[ad_1]

An growing variety of proposed purposes on high of Ethereum depend on some form of incentivized, multi-party knowledge provision – whether or not voting, random quantity assortment, or different use circumstances the place getting data from a number of events to extend decentralization is very fascinating, but in addition the place there’s a sturdy threat of collusion. A RANDAO can definitely present random numbers with a lot greater cryptoeconomic safety than easy block hashes – and definitely higher than deterministic algorithms with publicly knowable seeds, however it isn’t infinitely collusion-proof: if 100% of individuals in a RANDAO collude with one another, they will set the consequence to no matter they need. A way more controversial instance is the prediction market Augur, the place decentralized occasion reporting depends on a extremely superior model of a Schelling scheme, the place everybody votes on the consequence and everybody within the majority will get rewarded. The idea is that when you count on everybody else to be trustworthy, your incentive can also be to be trustworthy to be within the majority, and so honesty is a secure equilibrium; the issue is, nevertheless, that’s greater than 50% of the individuals collude, the system breaks.

The truth that Augur has an impartial token supplies a partial protection in opposition to this downside: if the voters collude, then the worth of Augur’s token could be anticipated to lower to near-zero because the system turns into perceived as ineffective and unreliable, and so the colluders lose a considerable amount of worth. Nevertheless, it’s definitely not a complete protection. Paul Sztorc’s Truthcoin (and likewise Augur) features a additional protection, which is sort of economically intelligent. The core mechanism is easy: moderately than merely awarding a static quantity to everybody within the majority, the quantity awarded is dependent upon the extent of disagreement among the many last votes, and the extra disagreement there may be the extra majority voters get, and minority voters get an equally great amount taken out of their safety deposit.

The intent is easy: when you get a message from somebody saying “hey, I’m beginning a collusion; though the precise reply is A, let’s all vote B”, in a less complicated scheme you might be inclined to go alongside. In Sztorc’s scheme, nevertheless, you might nicely come to the conclusion that this particular person is truly going to vote A, and is attempting to persuade just a few % of individuals to vote B, in order to steal a few of their cash. Therefore, it creates an absence of belief, making collusions more durable. Nevertheless, there’s a downside: exactly as a result of blockchains are such wonderful units for cryptographically safe agreements and coordination, it’s totally laborious to make it unimaginable to collude provably.

To see how, take into account the only doable scheme for the way reporting votes in Augur would possibly work: there’s a interval throughout which everybody can ship a transaction supplying their vote, and on the finish the algorithm calculates the consequence. Nevertheless, this method is fatally flawed: it creates an incentive for folks to attend so long as doable to see what all the opposite gamers’ solutions are earlier than answering themselves. Taking this to its pure equilibrium, we’d have everybody voting within the final doable block, resulting in the miner of the final block primarily controlling the whole lot. A scheme the place the top comes randomly (eg. the primary block that passes 100x the standard issue threshold) mitigates this considerably, however nonetheless leaves a large amount of energy within the palms of particular person miners.

The usual cryptographer’s response to this downside is the hash-commit-reveal scheme: each participant P[i] determines their response R[i], and there’s a interval throughout which everybody should submit h(R[i]) the place h could be any pre-specified hash perform (eg. SHA3). After that, everybody should submit R[i], and the values are checked in opposition to the beforehand supplied hashes. For 2-player rock paper scissors, or some other recreation which is solely zero-sum, this works nice. For Augur, nevertheless, it nonetheless leaves open the chance for credible collusion: customers can voluntarily reveal R[i] earlier than the very fact, and others can verify that this certainly matches the hash values that they supplied to the chain. Permitting customers to alter their hashes earlier than the hash submitting interval runs out does nothing; customers can at all times lock up a big amount of cash in a specifically crafted contract that solely releases it if nobody supplies a Merkle tree proof to the contract, culminating with a earlier blockhash, exhibiting that the vote was modified, thereby committing to not change their vote.

A New Resolution?

