[ad_1]

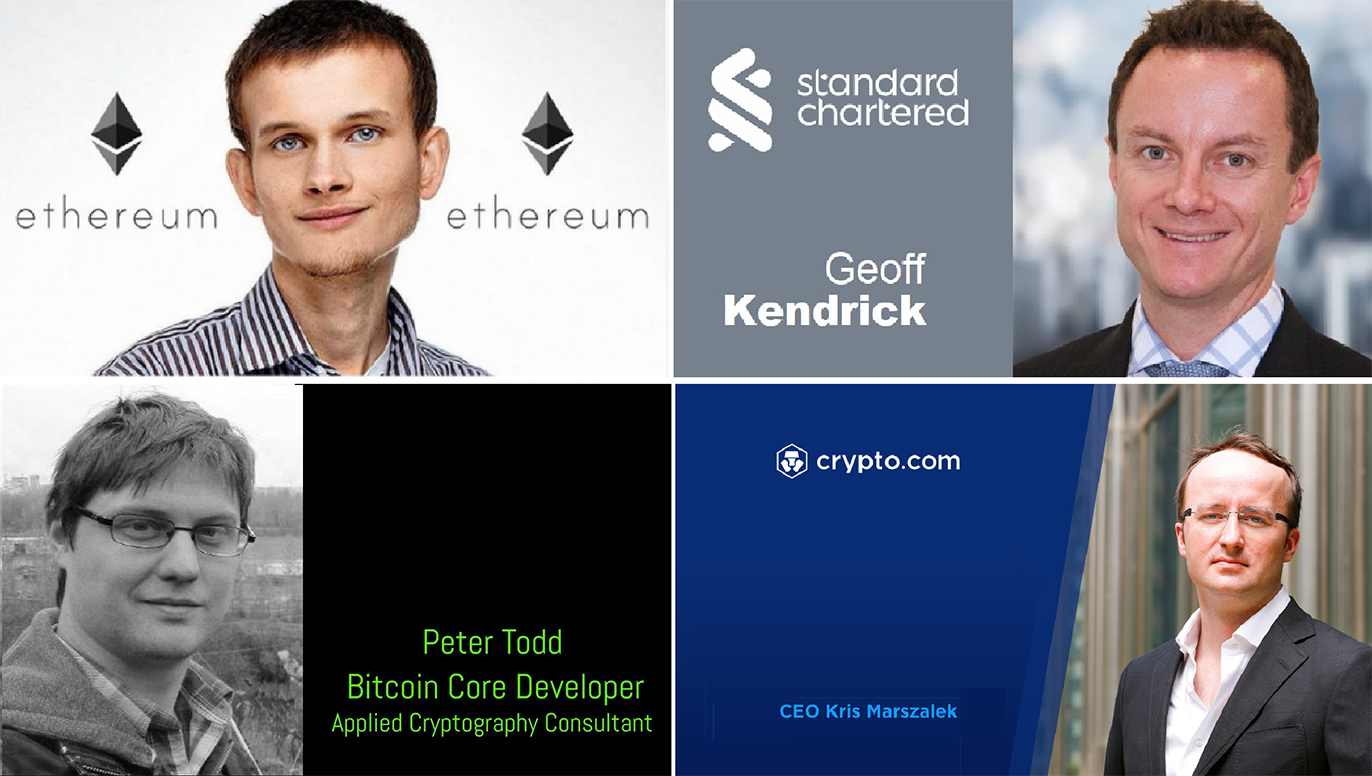

– Geoff Kendrick, Head of Crypto Analysis at Commonplace Chartered Financial institution, predicts that if Donald Trump is elected President of america, the value of bitcoin may triple by the tip of 2025, whereas Solana may see a fivefold improve. The professional believes {that a} Trump administration can be extra beneficial in direction of the Solana ecosystem in comparison with a Harris administration. Subsequently, if Kamala Harris turns into the occupant of the White Home, bitcoin is predicted to outpace Ethereum by way of development, whereas Ethereum, in flip, would surpass Solana and attain a stage of $7,000. Kendrick additionally means that bitcoin may attain $200,000 by the tip of 2025, whatever the end result of the November 5 elections.

– As promised, the American tv community HBO aired the documentary *Digital Cash: The Thriller of Bitcoin* on 9 October. The premiere garnered important curiosity from the crypto neighborhood, because the filmmakers claimed to disclose the id of bitcoin’s creator, recognized beneath the pseudonym Satoshi Nakamoto. In accordance with the filmmakers, it was a 39-year-old Canadian, Peter Todd, who was one of many early builders of Bitcoin Core however had by no means been among the many important suspects within the position of Satoshi.

