[ad_1]

🎉August was one other record-breaking month at Bondora Group. After traders made essentially the most out of the One Billion Celebration marketing campaign, investments sky-rocketed as soon as once more to set a brand-new document. On the person credit score market degree, the Netherlands and Latvia additionally exceeded their earlier mortgage origination information.

Uncover extra thrilling details about our August stats and numbers.

In August, 1,843 extra individuals created investor accounts with us. Do you’ve got pals who may additionally profit from easy on-line investing? Refer them utilizing your distinctive code out of your Dashboard so that you and your mates may every get an funding bonus.

Thanks to everybody who joined our one billion celebration. Throughout the complete marketing campaign, Bondora traders added €40.2 million to their Go & Develop accounts!

This leads us to the entire quantity you invested throughout August: a grand €28,478,639. This breaks the document that was set in July and is now the very best invested quantity monthly.

Our Bondora investor neighborhood earned a complete of €2,481,252 in returns in August. As we talked about in one other article just lately, it’s important to have fun your milestones as you proceed in your monetary journey to attaining your objectives.

“Are you able to inform me extra concerning the Go & Develop return fee?”

With Go & Develop, the annual return fee is as much as 6.75% p.a. for investments as much as the month-to-month restrict and as much as 4% p.a. for quantities exceeding the restrict. As of 9 September, you can now earn as much as 6.75%* p.a. in your complete Go & Develop portfolio PLUS any further quantity you make investments over the month-to-month restrict! (Learn extra about this information right here)

Whereas returns are usually not assured, traders have persistently acquired the complete attainable return on their funding for the reason that launch of Go & Develop in 2018.

The returns you earn are paid into your Go & Develop every day.

And, as a result of Go & Develop has a compound rate of interest, you obtain curiosity on the returns you’ve got already earned.

Right here’s a small instance:

Let’s say you make investments €700 each month for a 12 months and earn returns at a fee of as much as 6.75% p.a. Your funding will develop due to every day compounding curiosity, and by the tip of the 12 months, you’ll have added €8,400 in complete (€700 x 12 months).

With the 6.75% annual return, your complete steadiness shall be roughly €8,800—that means you’ve earned round €400 in returns. For quantities exceeding the month-to-month restrict, you’d obtain as much as 4% p.a.

And over time, the compounding impact will develop your returns much more considerably as your returns proceed to compound.

If you want to know extra or have any questions on Go & Develop, please be at liberty to write to our assist staff.

In August, €27,541,887 was originated in loans throughout all our energetic markets. After breaking our general document of mortgage originations in July, we’re celebrating two new information on the person market ranges in August.

€6,859,008 value of loans have been originated within the Netherlands. It is a 5.7% improve from July and a brand new document for the very best month-to-month mortgage originations determine within the Dutch market.

In Finland, mortgage prospects originated €15,524,047 value of loans, a 25.1% lower from July.

Within the Estonian market, there have been €4,853,948 in mortgage originations—a 15.4% lower from July.

As soon as once more, Bondora Group’s most just lately launched credit score market, Latvia, is exhibiting promising development, with originations rising by 36.5% to €304,884 in August. That is now Latvia’s highest-ever origination statistic.

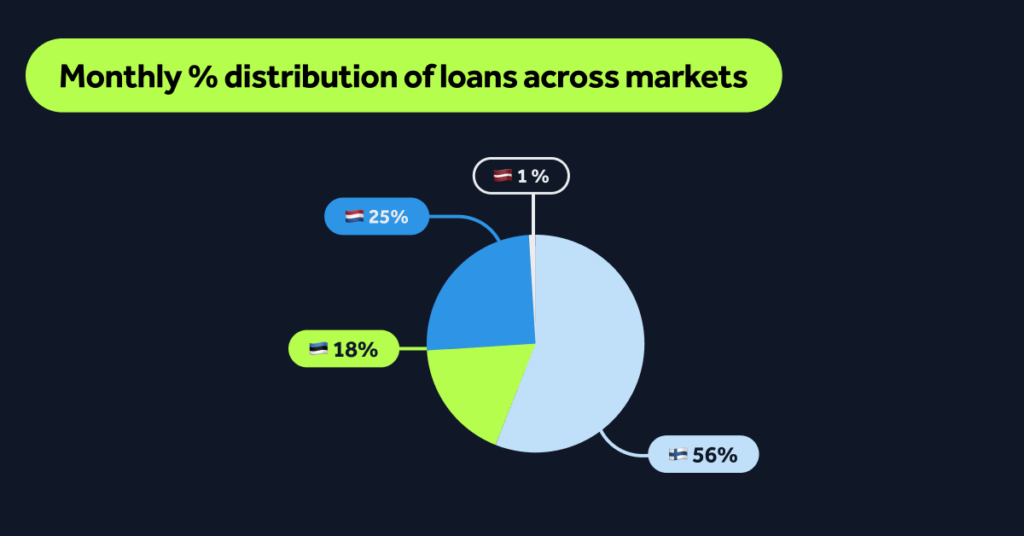

See from which markets essentially the most originations got here in August:

Finland continues to carry the title because the market with the most important share of mortgage originations, 55.9%.

For the second month in a row, the Netherlands holds its place because the second-largest credit score market, with 25.2% of all originations, whereas Estonia has a 17.8% share.

Latvia continues to be in fourth place with a 1.1% share of originations.

On the time of writing, our Instagram neighborhood consists of 14,716 followers. In case you aren’t already following us, that is your invite to be a part of us on Instagram! You’ll find common updates, enjoyable and academic content material, and unique behind-the-scenes moments.

[ad_2]

Supply hyperlink

Leave a Reply