[ad_1]

Crypto adoption retains rising globally, with the entire variety of crypto holders now at 617 million, based on a latest report from a16z.

However solely round 60 million of these holders use crypto month-to-month. The hole is obvious, however which means there’s a large alternative to activate extra holders.

In September, 220 million crypto addresses interacted with blockchain a minimum of as soon as, an enormous rise in comparison with the tip of 2023.

Solana leads in lively addresses

This surge in exercise is led by Solana, which accounted for practically 100 million of these lively addresses. NEAR adopted, recording 31 million lively addresses.

Coinbase’s L2 community, Base, reported 22 million, whereas Tron and Bitcoin confirmed 14 million and 11 million respectively.

Ethereum-based chains additionally noticed motion, with Binance’s BNB Chain logging 10 million and Ethereum itself seeing 6 million.

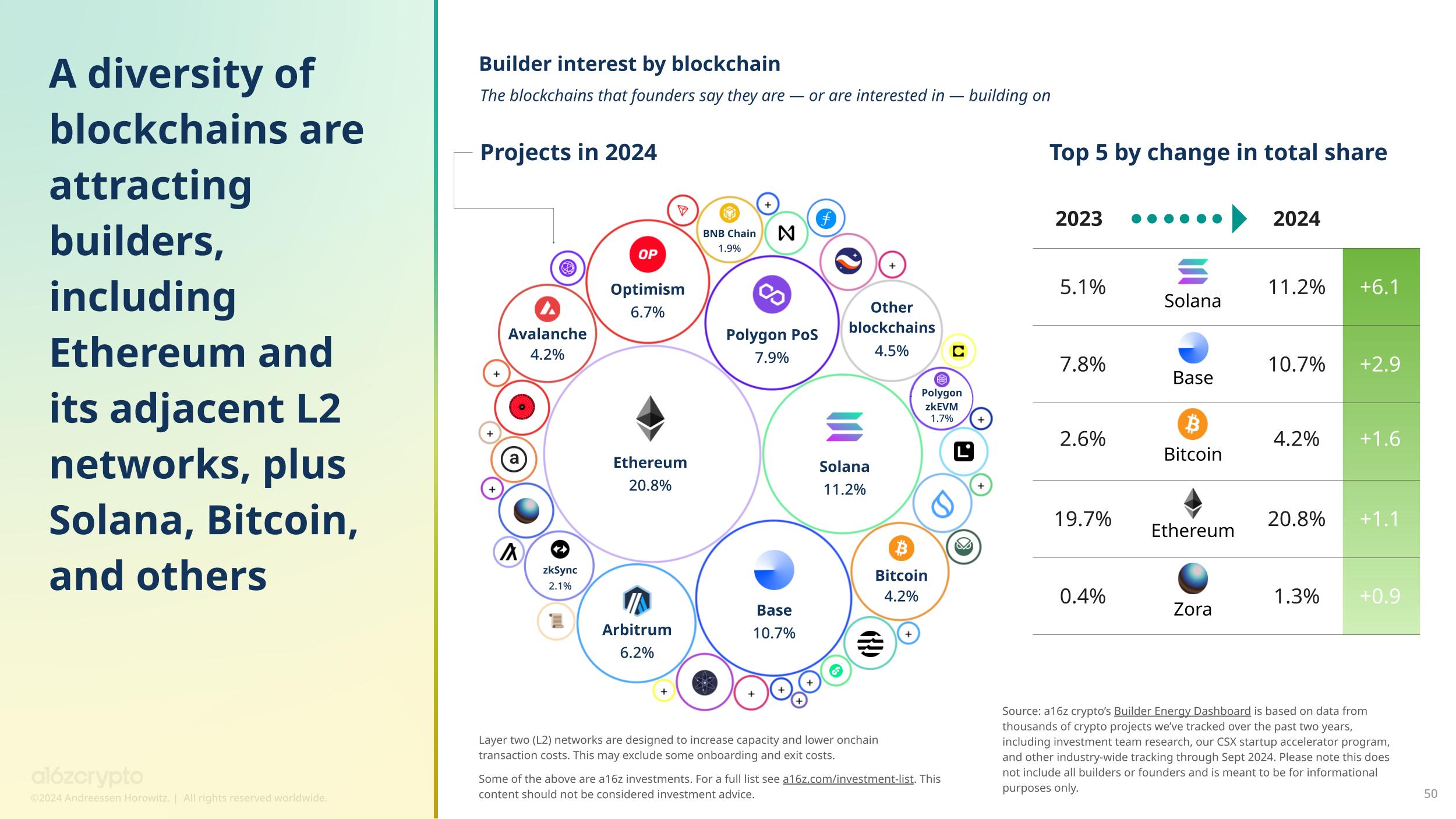

These developments line up with the broader curiosity in blockchain growth. Solana has seen the most important rise in builder curiosity, leaping from 5.1% final yr to 11.2% this yr.

Base additionally made positive aspects, going from 7.8% to 10.7%, and Bitcoin builders grew from 2.6% to 4.2%. Ethereum nonetheless dominates, although, with 20.8% of all builders centered on it.

U.S. declines in share

The variety of month-to-month cellular crypto pockets customers hit 29 million in June, a brand new excessive. The USA leads the share with 12% of customers.

However this proportion has been shrinking as extra crypto adoption occurs exterior the U.S. and a few initiatives start to exclude American customers by geofencing for compliance causes.

Crypto is spreading quick in international locations like Nigeria, India, and Argentina. Nigeria has been pushing for regulatory readability, together with incubation applications, and this has fueled an increase in crypto use for on a regular basis transactions like invoice funds and buying.

India, with its huge inhabitants and widespread cellular adoption, has turn out to be a key crypto market. Argentina, dealing with foreign money instability, is seeing its residents flip to stablecoins for monetary safety.

Crypto takes middle stage in U.S. Politics

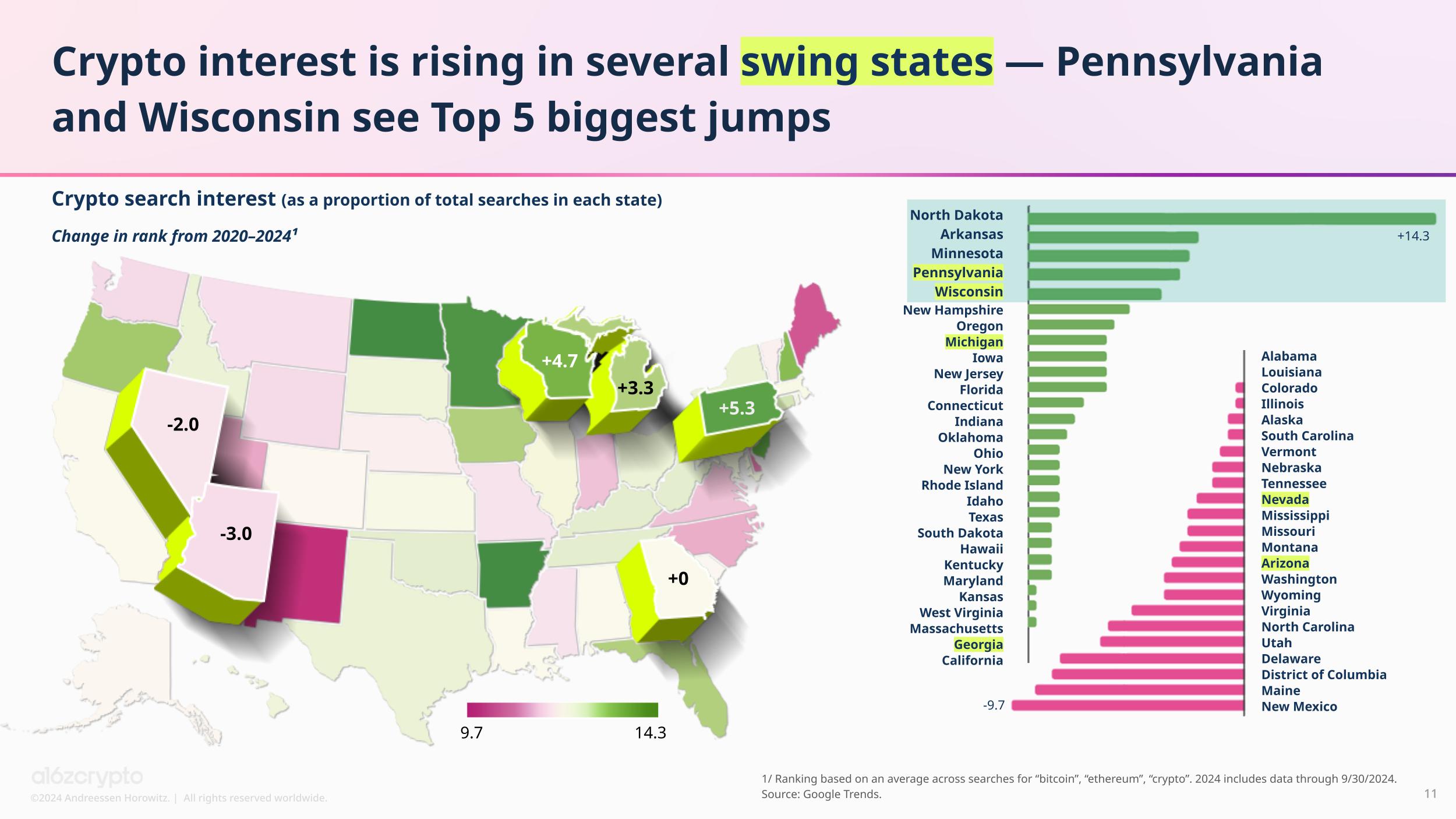

Crypto is now a scorching subject in U.S. presidential elections. Curiosity in crypto has surged in key swing states like Pennsylvania and Wisconsin.

Pennsylvania confirmed the fourth-largest soar in crypto-related searches, with Wisconsin following at fifth place. Michigan ranked eighth in crypto curiosity progress. Each candidates have been vying for the group’s votes.

In an enormous yr for crypto laws, the Home of Representatives permitted the Monetary Innovation and Know-how for the twenty first Century (FIT21) Act with bipartisan assist.

This invoice, which now waits for Senate approval, might present the regulatory readability that crypto entrepreneurs have been asking for.

On the state degree, Wyoming handed the Decentralized Unincorporated Nonprofit Affiliation (DUNA) Act, giving authorized recognition to DAOs (Decentralized Autonomous Organizations) whereas permitting them to function with out compromising on decentralization.

