[ad_1]

Key takeaways

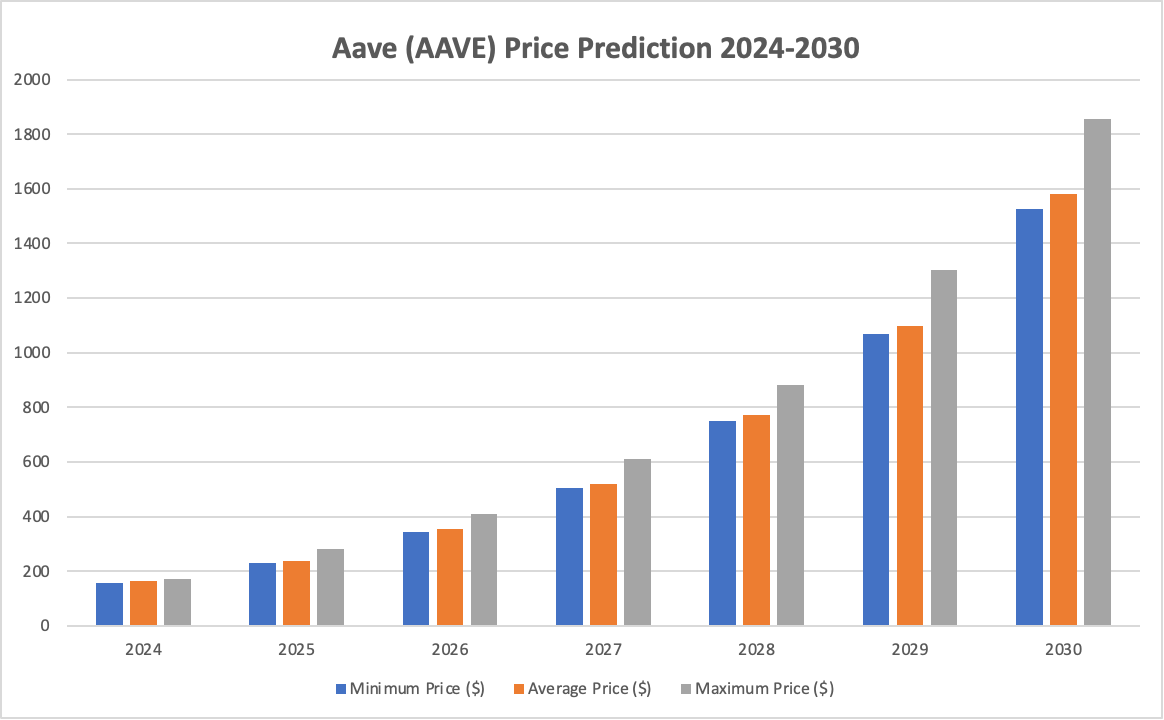

- AAVE value prediction for 2024 may attain a most worth of $172.28.

- By 2027, AAVE may attain a most value of $611.58.

- In 2030, AAVE will vary between $1,525 to $1,854.

Aave is a number one decentralized finance (DeFi) protocol on the Ethereum blockchain, identified for its revolutionary monetary options reminiscent of flash loans, which permit customers to borrow immediately with out collateral, and dynamic rates of interest that adapt to market situations. Members within the Aave ecosystem can deposit their digital crypto property again into liquidity swimming pools to earn their curiosity funds or acquire loans by borrowing funds with out offering collateral. Aave’s governance and price distribution are considerably pushed by its native token, AAVE, enhancing its utility and worth throughout the platform.

Having touched its ATH at $666.86 in Might 2021, will AAVE attain new heights regardless of the latest market downturn and consolidations? Let’s get into the Aave technical evaluation and predictions.

Overview

| Cryptocurrency | Aave |

| Ticker | AAVE |

| Present value | $162 |

| Market cap | $2,207,547,821 |

| Buying and selling quantity (24-h) | $179,823,915 |

| Circulating provide | 14,951,471 AAVE |

| All-time excessive | $666.86 on Might 19, 2021 |

| All-time low | $26.02 on Nov 5, 2020 |

| 24-hour low | $150.83 |

| 24-hour excessive | $163.66 |

Aave value prediction: Technical evaluation

| Metric | Worth |

| Worth Prediction | $170.76 (12.40%) |

| Volatility | 7.94% |

| 50-day SMA | $ 140.06 |

| 14-Day RSI | 51.11 |

| Sentiment | Bullish |

| Concern & Greed Index | 50 (Impartial) |

| Inexperienced days | 15/30 (50%) |

Aave value evaluation 1-day chart: Bullish uplifts end in AAVE value ascending to $162

TL;DR Breakdown

- Aave (AAVE) is at the moment in a bullish development.

- AAVE’s essential assist degree is current at $150.83.

- A breakout above $162 may see AAVE retest resistance at $163.66.

The Aave value evaluation for October 14 is displaying a bullish development, because it has risen considerably from $152 to $162. After a quick interval of consolidation, the value gained momentum and noticed constant upward motion, reflecting sturdy shopping for stress. This rise in worth signifies rising investor confidence, and the present value means that Aave is sustaining its upward trajectory, probably organising for additional beneficial properties if the constructive momentum continues.

Aave value evaluation 1-day chart: Aave reveals upward surge at $162

Aave’s value is displaying a robust bullish development on the 1-day chart, with the value rising fto $162. The latest value motion signifies a 4.58% achieve, displaying vital shopping for curiosity. This upward momentum means that Aave is at the moment benefiting from market optimism, and the value may proceed to rise if the demand persists.

The RSI (Relative Power Index) is at 60.49, which signifies a robust upward development being overbought. The MACD (Transferring Common Convergence Divergence) reveals a bullish crossover, with the MACD line transferring above the sign line, indicating growing momentum.

Aave value evaluation 4-hour chart: AAVE types an ascending triangle sample

In line with the 4-hour timeframe, Aave value evaluation reveals AAVE is forming an ascending triangle sample, an indication that patrons want to push costs greater. The formation of this sample additionally means that AAVE may see an upsurge quickly.

The Relative Power Index (RSI) is at 72.56, which indicators that Aave is within the overbought zone, reflecting sturdy shopping for stress. The MACD indicator reveals bullish momentum, with the MACD line (4.23) crossing above the sign line (2.97), and the histogram displaying constructive divergence. These indicators counsel that the bullish development could proceed, though some warning is suggested because the asset is in overbought territory

Aave technical indicators: Ranges and motion

Each day easy transferring common (SMA)

| Interval | Worth ($) | Motion |

| SMA 3 | 128.52 | BUY |

| SMA 5 | 134.58 | BUY |

| SMA 10 | 142.45 | BUY |

| SMA 21 | 151.64 | SELL |

| SMA 50 | 140.06 | BUY |

| SMA 100 | 118.62 | BUY |

| SMA 200 | 110.25 | BUY |

Each day exponential transferring common (EMA)

| Interval | Worth ($) | Motion |

| EMA 3 | 148.91 | SELL |

| EMA 5 | 142.87 | BUY |

| EMA 10 | 131.53 | BUY |

| EMA 21 | 119.27 | BUY |

| EMA 50 | 107.96 | BUY |

| EMA 100 | 102.49 | BUY |

| EMA 200 | 99.08 | BUY |

What to anticipate from AAVE value evaluation?

The general development for Aave throughout each the charts is clearly bullish. Aave is in a sustained uptrend, with the value not too long ago reaching round $162, displaying constant beneficial properties. The charts reinforces this bullish outlook, as the value continues to rise after a slight pullback, indicating sturdy shopping for momentum. Each timeframes present that Aave has been making greater highs and better lows, supported by bullish indicators just like the RSI being within the overbought zone and the MACD displaying constructive momentum.

Is AAVE a great funding?

Aave gives important infrastructure for lending and borrowing inside DeFi, increasing past conventional functions into areas like gaming, NFTs, and dApps. Its AAVE token performs an important position in powering the platform, making it a robust selection for traders on account of its confirmed market success and steady growth.

The place to purchase AAVE?

AAVE tokens might be traded on centralized crypto exchanges. The preferred change to purchase and commerce Aave is Binance, which is among the largest cryptocurrency exchanges on this planet, providing a variety of cryptocurrencies, together with AAVE. Coinbase and Bitfinex which presents quite a lot of buying and selling pairs and assist AAVE.

Will Aave recuperate?

Aave’s founder, Stani Kulechov, mentioned in an August 5 submit on X that the protocol efficiently dealt with the general stress throughout 14 lively markets on numerous Layer 1 and Layer 2 blockchains, securing $21 billion in worth. Stani famous that Aave’s income surge was primarily fueled by decentralized liquidations, a mechanism that helps keep market stability by robotically promoting off collateral when positions fall under required ranges.

Will Aave attain $100?

Aave (AAVE) can probably attain $100 if it breaks via the present resistance ranges and beneficial properties momentum from constructive, market sentiment and tendencies. Latest value actions counsel {that a} restoration to this degree is possible with elevated buying and selling exercise and investor curiosity.

Does Aave have a great long-term future?

Aave reveals potential for a great long-term future, given its potential to stabilize and recuperate after vital declines. The constant assist of round $79.8 signifies resilience and potential for future progress.

Latest information/opinion on AAVE

- Grayscale Launches AAVE Belief

Grayscale has launched its AAVE Belief, providing accredited traders oblique publicity to Aave’s decentralized finance platform via AAVE tokens.

Aave value prediction October 2024

Aave may expertise an uptrend in October, reaching $161.59 on the finish of the month. The minimal value projected for the coin is round $115.50, whereas the typical is round $148.87.

| Aave value prediction | Potential Low | Common Worth | Potential Excessive |

| Aave value prediction October 2024 | $115.50 | $148.87 | $161.59 |

Aave value prediction 2024

In This autumn of 2024, the worth of AAVE would possibly attain a most worth of $172.28, a minimal value of $157.3 and a median value of about $164.69.

| Aave value prediction | Potential Low | Common Worth | Potential Excessive |

| Aave value prediction 2024 | $157.3 | $164.69 | $172.28 |

Aave value prediction 2025-2030

| Yr | Minimal Worth ($) | Common Worth ($) | Most Worth ($) |

| 2024 | 157.3 | 164.69 | 172.28 |

| 2025 | 228.74 | 236.98 | 280.13 |

| 2026 | 342.65 | 354.49 | 408.12 |

| 2027 | 505.91 | 520.09 | 611.58 |

| 2028 | 749.73 | 770.53 | 882.8 |

| 2029 | 1,067 | 1,098 | 1,302 |

| 2030 | 1,525 | 1,580 | 1,854 |

Aave (AAVE) Worth Prediction 2025

The AAVE value prediction for 2025 anticipates a surge in value, leading to a most value of $280.13. Based mostly on skilled evaluation, traders can anticipate a median value of $236.98 and a minimal value of about $228.74.

Aave Worth Forecast 2026

In line with the AAVE value forecast for 2026, Aave is anticipated to commerce at a minimal value of $342.65, a most value of $408.12, and a median value of $354.49.

Aave Worth Prediction 2027

The AAVE value prediction for 2027 signifies a continued rise with minimal and most costs of $505.91 and $611.58, respectively, in addition to a median value of $520.09.

Aave Worth Prediction 2028

Aave value is predicted to achieve a minimal of $749.73 in 2028. The utmost anticipated AAVE value is $882.80, with a median value of $770.53.

Aave Worth Prediction 2029

The AAVE value prediction for 2029 estimates a minimal value of $1,067, a most value of $1,302, and a median value of $1,098.

Aave Worth Prediction 2030

The Aave value prediction for 2030 suggests a minimal value of $1,525 and a median value of $1,580. The utmost forecasted Aave value is about at $1,854.

AAVE market value prediction: Analysts’ AAVE value forecast

| Agency | 2024 | 2025 |

| Changelly | $163.36 | $260.76 |

| DigitalCoinPrice | $200.65 | $388.62 |

| CryptoPredictions | $163.16 | $174.92 |

Cryptopolitan’s Aave (AAVE) value prediction

In line with our AAVE value forecast, the coin’s market value would possibly attain a most worth of $170.89 by the tip of 2024. Wanting ahead to 2026, the typical Aave value may surge to $268.76.

AAVE’s historic value sentiment

- Launched as ETHLend in 2017, a peer-to-peer digital asset lending and borrowing platform; raised $16.2 million throughout the ICO. Rebranded to AAVE in 2018, with ETHLend turning into a subsidiary.

- In January 2020, the AAVE protocol went stay on the Ethereum mainnet. By August, it grew to become the second DeFi protocol to achieve $1 billion in whole worth locked. The FCA awarded AAVE an EMI license, boosting LEND by 30%.

- Aave v3 launched on the Ethereum mainnet on 16 March 2022; AAVE surged 114% to $261.29 by 1 April. By mid-August, it recovered barely to only over $100 however declined once more in the direction of the tip of the 12 months, buying and selling between $50 and $60.

- From late January to March 2023, AAVE confirmed an uptrend, buying and selling round $80 to $90. AAVE closed 2023 at about $109.

- Between January and April 2024, AAVE was on an upward development, reaching a excessive of $142. Between Might and June, it fluctuated between $77 and $113. In August, it opened at $95.07 and closed at $129.8, whereas in September, AAVE reached a peak value of $178.25. On the time of writing, AAVE is buying and selling throughout the vary of $151.52 to $164.28.

[ad_2]

Supply hyperlink

Leave a Reply