The Ethereum Basis was on the focal point lately regarding a liquidation plan it has set in place to promote elements of its Ether stability.

In response to the on-chain tracker Lookonchain, a pockets linked to the inspiration moved 2,500 ETH, valued round $6 million, to the trade Bitstamp on October 8, 2024. That is a part of an rising pattern through which massive holders, colloquially often known as “whales,” are promoting their holdings within the face of this risky market setting.

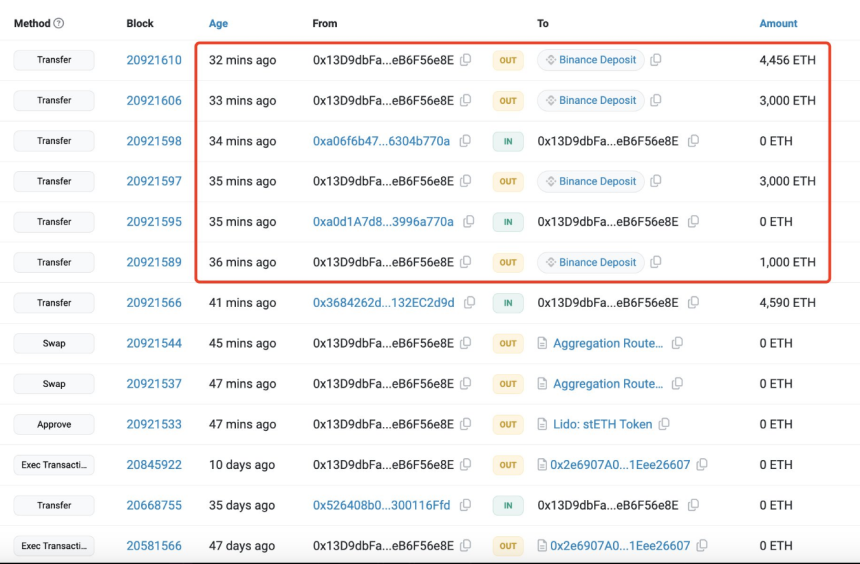

A whale deposited 11,456 $ETH($27.8M) to #Binance prior to now 40 minutes!https://t.co/0L5r2u9wF9 pic.twitter.com/gNZI3pKAEx

— Lookonchain (@lookonchain) October 8, 2024

Vital Transactions Uncovered

Lookonchain claims this isn’t the one transaction this basis has these days finished. ETH offered total in 2024 is as excessive as 3,766, which introduced $10.46 million. The group offered 950 ETH in September, equal to $2.27 million. They promote them usually, roughly each 11 days. The transaction averages about 151 ETH in dimension. The muse nonetheless retains a big sum: 271,274 ETH, or about $655 million.

Market Reactions And Jitters

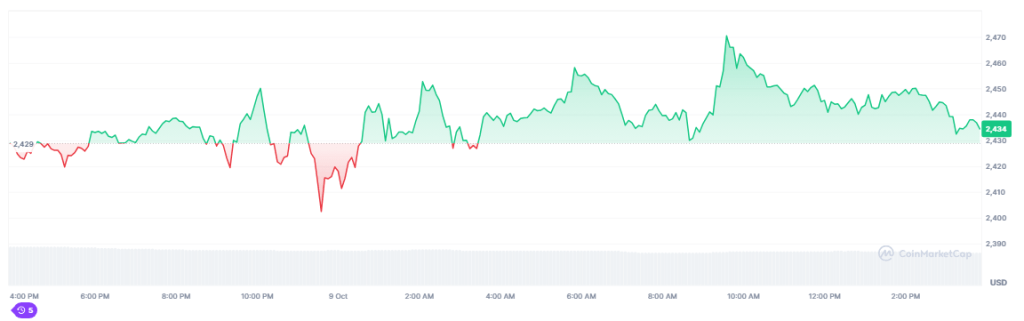

The crypto group has a cause to fret over the continual promoting of Ethereum. A lot of the traders have severely feared that this big liquidation would possibly result in downward stress on ETH costs. Over the last 14 days, the value of Ethereum went down by round 8%.

This has led some analysts to invest that these promoting occasions are contributing components behind the bearish market of ETH. Group commentators are divided between curiosity and concern relating to the historical past of the pockets by the inspiration, the way it impacts the market dynamics, Lookonchain has disclosed.

Future Monetary Planning

Such gross sales, in keeping with Aya Miyaguchi, an government director of the Ethereum Basis, are a part of a deliberate monetary technique – working to pay for operational prices and canopy the prices of ongoing tasks. Your entire annual finances is estimated to be round $100 million, with a few of these prices – comparable to salaries and grants – requiring fiat forex. Thus, turning a part of the ETH reserve into stablecoins like DAI has turn out to be routine.

With the Ethereum Basis nonetheless working by its monetary scenario in a risky market, solely time will inform how these continued gross sales will have an effect on each the value of ETH and the robustness of the Ethereum ecosystem. With fairly a little bit of sources nonetheless locked up by the inspiration, people are paying shut consideration to search for modifications or constructive/violent reactions out there.

Featured picture from ETF Stream, chart from TradingView

Leave a Reply