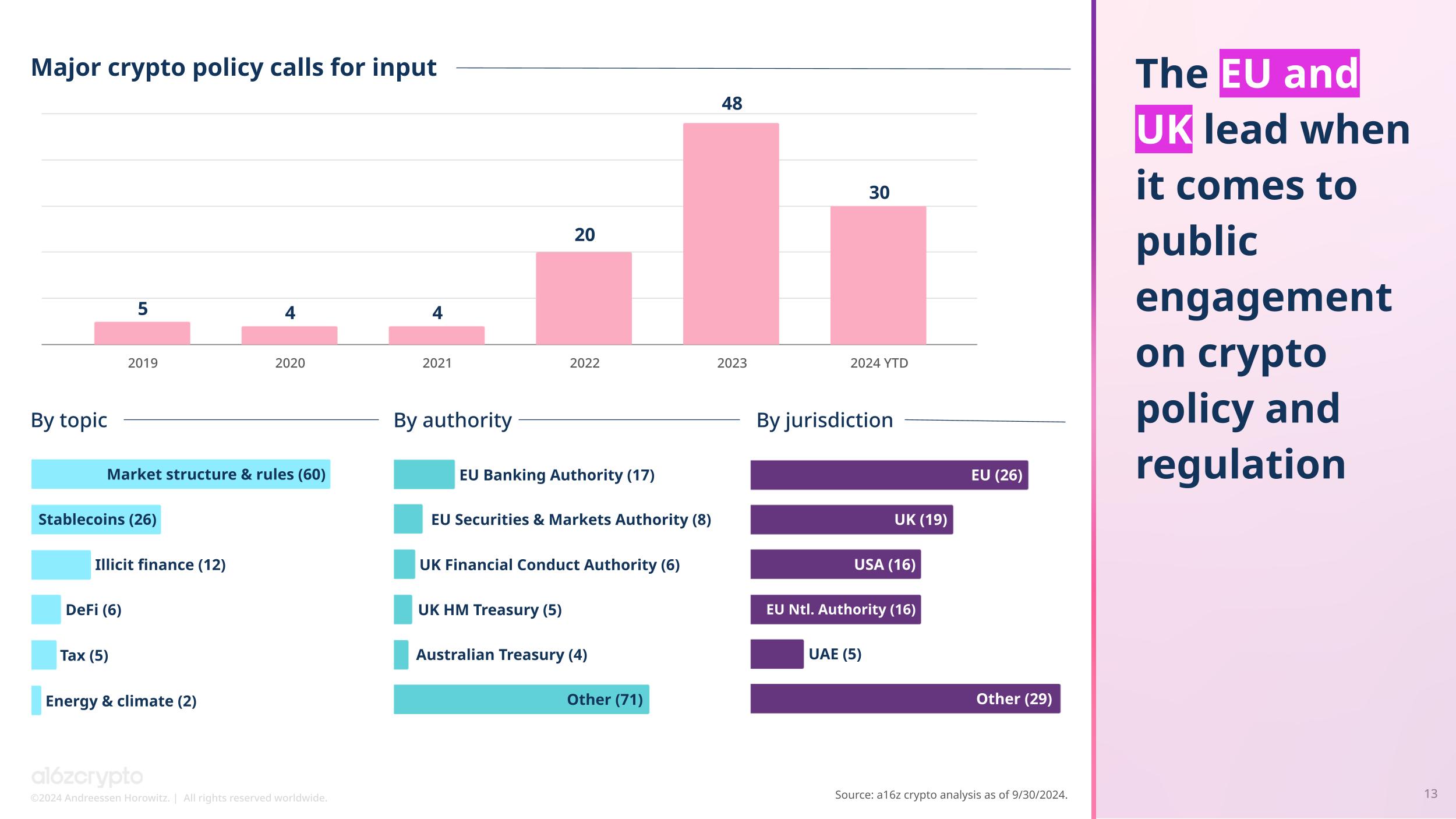

Throughout the Atlantic, the EU and the UK have taken a proactive method to crypto coverage. The European Union’s Markets in Crypto Act (MiCA) grew to become the primary complete crypto regulation in Europe and will likely be totally applied by the tip of the yr.

Stablecoins: The preferred crypto product

A16z says stablecoins have confirmed to be one in all crypto’s most helpful instruments. As of now, stablecoins have processed $8.5 trillion in transaction quantity throughout 1.1 billion transactions. As compared, Visa dealt with $3.9 trillion over the identical interval.

Stablecoins are additionally strengthening the U.S. greenback’s place globally. Greater than 99% of all stablecoins are denominated in {dollars}, with the euro coming in at a distant second with simply 0.2%.

Stablecoins have additionally turn out to be main holders of U.S. debt, rating within the prime 20, even surpassing locations like Germany.

The rationale stablecoins are thriving is because of main infrastructure upgrades. Blockchains at the moment are processing greater than 50 instances the variety of transactions per second in comparison with 4 years in the past.

Ethereum’s newest improve, Dencun (EIP-4844), launched in March, has drastically diminished charges for Layer 2 networks.

Zero-knowledge (ZK) proofs are additionally taking part in an enormous position in blockchain scaling. These cryptographic proofs permit computations to occur off-chain whereas nonetheless making certain they’re appropriate.

The report identified that the price of verifying ZK proofs has gone down, whereas their recognition has risen. In the meantime, there’s over $169 billion locked in DeFi protocols proper now.

