[ad_1]

KEY

TAKEAWAYS

- The macro image of the US financial system stays robust with the broader fairness indexes in an uptrend.

- There was some rotation within the sectors with Power taking the lead on account of rising crude oil costs.

- Use the StockCharts MarketCarpet to pick out shares on your ChartLists.

After Friday’s stellar jobs report—254,000 jobs added in September vs. the Dow Jones forecast of 15,000—shares and Treasury yields initially reacted with a giant bounce. The information confirms the power of the labor market and the US financial system.

Let’s not overlook, although, {that a} devastating hurricane ripped by six states, leaving individuals homeless, remoted, and with out energy. The hurricane would have precipitated job losses, particularly within the companies sector. We’ll know extra within the subsequent jobs report. Luckily, the US dockworkers’ strike was short-lived, so its impression could have been very gentle.

The Macro Image

The stronger-than-expected September jobs report resulted in elevated investor optimism. Along with a big enhance in new jobs, unemployment fell to 4.1%, and common hourly earnings are up by 0.4%.

The broader inventory market indexes closed larger into the shut, which is uncommon value motion for a Friday when too many uncertainties are lingering. The every day chart of the S&P 500 ($SPX) under reveals that after hitting an all-time excessive on September 26, the index pulled again near its 21-day exponential transferring common (EMA). Thursday’s doji candlestick represents indecision, and Friday’s jobs report reversed the indecision to optimism.

CHART 1. S&P 500 REMAINS BULLISH. The index bounced off its 21-day EMA with increasing market breadth. The variety of 52-week highs outnumbers the brand new 52-week lows.Chart supply: StockCharts.com. For academic functions.

Total, the S&P 500’s pattern is bullish, and market breadth is increasing, with new 52-week highs higher than new 52-week lows.

