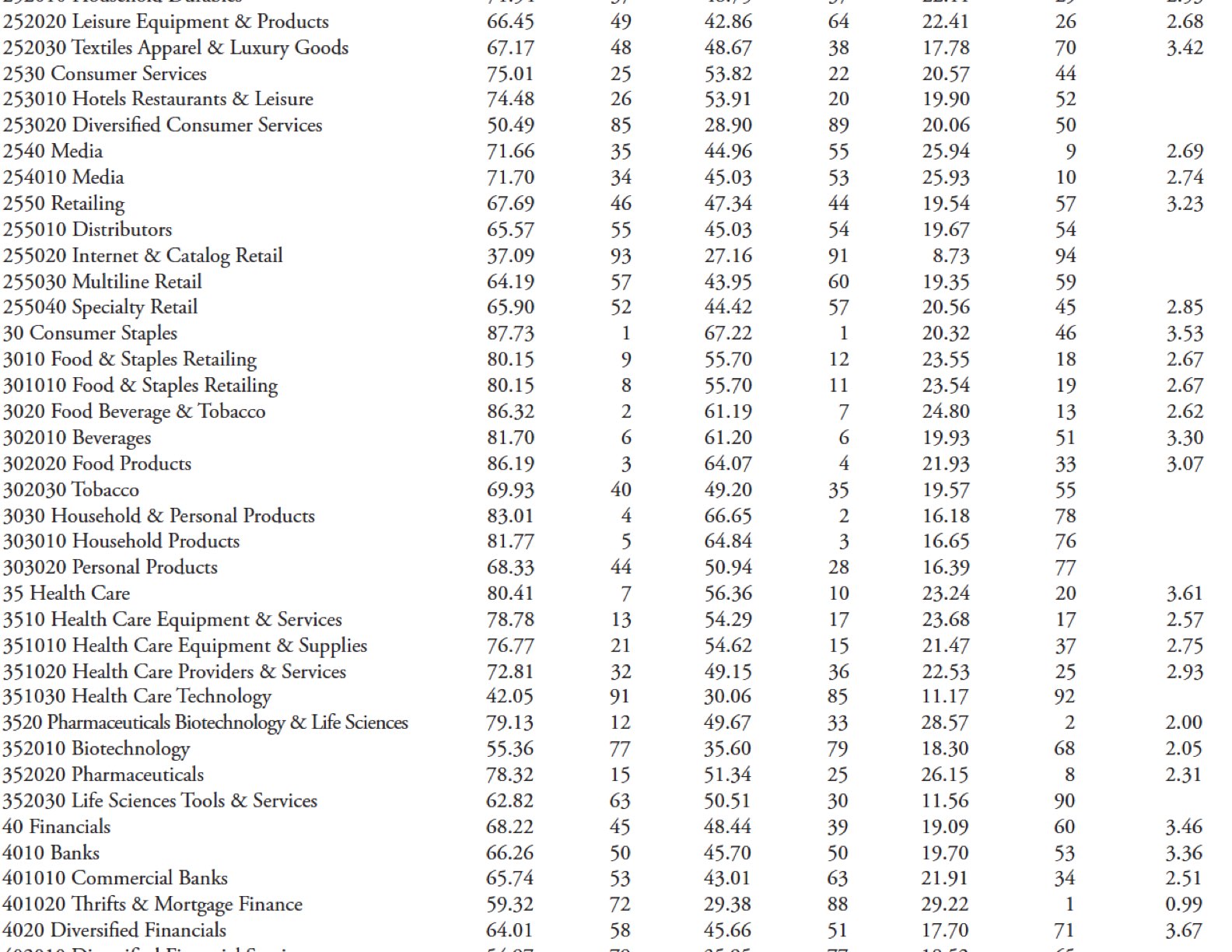

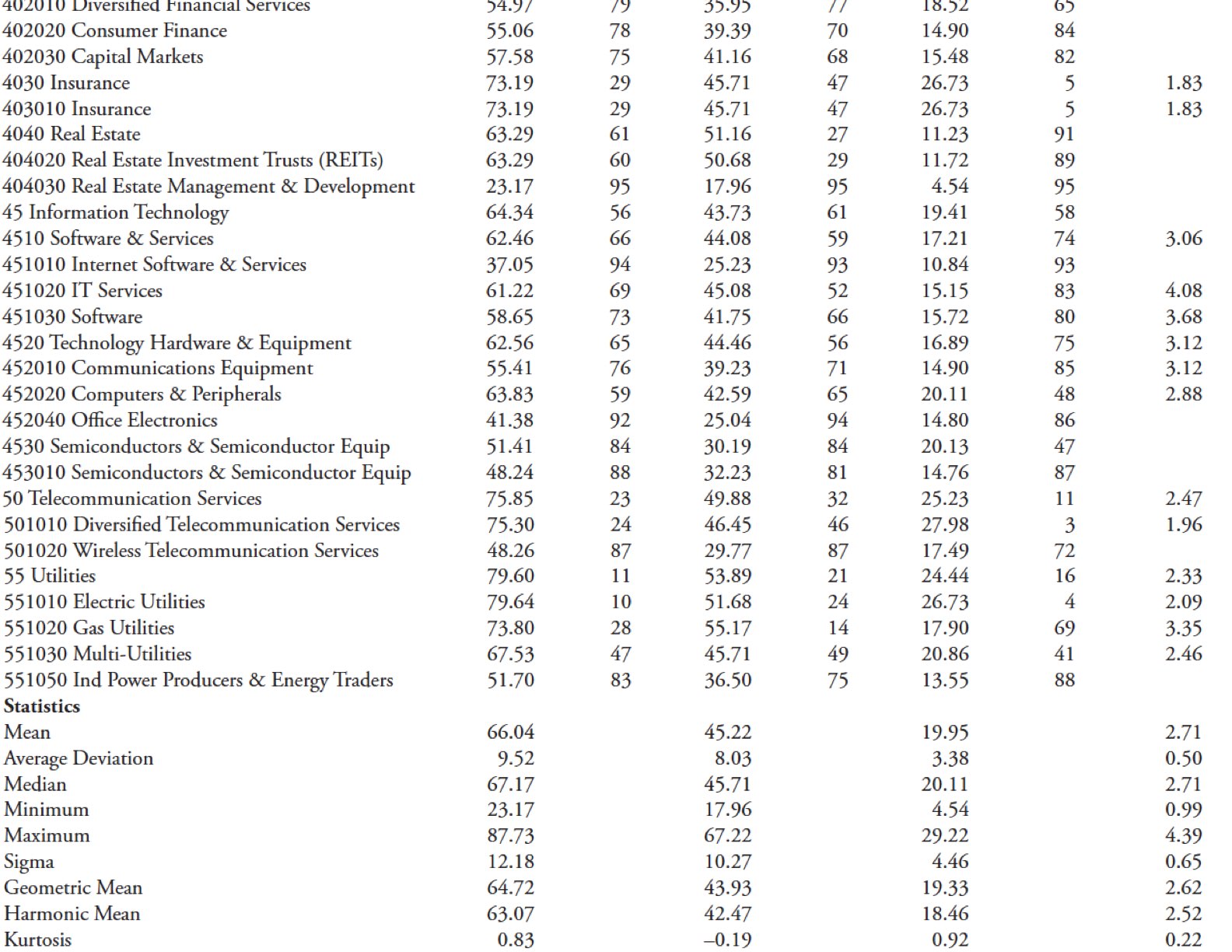

Desk 10.23 incorporates all the averages of the assorted filtered wave and pattern days evaluation categorized into Whole Trendiness, Uptrends, Downtrends, and the ratio of as much as downtrends. You’ll discover that there are lacking knowledge within the U/D Ratio column. That is due to a few various things.

- There have been a number of of the collection that simply didn’t have a protracted sufficient knowledge historical past.

- If you combine a small filtered wave with a protracted pattern expectation, you will see that some collection simply don’t have an Uptrend, a Downtrend, or each. Division doesn’t work nicely with a zero for numerator or denominator.

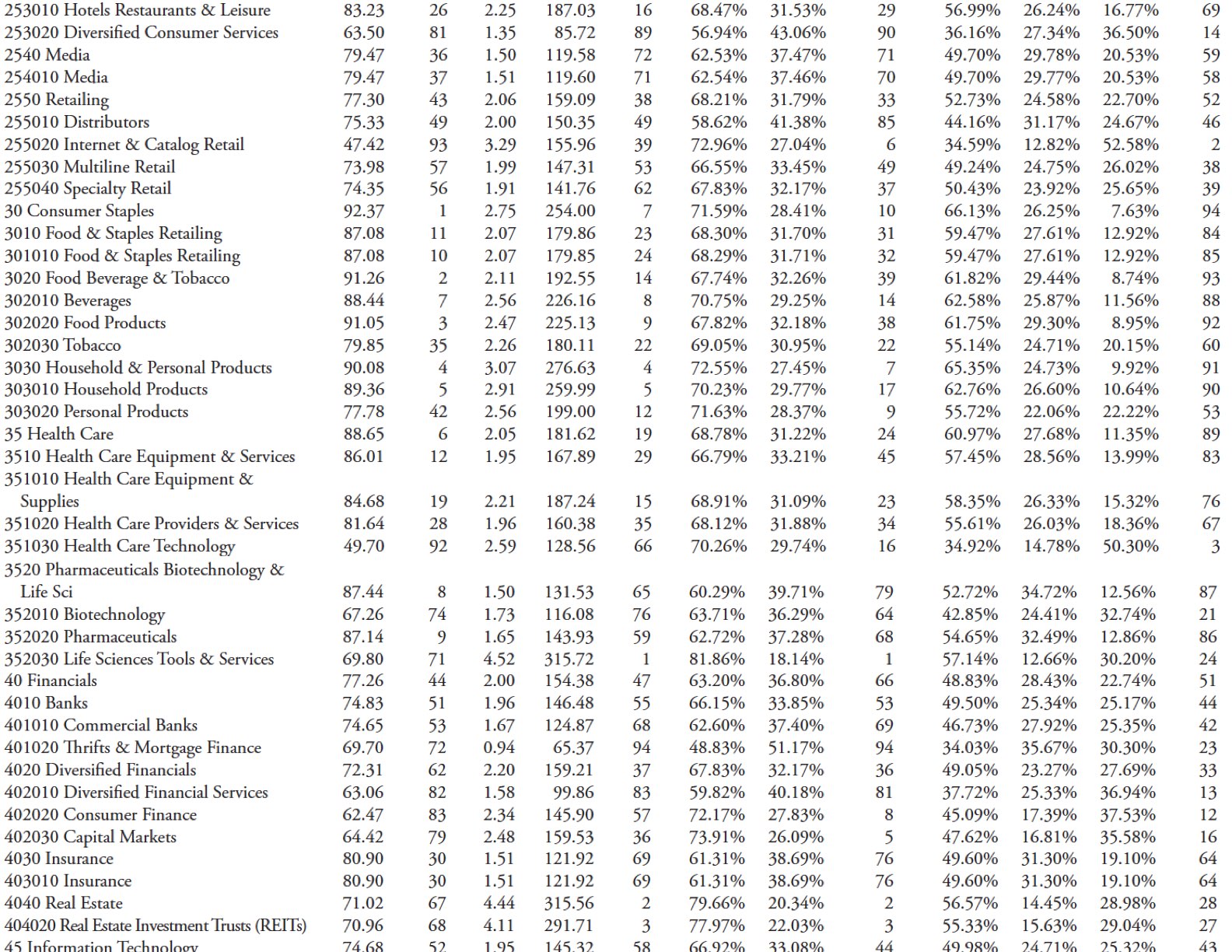

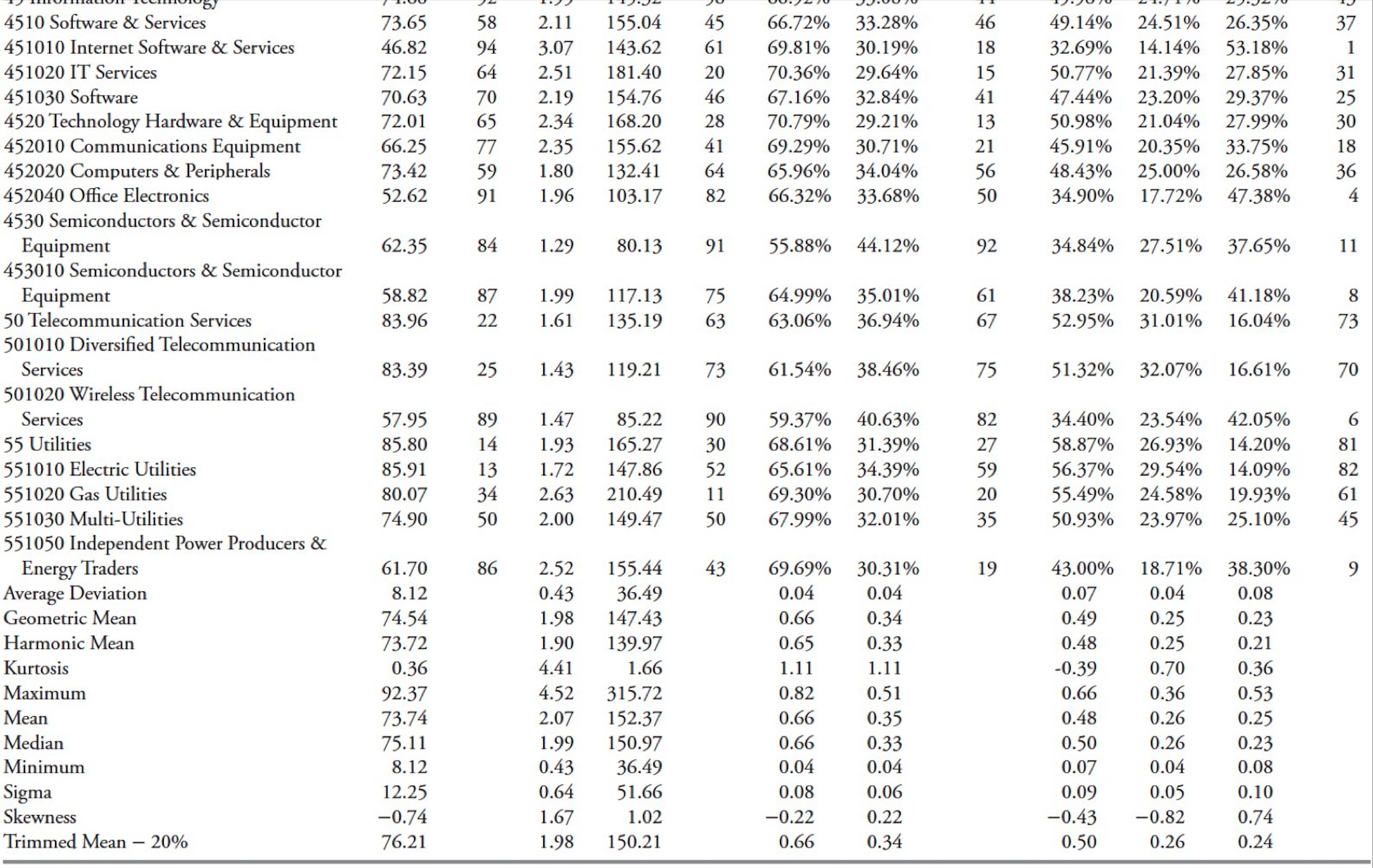

On first look on the above desk of all GICS points, it might be seen that all the ones which have numerical codes beginning with the quantity 3 are ranked excessive within the Whole Trendiness. Whereas I believe that is poor evaluation, let’s examine if there’s something there.

