[ad_1]

KEY

TAKEAWAYS

- Shares undergo trending and non-trending phases.

- Non-trending phases typically last more than trending phases.

- CIBR not too long ago broke out and began a brand new trending part.

The Cybersecurity ETF (CIBR) is resuming the lead because it surged to new highs this previous week. It is very important be aware that CIBR started its management function quite a bit earlier as a result of it hit a brand new excessive in late August. In the present day’s report will analyze the current breakout and recommend some prospects sooner or later.

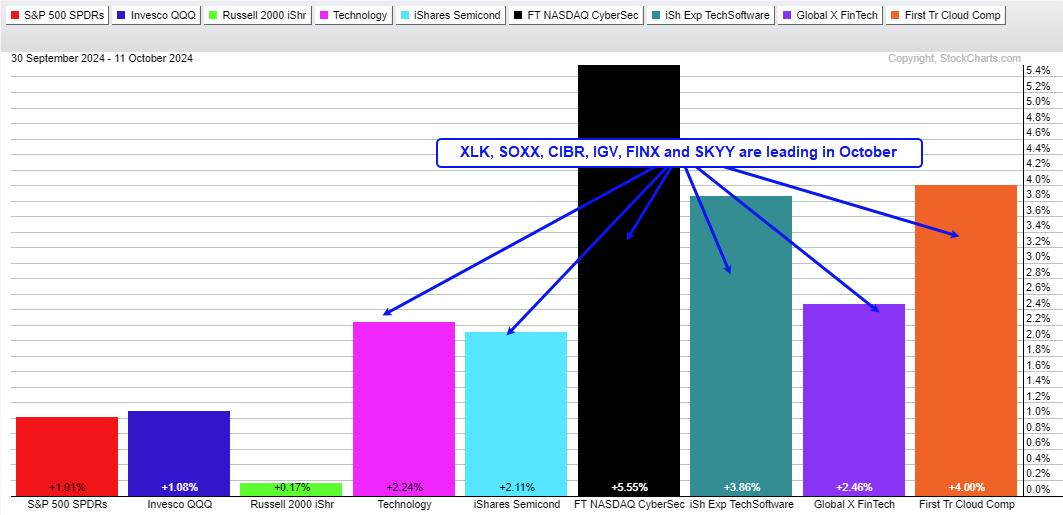

First discover that the Expertise SPDR (XLK) and 5 tech-related ETFs are main in October (semis, cybersecurity, software program, fintech and cloud). They’re up 2% or extra and simply outperforming the most important index ETFs (SPY,QQQ,IWM). The tech ETFs underperformed in July-August and at the moment are getting their mojo again.

I featured CIBR in Artwork’s Charts on September 14th, demonstrating the way to use the % above MA (5, 200) to outline the development and scale back whipsaws. In an long-term uptrend, shares and ETFs expertise each trending and non-trending intervals, with the latter typically lasting longer.

The chart beneath exhibits CIBR trending larger from late October 2023 to mid-February 2024, lower than 4 months. A non-trending interval adopted and lasted over six months. Most not too long ago, the ETF broke out of this vary and entered a brand new trending interval. I anticipate this trending interval to final a number of months and costs to increase larger.

The breakout zone round 59 (pink line) turns into the primary help space to observe in case of a throwback. Throwbacks happen when costs fall again to the resistance zone after a breakout. General, help is marked within the 59-60 space, and a pullback to this zone would offer a second likelihood to take part within the breakout.

TrendInvestorPro is targeted CIBR, tech-related ETFs and tech shares as they transfer from corrective non-trending intervals to trending intervals. We expect the market is wanting previous the elections and towards seasonal patterns, which quickly flip bullish. Alternative awaits! Click on right here to be taught extra.

Particular Provide!!

2 Instructional Studies/Movies with Each Subscription

“Discovering Bullish Setup Zones with Excessive Reward Potential and Low Threat”. The development is your pal, and pullbacks inside uptrends current alternatives. We present the way to discover compelling setups that mix market situations, development identification, oversold situations and buying and selling patterns. Buying and selling is all in regards to the odds and these setups put the chances in your favor.

“Utilizing Breadth for Capitulation, Thrusts, Market Regime and Oversold Situations”. This report covers 4 methods to make the most of breadth indicators. Capitulation situations typically sign main lows, whereas thrust indicators point out the beginning of a bullish part. Market regime helps distinguish between bull and bear markets, and oversold situations establish tradable pullbacks inside bull markets. We clarify the indications, settings, and indicators for every situation.

Click on right here for rapid entry!

Highlights from Current Weekly Studies/Movies:

October 4th Report: We recognized bullish breakouts in a number of tech-related ETFs (QQQ, XLK, MAGS). Moreover, we famous continued sturdy efficiency from software program and cybersecurity (IGV, CIBR). The report additionally showcased bullish continuation patterns for 3 main AI shares and recognized two bullish setups within the healthcare sector.

September nineteenth Report: We started with our breadth mannequin, which has maintained a bullish stance since December seventh. Narrowing yield spreads proceed to indicate confidence within the credit score markets. The report featured bullish setups in ETFs associated to copper, base metals, copper miners, and palladium (CPER, DBB, COPX, PALL).

Click on right here for rapid entry!

/////////////////////////////////////////////////

Select a Technique, Develop a Plan and Comply with a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Writer, Outline the Development and Commerce the Development

Wish to keep updated with Arthur’s newest market insights?

– Comply with @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering indicators throughout the development, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.

[ad_2]

Supply hyperlink

Leave a Reply