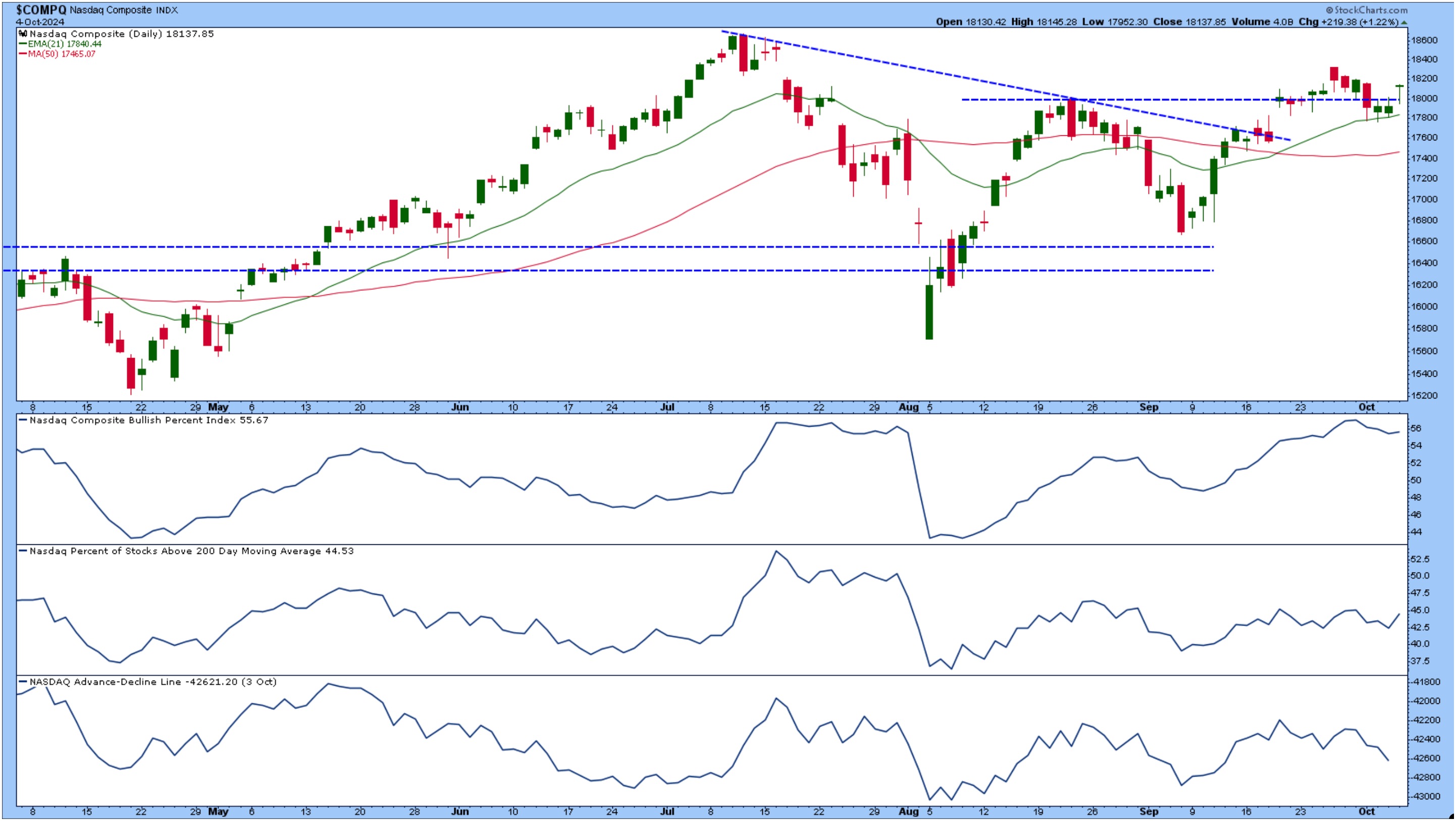

The Nasdaq Composite ($COMPQ) closed above its August excessive (see chart under). Market breadth, measured by completely different indicators than these within the chart of the S&P 500, can be increasing.

CHART 2. NASDAQ BOUNCES ABOVE AUGUST HIGH. The Nasdaq has been buying and selling sideways since its August excessive. Will as we speak’s breakout from that prime have sufficient momentum for follow-through motion? The market breadth indicators give combined alerts.Chart supply: StockCharts.com. For academic functions.

The Nasdaq Composite Bullish P.c Index (BPI) is at 55.67, indicating slight bullishness. The Nasdaq P.c of Shares above their 200-day transferring common is at 44.54, which is comparatively low, however it’s trending larger. The Nasdaq Advance-Decline Line is trending decrease, which is a little bit regarding. The Nasdaq hasn’t been as robust in its restoration because the S&P 500 and the Dow Jones Industrial Common ($INDU), which once more eked out a file shut.

Small-cap shares rallied the many of the indexes featured within the StockCharts Market Overview panel on Your Dashboard. After falling under the buying and selling vary it has been in for the final month, the S&P 600 Small Cap Index ($SML) is again throughout the vary (space between dashed blue horizontal traces).

CHART 3. SMALL-CAP STOCKS TICK HIGHER. After Thursday’s value motion, small-cap shares picked up power and made it again to shut inside their buying and selling vary. Superior outnumber has declined, and the proportion of shares buying and selling above their 50-day transferring common can be trending larger.Chart supply: StockCharts.com. For academic functions.

The market breadth indicators within the decrease panel present that market breadth for $SML can be bettering. The share of $SML shares buying and selling above their 50-day transferring common is trending larger, and the variety of advances and quantity advance % is larger.

The bond market additionally reacted strongly to the roles report. Treasury yields rose after the information broke, with the 10-year US Treasury yield closing up 3.4% at 3.98%. This helps the notion that the Fed will possible decelerate the tempo of fee cuts. The CME FedWatch Instrument displays the chance of a 25 foundation level rate of interest lower within the Fed’s November 7 assembly at 98.9%.

One other necessary space to look at is volatility. The Cboe Volatility Index ($VIX) pulled again on Friday, closing at 19.21. However do not be shocked to see it tick again up. Geopolitical turbulence remains to be entrance and heart, and there is an necessary election one month away. Traders ought to tread rigorously, since any occasion might trigger a volatility spike and alter the image.

Sector Efficiency

Crude oil costs rose this week, largely as a consequence of Center East tensions. The Power sector was a laggard within the final a number of months, however it has now damaged out of its downward-sloping trendline, ending the week because the top-performing sector.

The every day chart of XLE clearly reveals a reversal in vitality costs.

CHART 4. ENERGY SELECT SECTOR SPDR (XLE) BREAKS OUT. Rising geopolitical turbulence lifts oil costs larger. The S&P Power Sector BPI additionally spiked, displaying bullish dominance.Chart supply: StockCharts.com. For academic functions.

The S&P Power Sector BPI spiked larger to 68.18 placing it into bullish territory. If tensions proceed to escalate within the Center East, oil costs might rise additional.

