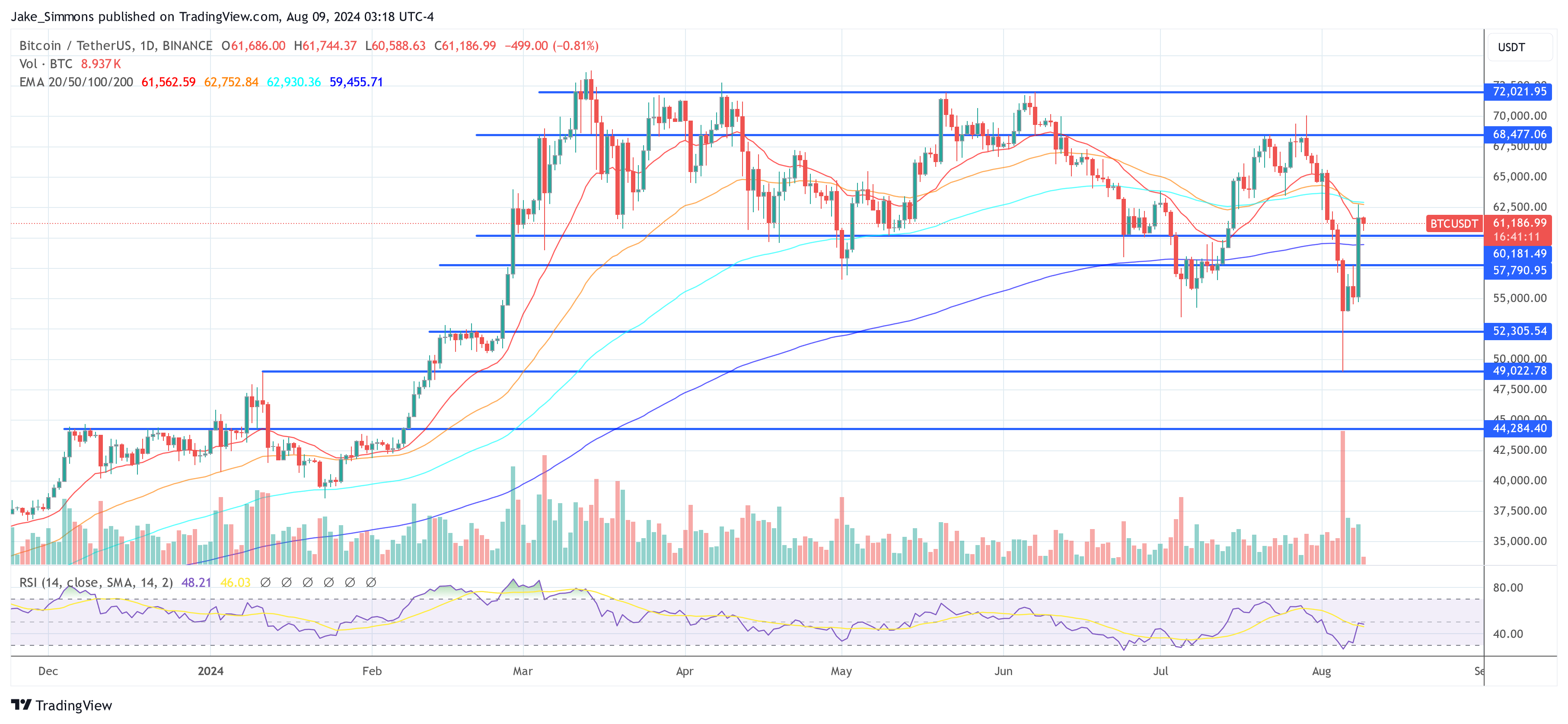

The Bitcoin worth data a serious rally in current days. After plummeting to a low of $49,000 on Monday, the BTC worth soared as excessive as $62,700 through the Asian buying and selling session as we speak. Thus, BTC has surged 24% from its Monday low. Over the past 24 hours alone, BTC has risen by 7%. These are the important thing causes:

#1 Fading US Recession Fears Gasoline Bitcoin Rally

Macro economics are the clear driver of the worth transfer as equities have rallied together with Bitcoin. Notably, the July unemployment fee in the US elevated to 4.3%, the best within the final 4 months. This triggered considerations a couple of potential recession, as per the Sahm Rule. This financial indicator suggests {that a} recession is likely to be beginning if the three-month shifting common of the nationwide unemployment fee rises by 0.50 proportion factors or extra relative to its lowest level within the earlier 12 months.

Associated Studying

The preliminary panic was exacerbated by a jobs report that fell in need of expectations, with solely 114,000 new jobs in comparison with the anticipated 175,000. Nevertheless, the narrative shifted dramatically yesterday with the newest launch of jobless claims knowledge. A major drop to 233,000, down by 17,000, marked the most important decline in virtually a yr, soothing jittery markets.

Mohamed A. El-Erian, President of Queens Faculty Cambridge and chief financial adviser at Allianz, defined through X that the worldwide monetary markets reacted to the information launch and interpreted it as “a reduction after final week’s unemployment and progress scare.” Nevertheless, he additionally warned that “that this high-frequency knowledge collection is inherently noisy.”

US weekly jobless claims got here in at 233,000, down from a revised 250,000 — a reduction after final week’s unemployment and progress scare.

The main points of this knowledge launch will probably be topic to a better stage of scrutiny with a view to assessing breadth and different distributional features.… https://t.co/fBqaJVs3sM— Mohamed A. El-Erian (@elerianm) August 8, 2024

Macro analyst Alex Krüger additional elaborated that “the market crash triggered by final week’s unemployment & payrolls knowledge has now totally reversed, after as we speak’s weekly jobless claims knowledge. Worth motion and new jobs knowledge affirm what I suspected: that the entire equities market had a crypto type levered flush-out, pushed largely by positioning, narrative and mass hysteria, and never as a lot by fundamentals.”

Associated Studying

Krüger additionally cautioned towards overemphasis on single knowledge factors: “There’s a cause the Fed makes emphasis on making no choices on single knowledge factors. Payrolls knowledge will be very noisy. But final Friday a lot of the market went on a loopy rampage calling for a coverage mistake and emergency fee cuts.”

#2 Quick Liquidations Amplify BTC Surge

The volatility in Bitcoin’s worth additionally catalyzed a major variety of brief liquidations. Previously 24 hours alone, 52,413 merchants have been liquidated, with complete crypto liquidations reaching $222.02 million, based on Coinglass knowledge. For Bitcoin particularly, over $90 million briefly positions have been liquidated, marking it because the third-highest short-liquidation occasion previously 5 months.