The filmmakers offered quite a lot of arguments, together with using British/Canadian spelling and a correlation between the timing of Satoshi’s publications and Todd’s examine schedule. The important thing “proof” was a message allegedly posted by Todd on the Bitcoin discussion board in 2010, beneath Nakamoto’s identify. Nonetheless, the arguments offered within the documentary did not persuade most viewers, with CryptoQuant CEO Ki Younger Ju even describing the movie as “appalling” and expressing shock on the extent of the filmmakers’ mistaken conclusions.

– Over the previous 12 months, the variety of Brazilian residents proudly owning digital property has elevated by greater than 70%: rising from 14% of the nation’s inhabitants in 2023 to 24% in 2024. Consultants consider that residents are starting to understand that integrating digital property into the actual financial system and on a regular basis life might help cut back prices and safety dangers when conducting business transactions, and may additionally function a way of combating inflation. Analysts at Mercado Bitcoin be aware that if the present fee of digital asset adoption continues among the many Brazilian inhabitants, the variety of cryptocurrency holders may attain and even exceed half of the nation’s inhabitants by 2030, amounting to just about 120 million individuals.

– The crypto funding firm Canary Capital, following Bitwise, has submitted an utility to the U.S. Securities and Trade Fee (SEC) to launch a spot XRP ETF based mostly on Ripple. The Canary XRP ETF is designed to supply buyers with entry to one of many largest altcoins via a standard brokerage account, with out the dangers related to straight buying and holding cryptocurrency. That is undoubtedly optimistic information.

The appliance was filed utilizing Kind S-1, which implies there are not any specified deadlines for the regulator to subject a choice. That is the draw back, because the evaluate course of may vary from “prolonged” to “infinite.” Moreover, the second obligatory step for launching an ETF includes submitting one other utility, which should be filed with the SEC by the inventory trade the place the brand new product shall be listed. Up to now, the regulator has not obtained such an utility.

– In america, not solely can authorities file lawsuits in opposition to business organisations, however the reverse can also be attainable. For example, the cryptocurrency trade Crypto.com has filed a lawsuit in opposition to the Securities and Trade Fee (SEC), accusing the company of overstepping its authority in regulating the crypto business. This was introduced by the platform’s co-founder and CEO, Kris Marszalek.

“This unprecedented motion by our firm in opposition to a federal company is a justified response to the SEC’s enforcement actions, which have harmed greater than 50 million American cryptocurrency holders,” he wrote on his social media web page. In accordance with Marszalek, the Fee has exceeded its authorized boundaries and now capabilities as an illegal entity, labelling almost all cryptocurrencies as securities. The top of Crypto_com additionally promised that the corporate would use “all out there regulatory instruments” to carry readability to the business and to guard the way forward for the crypto business in america via authorized means.

Each economists praised Vitalik Buterin for his important contributions to the financial economics of cryptocurrencies, emphasising that his work has far surpassed that of every other economist. In accordance with Tyler, Vitalik constructed the ingenious Ethereum platform and created a digital forex that challenges Mises’ regression theorem.

For reference, the regression theorem posits that the worth (or price) of cash might be traced again (“regressed”) to the worth of products and providers it initially represented.

Cowen and his colleagues additionally counseled Buterin’s continued efforts to develop the Ethereum community. They highlighted that he would make a superb speaker on the Nobel Prize ceremony (if, after all, he’s chosen), noting his popularity as a really courteous particular person.

– In accordance with analysts at MatrixPort, cryptocurrencies may transition from a distinct segment market to part of mainstream monetary methods by 2025. MatrixPort’s calculations point out that, amidst a worldwide easing of restrictions on the shopping for and promoting of digital property, round 7.51% of the world’s inhabitants has begun utilizing cryptocurrencies frequently. Bitcoin has emerged as the first driver behind this adoption, with “digital gold” changing into a serious subject of debate in monetary circles, each on the company and governmental ranges. The MatrixPort report highlights the rising affect of institutional participation, together with main banking firms and asset administration companies like BlackRock, which have considerably elevated their investments in crypto property following the launch of spot BTC-ETF and ETH-ETF merchandise.

Analysts predict that if world adoption of digital property surpasses 8% in 2025, it will function a transparent sign of a possible shift of cryptocurrencies into mainstream monetary methods. Nonetheless, MatrixPort additionally notes that attaining such a stage of adoption may face challenges from authorities regulators. The event of the business is additional constrained by the volatility of the crypto market and retail buyers’ issues concerning the safety of their property.

[ad_2]

Supply hyperlink

Leave a Reply