Oh my, sure there’s — all of them are a part of Client Staples or Healthcare. Each of those sectors are sometimes defensive in nature and often with much less volatility. When you confer with the desk originally of this part that has 109 market indices, it additionally incorporates 16 sectors or industries. Client Staples is ranked in that desk utilizing Trendiness One as quantity 3, whereas the Healthcare sector is ranked quantity 14. Keep in mind that these are relative ranks, however the outcomes affirm that Staples and Healthcare are good trending points.

Does this maintain up for different defensive points equivalent to Utilities and Telecom? The Utilities sector and the Electrical Utilities trade rank 14 and 13 in total trendiness; nevertheless, the opposite utility industries don’t rank excessive. Telecom sector ranks 23, with diversified telecom trade at 25 and wi-fi at 89. It also needs to be famous, when doing one of these evaluation, that the wi-fi knowledge begins 4 years later than the opposite, however I do not see that as a hindrance.

GICS Abstract Desk (With Insufficient Durations of Evaluation Eliminated)

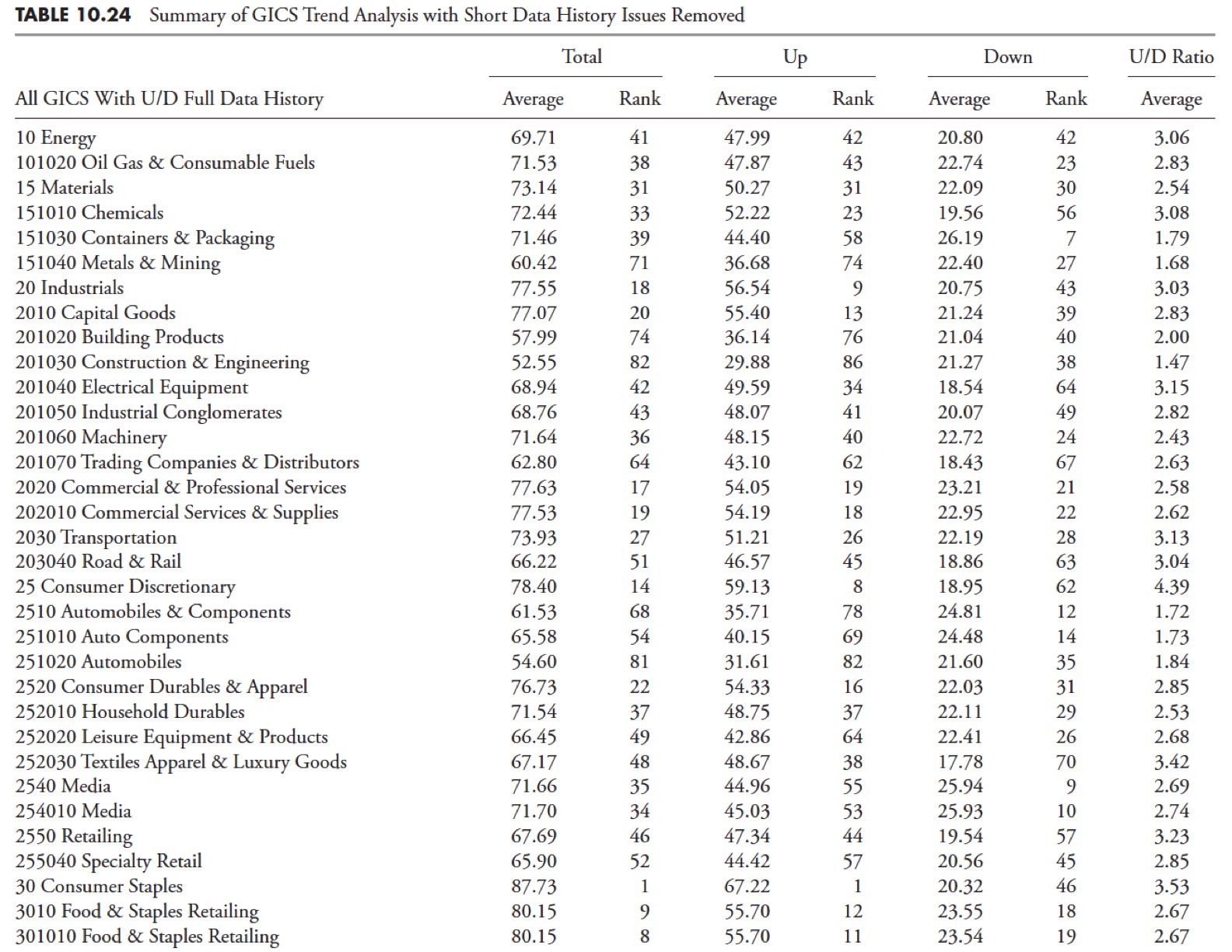

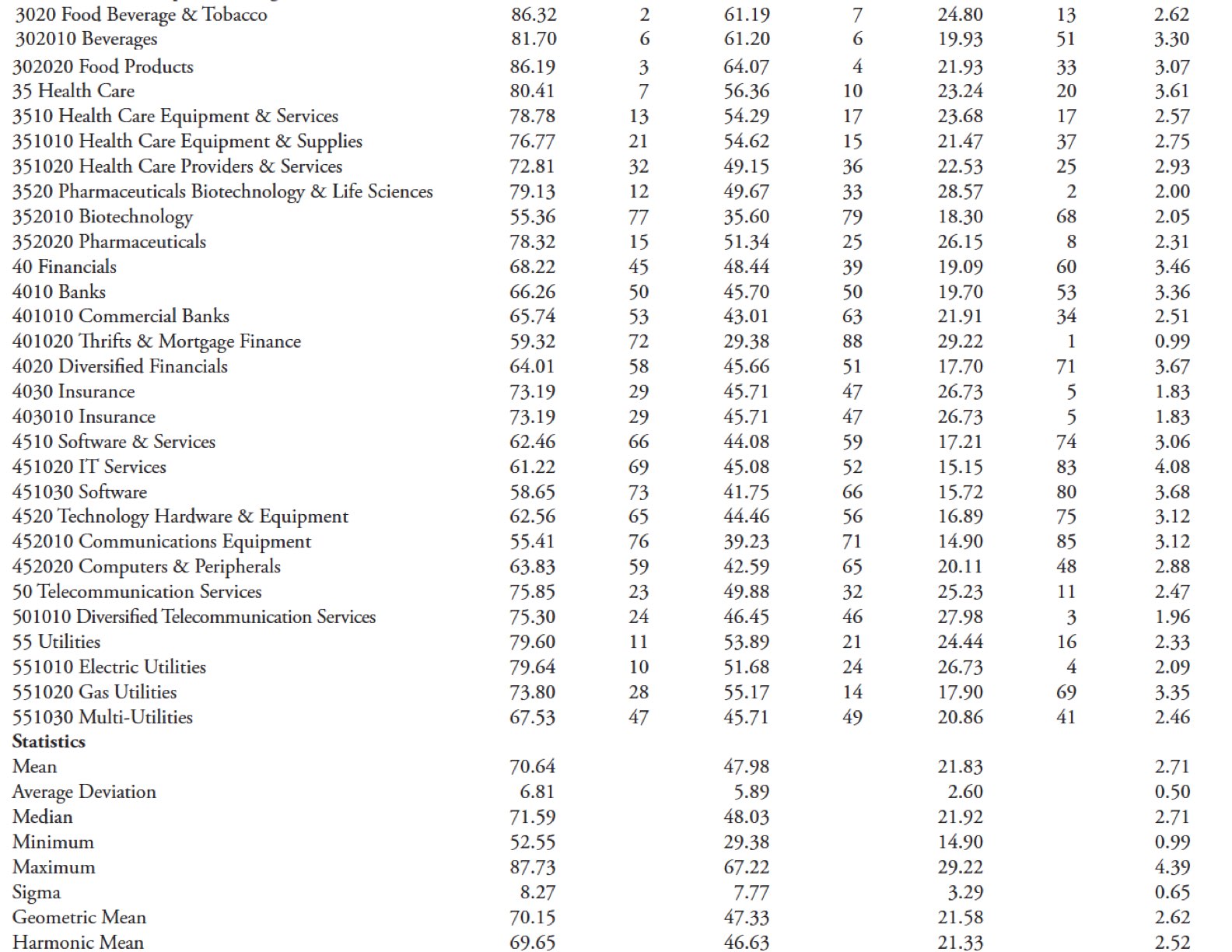

Let’s now take a look at which GICS points usually are not good at trending (Desk 10.24). The highest 5 are Web Software program and Companies, Web and Catalog Retail, Well being Care Know-how, Workplace Electronics, and Development Supplies. With this extensive dispersion of industries, let’s first verify the information. First word that of the 95 GICS points, solely 20 (21 p.c) have knowledge lower than the bulk, which all start in 1989. 4 of the poor trending points are on this class. Solely Development Supplies started in 1989. Since this evaluation is measuring relative trendiness, one would then must go to every particular person concern and chart it as was carried out within the earlier part.