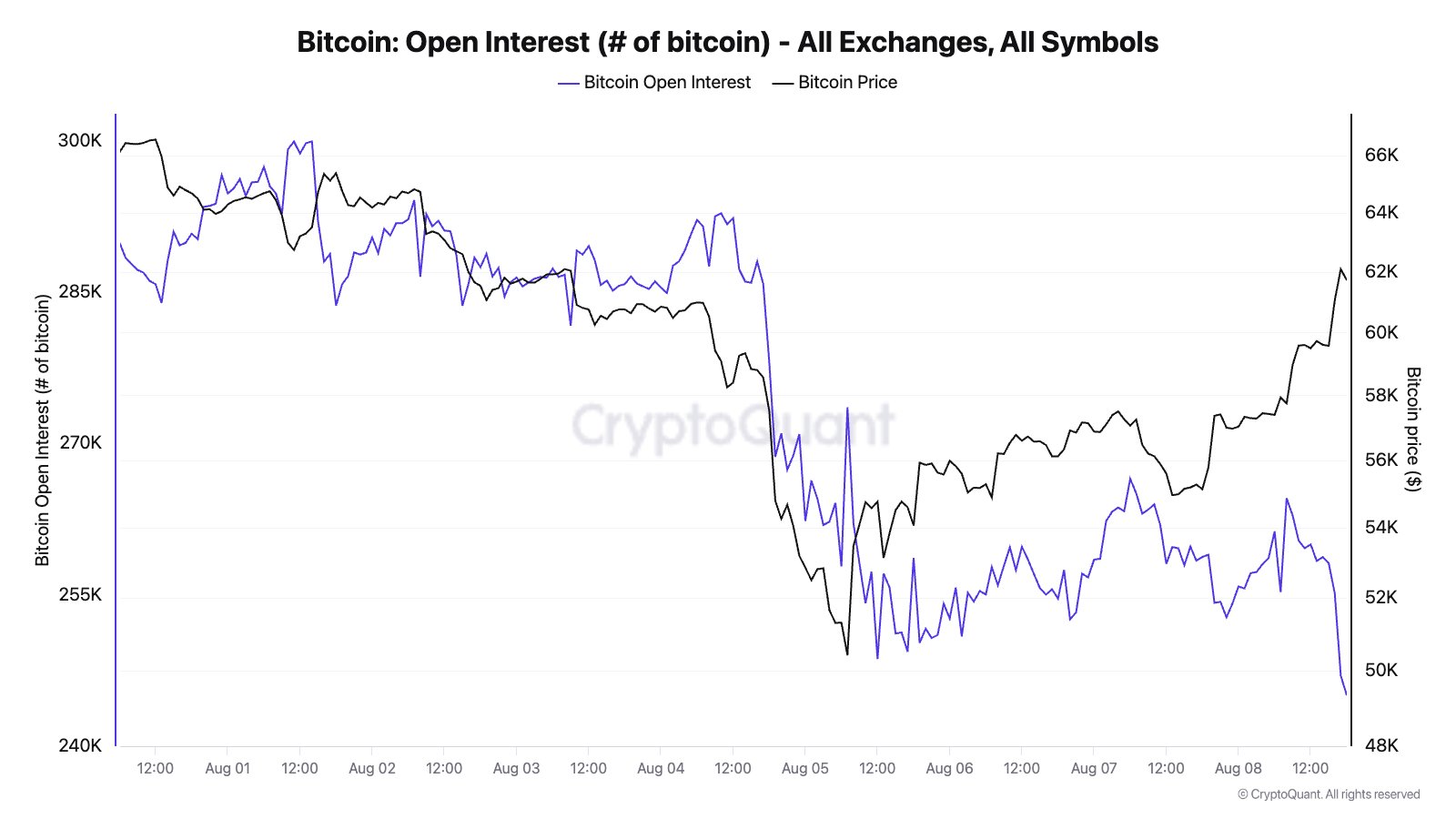

Julio Moreno, Head of Analysis at CryptoQuant, clarified the impression of those liquidations available on the market: “This Bitcoin bounce has been largely shorts masking positions within the futures market. Open curiosity down, costs up.”

#3 MicroStrategy Shopping for?

Because the Bitcoin worth climbed increased, there was a notable surge in demand from the spot market. Crypto analyst Kiarash Hossainpour speculated, “You heard it right here first: I may think about this loopy late night time market purchase coming from none apart from Saylor. The man simply introduced one other $2 billion purchase the opposite day. Who else buys within the illiquid hours after the US shut on a Thursday night time? Precisely, no one.”

MicroStrategy, beneath the management of Michael Saylor, introduced final week plans to extend its Bitcoin holdings considerably, getting ready to boost $2 billion by means of a brand new at-the-market fairness providing as reported in its Q2 2024 earnings report. The corporate said: “We proceed to carefully handle our fairness capital, and are submitting a registration assertion for a brand new $2 billion at-the-market fairness providing program.”

At press time, BTC traded at $61,186.

Featured picture created with DALL.E, chart from TradingView.com

Leave a Reply