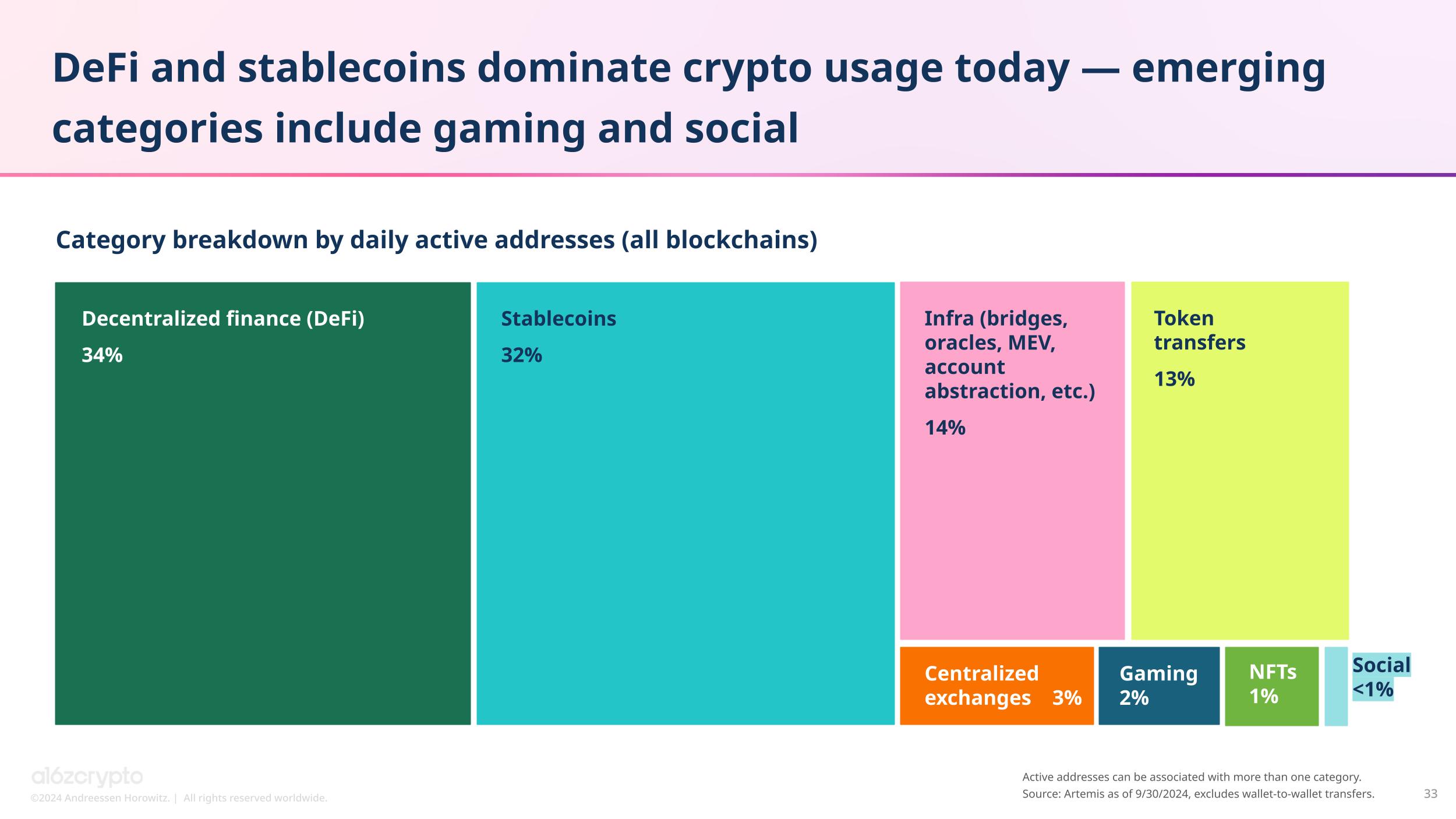

DeFi accounts for 34% of all crypto utilization, the very best share of each day lively addresses, even increased than stablecoins.

The decentralized change area has grown rapidly, and now makes up 10% of the spot crypto buying and selling exercise. It is a big change from simply 4 years in the past when all buying and selling occurred on centralized exchanges.

Since Ethereum transitioned to proof-of-stake, the community’s safety has improved, with 29% of all ETH now being staked.

Crypto and AI are crossing paths greater than ever. About 34% of crypto initiatives say they’re utilizing AI, based on the a16z Builder Power dashboard. One of many key areas for this integration is in blockchain infrastructure.

AI’s rising prices are pushing the expertise towards centralization, as solely giant firms have the assets to coach cutting-edge fashions. Crypto provides a possible resolution right here, with decentralized networks permitting for shared AI computing energy.

[ad_2]

Supply hyperlink

Leave a Reply