[ad_1]

Market analyst and President of the ETF Retailer Nate Geraci has backed the US-based spot Bitcoin ETFs to overhaul the Gold ETFs by way of cumulative web flows. This projection comes amidst a staggering efficiency by these Bitcoin ETFs previously few days the place they’ve attracted over $2 billion in weekly netflows.

Spot Bitcoin ETFs To Surpass Gold ETF In 2 Years, Analyst Says

The spot Bitcoin ETFs rattled the worldwide monetary markets this week recording web inflows of $2.13 billion based on knowledge from SoSoValue. This huge inflow of investments occurred as Bitcoin surged by 9.23%, approaching a essential resistance zone on the $70,000 value mark.

Amidst this market euphoria, Nate Geraci has predicted the spot Bitcoin ETFs to report a better cumulative complete netflows than the Gold ETFs within the subsequent two years. This forecast is basically unsurprising contemplating the exponential progress of those Bitcoin ETFs since their launch on January 11.

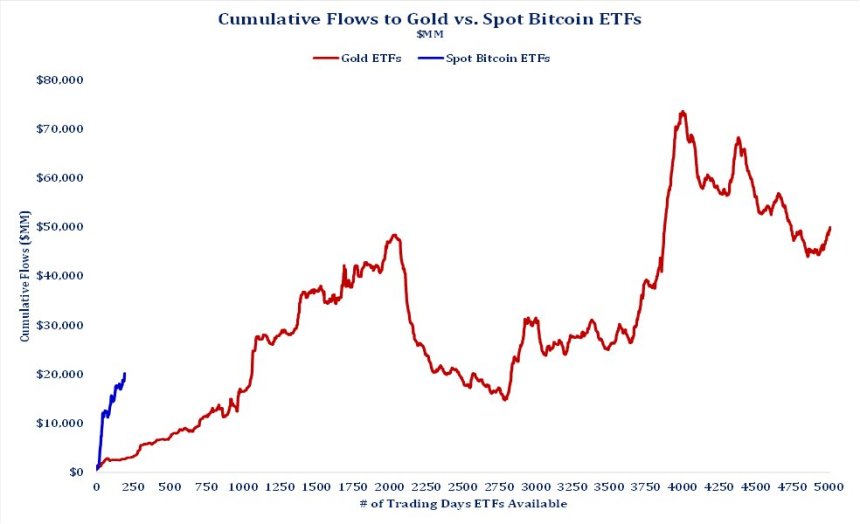

For context, the Gold ETFs at present boast of mixed web inflows of round $55 billion compared to $20.66 billion mixture web inflows within the spot Bitcoin ETFs market. Nonetheless, the Bitcoin ETFs have been buying and selling for barely a yr in comparison with the Gold ETFs which have been round for over 20 years.

Moreover, Bloomberg analyst Eric Balchunas just lately highlighted that spot Bitcoin ETFs have amassed over $65 billion in complete web belongings, a milestone that took Gold ETFs practically 5 years to attain. This determine can also be over 25% of the full belongings underneath administration within the world Gold ETF market.

As well as, Geraci’s concept is additional strengthened by the few 11 spot Bitcoin ETFs at present buying and selling in comparison with the virtually 5000 Gold ETFs on the worldwide monetary market. Subsequently, these Bitcoin ETFs may very well be poised to overhaul their Gold counterparts, particularly contemplating the upcoming crypto market bull run and present adoption ranges of digital belongings.

Bitcoin Set For Value Recorrection Amidst Market Surge

In different information, crypto analyst Ali Martinez has shared that Bitcoin might quickly expertise a “short-term dip” following its latest value rally. As earlier acknowledged, the crypto market chief gained by over 8% transferring from round $63,000 to just about breaking above $69,000.

Whereas the BTC market is at present bullish, Martinez states that the TD sequential is at present indicating a promote sign on the 4-hour chart which is strengthened by a bearish divergence on the Relative Power Index (RSI). If Bitcoin’s value have been to say no, buyers would flip their consideration to the $60,000 value zone at which lies its subsequent assist degree. Albeit a robust promoting stress might trigger the premier cryptocurrency to commerce as little as $55,000.

On the time of writing, Bitcoin continues to commerce at $68,428 with a 0.98% achieve within the final day.

[ad_2]

Supply hyperlink

.png?w=280&resize=280,210&ssl=1)

Leave a Reply