[ad_1]

American establishments are making ripples within the cryptocurrency market, having invested a staggering $13 billion in spot Bitcoin ETF shares since its inception in January 2024. Many individuals are shocked by this transfer, provided that conventional monetary establishments have been first hesitant to enter the world of digital property.

Associated Studying

In accordance with CryptoQuant CEO Ki Younger Ju, 1,179 establishments presently personal a complete of 193,064 BTC, indicating a serious shift in opinion in the direction of crypto investments.

Institutional Adoption Grows

The adoption of Bitcoin ETFs by the U.S. Securities and Alternate Fee (SEC) has contributed considerably to the spike in institutional curiosity. This authorized approval has created new alternatives for monetary establishments to supply cryptocurrency investments, permitting them to faucet into extra income streams.

Institutional possession of U.S. #Bitcoin Spot ETFs is round 20%, with asset managers holding 193K BTC (per Type 13F filings). pic.twitter.com/9YTOEH3G5w

— Ki Younger Ju (@ki_young_ju) October 22, 2024

Massive Chunk Of The Pie

Apparently, huge gamers reminiscent of Millennium Administration and Jane Avenue now maintain over 20% of the entire market by means of varied Bitcoin ETFs value about 961,645 BTC. This speedy absorption instantly reveals that the nervousness over cash associated to digital foreign money was shorter-lived.

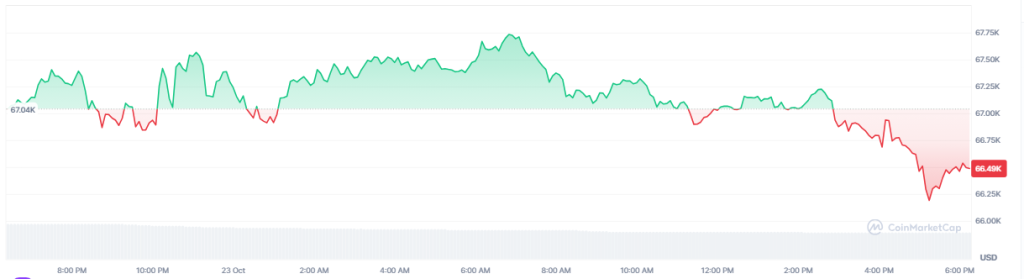

Analysts suppose the extra the institutions interact with Bitcoin ETF, the value will preserve going. Even so, the present worth of Bitcoin stands at round $67,000 and is more likely to go to $100,000 in early 2025, primarily based on previous tendencies, however extra importantly, how individuals’s pondering is altering in the direction of embracing Bitcoin as a respectable asset class.

Choices Buying and selling Accepted

One other main turning level got here when the SEC recently accepted choices buying and selling for spot Bitcoin ETFs on NYSE American LLC and CBOE. This means that with typical monetary devices, institutional traders can now successfully cut back their Bitcoin publicity.

A giant change has occurred for institutional consumers since they will now commerce choices on these ETFs. It not solely makes Bitcoin simpler to make use of, however it additionally makes it extra like common banking. Now that choices buying and selling is feasible, consultants suppose that extra institutional consumers will get into the Bitcoin market.

Institutional traders’ skill to commerce ETF choices is a turning level. Bitcoin turns into more and more accessible and built-in into commonplace banking. Now that choices buying and selling is feasible, consultants count on extra institutional traders to affix Bitcoin.

Associated Studying

A Shiny Future Forward

Bitcoin and its ETFs seem to have a promising future. Establishments’ continued engagement with this asset class is anticipated to have a good influence on different digital property. The SEC’s regulatory system gives a layer of safety that many traders worth. This readability might result in rising participation from conventional monetary establishments, thus cementing Bitcoin’s place within the funding scene.

General, the mix of institutional demand and governmental assist means that Bitcoin is greater than a passing fad; it’s changing into a vital part of contemporary finance. As time passes, it will likely be attention-grabbing to see how this altering panorama impacts each the digital foreign money market and broader financial tendencies.

Featured picture from StormGain, chart from TradingView

[ad_2]

Supply hyperlink

.png?w=280&resize=280,210&ssl=1)

Leave a Reply