[ad_1]

KEY

TAKEAWAYS

- Sector Rotation Mannequin and present sector rotation usually are not supporting broad market energy.

- Plotting the members of $INDU on a Relative Rotation Graph helps discover the very best names in that universe.

- TRV, WMT, and AXP are nonetheless sturdy, however now have an excessive amount of threat for brand spanking new positions.

- CAT, CSCO, and HD have surfaced as doubtlessly sturdy candidates.

On this week’s RRG video, I shared my issues in regards to the present market situations. The sector rotation mannequin and present sector rotation, as we see it on the Relative Rotation Graph for US sectors, are sending us conflicting indicators. This mix continues to make me cautious about absolutely shopping for into the rally with new positions.

Being fully-invested is just too dangerous for the time being (for me).

My present strategy is that the danger of being absolutely invested available in the market proper now, and even shopping for into it, is just too excessive for my consolation. As an alternative, I recommend we give attention to figuring out particular person shares or industries that current revenue alternatives for lengthy positions.

Dow Jones Industrials: Discovering the Proper Shares

I have never blogged about particular person shares for some time, particularly not in regards to the members of the Dow Jones Industrials. Thus, I believed it will be helpful to look at the constituents of the Dow Jones Industrials Index to seek out appropriate candidates for lengthy positions.

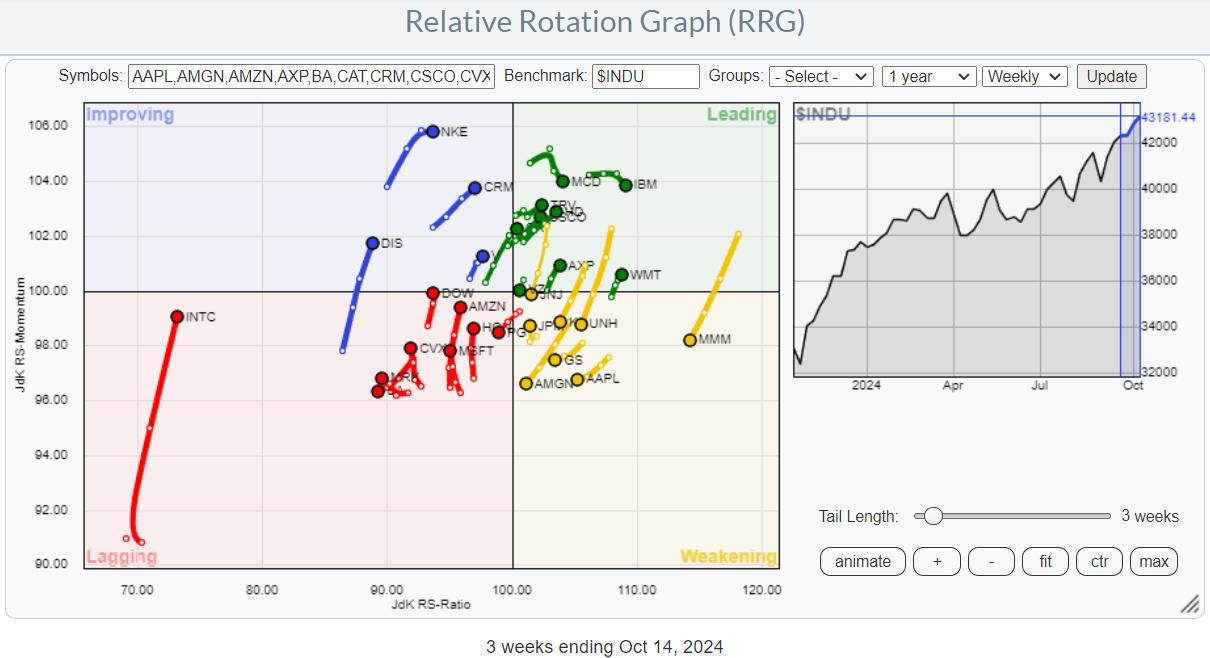

Outliers on the RRG

Whenever you take a look at the RRG holding the Dow Jones Industrial Shares, two actual outliers catch the attention. The primary is Intel (INTC), which is within the lagging quadrant and experiencing a big hiccup in relative momentum. The second outlier is 3M (MMM), situated within the weakening quadrant and quickly dropping relative momentum. If faraway from the equation, these two shares enable us to see a extra balanced distribution of shares throughout the assorted quadrants.

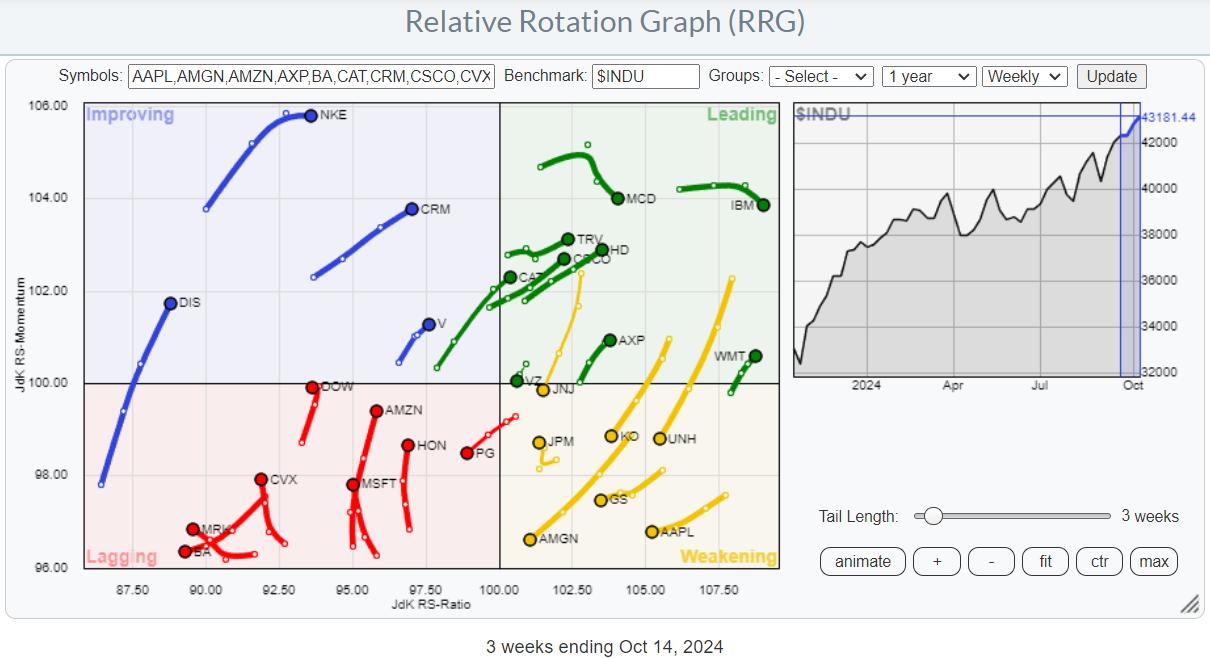

Constructive RRG Headings

My subsequent step is to toggle over all the person shares and spotlight these with a constructive RRG heading between 0 and 90 levels. This means {that a} inventory is gaining relative energy in opposition to the Dow Jones Industrials and is supported by constructive momentum.

With this filter, we see two shares within the lagging quadrant on a constructive heading: Amazon and Honeywell. 4 shares are contained in the bettering quadrant, they usually appear to be persevering with their enchancment: DIS, NKE, CRM, and V.