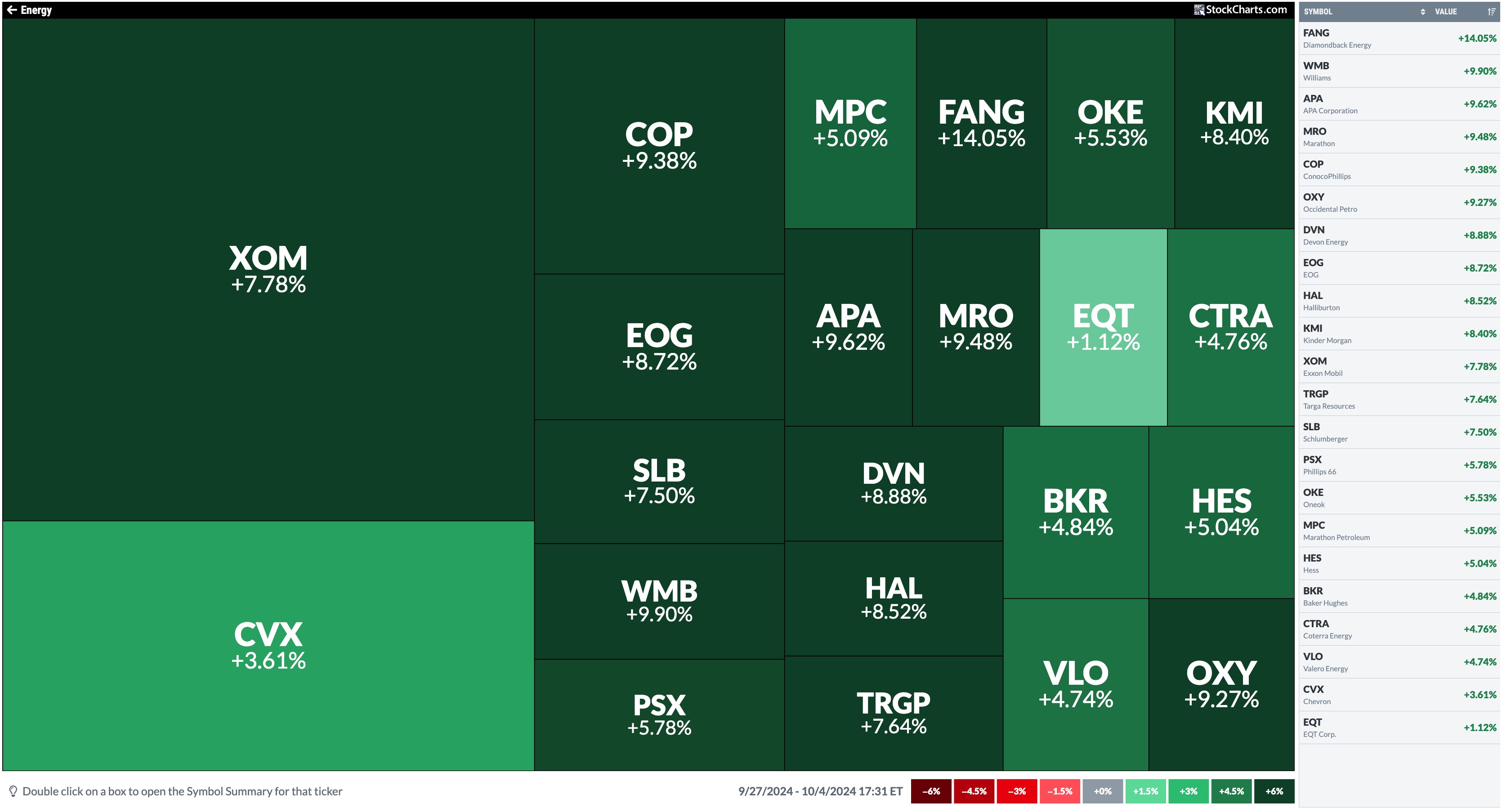

To determine the shares within the sector, pull up the StockCharts MarketCarpet, choose 5D Change from the Colour By dropdown menu, and click on on Power (see picture under).

ENERGY SECTOR MARKET CARPET. It is easy to see which had been the highest gainers within the sector. The desk on the proper may be sorted in ascending or descending order. Double click on on any field to see the Image Abstract web page for the ticker image.Picture supply: StockCharts.com.

The desk on the proper reveals the top-performing shares within the sector.

Create a ChartList of vitality shares and populate it with the shares listed within the desk. Prime performers as of this writing are Diamondback Power (FANG), Williams Cos., Inc. (WMB), APA Company (APA), Occidental Petroleum (OXY), and Marathon (MRO). And do not forget Vistra Power (VST), the highest StockCharts Technical Rank inventory.

Earlier than including the shares to your ChartList, you might need to analyze every yet one more carefully. Double-clicking on the field of any inventory will open the Image Abstract web page for the chosen image.

Different Areas To Contemplate

Metals and shares of Chinese language corporations have additionally been rallying. Gold, silver, and copper costs noticed important rises. The iShares China Giant-Cap ETF (FXI) gapped larger, hitting a brand new 52-week excessive. Our weblog posts cowl each subjects deeply, so take a look at the articles.

The primary buying and selling week of October ends on a robust notice. However it’s October, and traditionally, the month tends to be unstable, particularly in an election yr. Plus, earnings season kicks off on the finish of subsequent week. This implies there’s all of the extra cause to be cautious.

Finish-of-Week Wrap-Up

- S&P 500 closed up 0.22% for the week, at 5751.07, Dow Jones Industrial Common up 0.09% for the week at 42,352.75; Nasdaq Composite closed up 0.10% for the week at 18,137.95

- $VIX up 13.27% for the week, closing at 19.21

- Finest performing sector for the week: Power

- Worst performing sector for the week: Shopper Staples

- Prime 5 Giant Cap SCTR shares: Vistra Power Corp. (VST); KE Holdings, Inc. (BEKE); JD.com, Inc. (JD); Applovin Corp (APP); Carvana (CVNA)

On the Radar Subsequent Week

- Fed speeches

- September Shopper Value Index (CPI)

- September Producer Value Index (PPI)

- Earnings season kicks off with JP Morgan Chase (JPM), Wells Fargo (WFC), and Delta Airways (DAL)

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

[ad_2]

Supply hyperlink

Leave a Reply