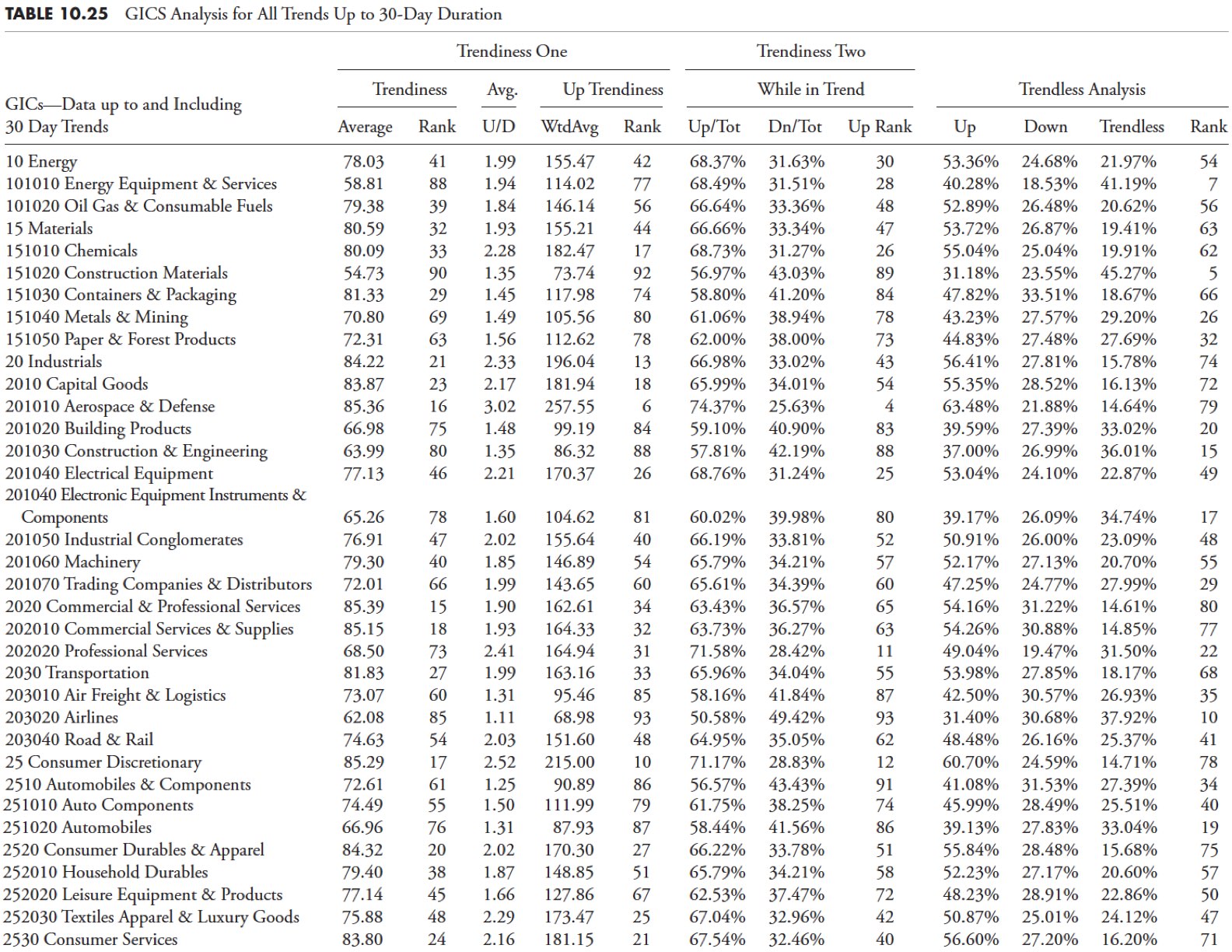

GICS Desk for All Traits As much as and Together with 30 Days

Desk 10.25 reveals the evaluation on the GICS knowledge in the identical method as the sooner evaluation on the 109 market indices. A overview of the main points in that part could be useful.

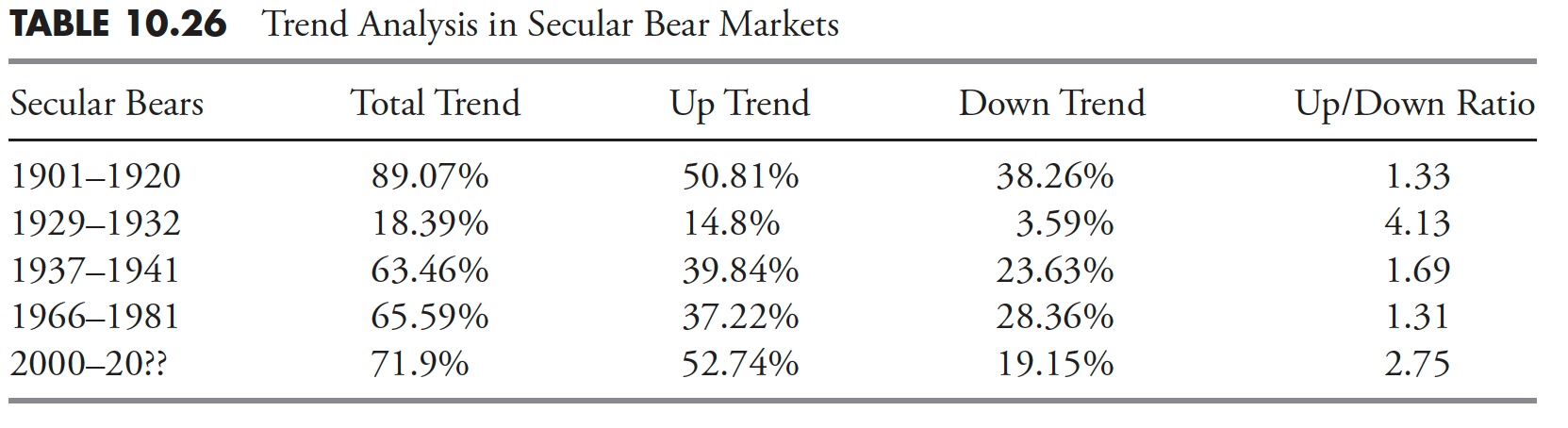

Development Evaluation in Secular Bear Markets

Desk 10.26 reveals the pattern evaluation for the durations when the Dow Industrials was in a secular bear market. Though these outcomes usually are not as sturdy because the analysis on this chapter, and makes use of the 21-day pattern with out a transfer of greater than 5% because the measure, it does present, by instance, the message. With out finding out the markets, one may assume that secular bear markets are primarily downtrending markets. Hopefully this desk dispels that notion and reveals that, throughout secular bear markets, a robust tendency to pattern nonetheless exists.

If there’s a single takeaway from all this evaluation on market developments, it’s this: markets pattern. Herding causes demand, which is the alternative of financial provide and demand. The inventory market is a requirement occasion. Some points pattern higher when in uptrends than in downtrends, whereas the reverse holds true for some. From the tables on this chapter and within the appendix, it’s best to have the ability to discern which indices, sectors, or industries are higher for trending.

[ad_2]

Supply hyperlink

Leave a Reply