[ad_1]

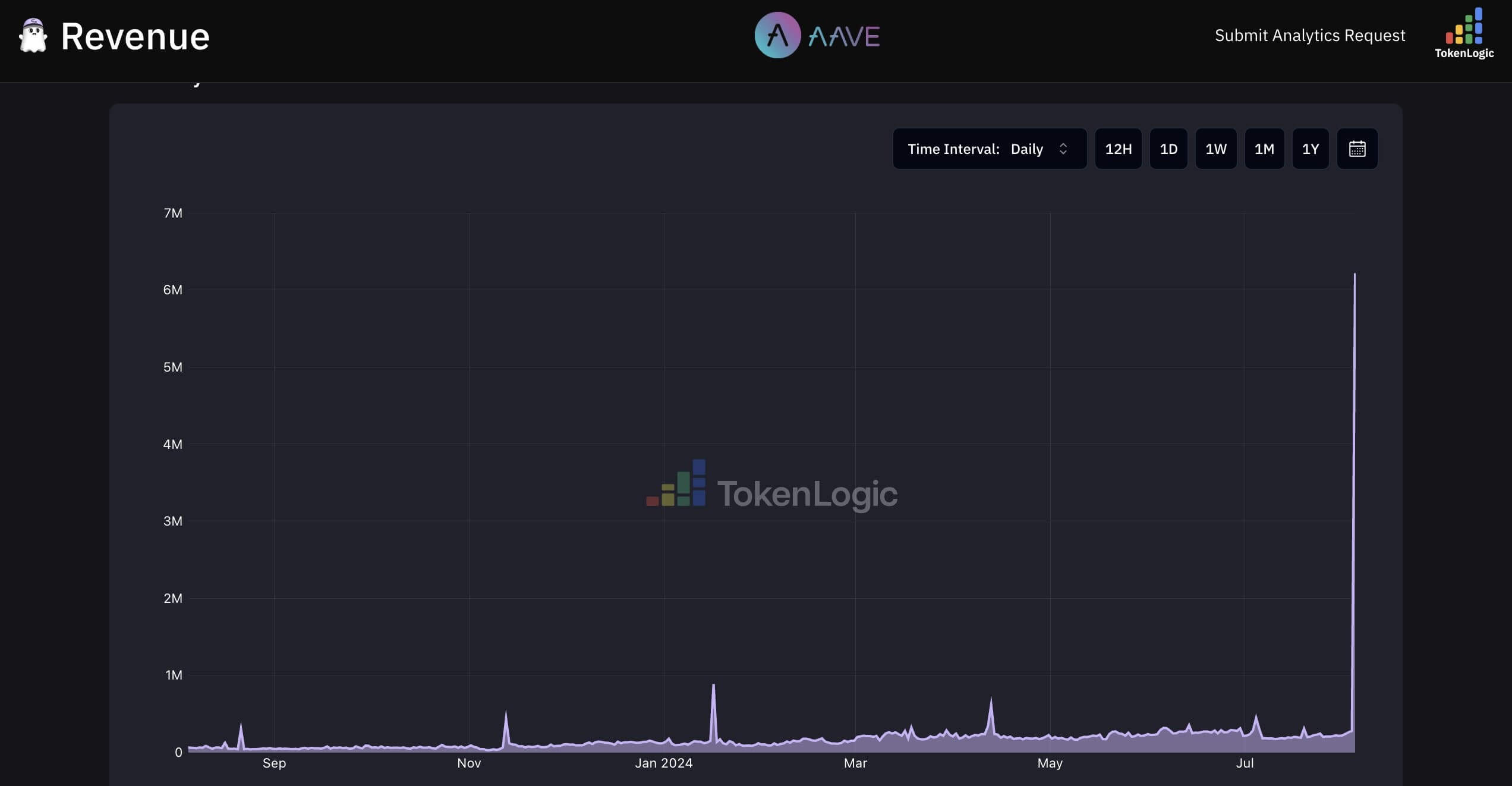

Main DeFi platform Aave Protocol generated over $6 million in income throughout the present market downturn.

On-chain information reveals that Aave earned $802,000 from a $7.4 million wrapped Ether (WETH) liquidation, reflecting a surge in liquidation exercise on the platform. Total, Aave V3 noticed $233 million in liquidations, the protocol’s highest single-day determine, based on Blockanalitica.

On account of these vital actions, Aave Founder Stani Kulechov revealed that the protocol earned $6 million in only one night time from facilitating liquidations. He mentioned:

“Aave Protocol withstood market stress throughout 14 lively markets on varied L1s and L2s, securing $21 billion price of worth. Aave Treasury was rewarded with $6 million in income in a single day from decentralized liquidations for conserving the markets protected.”

Kulechov emphasised that the protocol’s income from these liquidations displays its resilience and demonstrates why constructing in DeFi is essential.

Marc Zeller, the founding father of Aave Chain, corroborated Kulechov’s assertion and identified that the platform was thriving amid the broader market turmoil. He wrote:

“Aave protocol stays strong no unhealthy debt, income ATH & Payment change TEMP CHECK vote permitted.”

In accordance with DeFillama information, Aave is the largest crypto-lending platform within the business, based on the Ethereum community. As of press time, the full worth of property locked on the platform stood at round $9.8 billion.

DeFi stands robust

Aave’s strong efficiency over the previous day, regardless of current market volatility, displays a broader pattern throughout the DeFi sector.

DeFi researcher Ignas identified that essential DeFi protocols functioned easily throughout the jittery market with out many complaints.

In accordance with him, there have been no vital will increase in Lido’s stETH withdrawal queue, and liquid staking asset property experiencing minimal depegging—with weETH falling by 1%, ezETH by 0.6%, and stETH by 0.4% from ETH.

He furthered that though ETH fuel charges spiked to 370 gwei, they’ve since stabilized round 20 gwei. Moreover, there are not any vital liquidation dangers for DeFi until ETH falls to $1,771 or WBTC to $31,000.

Talked about on this article

[ad_2]

Supply hyperlink

Leave a Reply