[ad_1]

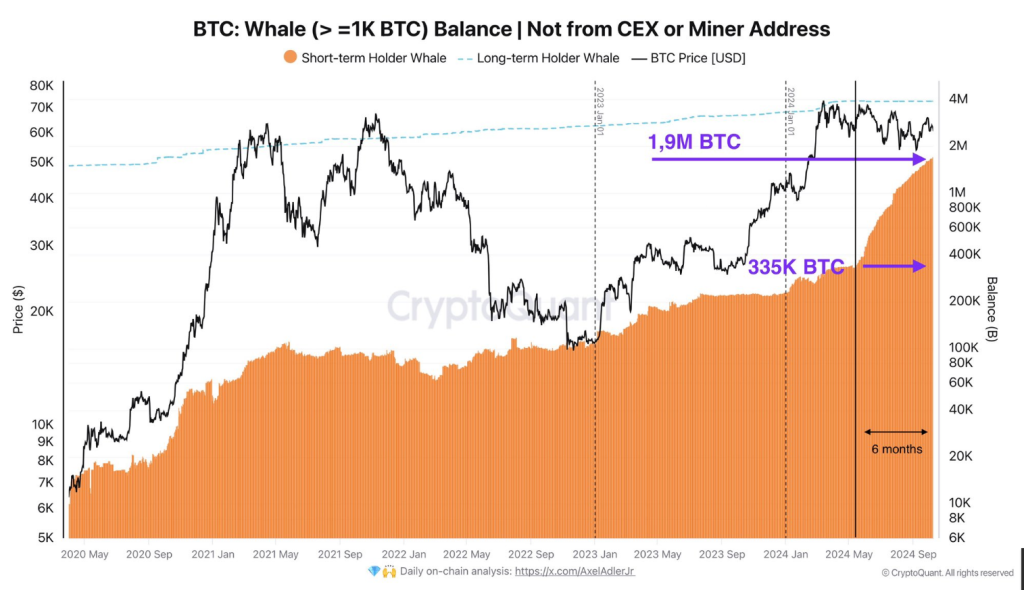

Bitcoin whales have stockpiled $90 billion in BTC since Could, a interval marked by range-bound market circumstances. In response to an open disclosure by Axel Adler Jr. of CryptoQuant, traders holding over 1,000 BTC have seen fast development of their balances.

Associated Studying

Whale Urge for food Grows

Over the previous six months, they gathered about 1.5 million BTC, representing a large influx of capital price roughly $90 billion at a mean worth of $60,000. Nonetheless, these tokens got here from weaker arms that offered at a loss.

1.5M BTC has been gathered by whales (with >1K BTC on steadiness) over the past 6 months.

There’s actually nothing to debate right here. pic.twitter.com/7cAVWVEK15

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 10, 2024

Information reveals vital development amongst whales, who held solely 335,000 BTC in early Could when Bitcoin traded between $60,000 and $65,000. Whereas costs remained in that vary, whales continued to build up, and now maintain round 1.9 million BTC, indicating robust short-term confidence amongst high-net-worth traders.

Netflow Metrics Of Massive Holders

Current knowledge reveals that accumulation sprees haven’t cooled off, regardless of latest worth corrections. For instance, yesterday, BTC fell beneath $59K for the primary time this month, resulting in huge liquidations.

Don’t imagine that whales gathered 1.5M BTC and marvel the place they obtained it from?

How about looking on the loss-making gross sales on exchanges?

Within the final 24 hours, 24.1K BTC have been offered at a loss. pic.twitter.com/tAgeCI6qhe

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 11, 2024

But, massive holders, who account for 0.1% of the circulating provide, netted +629 BTC yesterday. Two days in the past, this determine was even increased, with an inflow of two,480 BTC.

Moreover, CryptoQuant statistics point out that Bitcoin’s change reserve has fallen from 2.576 million tokens firstly of October to 2.571 million tokens, reflecting ongoing accumulation.

Worth Prediction And Market Implications

As of this writing, Bitcoin was pegged at $61,690 having misplaced 1.68% for the week. DMI had +DI standing at 18.3 with -DI positioned at 23.3, which have been a few factors above however declining constantly.

Associated Studying

It merely signifies that regardless of the relentless promoting pressures, they’re considerably weak. Because it at present stands at -40.74, Williams %R is on the impartial aspect. From this, Bitcoin may get caught on this vary till robust shopping for or promoting stress will come up.

Skilled analyst Peter Brandt holds that Bitcoins will attain an all-time excessive of $150,000 for this cycle however warns that incapability to interrupt out of the present vary will trigger the value to shatter and can go means down, 75% at worst.

Featured picture from Pexels, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply