[ad_1]

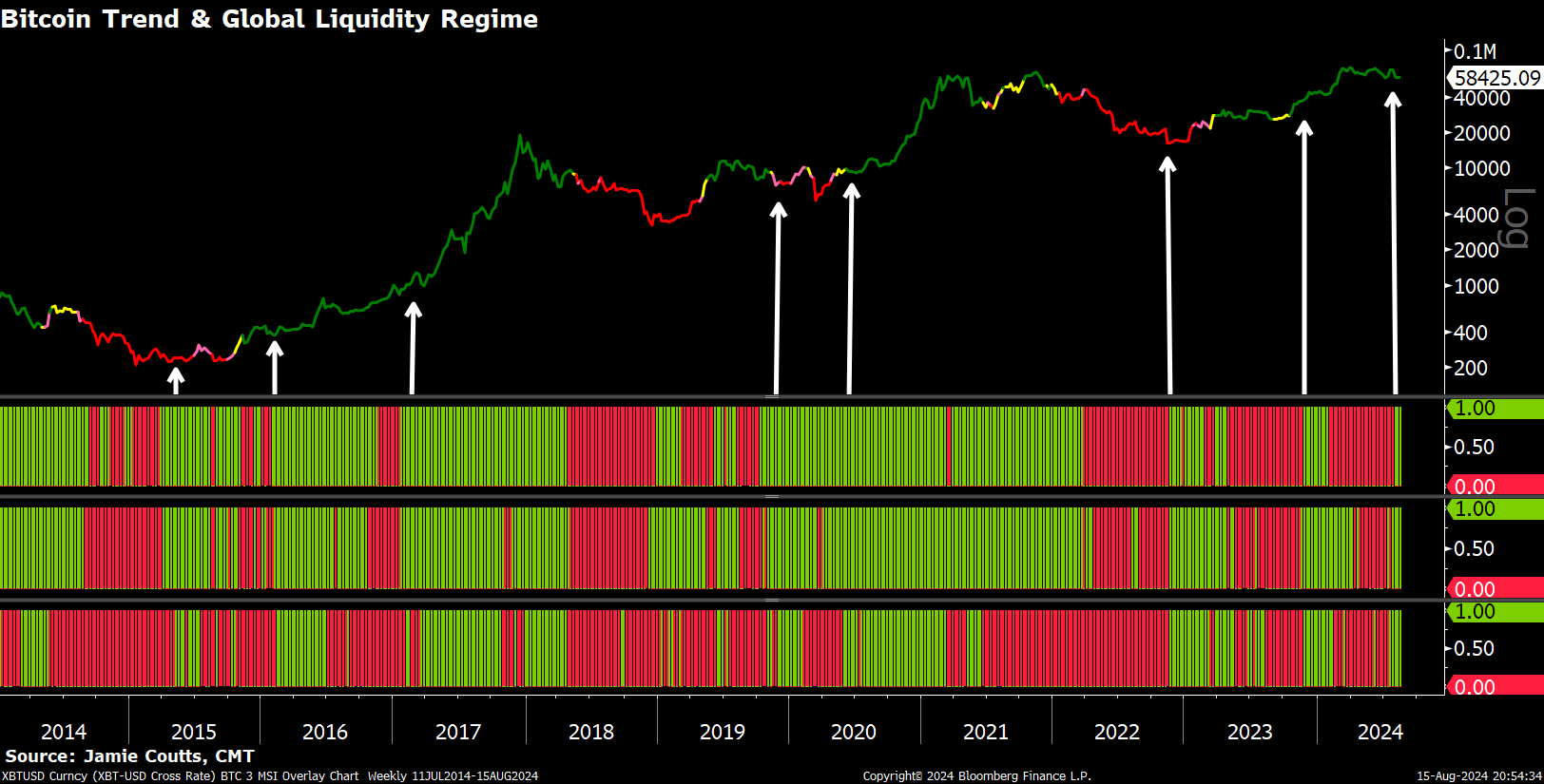

Actual Imaginative and prescient analyst Jamie Coutts believes that Bitcoin (BTC) might attain a six-figure worth throughout the present cycle.

Coutts says that in comparison with earlier bull cycles witnessed in 2017 and 2020, Bitcoin is more likely to document diminishing returns this time spherical.

In accordance with Coutts, Bitcoin rallied by 19X in 2017 and 6X in 2020 however is just more likely to go up by between 2X to 3X this cycle.

On how Bitcoin can go up by as much as 200% this cycle, the Actual Imaginative and prescient analyst says,

“For BTC to fulfill this goal, the US Greenback Index (DXY) would should be properly under 101, prompted by ongoing central financial institution injections.”

The DXY is a measure of the US greenback’s energy in opposition to a basket of different giant world currencies. When the DXY is falling, it signifies that the US greenback is weakening in opposition to different main currencies and vice versa. The DXY is at the moment at 102.65.

Coutts additionally says that his world liquidity mannequin which predicted a 75% rally for Bitcoin in November of 2023 is flashing bullish once more.

“The central banks are capitulating, the liquidity spigots are opening, and Bitcoin is about to go a lot larger.”

In accordance with the Actual Imaginative and prescient analyst, the Financial institution of Japan (BoJ) and the Folks’s Financial institution of China (PBoC) have contributed 41% of the worldwide liquidity added during the last month.

“Over the previous month; the BoJ and the PBoC have added $400 billion and $97 billion, respectively; the broad world cash base (credit score) has expanded by $1.2 trillion, which has been considerably aided by a pointy decline of the US greenback. This means that it’s coordinated with the Federal Reserve’s consent.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: FLUX

[ad_2]

Supply hyperlink

Leave a Reply