[ad_1]

Crypto buyers are usually not eager on coping with cryptocurrency buying and selling platforms, which has resulted within the dwindling trade reserves of Bitcoin and Ethereum. Centralized exchanges on Bitcoin and Ethereum hit a historic low after buyers and crypto fans opted for self-custody options for his or her digital property.

Associated Studying

Staying Away From Cryptocurrency Buying and selling

A latest development confirmed that merchants and different fans select to carry on to their crypto property somewhat than promote them on Bitcoin and Ethereum trade platforms.

They most well-liked direct possession of their property utilizing self-custody wallets, which created an growing demand for self-custody options. Nonetheless, it led to a decline within the liquidity of BTC and ETH on centralized exchanges.

Strengthening Bitcoin And Ethereum Values

A constructive consequence of merchants’ choice for self-custody options is the growing worth of Bitcoin and Ethereum property over time. Merchants veering away from cryptocurrency buying and selling platforms create a way of shortage, resulting in the expansion of its worth.

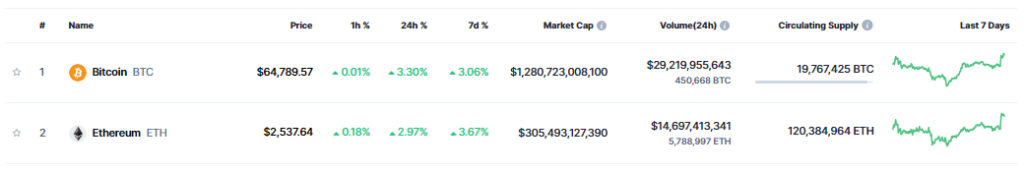

On the time of writing, the value of Bitcoin is pegged at $64,842. Since hitting a record-high of $73,000 in March this 12 months, the worth stays someplace between $66,000 and $49,000. In the meantime, based on Coinmarketcap, Ethereum is buying and selling at $2,464.

Bitcoin, Ethereum Reserves Drop

Bitcoin and Ethereum on centralized reserves took a nosedive and hit a historic low early this month. As of October 13, CryptoQuant’s chart confirmed that centralized exchanges for BTC recorded an all-time low of two,666,717 bitcoins.

The best quantity of Bitcoin was pegged at 3,361,854, which was recorded on June 8, 2022. After that interval, Bitcoin went on a pointy decline. It hit its lowest stage early this month.

By way of quantity, spot exchanges have 1.1 million Bitcoin in reserves, whereas spinoff exchanges personal 1.39 million reserves. By far, Binance owns 563,000 Bitcoin reserves, the biggest crypto trade by buying and selling quantity, adopted by Kraken with 112,3000 reserves.

Alternatively, Coinbase Superior holds 830,530 Bitcoin reserves and Coinbase Prime has 3,000 reserves. Ethereum’s centralized exchanges additionally face an identical dilemma to Bitcoin whereby its reserves proceed to plummet and hit a report low of 18.7 million.

Associated Studying

Based on CryptoQuant, spinoff exchanges maintain a giant portion of Ethereum with 10.3 million in reserves, whereas 8.4 million Ethereum reserves are being stored at spot exchanges.

Traditionally, Ethereum’s all-time excessive in reserves was 2,310,823 recorded on 6 September 2022. Since that interval, Ethereum reserves in central exchanges proceed to plunge.

By way of reserves, Coinbase has a big reserve of 4.5 million Ethereum, adopted by Binance with 3.6 million Ethereum. Kraken additionally holds a big Ethereum reserve of 1.3 million.

Featured picture from Pexels, chart from TradingView

[ad_2]

Supply hyperlink

.png?w=280&resize=280,210&ssl=1)

Leave a Reply