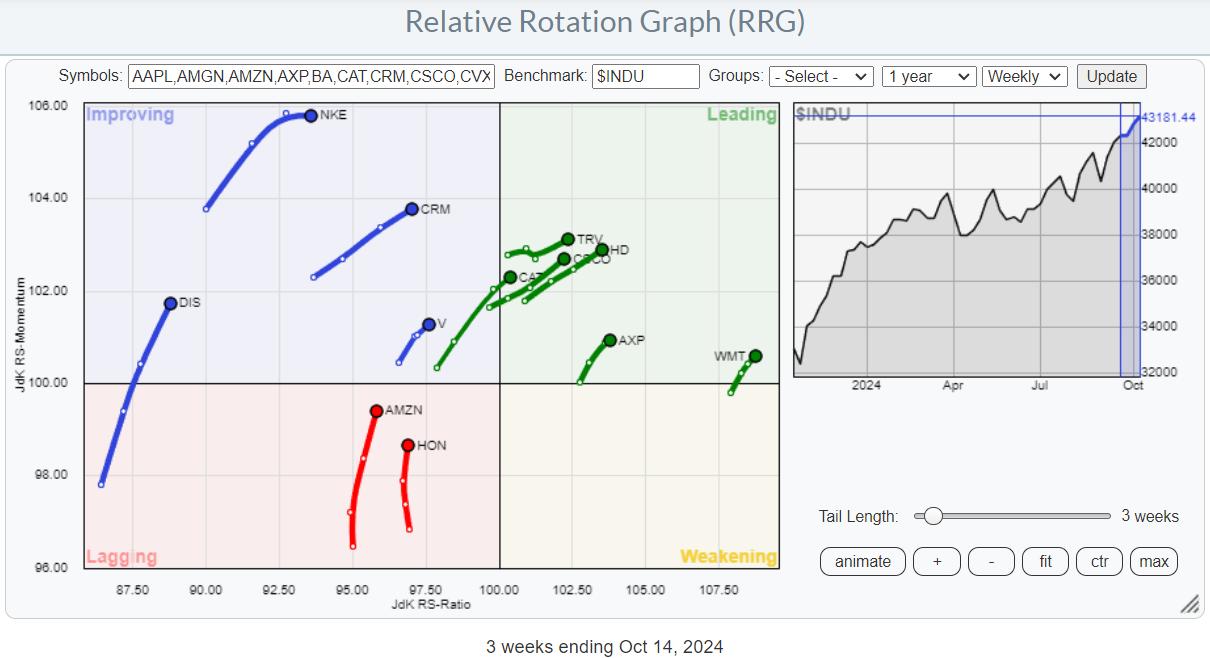

Concentrating on the Main Quadrant

The main quadrant has a better focus of shares on a constructive heading, and that is the place I wish to focus our consideration. After reviewing the person charts of those shares, I’ve recognized a number of value a better look and could be thought-about for including to a portfolio.

The Robust Performers: TRV, WMT, and AXP

Vacationers (TRV), Walmart (WMT), and American Categorical (AXP) are exhibiting very sturdy charts when it comes to worth and relative energy. Nevertheless, they’ve had such a long term that I would not suggest chasing them increased. The identical goes for American Categorical (AXP). In the event you already maintain these shares, they’re an ideal “maintain,” however I would not provoke new positions.

The High Three Picks

Now, let’s speak in regards to the three shares that stand out as potential additions to our portfolio.

Caterpillar (CAT)

Caterpillar’s worth has simply damaged above the earlier excessive at $380 and is consolidating. So long as it stays above $380, it has an excellent likelihood of continuous its uptrend. The RRG traces have turned up and are each above 100, indicating a constructive RRG heading.

