[ad_1]

Bitcoin (BTC), the biggest cryptocurrency by market capitalization, began the third week of October with a 6% every day surge. BTC’s efficiency has fueled bullish sentiment amongst crypto traders and market watchers, who recommend it is perhaps prepared to maneuver to $70,000.

Associated Studying

Bitcoin Reclaims Key Help Ranges

Bitcoin started the week reclaiming key resistance ranges after a 6% surge from Sunday’s worth. This efficiency noticed BTC transfer from the $62,000 assist zone to retest the $66,000 assist space on Monday morning.

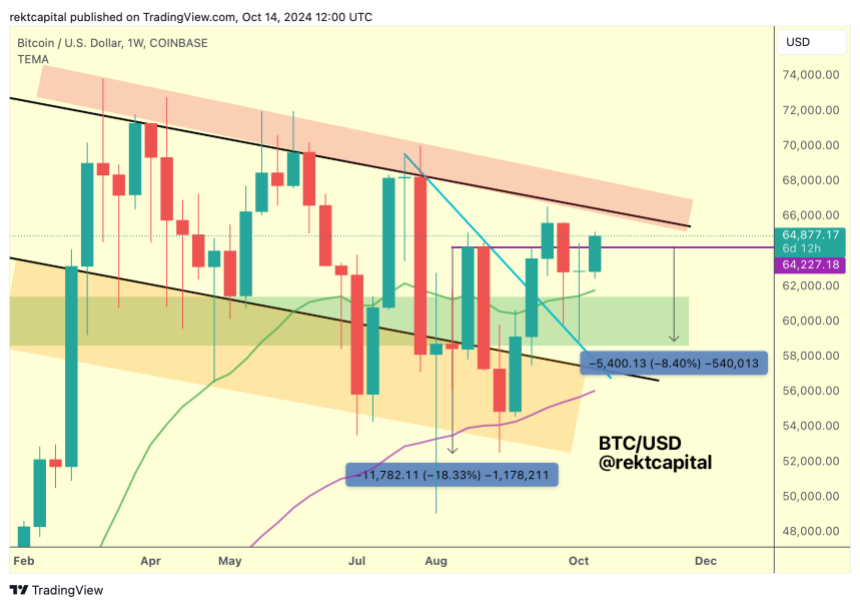

Following the current efficiency, Bitcoin’s October returns to date have turned inexperienced with a 3.17% month-to-month return, in accordance with Coinglass knowledge. Crypto analyst Rekt Capital highlighted Bitcoin’s current actions, noting that BTC has been in a position to reclaim a 2-month downtrend as assist.

Per the analyst, the flagship cryptocurrency has retested a downtrend line relationship again to late July since October began. BTC efficiently retested and bounced from the trendline for 2 consecutive weeks, turning the vary into assist.

Moreover, the analyst identified that Bitcoin has carried out a number of profitable retests, together with a “risky retest” of the 21-week Bull Market Exponential Shifting Common (EMA).

“Discover how the underside of the inexperienced boxed space is confluent with the July Downtrend retest and the retest of the 21-week EMA is confluent with the highest of the inexperienced field,” the analyst added.

Equally, Ali Martinez highlighted that BTC is at present making one other try to reclaim the 200-day Shifting Common after 4 consecutive rejections up to now two months.

BTC Challenges August Highs

Rekt Capital famous that BTC has solidified the $58,000-$61,000 vary as a assist space all year long: “It has executed so at a Larger Low in comparison with final month’s draw back wicking lows in addition to August’s draw back wicking lows.”

Furthermore, the analyst said that Bitcoin challenged August highs, at round $64,200, after the current retests of the important thing ranges. He steered that BTC’s current actions are a “clear signal” that August’s degree is “weakening as resistance.”

Rekt Capital identified BTC is retesting the multi-month weekly downtrend channel prime, which can also be weakening as resistance. The flagship cryptocurrency efficiently examined the channel’s vary lows as assist this month.

The vary lows have been 7-month confluent assist with the earlier all-time excessive (ATH) space. Nonetheless, the analyst famous that BTC will need to have a weekly shut above the downtrend channel’s prime to interrupt out of this sample.

A weekly shut above August highs, adopted by a profitable retest of this degree, would “pose a big buy-side stress on the Downtrending Channel Prime,” which might be accelerated if BTC’s every day shut sits above $64,200.

Associated Studying

Furthermore, a every day shut above $65,000 and a profitable reclaim of the vary as a assist zone might ship BTC’s worth towards the $70,000 resistance zone. The analyst famous that every time Bitcoin closed the day above this degree, the cryptocurrency moved inside the $65,000-$71,350 vary within the following days.

As of this writing, BTC is buying and selling at $65,812, a 4% and 10.3% surge within the weekly and month-to-month timeframes.

Featured Picture from Unsplash.com, Chart from TradingView.com

[ad_2]

Supply hyperlink

Leave a Reply