Nevertheless, there may be additionally one other path to fixing this downside, one which has not but been adequately explored. The concept is that this: as a substitute of constructing pre-revelation for collusion functions expensive throughout the main recreation itself, we introduce a parallel recreation (albeit a compulsory one, backed by the oracle individuals’ safety deposits) the place anybody who pre-reveals any details about their vote to anybody else opens themselves as much as the danger of being (probabilistically) betrayed, with none approach to show that it was that particular one that betrayed them.

The sport, in its most elementary type, works as follows. Suppose that there’s a decentralized random quantity technology scheme the place customers should all flip a coin and provide both 0 or 1 as inputs. Now, suppose that we need to disincentivize collusion. What we do is easy: we enable anybody to register a wager in opposition to any participant within the system (observe using “anybody” and “any participant”; non-players can be part of so long as they provide the safety deposit), primarily stating “I’m assured that this individual will vote X with greater than 1/2 likelihood”, the place X could be 0 or 1. The foundations of the wager are merely that if the goal provides X as their enter then N cash are transferred from them to the bettor, and if the goal provides the opposite worth then N cash are transferred from the bettor to the goal. Bets could be made in an intermediate section between dedication and revelation.

Probabilistically talking, any provision of knowledge to some other celebration is now probably extraordinarily expensive; even when you persuade another person that you’ll vote 1 with 51% likelihood, they will nonetheless take cash from you probabilistically, and they’ll win out in the long term as such a scheme will get repeated. Be aware that the opposite celebration can wager anonymously, and so can at all times fake that it was a passerby gambler making the bets, and never them. To boost the scheme additional, we will say that you just should wager in opposition to N completely different gamers on the similar time, and the gamers have to be pseudorandomly chosen from a seed; if you wish to goal a selected participant, you are able to do so by attempting completely different seeds till you get your required goal alongside a couple of others, however there’ll at all times be a minimum of some believable deniability. One other doable enhancement, although one which has its prices, is to require gamers to solely register their bets between dedication and revelation, solely revealing and executing the bets lengthy after many rounds of the sport have taken place (we assume that there’s a lengthy interval earlier than safety deposits could be taken out for this to work).

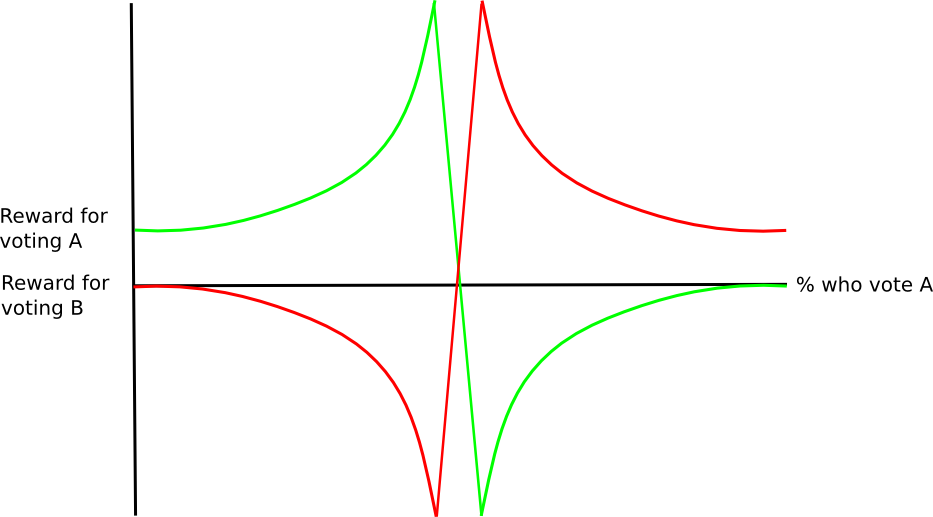

Now, how can we convert this into the oracle situation? Take into account as soon as once more the easy binary case: customers report both A or B, and a few portion P, unknown earlier than the top of the method, will report A and the remaining 1-P will report B. Right here, we alter the scheme considerably: the bets now say “I’m assured that this individual will vote X with greater than P likelihood”. Be aware that the language of the wager shouldn’t be taken to indicate data of P; moderately, it implies an opinion that, regardless of the likelihood a random consumer will vote X is, the one specific consumer that the bettor is focusing on will vote X with greater likelihood than that. The foundations of the wager, processed after the voting section, are that if the goal votes X then N * (1 – P) cash are transferred from the goal to the bettor, and in any other case N * P cash are transferred from the bettor to the goal.