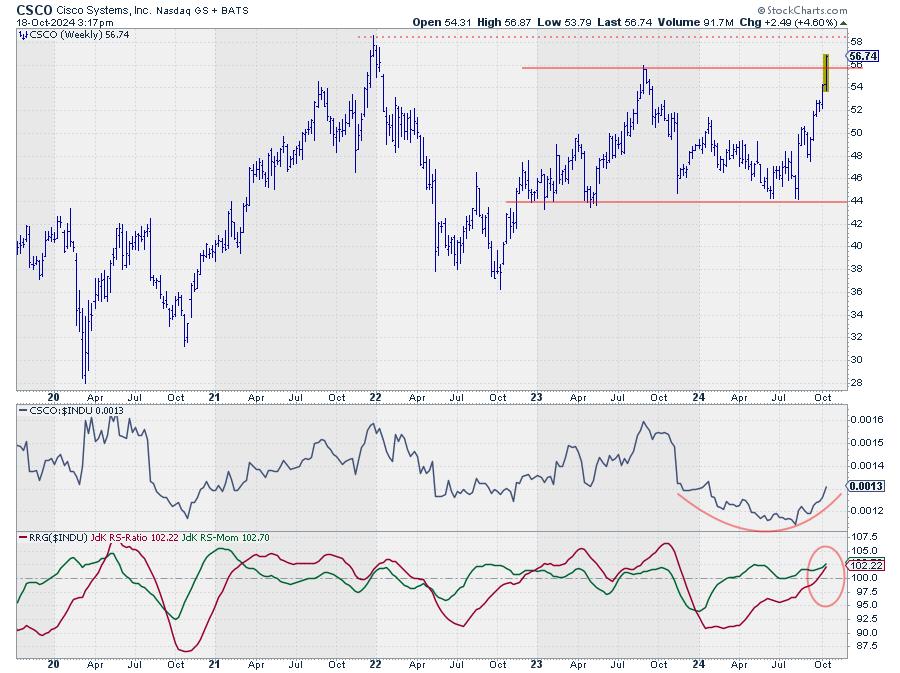

Cisco (CSCO)

Cisco bottomed out round $44 and has climbed to its earlier excessive of round $56. It is now breaking above that resistance, which is a constructive signal.

The subsequent goal is the late December 2021 peak, just under $60. The relative energy is selecting up once more, confirmed by each RRG traces pushing above the 100 degree. As soon as that barrier is taken out, a number of upside potential for CSCO might be unlocked.

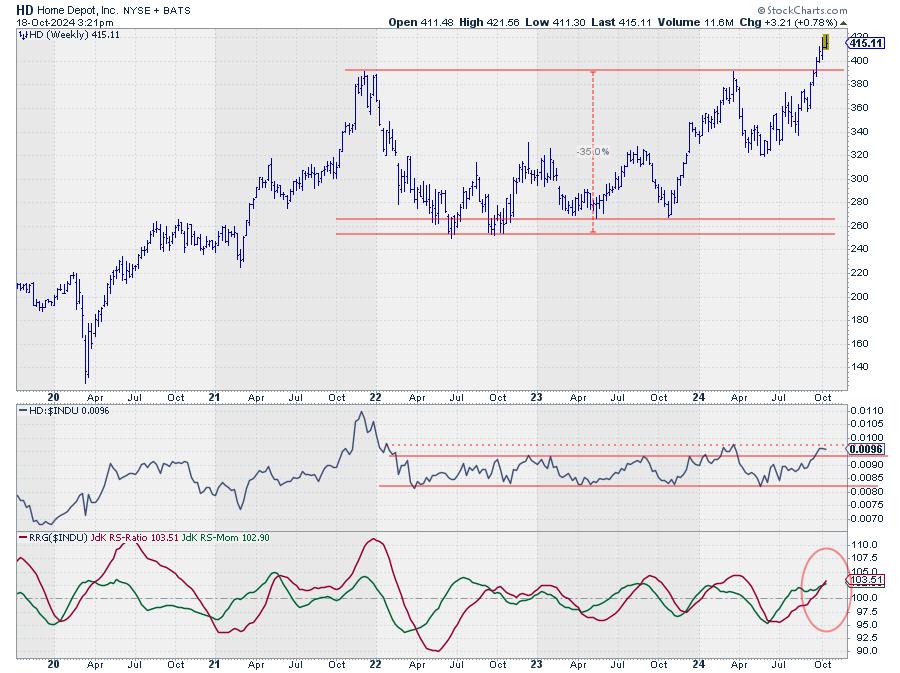

House Depot (HD)

House Depot has damaged above resistance round $390, shaped by two peaks in late 2021 and March 2024. The inventory confirms a brand new uptrend with the RRG traces pushing above 100. We may see important upside potential when the uncooked RS line surpasses its earlier excessive from March 2024.

By measuring the peak of the vary from $260 to $390, we will venture a tough worth goal of $520 for House Depot to be reached inside the subsequent two years, so long as the help round $390 holds.

Keep in mind, it isn’t about chasing the market; it is about making knowledgeable choices primarily based on stable evaluation.

#StayAlert and have an ideal weekend, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to each message, however I’ll actually learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra

[ad_2]

Supply hyperlink

Leave a Reply