[ad_1]

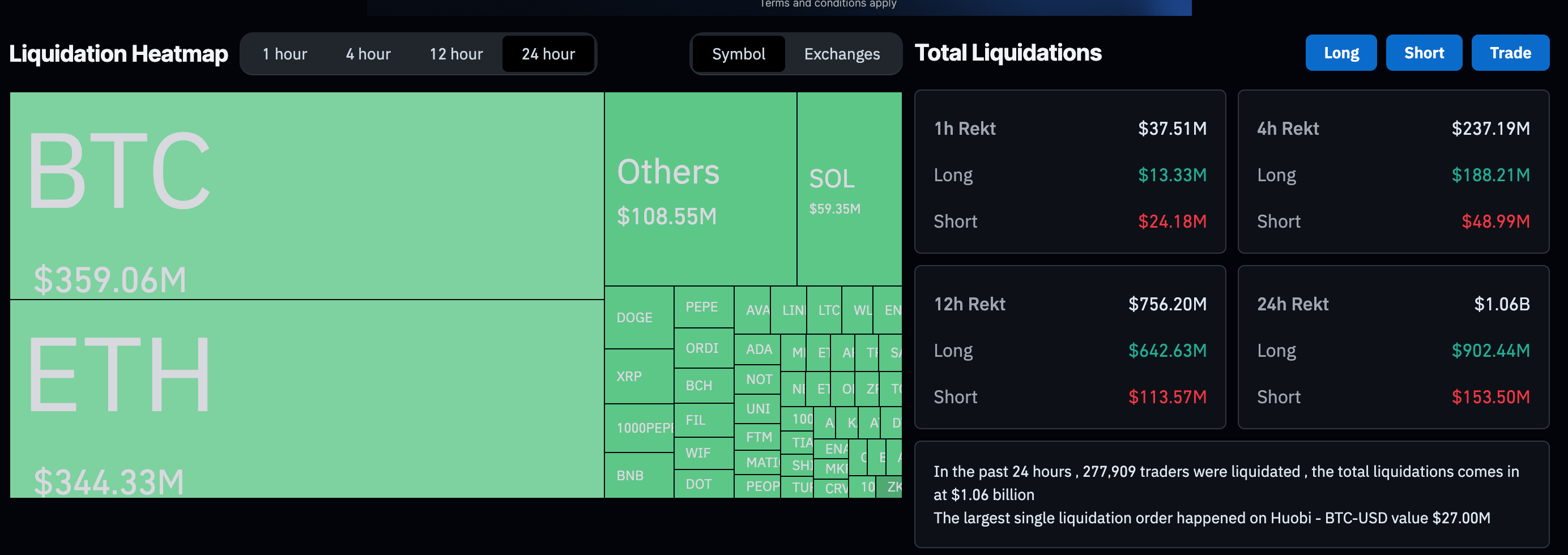

Bitcoin skilled a pointy decline from $61,000 to $49,000 inside 24 hours earlier than rebounding to roughly $52,000 as of press time. The value drop triggered important market liquidations, with whole losses reaching $1.06 billion, in accordance to Coinglass. Lengthy positions have been closely affected, accounting for $902.16 million, whereas brief positions noticed $153.18 million in liquidations.

Breaking down the liquidations by asset, Bitcoin positions suffered $359.06 million in liquidations, whereas Ethereum positions recorded $344.33 million. Ethereum declined over 20% throughout the identical interval. This knowledge displays a major market correction, impacting leveraged merchants. The rebound to $52,000 suggests a possible stabilization, however the latest volatility underlines the market’s inherent dangers as international instability will increase and the Japanese yen continues to battle.

The Japanese yen has surged to a seven-month excessive, buying and selling at round 145.25 per greenback, pushed by weak US jobs knowledge that heightened fears of an financial slowdown and expectations of deeper fee cuts by the Federal Reserve. This yen appreciation has considerably disrupted the yen carry commerce, the place traders borrow in low-yielding yen to spend money on higher-yielding belongings. The unwinding of those trades has led to a worldwide sell-off, with Japan’s Nikkei 225 index plunging practically 7% and different Asian markets following go well with. The turmoil has prolonged to rising market currencies, with the Mexican peso falling as a lot as 2% towards the greenback.

[ad_2]

Supply hyperlink

Leave a Reply