Be aware that, within the regular case, revenue right here is much more assured than it’s within the binary RANDAO instance above: more often than not, if A is the reality, everybody votes for A, so the bets could be very low-risk revenue grabs even when complicated zero-knowledge-proof protocols have been used to solely give probabilistic assurance that they’ll vote for a specific worth.

Facet technical observe: if there are solely two potentialities, then why cannot you identify R[i] from h(R[i]) simply by attempting each choices? The reply is that customers are literally publishing h(R[i], n) and (R[i], n) for some giant random nonce n that may get discarded, so there may be an excessive amount of area to enumerate.

As one other level, observe that this scheme is in a way a superset of Paul Sztorc’s counter-coordination scheme described above: if somebody convinces another person to falsely vote B when the true reply is A, then they will wager in opposition to them with this data secretly. Significantly, benefiting from others’ ethical turpitude would now be now not a public good, however moderately a personal good: an attacker that methods another person right into a false collusion may acquire 100% of the revenue, so there could be much more suspicion to affix a collusion that is not cryptographically provable.

Now, how does this work within the linear case? Suppose that customers are voting on the BTC/USD value, so they should provide not a selection between A and B, however moderately a scalar worth. The lazy resolution is solely to use the binary method in parallel to each binary digit of the worth; another resolution, nevertheless, is vary betting. Customers could make bets of the shape “I’m assured that this individual will vote between X and Y with greater likelihood than the common individual”; on this means, revealing even roughly what worth you’re going to be voting to anybody else is more likely to be expensive.

Issues

What are the weaknesses of the scheme? Maybe the most important one is that it opens up a chance to “second-order grief” different gamers: though one can not, in expectation, pressure different gamers to lose cash to this scheme, one can definitely expose them to threat by betting in opposition to them. Therefore, it might open up alternatives for blackmail: “do what I would like or I am going to pressure you to gamble with me”. That stated, this assault does come at the price of the attacker themselves being subjected to threat.

The only approach to mitigate that is to restrict the quantity that may be gambled, and maybe even restrict it in proportion to how a lot is wager. That’s, if P = 0.1, enable bets as much as $1 saying “I’m assured that this individual will vote X with greater than 0.11 likelihood”, bets as much as $2 saying “I’m assured that this individual will vote X with greater than 0.12 likelihood”, and many others (mathematically superior customers might observe that units like logarithmic market scoring guidelines are good methods of effectively implementing this performance); on this case, the amount of cash you may extract from somebody can be quadratically proportional to the extent of personal data that you’ve got, and performing giant quantities of griefing is in the long term assured to value the attacker cash, and never simply threat.

The second is that if customers are identified to be utilizing a number of specific sources of knowledge, significantly on extra subjective questions like “vote on the worth of token A / token B” and never simply binary occasions, then these customers can be exploitable; for instance, if you realize that some customers have a historical past of listening to Bitstamp and a few to Bitfinex to get their vote data, then as quickly as you get the most recent feeds from each exchanges you may probabilistically extract some amount of cash from a participant based mostly in your estimation of which trade they’re listening to. Therefore, it stays a analysis downside to see precisely how customers would reply in that case.

Be aware that such occasions are an advanced challenge in any case; failure modes corresponding to everybody centralizing on one specific trade are very more likely to come up even in easy Sztorcian schemes with out this sort of probabilistic griefing. Maybe a multi-layered scheme with a second-layer “appeals court docket” of voting on the high that’s invoked so hardly ever that the centralization results by no means find yourself going down might mitigate the issue, nevertheless it stays a extremely empirical query.

[ad_2]

Supply hyperlink

Leave a Reply