[ad_1]

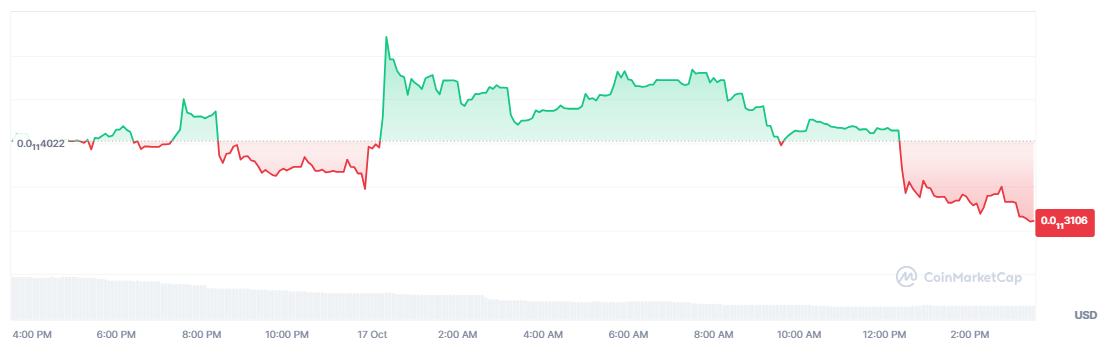

The anticipated launch of the Donald Trump World Liberty Monetary (WLFI) token has globally confronted challenges in elevating the anticipated $300 million. Thus, the fundraising actions have been described as a complete failure inside two days after it was launched on 15 October since WLFI has raised solely round $11 million accounting for less than 4% of the goal. Really, with a lot effort positioned to promote the undertaking, which was even described as a ‘crypto financial institution,’ issues have turned out totally different.

Technical Points Have an effect on Trump Token Gross sales

It was assumed that the WLFI token would generate an enormous curiosity particularly with Trump on the helm. Co-founder Zachary Folkman stated that there have been greater than 100,000 folks able to put their cash in. The opposite aspect of the coin nevertheless is kind of totally different. The undertaking’s web site couldn’t be accessed for lengthy intervals, exasperating potential purchasers who tried unsuccessfully to take part within the sale.

In precise sense although, the token is de facto held by lower than 9,300 distinctive wallets, a far cry from the anticipated investor uptake. The teething issues related to the undertaking not solely curtailed the gross sales throughout the launch but additionally created viable considerations concerning the way forward for the undertaking.

Figuring out Investor Angle And Regulatory Points

The WLFI token is described as a D regulation providing whereby it’s provided to solely a selected group of individuals often called accredited buyers or people who both have a web price of over $1 million or gross earnings of as much as $200,000 yearly.

This limitation on investor inclusion successfully reduces the obtainable clientele base. As well as, in contrast to lots of the cryptocurrencies that permit for quick buying and selling of their tokens, WLFI tokens are non-transferable and are primarily governance tokens. Traders can vote on proposals within the platform however are comparatively passive in the meanwhile.

Aside from these obstacles, Trump fairly shortly after the launch printed a put up on social media urging his followers to put money into WLFI. He went on to say that cryptocurrency was the means to go, however his name to motion didn’t end in a direct upsurge of gross sales.

A Cloudy Future Forward?

WLFI’s future is however unknown even because it battles to amass momentum. The cash gathered is supposed for WLF’s treasury, however and not using a clear path plan or vital rewards for buyers, confidence might proceed to erode. Critics notice that WLFI is opaque; it has not printed a complete white paper or marketing strategy that seasoned buyers often demand from such initiatives.

In the meantime, regardless of the hiccups, Etherscan information verified that 1000’s of buyers rushed to the Trump-endorsed DeFi undertaking. Within the first hour, 3,000 distinct addresses collected about 350 million WLFI cash within the face of the tough begin.

Featured picture from Andrew Harnik/AP, chart from TradingView

[ad_2]

Supply hyperlink

Leave a Reply